The U.K. food delivery industry exploded during the pandemic. But as the lockdowns ease, which food delivery stock will come out on top? Here we use our Stock Intelligence platform to dive into the key alternative data trends for three of the market’s biggest players, namely Deliveroo (ROO), Uber Eats (UBER) and Just Eat Takeaway (JET). According to Lumina Intelligence, U.K. food delivery grew by £3.7 billion in 2020 to reach £11.4 billion

And that’s a wrap! Amazon Prime Day was another success for the eCommerce giant, check out our exclusive coverage of results first. Shoppers came ready to open up their wallets on Prime Day. Revenue jumped nearly 600% compared to the daily average in the 20 days leading up to the two-day event, an increase that was almost double that of product views (+353%) and unit sales (+365%). To help understand consumer behavior driving this Prime Day performance, we used Shopper Intelligence, our eCommerce Intelligence platform, to break down trends on a category and brand level

The world keeps changing. We don’t have to tell you that. COVID-19 took almost everything we knew and flipped it upside down. From March 2020, work-from-home companies saw demand surge, while travel came to a virtual standstill. But now, as we’re coming out from the other side, consumer trends are shifting once again. What’s next for the market? What trends should you keep tabs on as the world begins the next new norm.

Following the roll-out of the vaccine against the COVID-19 virus, the initial excitement of post-COVID life appears to be wearing off – slightly. What does that mean for the market? In this month’s Digital Heat we see travel trends start to stabilize following the strong growth in previous months. Read on for a deeper dive into what’s driving these trends as well as other changes in online behavior. How are we doing this? Digital Heat, an easy-to-use heatmap to help you quickly identify at scale which industries and companies are most impacted by the current economic environment.

Earlier this month (June 2), Amazon announced that its annual Prime Day will take place June 21 – 22. Prime Day 2021 will feature over 2 million deals worldwide, the most ever offered in the event’s seven-year history! Although the impact of the pandemic makes it particularly difficult for brands to develop 2021 strategies, we’ll use Similarweb Shopper Intelligence to make actionable, Amazon Prime Day predictions by comparing this year with last and describing top consumer trends we foresee impacting this year’s shopping event.

The pandemic has completely changed the trajectory of stocks and sectors. Whether we like it or not, coronavirus has sped up the world’s digital transformation by months or even years. “The move to digitization has accelerated, and the benefits will be permanent,” says KPMG’s global advisory head Carl Carande. “There is no going back.” With this in mind, we decided to zero in on the top 10 investing trends for 2021, covering everything from bitcoin and cryptocurrency to IPOs and SPACs.

Zoom Video Communications (ZM) is on the cusp of its fiscal first quarter earnings report on June 1. As expected, Zoom’s momentum is fading as lockdowns ease and on-site activity returns. Shares are significantly underperforming year-to-date, even when compared to the overall weaker performance across the tech space.While many organizations are moving to adopt a more permanent flexible work environment, the risk-reward ratio for Zoom has now undeniably shifted.

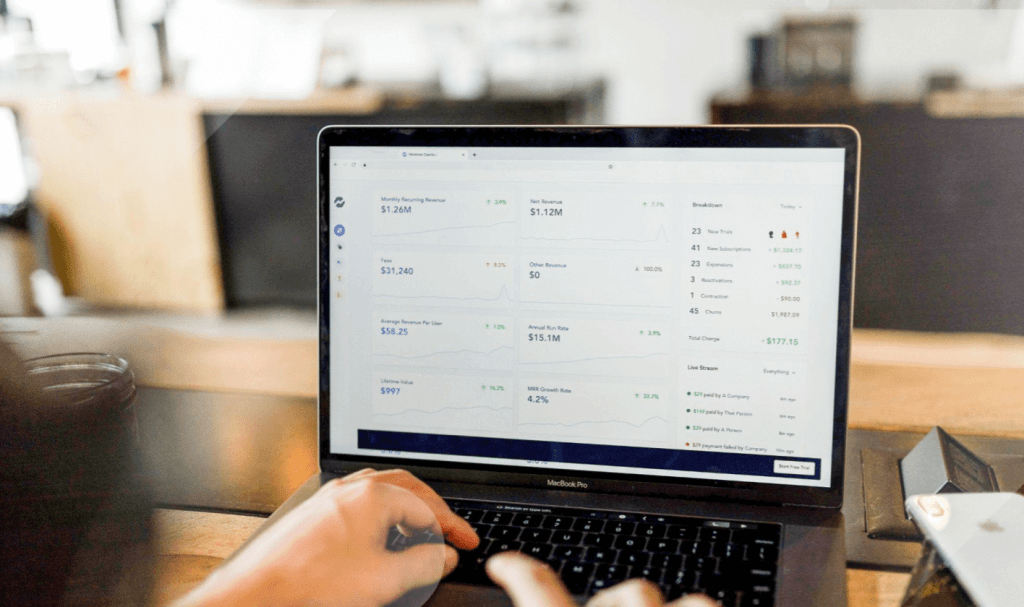

Monday.com has officially filed for its initial public offering (IPO) on the NASDAQ stock exchange, under the ticker MNDY. The project management tech company is yet to report a profit, but did report impressive total revenue for 2020, of $161 million. The company has not yet disclosed its target valuation. In the meantime, let’s see what the alternative data has to say, ahead of the monday.com IPO.

Now it’s the turn of SaaS companies to take center stage this earnings season. For the first quarter, SaaS expectations called for sustained enterprise momentum. However, for certain B2B platforms, there are concerns that these expectations could prove aggressive. That’s the case even for those who have experienced account growth acceleration in 2021, such as cloud-based software provider Salesforce (CRM) and Workday (WDAY).

Thanks to the coronavirus vaccine rollout, the market is shifting once again. So what does that mean for the industries most influenced by the pandemic lockdowns? This report delves into online trends in sectors and industries from SaaS to travel. How are we doing this?

After coming to a shrieking halt in 2020, the online event ticketing industry is making an awe-inspiring comeback. Demand is surging as lockdowns, and stay-at-home orders ease in many countries around the world. For a market dominated by a small number of large booking websites focusing on live music events, concerts, and festivals, the transition to virtual was virtually not an option for fans and event-goers.

With Mother’s Day fast approaching and graduations around the corner, many shoppers are looking for last-minute gifts. Flowers are the go-to presents for these special spring events. This raises the question: Which flower websites are outperforming now? To answer this, we’ve compiled a list of the fastest-growing flower sites in the U.S. for the first quarter (Q1) of 2021. Keep reading to find out which industry trends are driving this growth.

Heading into the print on May 6, we used Similarweb’s alternative data to analyze Peloton’s (PTON) unique users and payment referral traffic as a window into F3Q21 earnings. Peloton is in a tricky spot right now. Shares are down 35% year-to-date, as investors question the sustainability of elevated pandemic growth levels.

From taste preferences and health risks to ancestry links, 23andMe, provides direct to customer (DTC) home genetic testing kits that give customers insights into their genetics. All customers need to do is spit into a tube. But that’s not all. 23andMe is on a mission to disrupt what it believes to be a dysfunctional healthcare system.

Etsy has been on a strong run. And expectations remain high for the eCommerce site known for selling handmade and vintage items. A strong 4Q20, greater-than-anticipated holiday sales, and a new personalized search feature all add to the bullish picture for the company. But, as vaccinations around the globe are rolled out and lockdowns ease, will the momentum continue?

Here we dive into the digital health of three major tech stocks: Facebook (FB), Twitter (TWTR), and Microsoft (MSFT). What do the online trends reveal about these mega-caps? Using our powerful alternative data, we reveal the key digital insights heading into the print. Let’s take a closer look at these internet giants now.

On March 26, the co-working space company announced a definitive merger agreement with a special purpose acquisition company (SPAC), BowX Acquisition Corp. (NASDAQ: BOWX). Once the merger completes, WeWork will be a publicly listed company, and a must-follow for stock intelligence enthusiasts. It will also receive $1.3 billion of cash, “to fund its growth plans into the future.”

Cryptocurrencies had a monumental year. In December, Bitcoin (BTC) shot past $20 thousand, and at the time of writing, BTC is trading just below the $60 thousand level. This rapid ascent may bring déjà vu of 2017 when BTC climbed from $975 to $20,089. An analysis of the digital growth of U.K. cryptocurrency sites, along with worldwide events, indicates that financial services companies should keep a close eye on crypto this time. We’ll show you some tools to help.

As if Netflix’s latest documentary Seaspiracy wasn’t enough to make us really ponder the fate of our oceans, last week a huge shipping container was blown off course and became stranded in the Suez Canal. The 200,000-ton, 400-meter long (1,312-foot) ship blocked the infamous waterway for about a week before finally being freed from the shoreline. The Suez Canal accounts for approximately 30% of the world’s daily shipping container freight and is a critical link for trade between Europe and Asia. It’s estimated that the shutdown of the canal was holding up $9.6 billion each day, or $6.7 million a minute.

Expectations for Chewy are high heading into the print on March 30. The eCommerce pure play beat consensus revenue estimates for the past six consecutive quarters. And in its last earnings report, the company issued strong guidance for the current quarter (November–January 2021). However, shares have pulled back recently on valuation concerns. Chewy is down 13% year-to-date following a massive build-up in 2020. Given the recent weakness in its stock over the past month, the key question now is: Will CHWY be able to beat revenue consensus estimates again and propel its stock price higher?