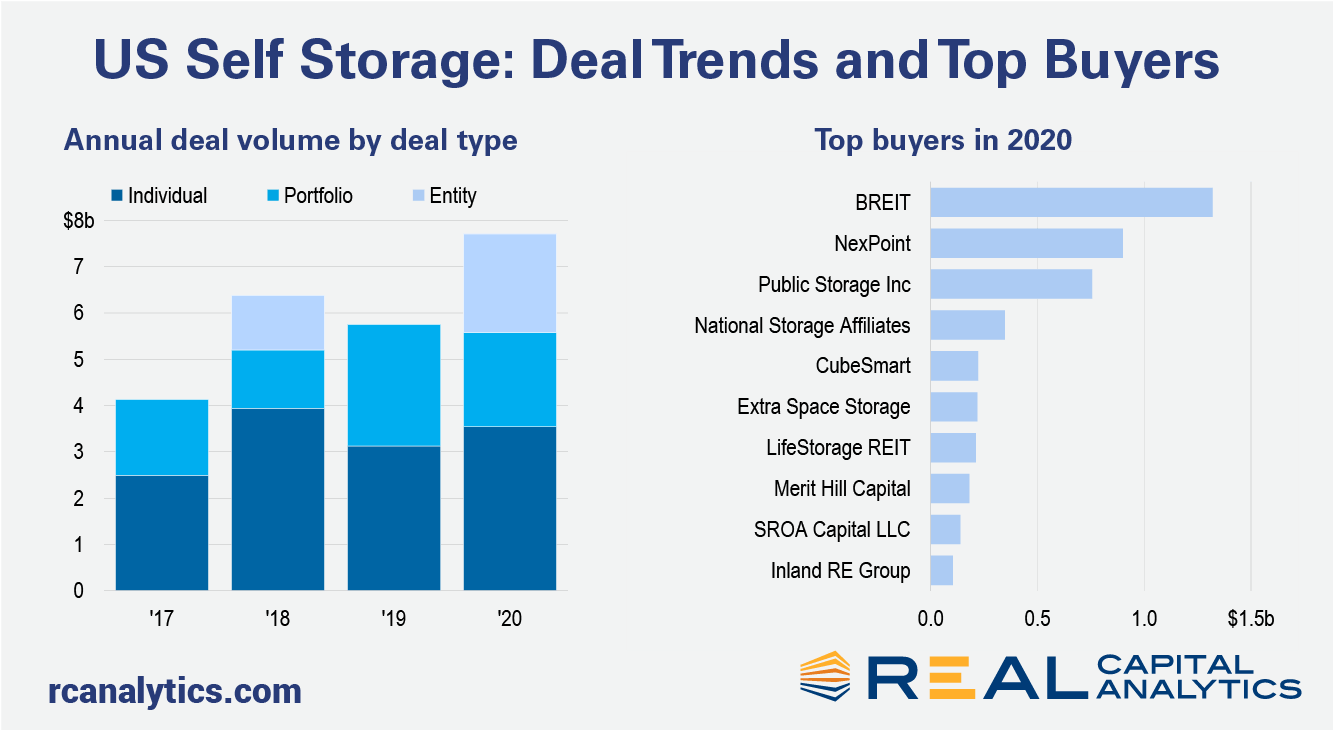

Transactions involving U.S. self storage assets reached a record level in 2020 despite the disruption and uncertainties caused by the global pandemic. While two outsized entity-level deals boosted transaction volume, individual deals and a wide range of buyers are evidence of ongoing broad interest in the sector. At $7.7 billion for the year, self storage deal activity was one-third higher than that of 2019, a stark outperformance compared to the U.S. market overall which slumped by more than a quarter.

The number of unique, active buyers in a market is a key signal for liquidity and one of six measures that Real Capital Analytics uses to calculate the RCA Capital Liquidity Scores. In the chart below we show 18 leading commercial real estate markets and the buyer count measure for Q4 2020 compared to the average and range of the past 10 years.

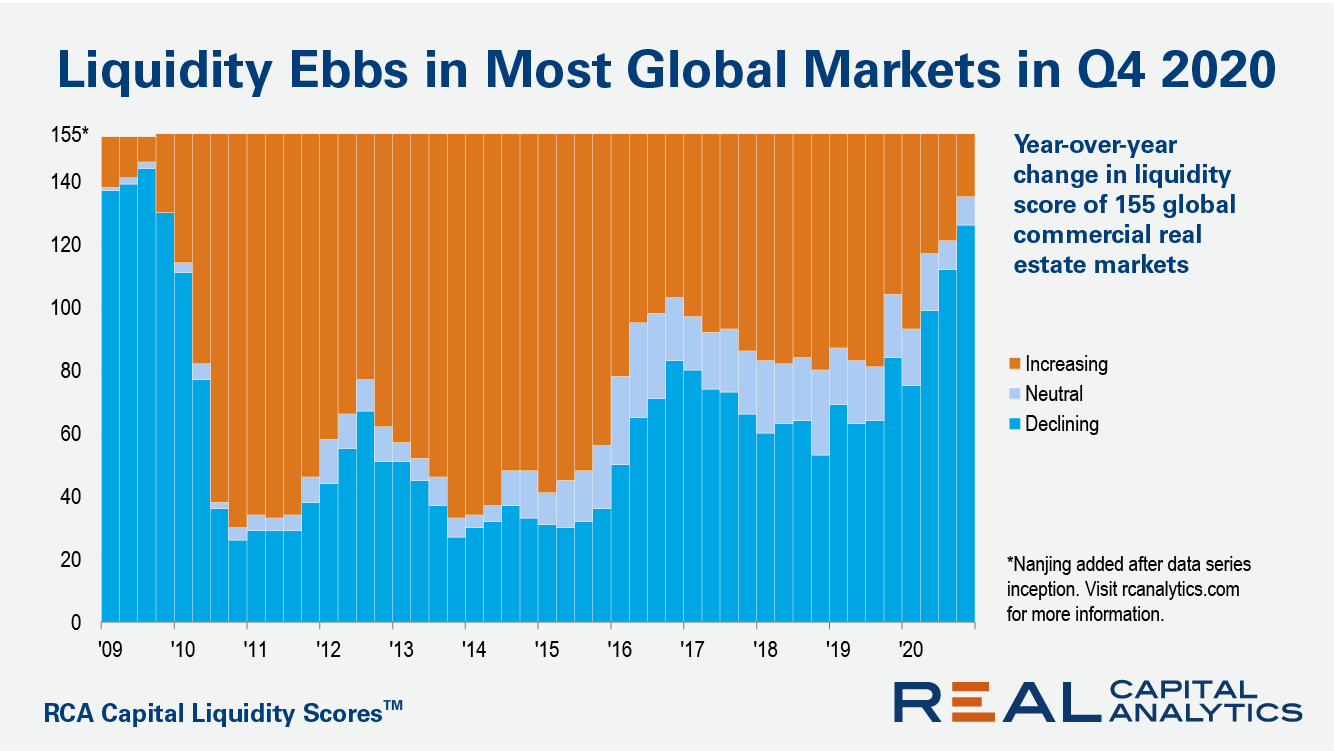

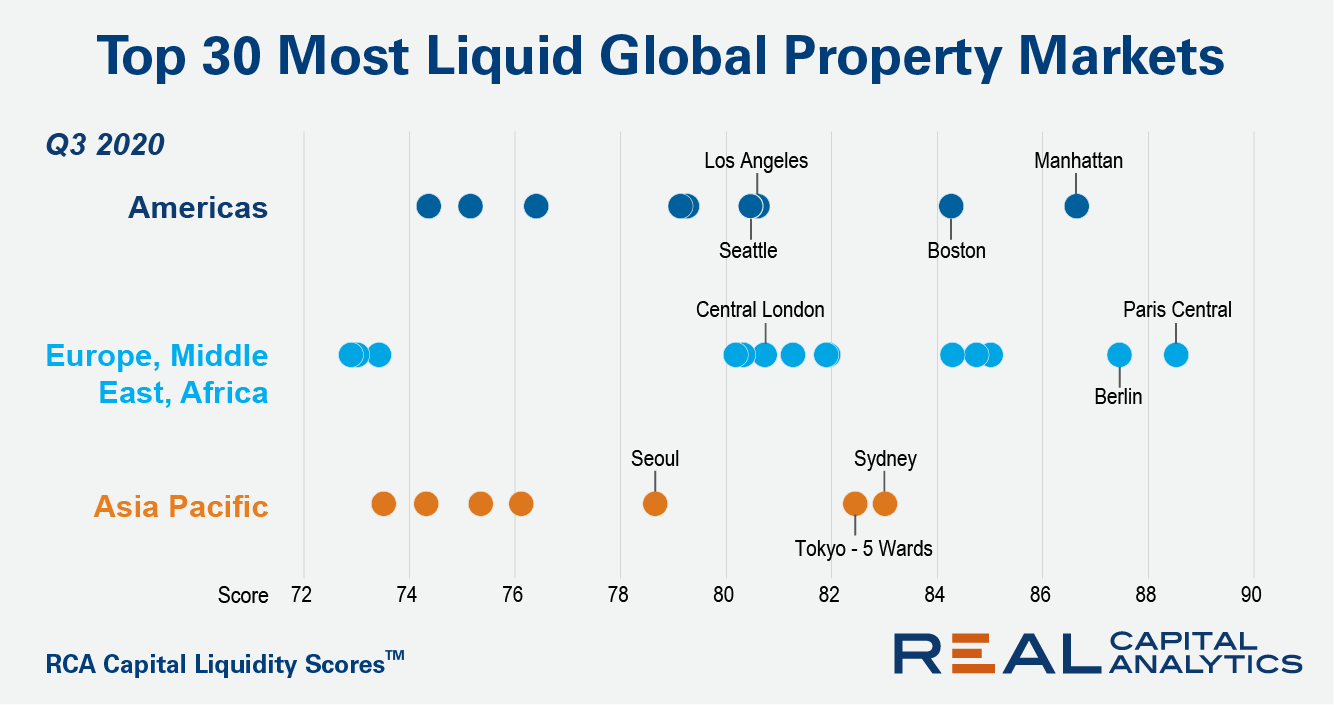

Commercial property market liquidity at the end of 2020 was below the levels from a year prior in 126 out of 155 markets worldwide, the latest update of the RCA Capital Liquidity Scores shows. The count of markets with scores falling on an annual basis was the highest since the end of 2009, during the Global Financial Crisis. However, there are signs of optimism.

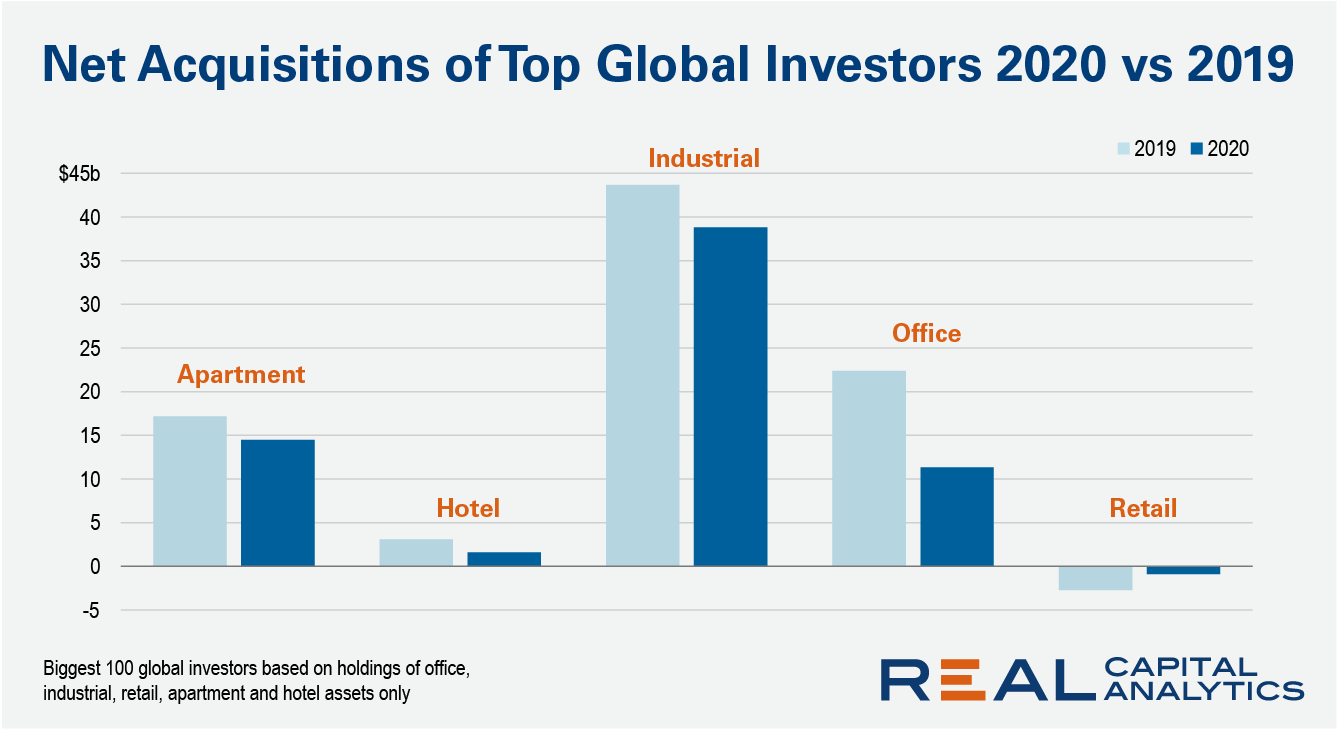

The top global investors acquired more commercial real estate in 2020 despite the challenges of the pandemic. There are clear signals in what they bought, however, that these investors are reacting to the uncertainty presented by the Covid-19 turmoil. Net purchases by property sector indicate that concerns about the office sector surfaced in 2020.

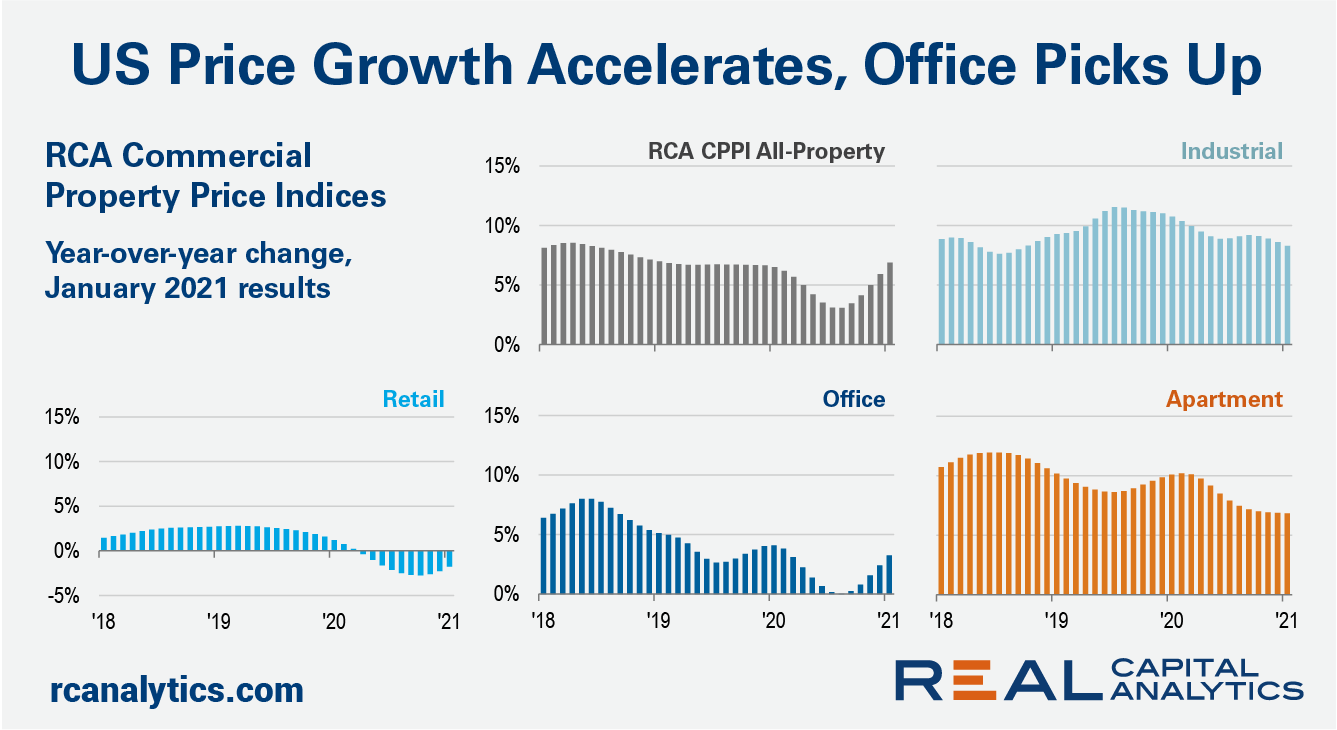

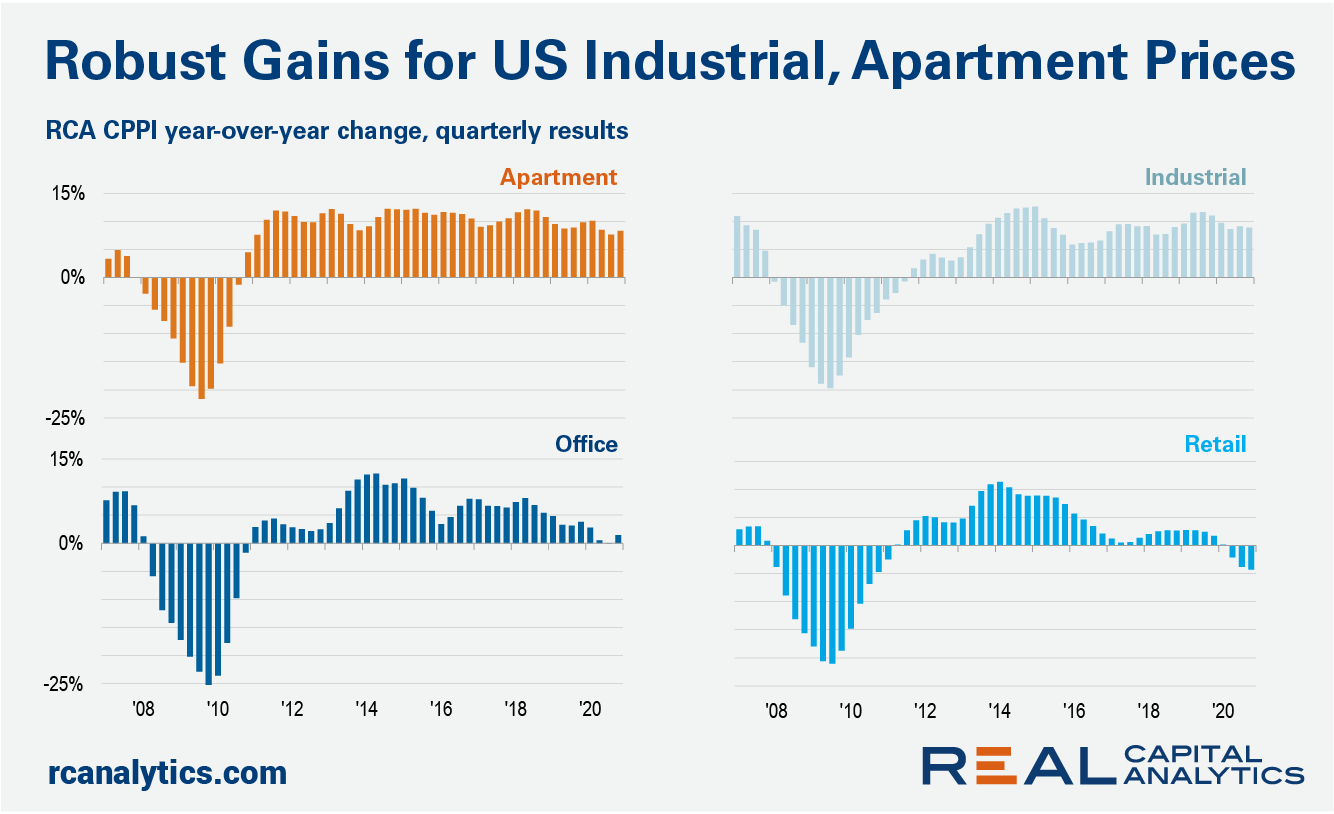

The pace of U.S. commercial property price growth accelerated in January, climbing back near the growth rates seen before Covid-19 struck, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 6.9% from a year ago and 1.2% from December.

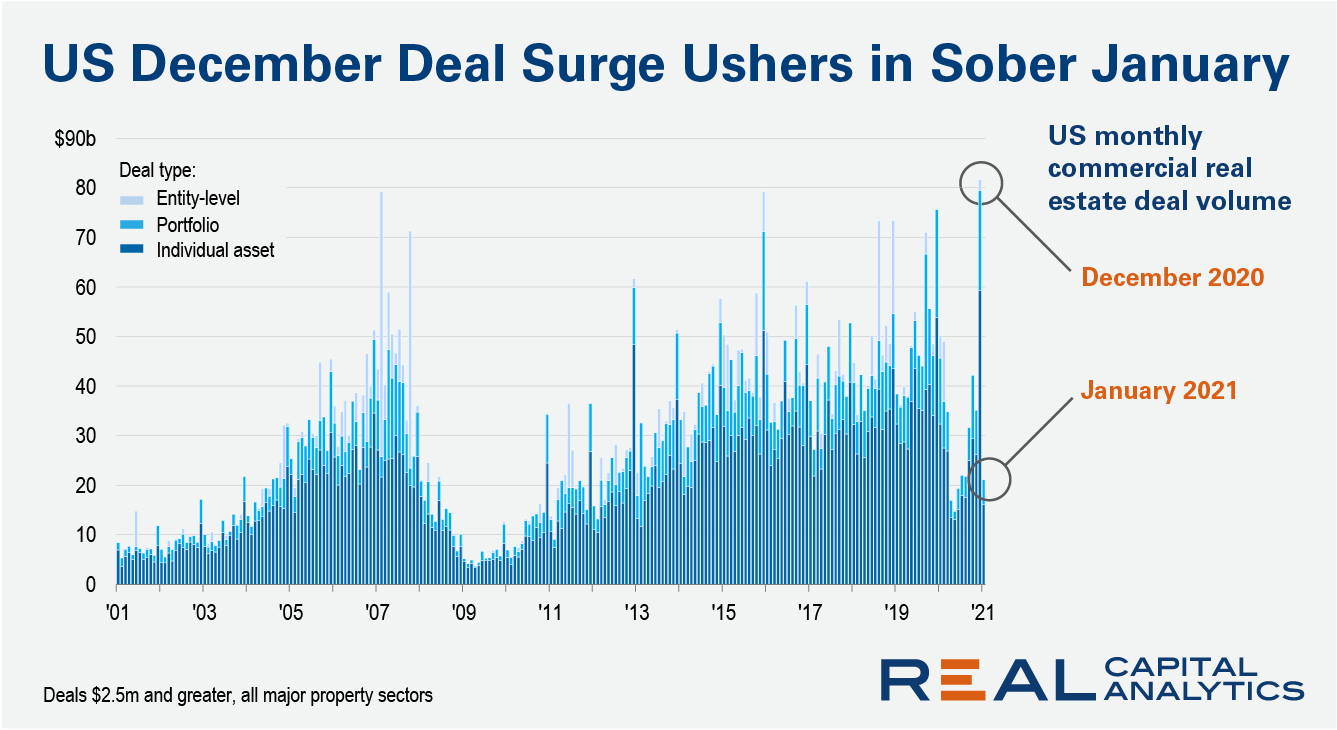

Activity in the U.S. commercial real estate market stumbled in January after an end-of-year surge in apartment, industrial and office sales had led December 2020 deal volume to a record level, the latest edition of US Capital Trends shows. Transaction volume fell 58% in January from a year prior, similar to the declines seen in the second and third quarters of 2020. By contrast, December deal volume had increased 8% year-over-year to broach the $80 billion level for the first time, according to RCA records.

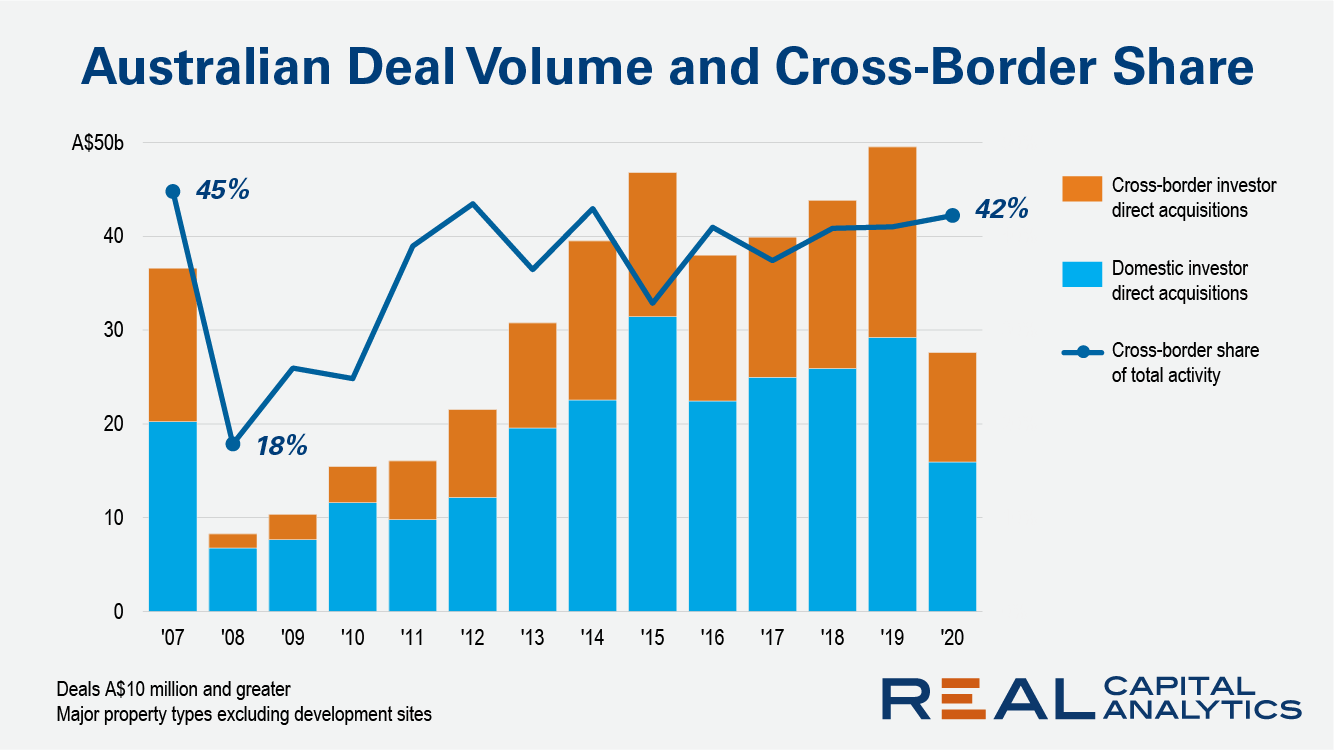

Cross-border flows into Australian commercial real estate sank in 2020, but the magnitude of the drop was moderated by a European champion: German institutional investment. Spending by groups headquartered in Germany alleviated fears that overseas investors would desert Australia, as occurred in the last global downturn. During the Global Financial Crisis (GFC), investors across the world retreated to the sanctuary of their home territories.

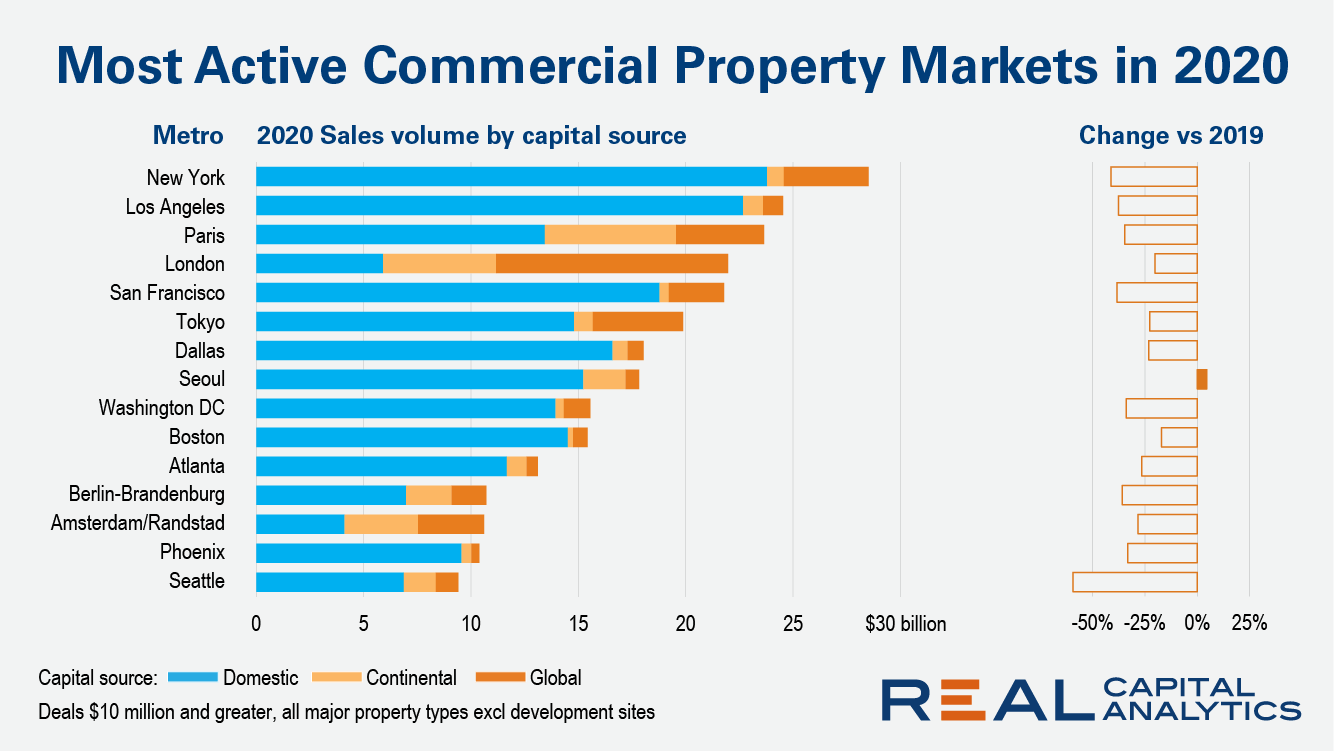

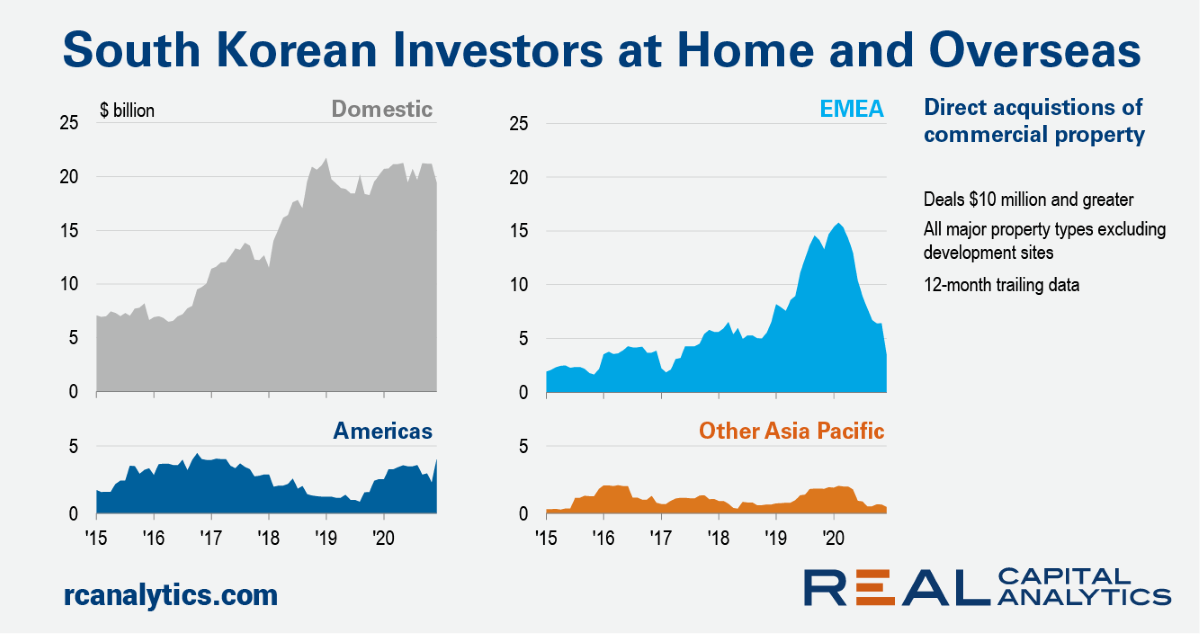

Just one of the top 15 most active global commercial real estate markets recorded an increase in sales volume in 2020 versus 2019. For the rest, the picture was one of falling transaction activity as the Covid-19 pandemic hampered dealmaking and soured the outlook for some commercial property types. In Seoul, volume crept up to an all-time high as domestic investors refocused on their home market. The Korean capital became the world’s largest retail transaction market in 2020 and second largest office market, behind Paris.

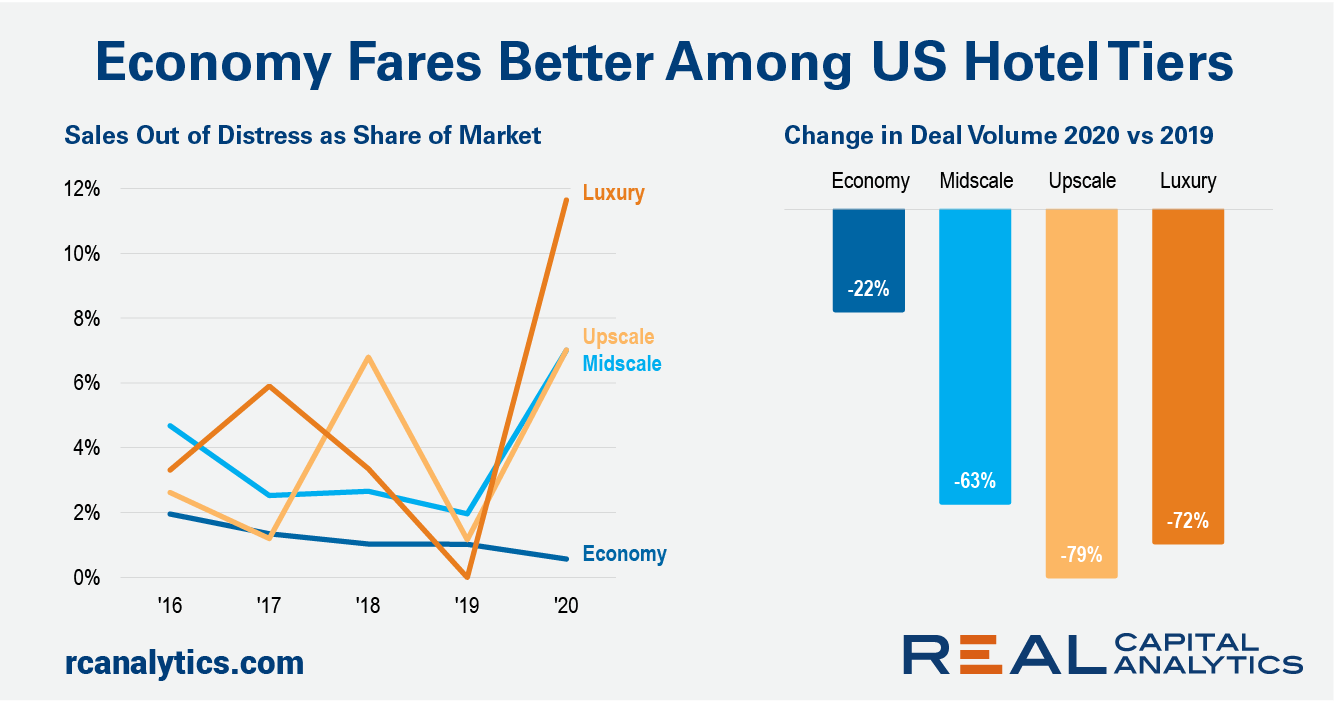

The pandemic hit the U.S. hotel sector hard in 2020. Between travel bans and the economic downturn, the impact to the sector which had already shown some cracks was swift and steep. Transaction volume in the sector fell by more than two-thirds compared with 2019, to the lowest level since 2009. However, the misery was not experienced equally across all chain scales. In 2020, investors had a clear preference for economy branded hotels.

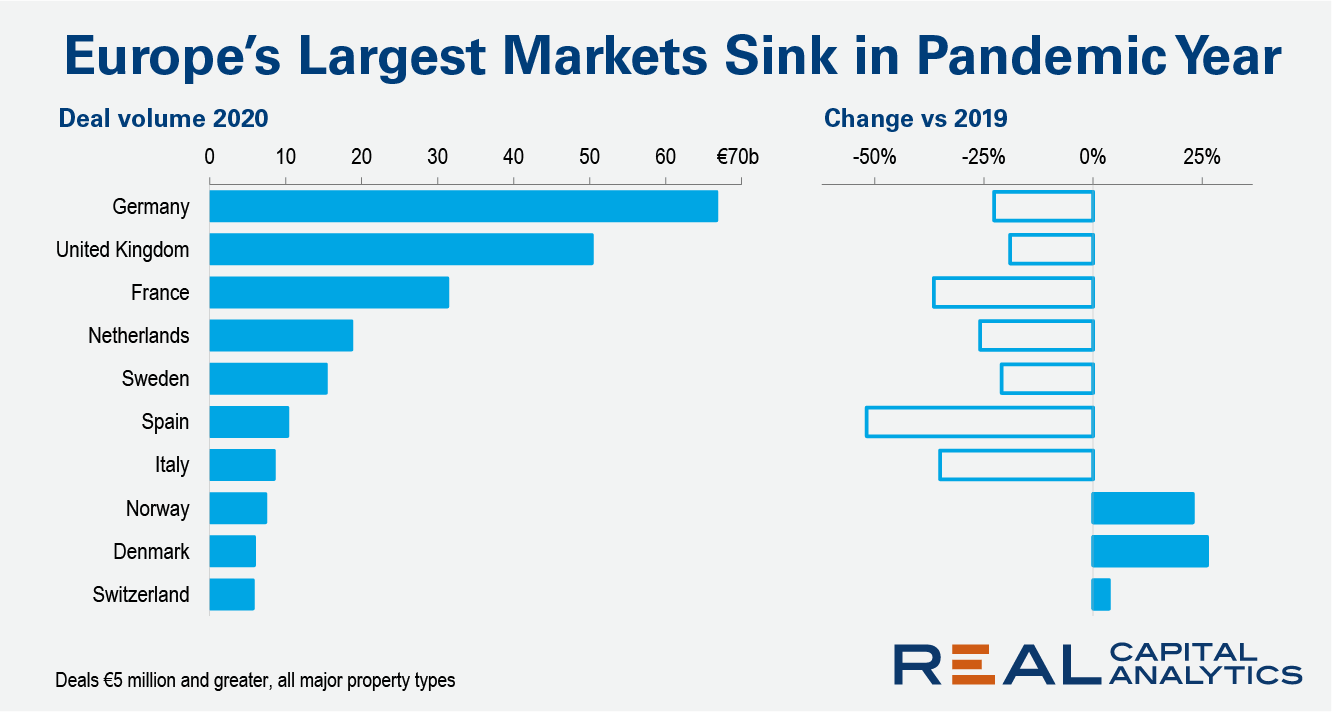

Commercial property sales activity in Europe tumbled by just over a quarter in 2020 in the face of challenges from the Covid-19 pandemic, with a steeper drop seen into the close of the year, the latest Europe Capital Trends report shows. Investment volume across all property types dropped 27% versus 2019. In the fourth quarter, activity was 44% lower than the same period a year earlier, when a record total of commercial property deals closed.

Investment in the logistics sector reached a record high in Asia Pacific in 2020, with four of the region’s markets ranking in the top 10 biggest logistics markets globally in the year. The e-commerce revolution was already well underway before 2020, and the Covid-19 pandemic served to reinforce investor appetites for warehouses even further. Deal activity totaled $13.5 billion in 2020, according to preliminary Real Capital Analytics data, just eclipsing investment levels in 2018 and 2019.

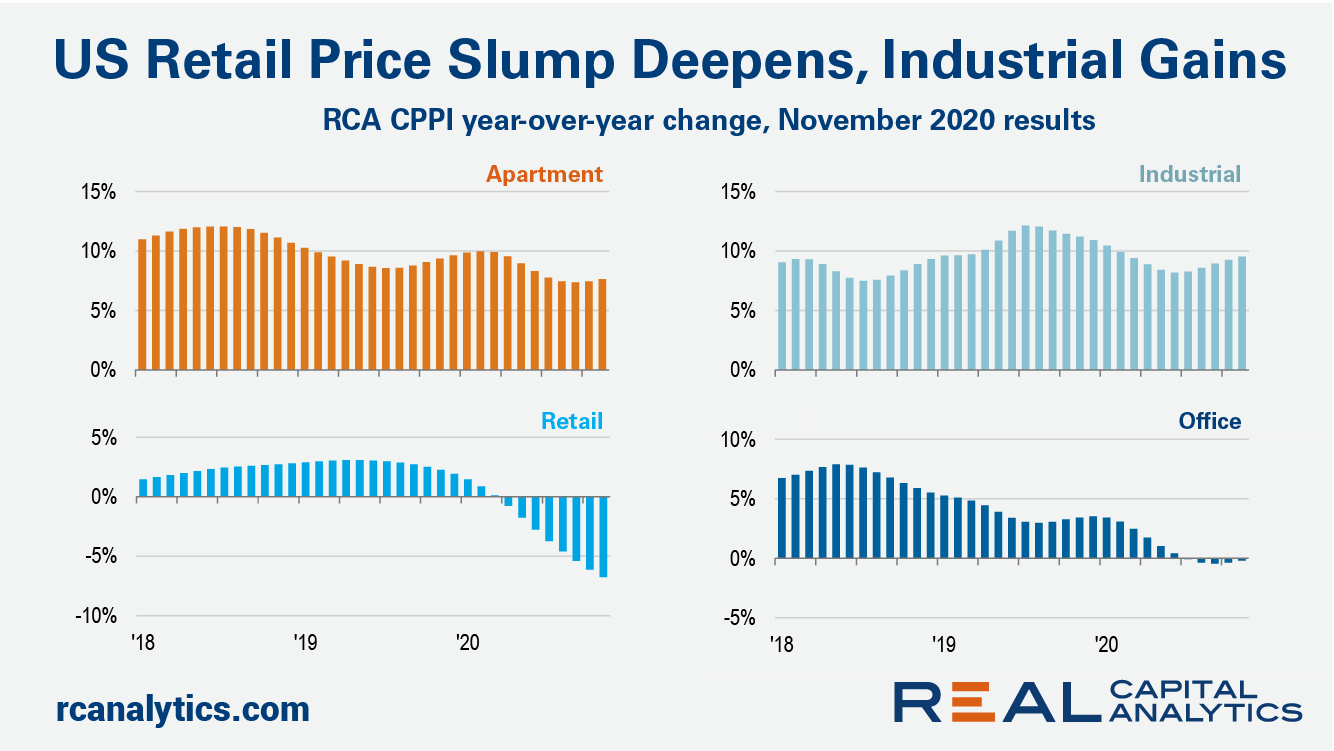

The headline rate of U.S. commercial property price growth accelerated into the last month of 2020, gathering strength on the back of robust apartment and industrial sector price increases. The US National All-Property Index grew 7.3% from a year earlier, the latest RCA CPPI: US summary report shows.

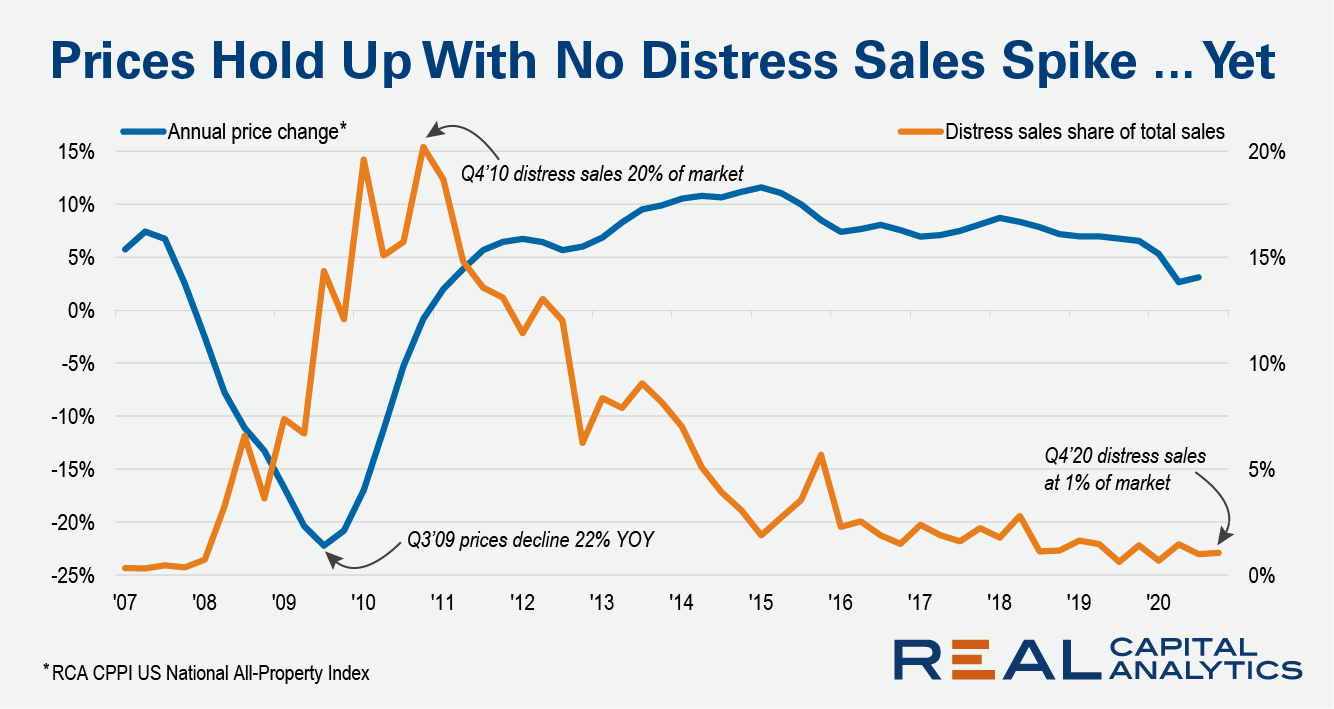

A common theme in the media for December was that we lived through a horrible year in 2020 and that 2021 would be better for us all. Perhaps this sentiment will hold by year-end but the start has been chaotic. Conditions might become more distressing for commercial real estate investors throughout the year, a turn of events that some players are hoping to see.

The biggest institutional investors into Europe’s commercial property market set a new record for apartment investment in 2020. Nearly 30% of total acquisition activity was focused on the residential for rent and student housing sector last year, according to Real Capital Analytics data.

There is a line of thinking around the Covid-19 pandemic that developers can solve some of the problems caused by rising office vacancies in Midtown Manhattan. Developers are capable of amazing feats, but a stabilization of the office market will ultimately depend on a curtailment of the pandemic.

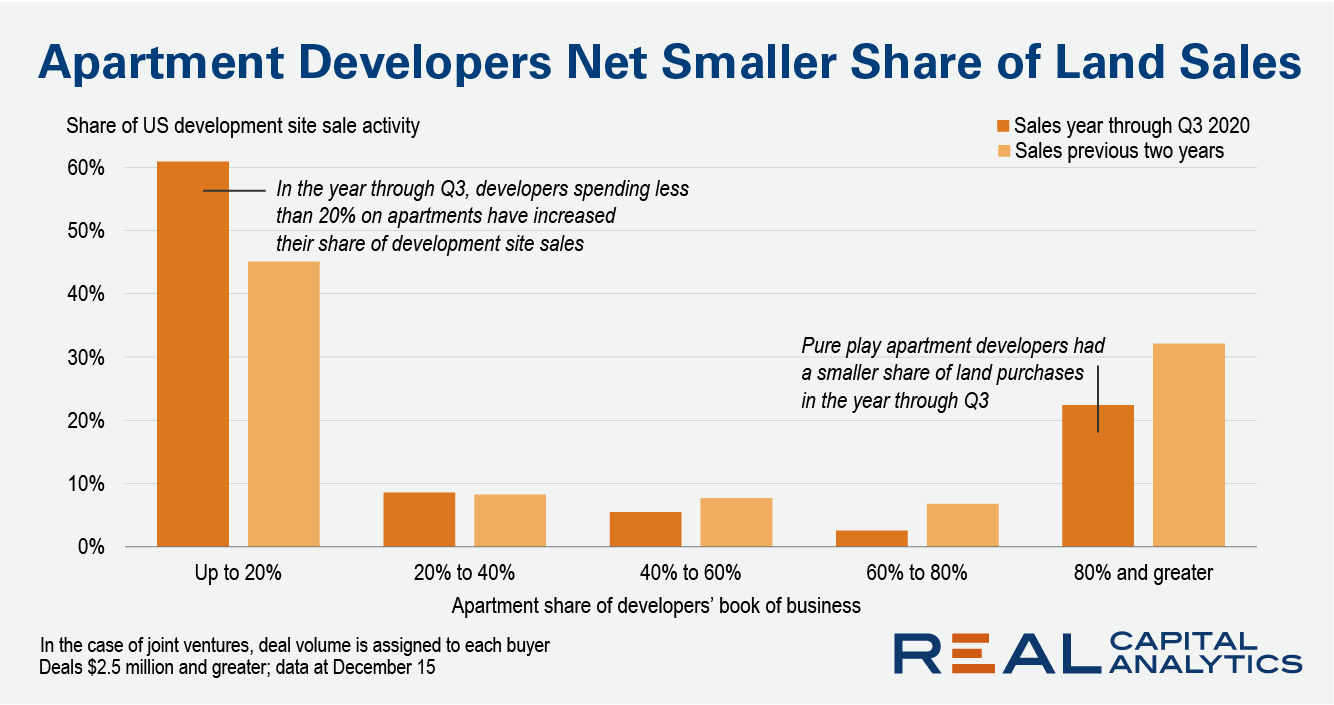

Development site sales were a bright spot for the U.S. market in 2020, with investment activity for the year through November down only 5% from a year earlier, according to Real Capital Analytics data. Who is buying these sites and the reasons why have changed from earlier in the cycle.

Europe’s biggest commercial real estate markets have maintained higher liquidity through the ongoing Covid-19 pandemic than markets in the Americas and Asia Pacific, according to the third quarter 2020 update of the RCA Capital Liquidity Scores.

One of the biggest cross-border stories of 2019 was the outpouring of South Korean capital into Europe and the U.S. Towards the end of last year, there were signs that this trend was reaching its satiation point – asset managers had needed time to digest and syndicate the stakes in their newly acquired real estate assets back home.

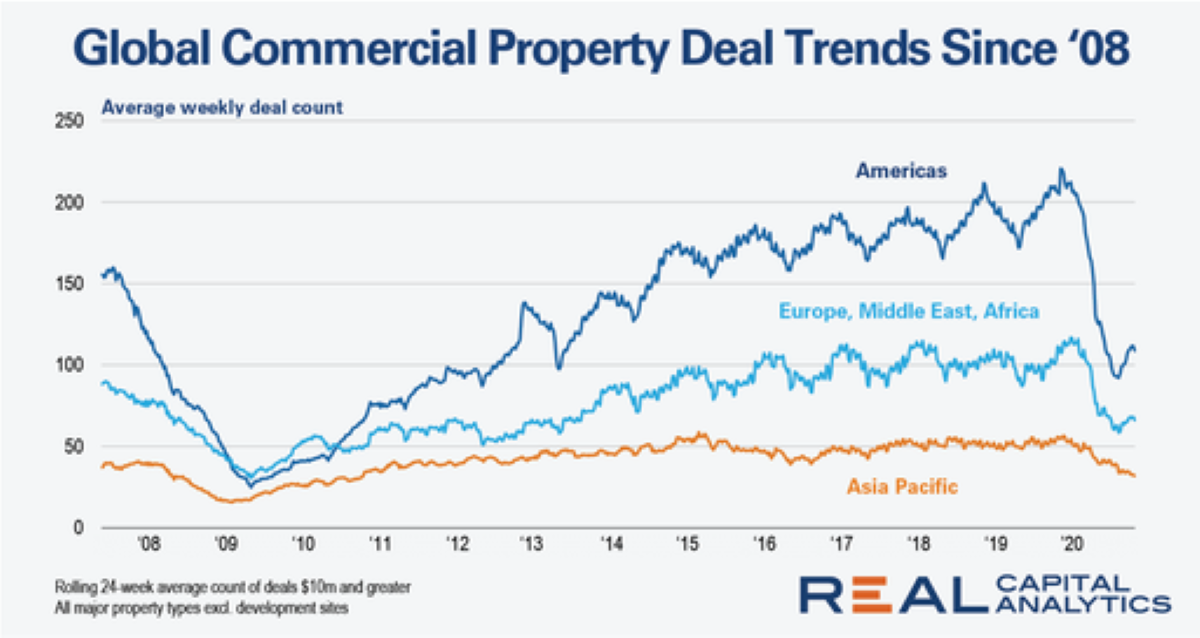

In July, after the first full quarter when we saw the global impact of the Covid-19 maelstrom, we studied the drop in global commercial real estate activity with a historical perspective going back to the Global Financial Crisis (GFC). Today, the chart plotting the average weekly deal count for the three global zones reveals more about the decline caused by an extraordinary crisis

The U.S. national rate of commercial property price growth rose in November at the fastest annual clip since the beginning of the pandemic on the back of continued strong industrial and apartment price gains. The US National All-Property Index increased 5.7% from a year ago, the latest RCA CPPI: US summary report shows. In the retail sector meanwhile, the slump in prices deepened.