COVID-19 reached its peak in the United States last month and the housing market felt the strain of the pandemic. A record number of houses were pulled off the market, new construction slowed, and existing home sales decreased.

Existing housing activity, which often sees a boost from property transactions, was no exception. Across the board, maintenance and remodeling—a subset of maintenance that includes renovations, additions, and alterations—declined drastically year over year.

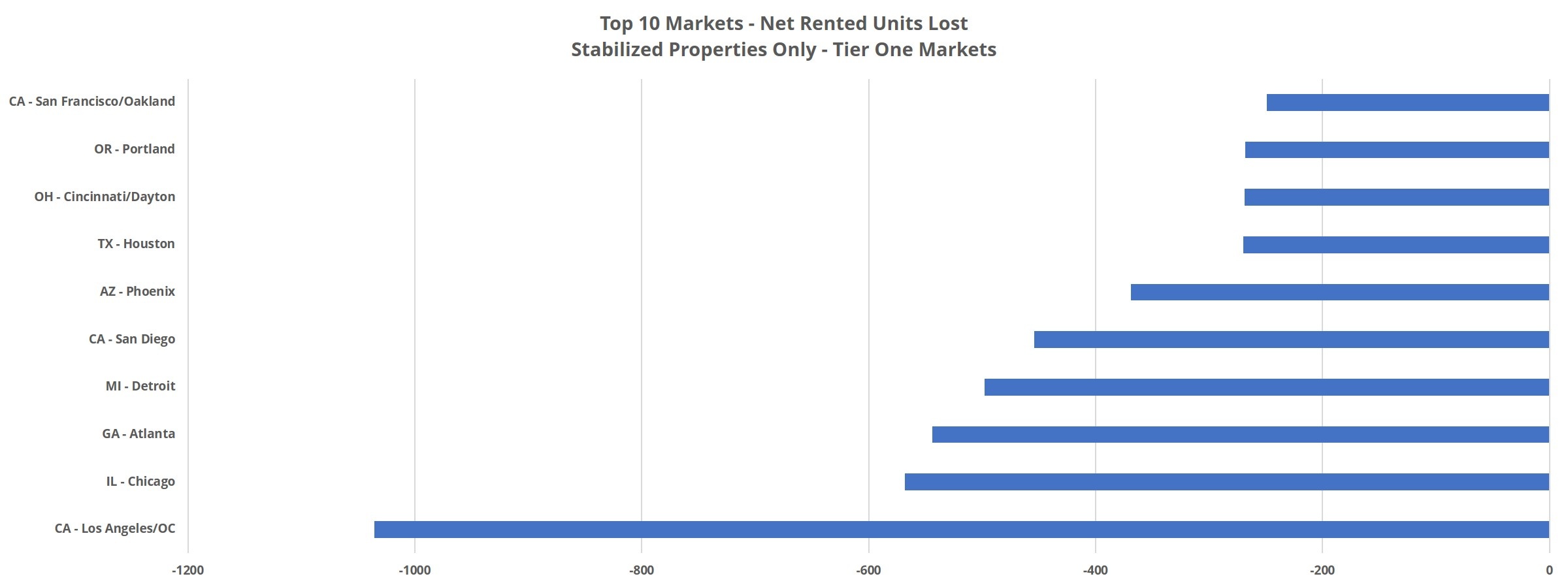

The dominant story of 2020 across all markets continues to be COVID-19 and the fallout from both the virus and the response to it. The impact is being felt across the economy, and multifamily real estate is no exception. April was the first full month in which a majority of the country was locked down and provides a first full look at what that may look like for the apartment industry. We’ll use this space to highlight some markets that stood out in April.

Total construction starts declined 25% from March to April to a seasonally adjusted annual rate of $572.2 billion as COVID-19 and economic recession hit the construction sector. In April, nonresidential building starts fell 37% from March, while residential dropped 25%. The decline in nonbuilding construction starts was more tepid, falling just 5% due to strong activity in streets and bridges.

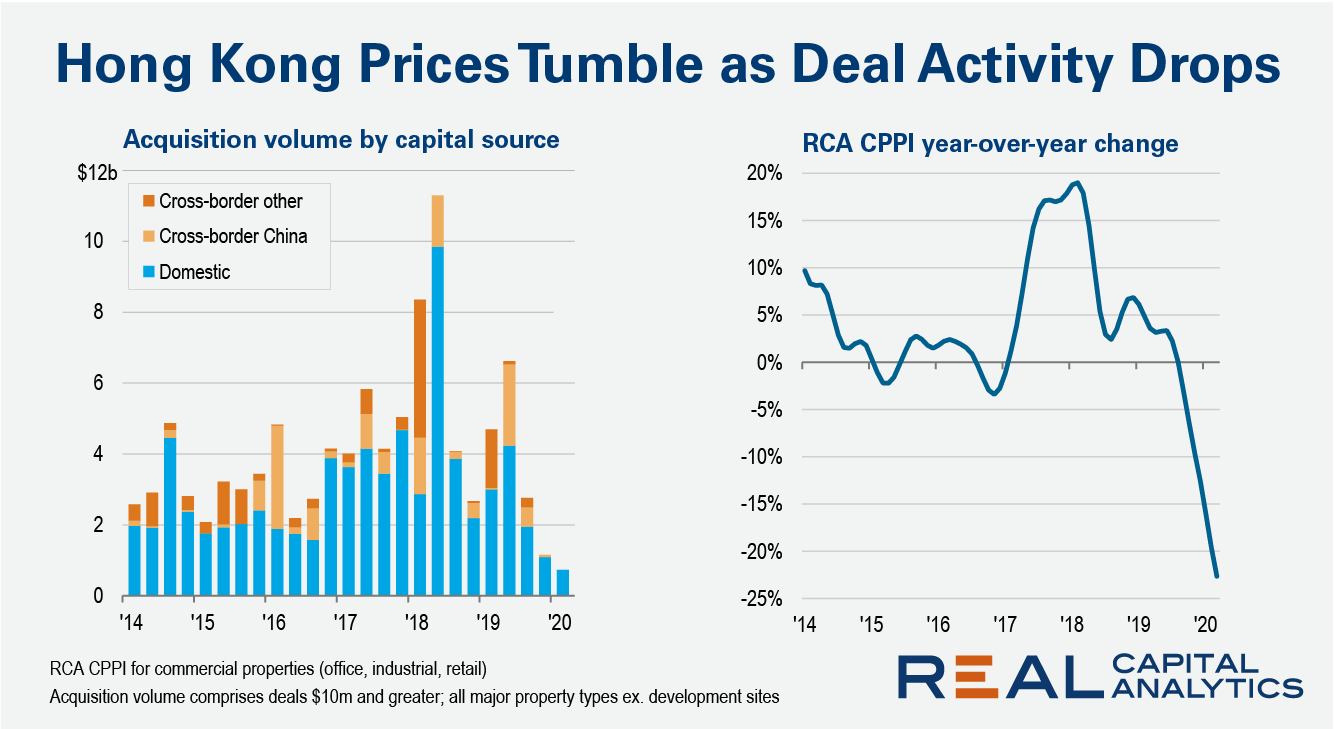

Commercial real estate markets are often referred to as roller coasters as the relatively fixed supply of investment grade stock forces prices higher during the good times and lower when that demand ebbs, sometimes very quickly. One market that illustrates the highs and lows of real estate investment in recent times is Hong Kong.

The dominant story of 2020 across all markets continues to be COVID-19 and the fallout from both the virus and the response to it. The impact is being felt across the economy, and multifamily real estate is no exception. April was the first full month in which a majority of the country was locked down and provides a first full look at what that may look like for the apartment industry. We’ll use this space to highlight some best and worst performing markets in April.

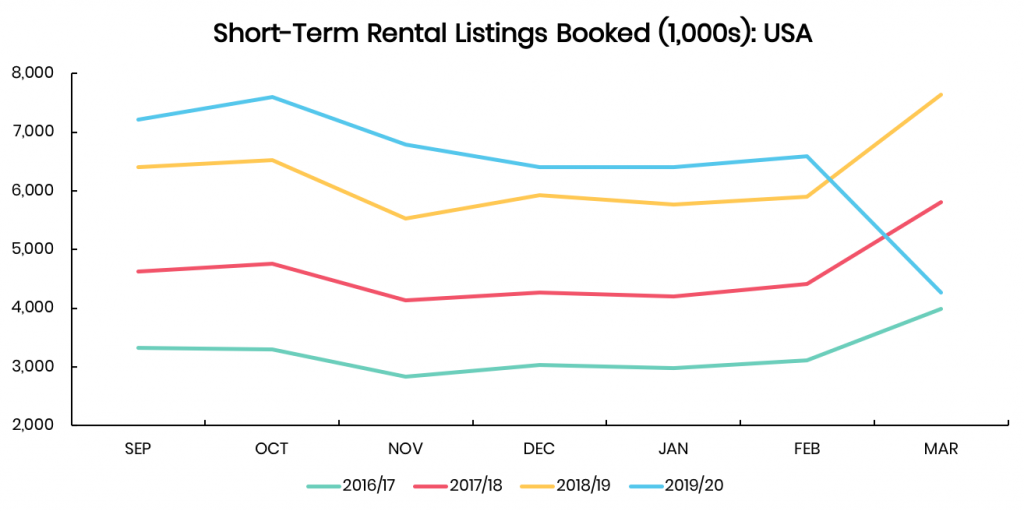

Airbnb bookings in the U.S. are rebounding at an accelerating rate, implying a possible V-shaped recovery for short-term rental bookings, and potentially the accommodations industry and even the wider economy.

The Dodge Momentum Index moved 6.0% lower in April to 135.9 (2000=100) from the revised March reading of 144.5. The Momentum Index, issued by [Dodge Data & Analytics](https://www.construction.com/), is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index pulled back during the month – the commercial component fell 7.6%, while the institutional component dropped 3.2%.

April is in the books and as the first full month in which COVID-19 response measures were in effect for much of the country, industry observers have been anxiously awaiting a look at final results for the month. As part of ALN’s ongoing analysis of the impact of COVID-19 on the multifamily industry, today we take a look at price class performance in the month of April.

The response measures taken in the face of the COVID-19 pandemic began to be felt in earnest in March for much of the US multifamily industry. ALN is conducting an ongoing survey of more than 60,000 conventional properties around the United States in effort to understand to what extent on-time full rent payments are being made and what measures properties are taking to work with their residence during this challenging and unprecedented period.

Our first look at this data will focus on Texas and all numbers are derived from the responses of about 500 conventional properties of at least 50 units.

The objective of this report is to provide an update on the situation in Asia from the previous report and analyze how the coronavirus impact on the short-term rental market has evolved in these areas. Additionally, we aim to demonstrate the impact in the more severely affected countries in Europe and various states around the United States, as both the number of cases and fear of travel have begun to impact vacation rental markets all around the globe.