Worker and traveller presence across UK ports fell 40pts during the first national lockdown before recovering to 90% of January levels, where it has held fast over the course of the last seven months. As the Brexit transition period draws to a close, and amid reports of bottlenecks across the country’s ports of entry, the Huq Index offers a high-frequency measure of activity at these locations.

Eager shoppers appear to have flocked to the high street with the end of lockdown, causing footfall to UK clothing stores to rise to 62% of YoY levels in the last few days. Huq’s Index shows how the second national lockdown and forced closure of many stores saw footfall levels drop to just 15% of YoY levels – almost as low as they did in April.

Over the course of 2020 we have seen reports of the pandemic affecting different parts of the UK in different ways, with age, industries and travel distances suggested as possible contributors. Today we look at Huq’s measure of population mobility for England – that is, the extent to which residents of cities in different regions are travelling on average day by day.

UK residents living in regions destined for Tier 1 tomorrow have demonstrated greatest restraint in terms of mobility during recent months and the last few weeks of lockdown. What will they do with their newfound freedoms? Data from the Huq Index – which measures daily distances travelled – suggests not very much.

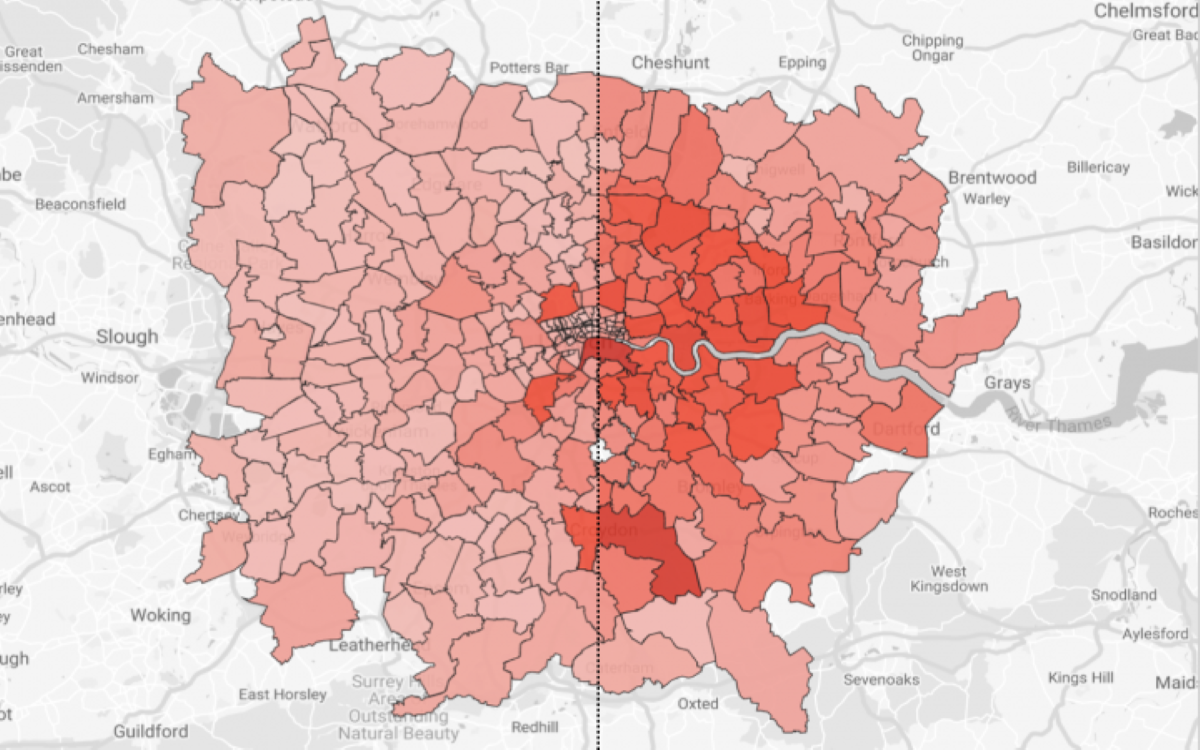

Huq has mapped the density of people within London by postcode district, month-on-month since the start of the year to create a time-lapse revealing emerging patterns. The visualisation shows how lockdowns one and two have transformed the capital, and what activity looks like across the city today.

Against a backdrop of different policies and lockdown measures across Europe, continental clothing retail is tracking at 38% of year-on-year levels compared to just 17% in the UK – where non-essential retail remains closed. Similar measures of customer levels for other discretionary sectors show the UK and EU in lock-step at low or close to zero, while staples – ie. Groceries – in the UK are tracking higher significantly higher.

Alternative real-time data from Huq predicts a bleak winter ahead for European manufacturing – particularly in food, chemicals and aerospace.

Supermarket shopping in the UK is holding resilient through the UK’s second national lockdown, with footfall over the last week comparable to last year’s levels while attendance to supermarkets on the continent has reached a new low.

Catherine McGuinness, chair of policy at the City of London Corporation, which governs the financial district, warned of “a bleak winter”. She said: “People have been steadily coming back to the City but this plateaued in September and will now drop off.”

City population mobility in parts of the UK is just 15pts lower than usual levels in this second national lockdown, with Huq’s Index suggesting that residents have been far less restrained than they were during lockdown 1.0 in April.

Staffing levels at industrial facilities across Europe have fallen significantly with much of the continent in the midst of lockdown, with worker presence in some sectors dropping to levels beneath April. The second wave has brought steepest declines to Aerospace, Chemical and Food producers.

As we approach the end of the first week of lockdown 2.0, the Huq Index shows that footfall across the UK’s foodservice outlets appears to be holding stronger than it did when businesses were forced close earlier this year.

Footfall to UK supermarkets has so far dodged the second wave slump, with Huq’s Index recording levels higher than last year over the last week whilst all other consumer sectors dive and supermarkets on the continent see attendance cut in half.

Not only has footfall into shops and stores declined during the pandemic, but customers are also visiting a less diverse mix of retailers as the crisis continues to drive change in retail behaviour. This new Huq Index measures the range of retail brands visited by customers within a category every week, and finds that loyalty increased by as much as 20% in the aftermath of the first lockdown.

The presence of customers across all consumer industries in Europe fallen sharply over the last two weeks as countries across the continent introduce measures consistent with those seen during the first lockdown. This effect is most keenly felt across discretionary industries – particularly hospitality, accommodation, leisure and apparel.

Visits to National Trust properties are within touching distance of pre-Covid levels as restrictions on indoor entertainment encourage visitors out into the nation’s parks and gardens. The Huq Index measured a sharp drop in attendance to both open and ticketed properties with the onset of lockdown in March

The Huq Index shows the decline in footfall across the UK’s foodservice outlets levelling off at 25pts following a wave of new restrictions across the country. Despite suffering a 35% loss from its summer peak on the 31st August, it is good news for the industry that it looks like the floor is close to here, and not some 20pts lower as it was during April and June this year.

Londoners are shying from big brand retailers in favour of shopping at independent outlets, with independent and single-site retailers consistently outpacing chains throughout the autumn.

Visits to pubs across the UK has held relatively steady as tighter restrictions come into force in many regions and new local lockdowns create precipitate another sharp decline in Foodservice industry trade. The Huq Index for Restaurants and Pubs shows footfall across the sector fall by an average of 29pts in the last 30 days.

Pedestrian footfall in Manchester has sunk to 50% of year-on-year levels as tighter restrictions and ambiguity over lockdown policy impacts mobility and trade. Through the summer, Huq’s mobility indicator for the city shows a steady recovery to levels of around 75% of 2019 by September, however this has dropped sharply over the last week.