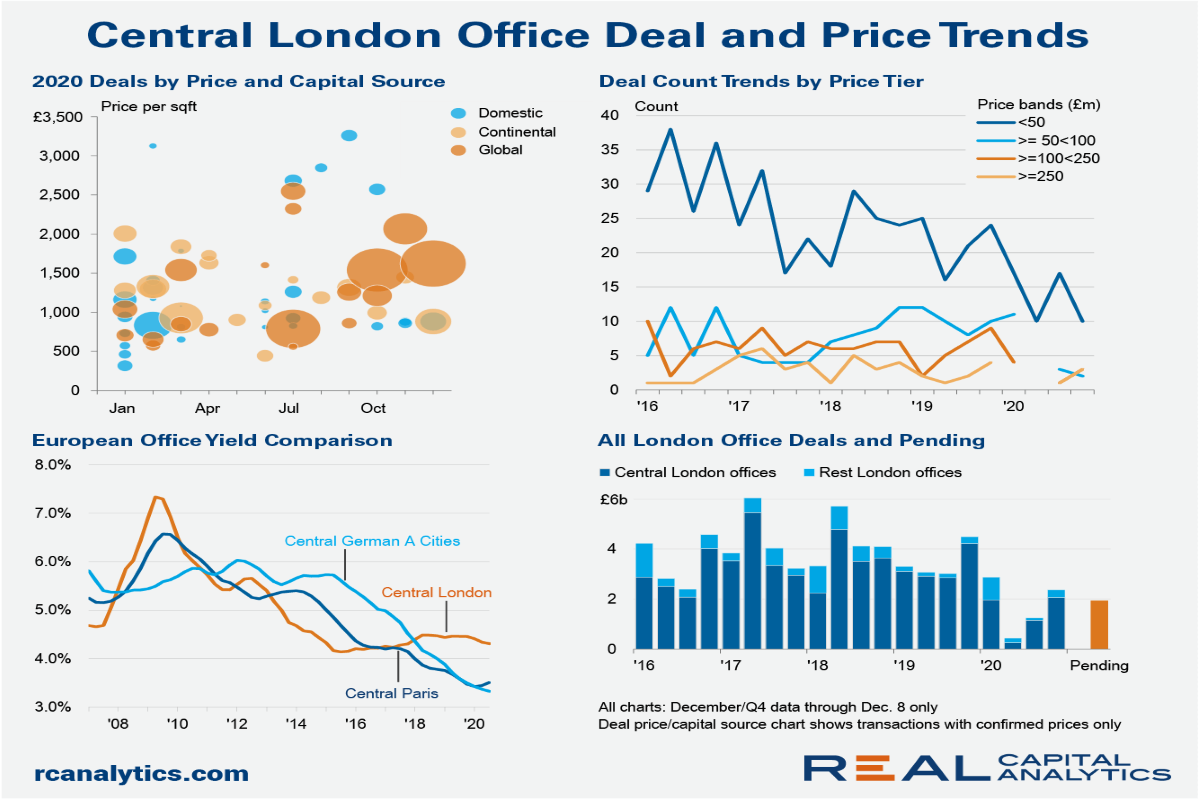

Dealmaking for Central London offices froze in the second quarter of 2020 with the onset of the pandemic. Only 10 properties changed hands, making it the weakest quarter on record, worse even than the depths of the Global Financial Crisis.

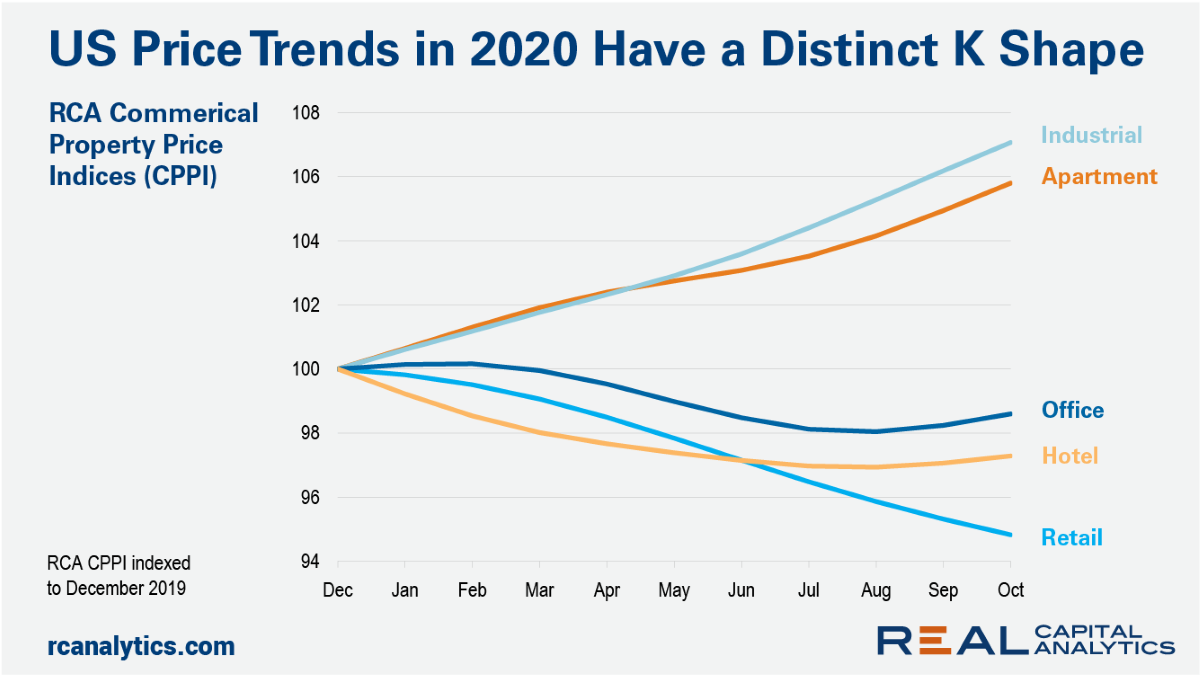

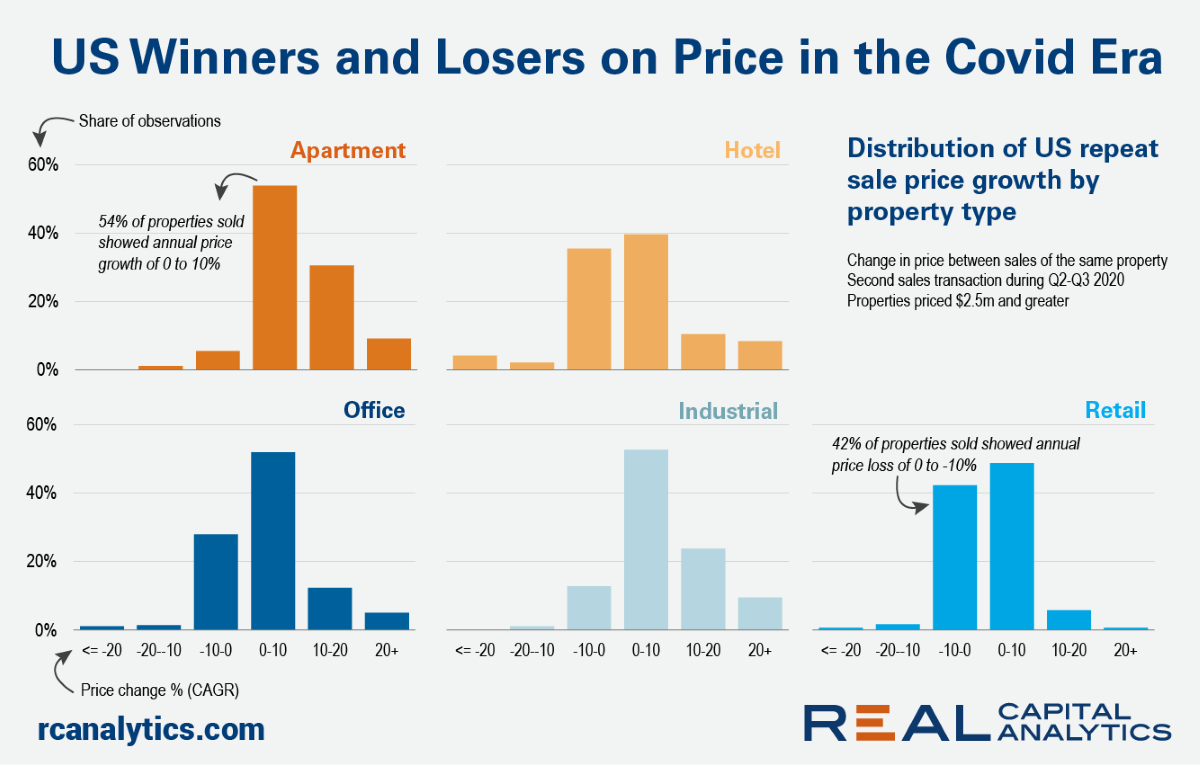

Every recession has a different impact on the performance of commercial real estate. This recession has the unique feature of savaging some sectors while boosting others. Given patterns of distress in the marketplace, the over or under performance of various property sectors in 2020 is likely to persist into 2021.

Into the final weeks of 2020, RCA’s tracking of global commercial real estate activity shows that the Americas region has been worst affected by the Covid-19 pandemic in the year so far.

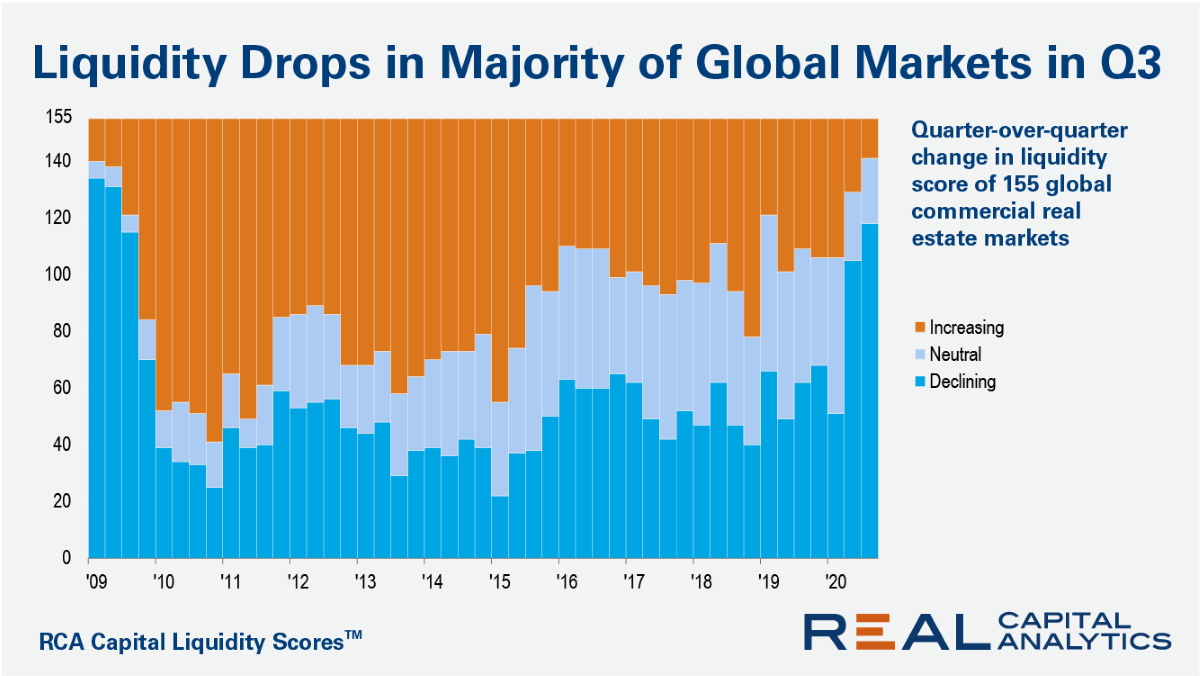

Market liquidity fell in 118 of 155 global commercial real estate markets in the third quarter of 2020, a widening swathe of liquidity declines than seen in the second quarter of the year, according to the latest update of the RCA Capital Liquidity Scores.

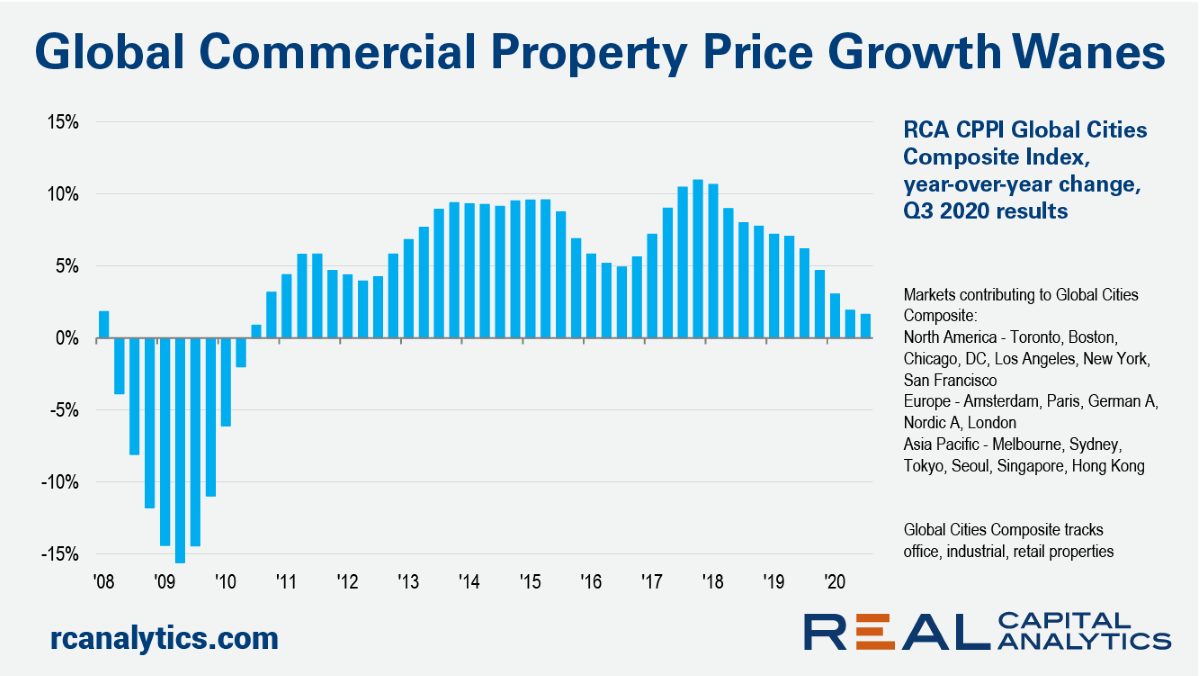

The global rate of commercial property price growth waned in the third quarter of 2020 as transaction activity continued to stumble amid the worldwide health crisis, the latest RCA CPPI Global Cities report shows.

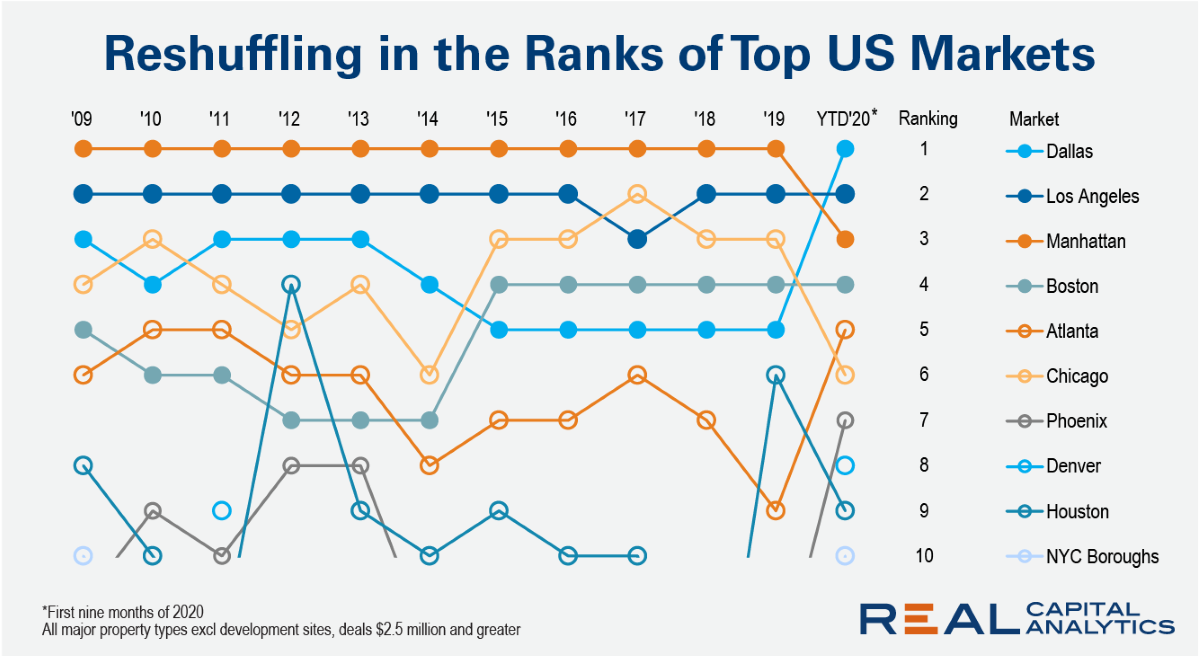

Dallas sits atop U.S. leader board for commercial property deal volume in the first nine months of 2020. Normally Manhattan would occupy the #1 position. Los Angeles has sometimes taken the top spot for shorter periods during times of market disruption in Manhattan, but Dallas has never topped the rankings for an extended period until 2020.

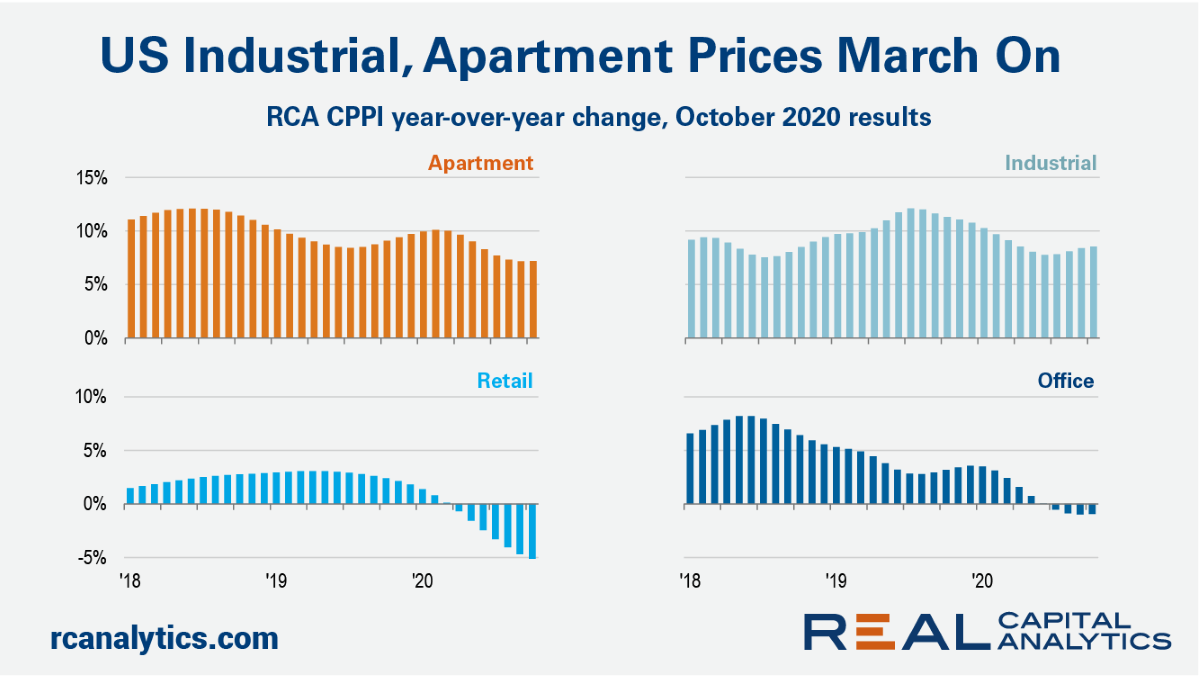

The U.S. national rate of commercial property price growth rose in October as the weight of capital into the high-flying apartment and industrial sectors boosted gains, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 3.6% from a year ago, the apartment index rose 7.2% and the industrial index 8.5%.

The Covid-19 pandemic has accelerated structural trends that were already reshaping the global commercial property investment landscape. One of these trends is the continued shrinking of the investable universe, with a huge chunk of the retail sector now seen as uninvestable.

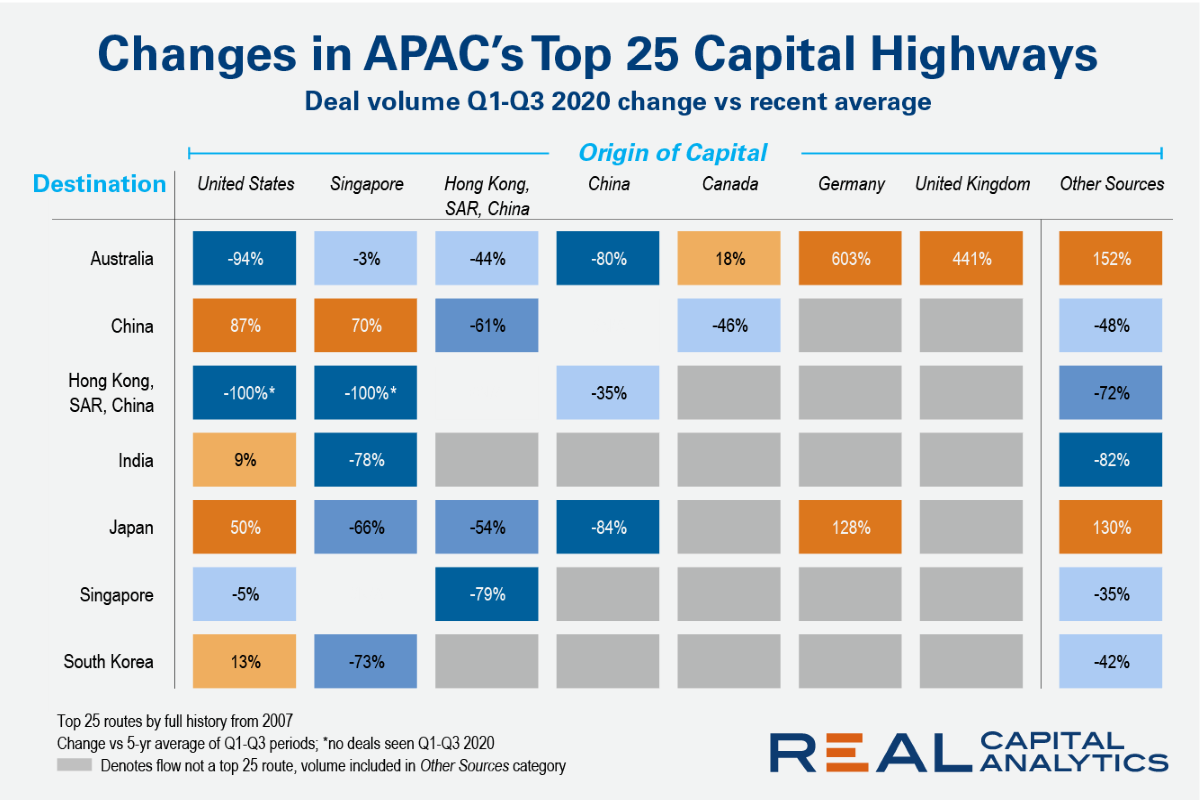

In the below chart we present the 25 biggest trade routes in Asia Pacific and illustrate how cross-border investment has behaved during this pandemic year. Novel capital flows, such as Austrian investors spending in China and Saudi players investing in Singapore, may be interesting from an anecdotal perspective, but market liquidity is ultimately driven by the most well traveled capital highways.

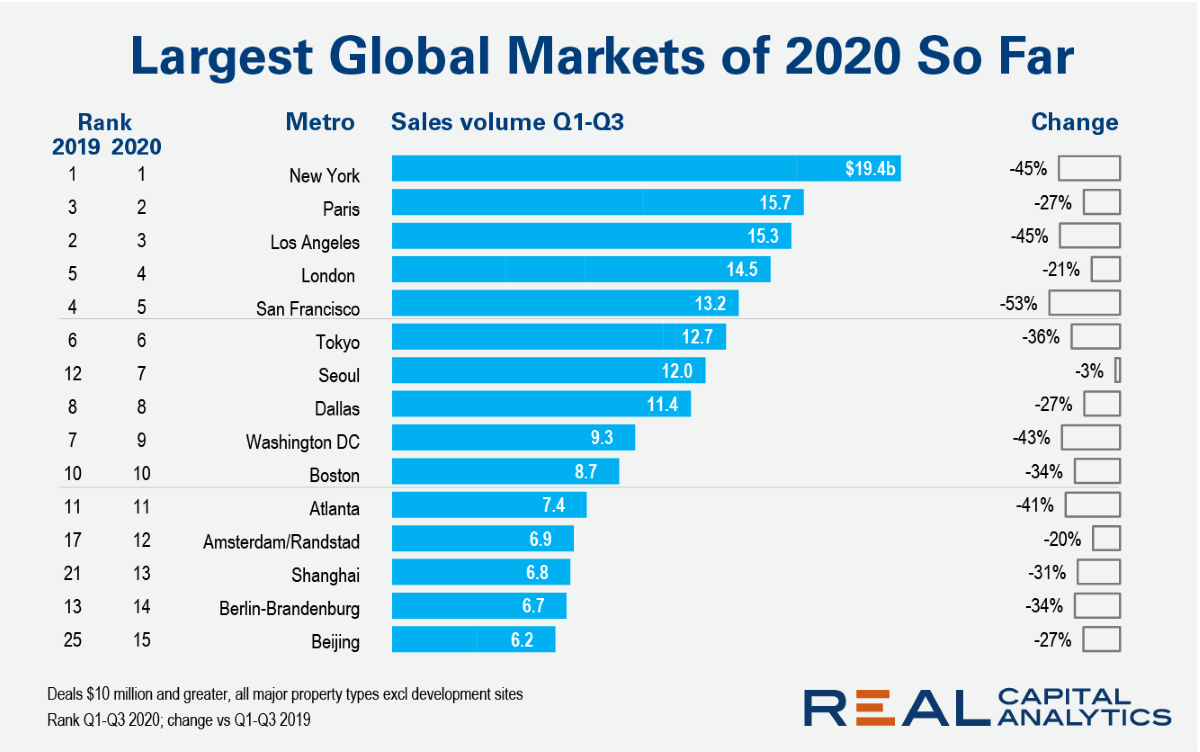

At the halfway point of 2020 there were a handful of top global metros that posted growth in deal activity versus the first half of 2019. One quarter on and there are no such positives in the list of the world’s largest metros. Seoul returned deal volume close to that of last year, but the market is still just in negative territory.

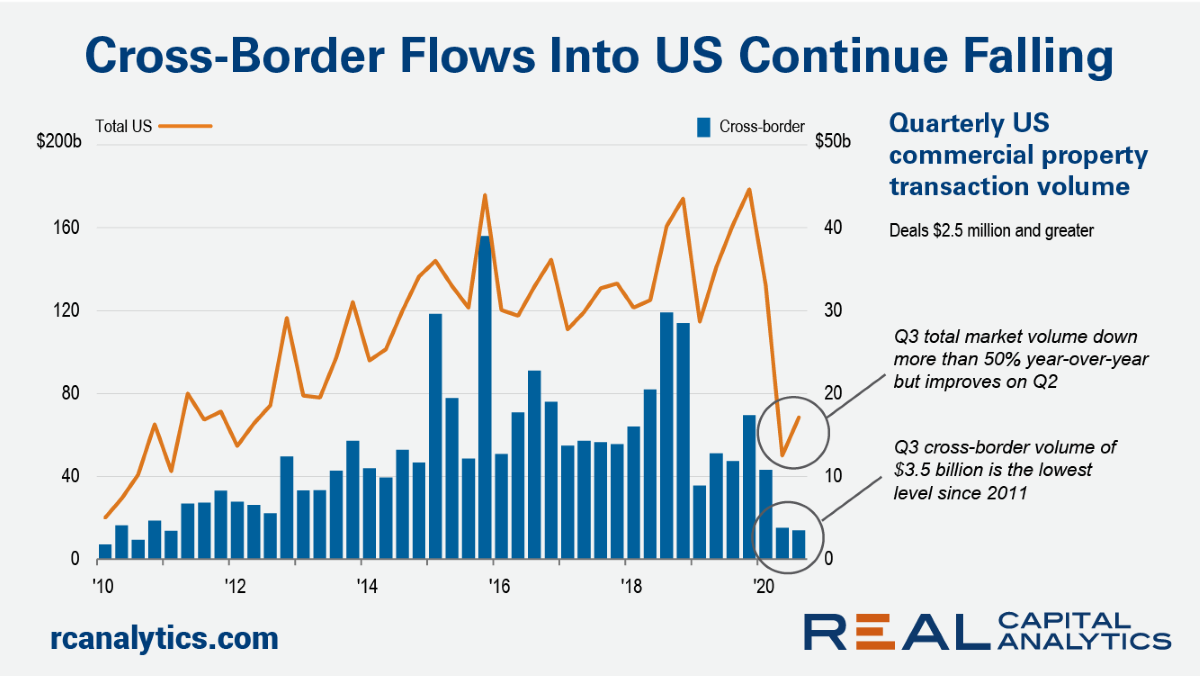

Total U.S. investment activity improved to some degree in Q3 2020, with sales volume up more relative to Q2 2020 than normal seasonal patterns would suggest. Not so for cross-border investment. Deal volume for cross-border buyers edged lower in the third quarter.

At the end of the third quarter, the count and volume of deals across the three global zones has fallen back even further as the Covid-19 pandemic grinds on. In the Americas, deal volume through the end of September was 41% lower than the same point in 2019, and the deal count 34% lower.

Why settle for a deal when you can hold out for a steal? That is the attitude of investors hoping to cash in on distressed asset sales in the aftermath of the Covid-19 downturn. The reality, however, is that many of the highest quality assets will not be available on the cheap.

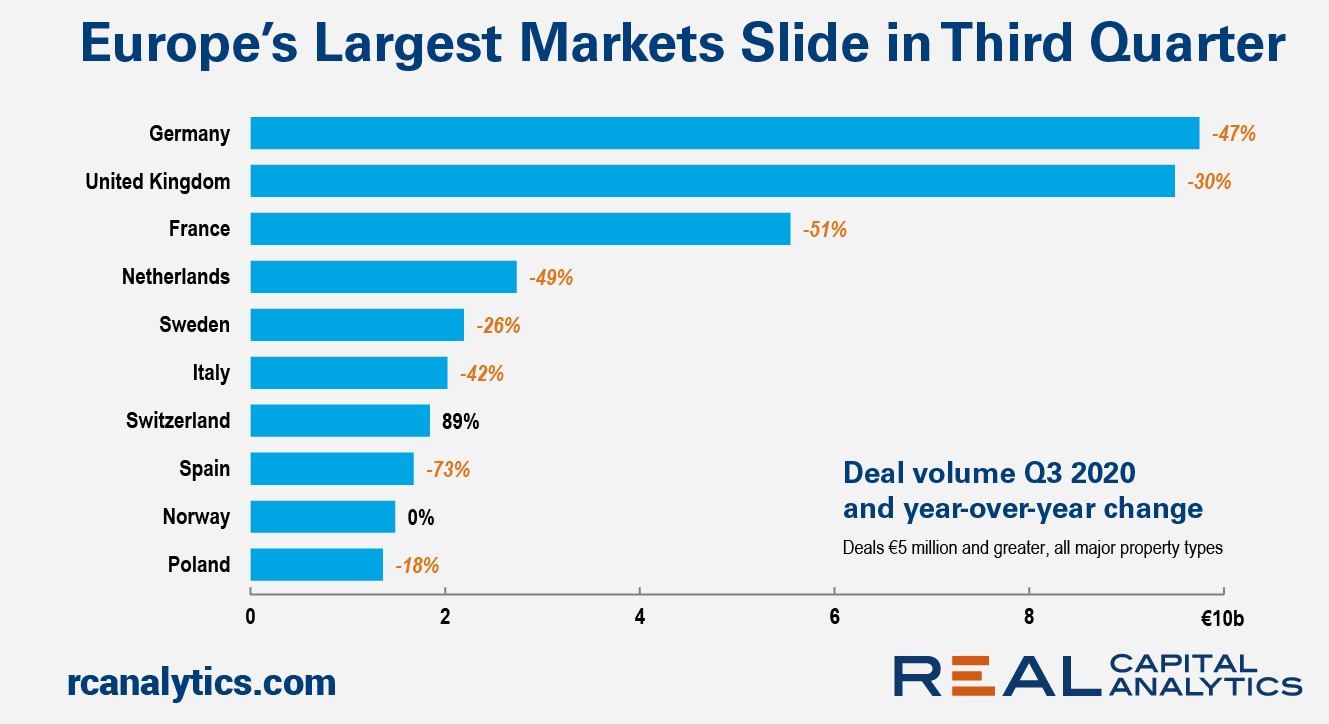

Commercial property deal activity in Europe slumped during the third quarter, rocked by the Covid-19 pandemic’s continued impact on dealmaking, economic growth and market prospects. The latest edition of Europe Capital Trends shows deal volume dropped 43% in the third quarter from a year ago, and was down from the levels seen in the second quarter of this year.

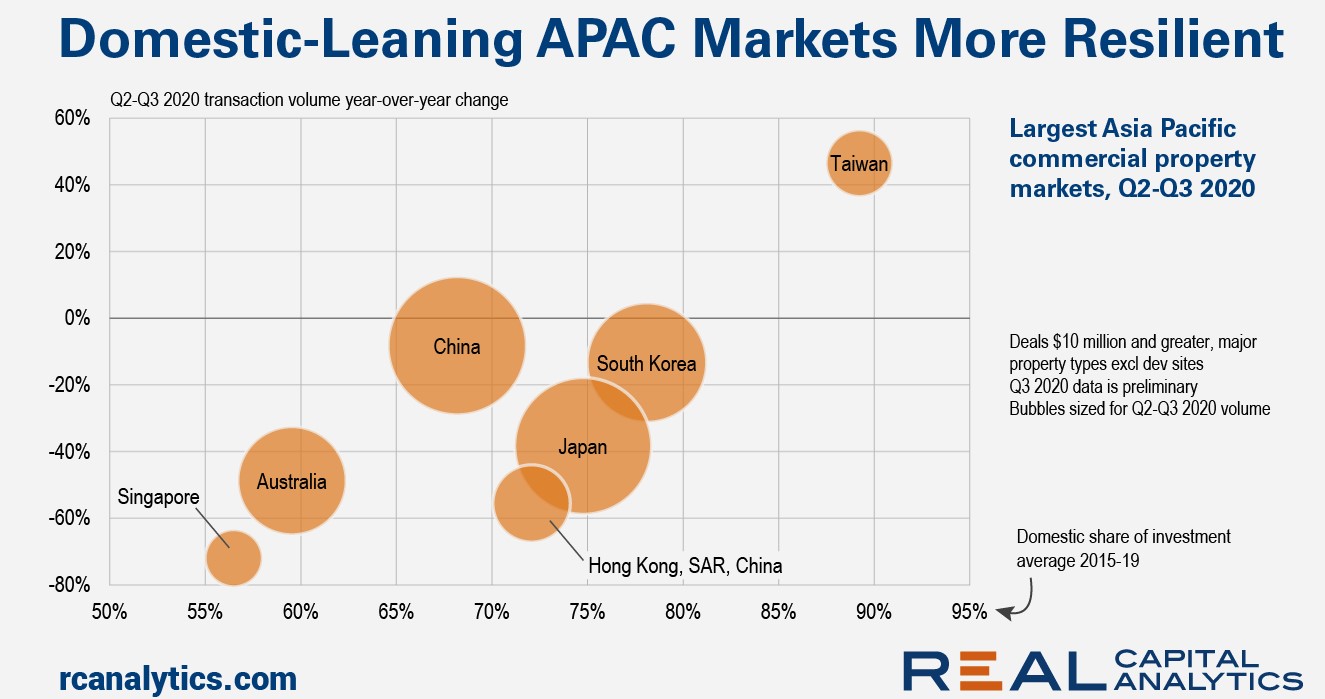

Global and regional cross-border investors pulled back from new Asia Pacific deals in Q3 2020 at almost double the rate that domestic buyers retreated, preliminary Real Capital Analytics data shows. Investment by domestic buyers was higher in the third quarter than the second quarter of 2020, though the level was down significantly versus a year ago.

The annual rate of U.S. commercial real estate price growth came in at 1.4% in September, as continued gains in apartment and industrial sector prices balanced out declines in retail and office prices, the latest RCA CPPI: US summary report shows. The US National All-Property Index gained 0.2% in September from August.

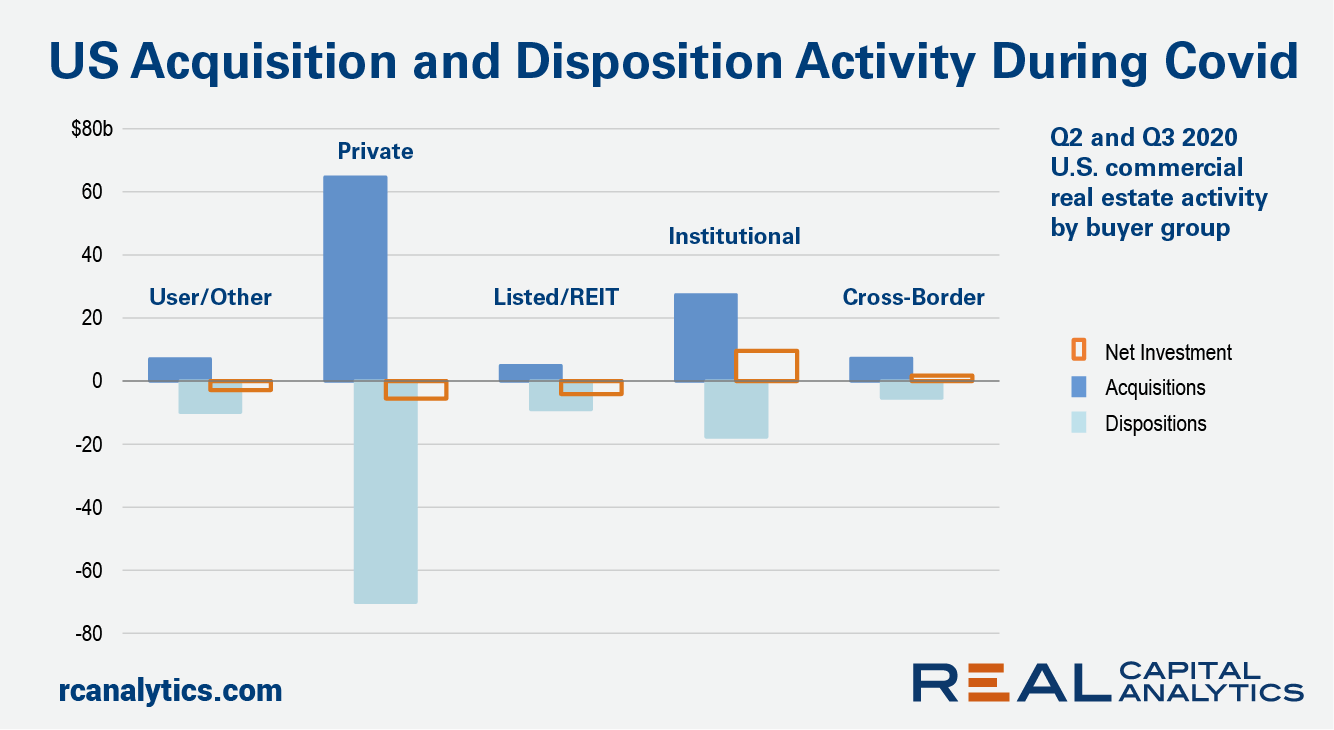

U.S. deal activity has corrected in 2020 following the onset of the Covid-19 crisis. Looking at total acquisitions by all investor types, deal volume for the past two quarters has retreated to levels last seen in 2012. Institutional investors, however, stand as net buyers of U.S. commercial real estate in the face of the pandemic.

The latest data from Real Capital Analytics shows that the European logistics sector continues to attract plenty of capital amid the myriad of uncertainties caused by the Covid-19 crisis. The flow of investment into logistics properties has buttressed the industrial sector overall and it is the only major property type to register higher deal activity so far this year than 2019.

U.S. commercial real estate deal volume has fallen sharply in 2020 but there is still capital flowing into the sector, which supports asset pricing. More capital flowed to refinancing activity than into new acquisitions in the first half of 2020, the latest edition of US Capital Trends shows.

German investors have new incentives to look at commercial real estate investments in the U.S. This group of investors was the second largest source of cross-border capital for deals in the U.S. over the last 12 months, behind Canadian players. A short while ago it was difficult for German investors to look at U.S. because of hedging costs. Those costs are fading and can make U.S. investments look comparatively inexpensive.