Below, ETR recaps the datasets on leading vendors in the Observability sector, based on ETR's Summer Technology Spending Intentions Survey (TSIS), which captures where IT budgets are being invested in 2H21, citing participation from \~1,200 IT decision-makers. Below are specific excerpts from each vendor's outlook report, originally published on July 23rd, 2021. Spending intentions on Datadog have accelerated to multi-year highs, driven by more customers indicating plans to Increase spend with the vendor in 2H’21.

Our Macro survey series, which continues to build upon our COVID-19 impact series, saw participation from 950 IT Decision makers. The full results are now available with topics that include: IT spend growth, tech sector priorities, remote vs. hybrid vs. in-office projections, and hiring trends. While we can't give away all the great data findings from our macro survey series, in the full report you will find key takeaways like these on overall IT budget growth and Sector Spending Priorities.

In light of recent IPO announcements, we're pleased to present reports from our Spring Emerging Technology Study for several of these soon-to-be-public vendors. This survey saw participation from a record high 1,000+ IT Decision-Makers, capturing over $400B in anticipated total annual IT spend. Monday.com’s Net Sentiment score is showing signs of recovery from 2020 studies, driven by a reduction in churn indications.

Below, ETR recaps the datasets on leading vendors in the Enterprise Apps, Data Warehousing, Productivity Apps, Marketing, and IT Services sectors. This article is based on ETR's Spring Technology Spending Intentions Survey (TSIS), which captures where IT budgets are being invested, citing participation from 1,500 IT decision-makers. Below are specific excerpts from each vendor's TSIS report, originally published on April 16th, 2021.

Below, ETR recaps the datasets on leading vendors in the Data Warehousing, Productivity Apps, and Storage sectors. This article is based on ETR's Spring Technology Spending Intentions Survey (TSIS), which captures where IT budgets are being invested, citing participation from 1,500 IT decision-makers. Below are specific excerpts from each vendor's TSIS report, originally published on April 16th, 2021.

We are excited to show you several data points and macro takeaways from our Spring Technology Spending Intentions Survey and COVID-19 Impact drill down series, citing participation from 1,500 IT decision-makers.

The past week, high-flying CDN-turned-edge-computing vendor Fastly announced that its 3Q'20 revenues would be 5% lower-than-expected due primarily to significantly lower than anticipated revenues from its largest customer, which it had previously disclosed as ByteDance, the operator of TikTok.

"We originally started with Redshift as our data warehouse. Over time, we realized that there were some features that were missing that we weren’t able to take advantage of, so we looked at Snowflake and realized it was a much more current and modern cloud infrastructure to move to."

Ahead of Snowflake's rumored IPO, ETR reviews its most recent data to determine whether Snowflake can maintain its elevated adoption rate & continue penetrating the largest accounts in the world. The information below was collected through a topical study ETR conducted in May 2020.

Based on the preliminary data, 44% of CIOs indicated their organization is decreasing investments in emerging tech due to COVID-19.

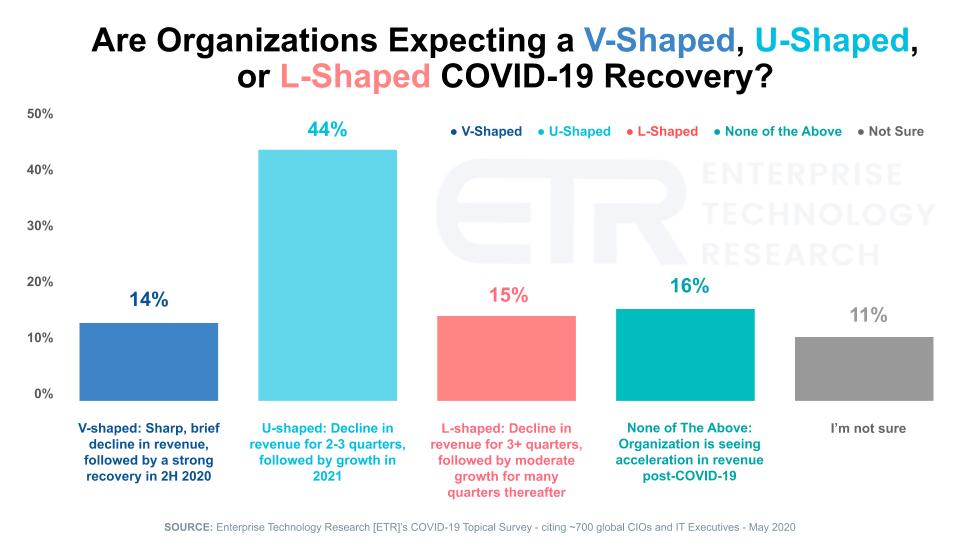

ETR launched its Summer Emerging Technology Study last Thursday afternoon to gauge CIO sentiment levels across 300+ private enterprise technology companies. As a follow up, we asked these same high-level IT decision makers to provide insight as to the type of recovery their organization expects due to COVID-19. Specifically, we gauged whether their organization is expecting a V-shaped, U-shaped, or L-shaped recovery due to COVID-19.