Consumer Edge data has been a strong predictor of H&M sales growth in both the US and the UK. But, the similarities between the markets may end there. In this week’s Insight Flash, we compare trends in both markets to assess differences in growth rates, which months are the most important to monitor trends, and brand performance. The US and the UK markets behave very differently, making it crucial to be able to track trends in both.

With brick-and-mortar retail suffering due to COVID-19, several specialty players have sought haven within higher-traffic big box retailers. This is a familiar model in the beauty industry, where specialty players have long operated their own counters in department stores. This makes it unsurprising that two of the most notable tie-ups in recent months have also been in the beauty space – Target’s announced partnership with Ulta (which was reviewed in a prior Insight Flash), and now Sephora’s entry into 200 Kohl’s locations.

It was the best of times, it was the worst of times . . . actually, the COVID-19 pandemic has just been the worst of times. But it has led to interesting divergences in the US and UK grocery markets. In today’s Insight Flash, we compare the two, digging deep into relative performance and market share for Instacart in the US and Ocado in the UK, in our first-ever flash leveraging our brand-new UK dataset.

“Buy now, pay later” may as well be America’s motto. Credit has always been an important driver of the economy, but a new batch of installment payment brands making microloans to consumers have come onto the scene recently as major disruptors to more traditional credit cards.

While COVID-19 has changed many consumer behaviors and limited entertainment, team sports have played on. Specifically, football on Sundays, and the foods that go with it, has remained in place as a national pastime. As the playoffs progress heading into the Super Bowl, we take advantage of CE Vision’s unique ability to easily isolate transactions by day of week to examine how food delivery on Sundays during Football Season differs from during the rest of the year.

Among the list of COVID-19 winners and losers, Wine & Liquor stores stand out as clear winners. Brick-and-mortar locations were considered essential businesses in many states and were allowed to stay open while other retailers shuttered, and both online and offline outlets benefitted from the closure of restaurants for seated dining.

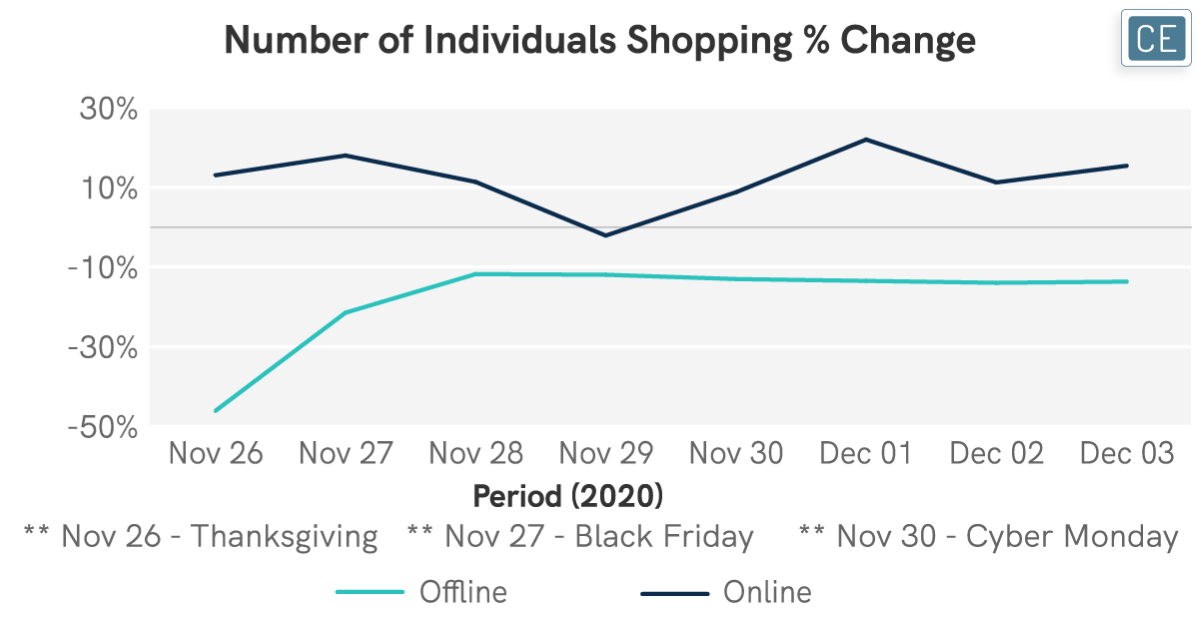

At this point, it should be unsurprising to hear that online sales grew faster than offline during Black Friday week, when customers in previous years have formed lines blocks long to catch early deals and it used to be that parking spaces at malls took hours to find.

After a wildly successful IPO, Airbnb looks to continue to build on its COVID-driven momentum. As traditional travel has slowed, Airbnb has become the preferred method of lodging for many Americans looking for what seems to them a safer way to get away from it all. But is the company’s recent growth sustainable?

The recent work-from-home trends have made daytime pajamas the norm and led to declining sales (and in some cases bankruptcy) for many business casual clothing brands. One company that seems to be bucking the trend is Stitch Fix, which recently reported surprisingly strong sales trends.

DoorDash’s recent IPO made a big splash as the stock shot up on the first day. But is the company positioned for success? In today’s post, we examine several key components of DoorDash’s performance, which may provide insights for competitors and potential restaurant partners, but also any business thinking about expanding its delivery offering amidst the recent e-commerce boom.

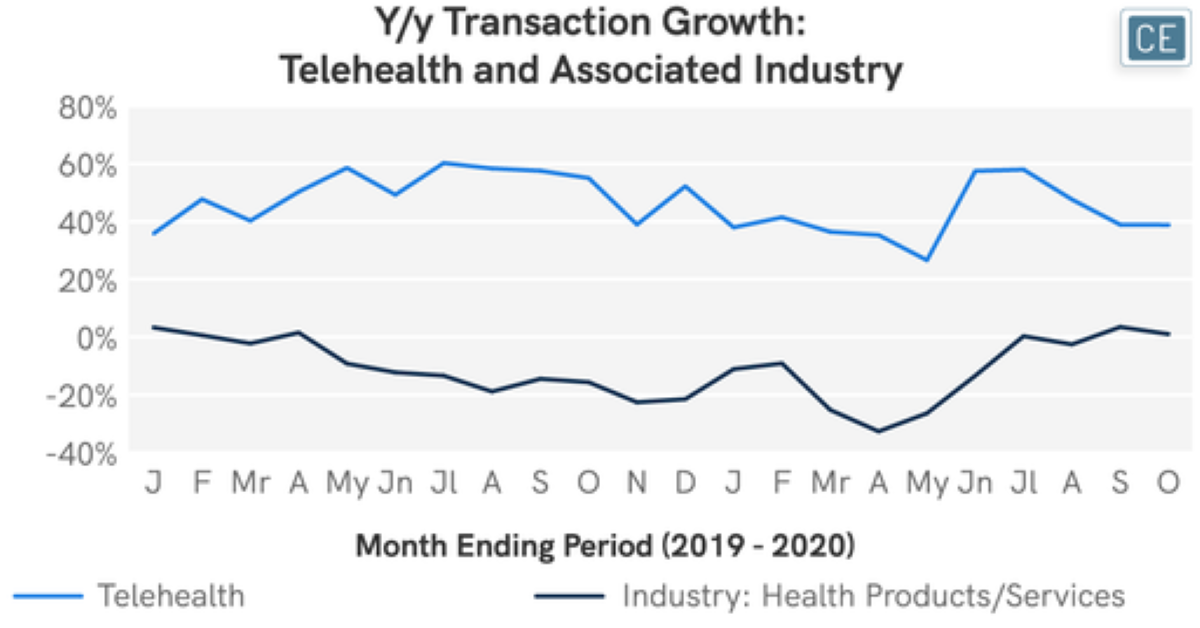

At a time when health and disease are at the forefront of news reports and have taken over most people’s daily lives, it is almost counterintuitive the extent to which there are reports of people letting their health suffer because they are afraid to see an in-person doctor. Enter the telehealth sector, already experiencing strong growth pre-pandemic, with COVID-19 allowing it to maintain that strength.

For many corporate strategy and business development groups, finding other brands with the right balance of similarities and synergies to form a partnership can be a challenging task. The ideal partner should be among the most successful in its industry, with best-in-class growth rates.

Among the many categories hit hard by the COVID-19 pandemic has been the Beauty sector. Year-over-year Beauty spend dropped by a quarter in March 2020 and by a third in April 2020 as quarantines and stay-at-home orders meant that beauty shoppers didn’t have anywhere to go out to, limiting the need for products such as lipstick and haircare.

When stay-at-home orders closed gyms and fitness classes in many states in March, many Americans turned to baking as an alternate activity, leading to jokes about the COVID-driven 19 pounds of weight gain. However, not all consumers turned to banana bread for comfort. Many former gym members began purchasing at-home equipment and streaming classes, leading to success for companies like Peloton.

COVID-19 has changed the dynamics of the restaurant industry, with quarantine and shelter-in-place orders leading some to increase the amount of food they’re ordering in, while others hesitated to have any contact with even delivery workers. CE Vision provides the unique ability to look at individual transactions by restaurant and by delivery service in order to give users a more wholistic view of trends.

COVID-19 has changed the dynamics of the restaurant industry, with quarantine and shelter-in-place orders leading some to increase the amount of food they’re ordering in, while others hesitated to have any contact with even delivery workers.

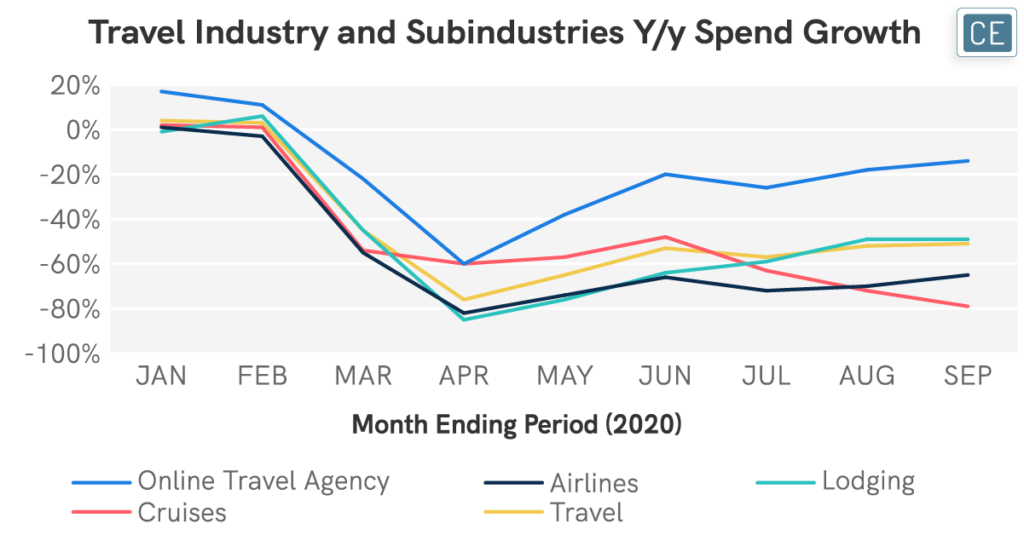

Although many sectors of the economy have seen declining sales due to the COVID-19 pandemic, the travel industry has arguably borne the worst of the declines. Cruises have been the worst-hit, with spend down -80% y/y in September. Airlines have not faired much better, with spend down almost two-thirds. Yet, other parts of the travel industry are doing comparably better.

Consumer Edge credit card data has been very effective in predicting Macro-level economic growth trends. For the unadjusted Retail sales number that the Census Bureau reports every month, government data accelerated +730 bps and CE data caught this acceleration with data delivered well in advance of the report. Pent-up demand may be a key driver of this acceleration, as the September growth rate was higher than even any 2019 monthly growth rates.

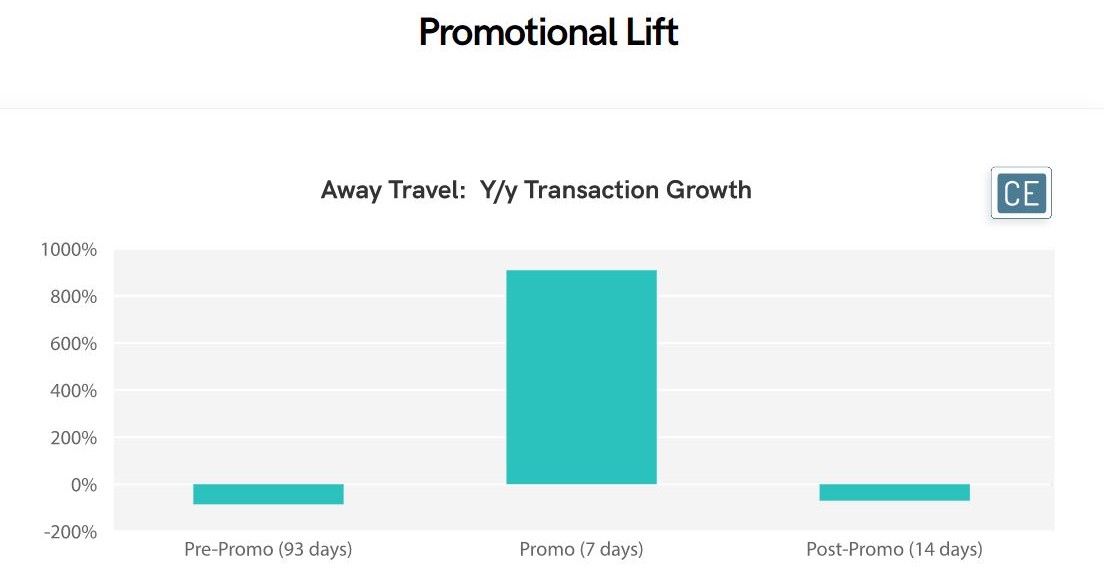

One of the trademarks of some hip new brands, including Away Travel and Everlane, has been an avoidance of the entrenched practice of marking items up just to mark them down, with many older brands known for having “sales” almost every other week. Yet, in the face of depressed shopping activity due to the COVID-19 pandemic, both brands launched uncharacteristic fixed price sales this past summer.

In addition to increased purchases of flour and furniture, the early spring lockdown in many states led to more consumption of video streaming services as consumers looked for alternative sources of entertainment under stay-at-home orders.