Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

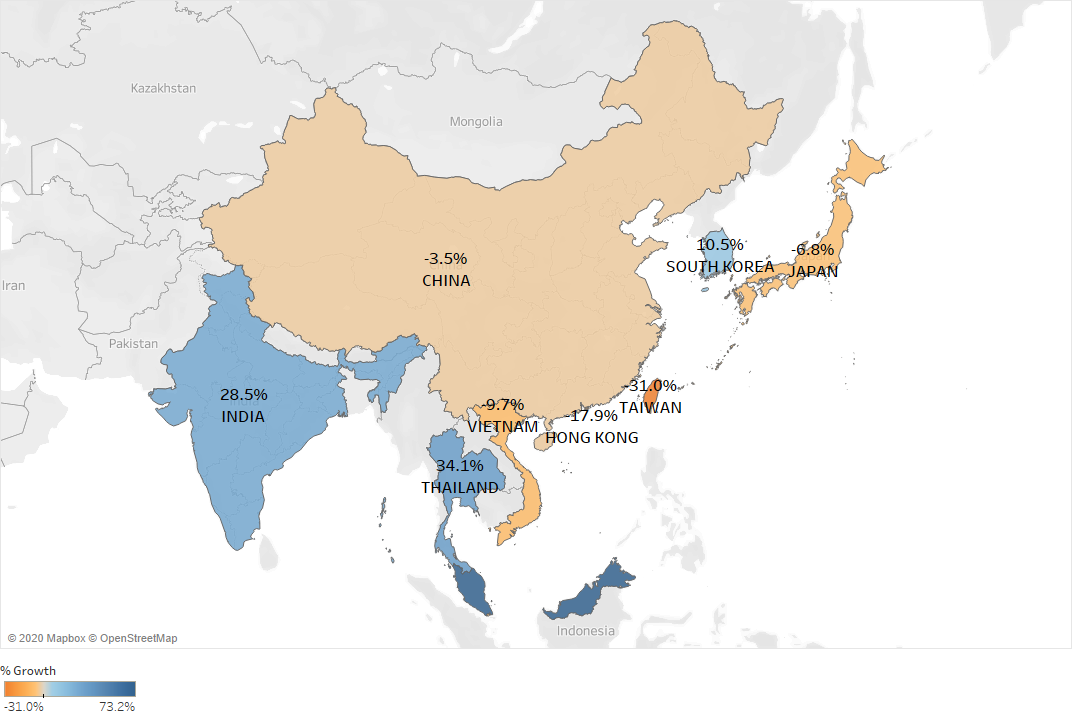

China container exports to the United States rose 63.1% in April in terms of gross tonnage versus a March low. This represents a significant jump compared to a 22.3% month-over-month rise in April 2019.

As China’s largest trading partner, the United States accounts for 16.8% of all exports. April’s total tonnage of 4.0 million tons shipped to the United States represents a 16.2% annual decline. This is a significant turnaround relative to the 37.2% annual decline in March 2020.

Figures from a leading customs data provider, Descartes Datamyne, point to a rebound in China that is led by shipments of home goods, machinery, plastic goods, iron goods, and toys. The recovery, in fact, is quite broad as 73 of all 99 cargo categories (HS 2) experienced an increase in tonnage, even when adjusted for seasonality.

Additionally, on average, containerships travel 0.26% empty. In March 2020, empty containers nearly quadrupled to 0.94%. As a sign of balance and an increase in shipping demand, empty container rates have recovered to 0.40% in April.

Satellite data provider, RS Metrics, reports that in spite of manufacturing activity rebounding in China for March after a dramatic contraction in February, metal production tracked using satellite analytics shows a continued decline in March which is also extending into April.

RS Metrics is seeing the following based on its analytics:

All eyes are focused on China as the world gauges what a post COVID-19 world might look like. According to the data, the reopening of Chinese businesses and the easing of travel restrictions has not yet rippled through to copper and aluminum production.

According to data from 1010data, a company tracking US credit card spending behavior, consumer spending collapsed at the end of March.

Spending on consumer credit and debit cards in the US had been mostly flat year over year heading into the European travel ban. Beginning on March 13th there was a freefall in spending which hit a bottom at a 46.3% year over year decline. Overall spend recovered slightly to down 32.9% by April 1st.

Diving into the specific sectors of the economy that have been impacted, Travel was by far the worst, declining 90% in overall spend.

The data from 1010data paints a scary picture for how the rest of 2020 is likely to play out. As discretionary spends come to a halt it will ripple through the supply chains of the companies impacted and ultimately lead to more layoffs in the future.