As the United States has bounced between planned openings and closures, businesses which rely on consumer interaction have had to adapt to keep up. To truly observe the experience, one need not look further than traditional malls across the country. Many stores have adhered to regulations that require a reduction in hours, reduced occupancy, and other restrictions to help prevent the spread of the COVID-19 virus.

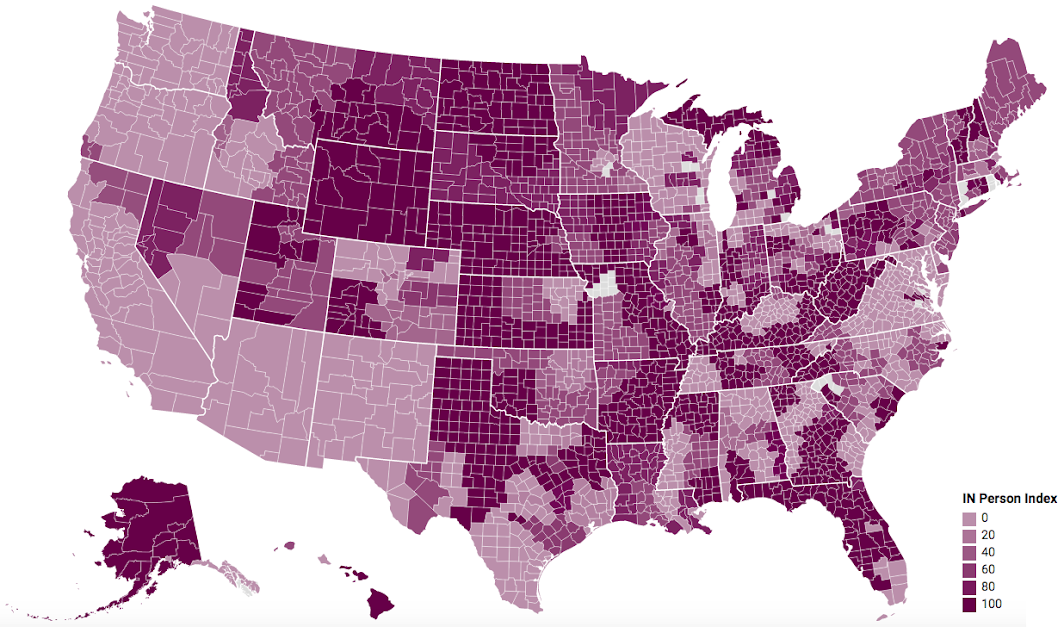

More than 50% of US K-12 public school students will be attending school remotely to start the school year, according to a comprehensive, ongoing survey conducted by Burbio.com. Specifically, 52% of students are projected to be learning online to start the year, 44% will be attending in-person either every day or certain days of the week, and 4% of students are in school districts that haven’t finalized plans.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

For years, experts have been hailing a new era where companies can hire talent on a per project basis and labor can have a more flexible work-life balance. With the advent of many infrastructural technologies (personal websites, automated invoicing, flexible cloud storage, etc), many individuals have been taking advantage of their valuable skills and joining the freelance economy.

We may not have realised it at the time and it certainly didn’t feel that great, but last week’s global capacity may have represented the peak week for 2020 in the new world of Covid-19. Last week we broke through the 60 million mark; this week we are just below that point and although there are pockets of capacity growth around the globe there are also a number of new travel and rumoured travel restrictions dragging capacity down.

As per Census Bureau's Construction Spending Survey, over the 12 months ended Jun-20, the value of private construction put in place for Parking increased +131%, with Drug store being the 2nd best sector @ +46.7%. Given this staggering growth over recent months, in this article we will present probable reasons for this dramatic growth, along with an overview of the Parking industry.

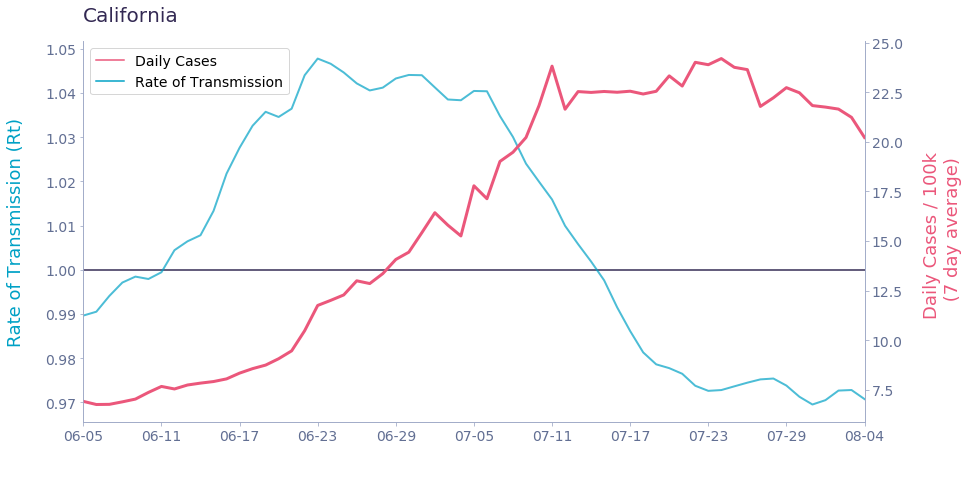

The start of summer brought with it a renewed surge in coronavirus cases, with daily new case counts climbing to a mid-July peak that was twice as bad as the initial spring wave. However, the latest national data shows a slight deceleration in cases over the past week. But is this just a temporary reprieve — or perhaps the result of reporting issues?

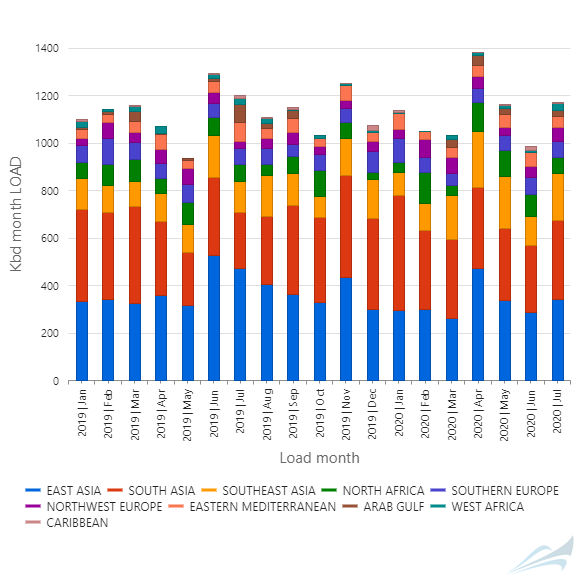

July finished with additional signs that the LPG markets are coming back into favor, with overall offtake increasing 14% from June. Higher discharges took place in parts of Asia, where Japanese and South Korean imports each grew 24%, to 324,000 bpd and 333,000 bpd respectively.

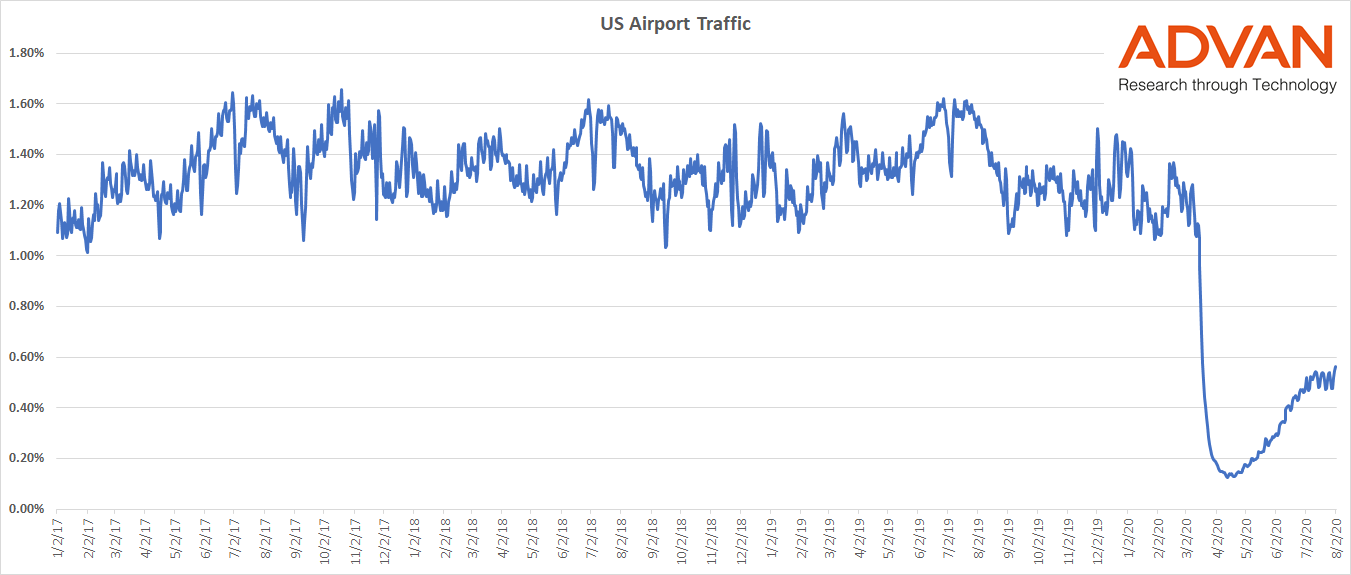

As we near the last stretch of the US summer season, we looked again at foot traffic data for US airports as one measure of the impact being felt by the travel industry. In our blog post on June 19th, we noted that traffic at US international hubs was severely depressed, with some regional hubs seeing a little more activity.

The Dodge Momentum Index moved 3.4% higher in July to 124.7 (2000=1000) from the revised June reading of 120.5. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. During the month, the commercial component increased 5.3% while the institutional component was unchanged.

For the fourth straight month, roughly one-in-three Americans failed to make a full, on-time housing payment. Late and unpaid housing bills are accumulating, putting financial strain on many families and deepening concerns of near-term evictions and foreclosures. As federal and local eviction bans continue expiring across the nation, 32 percent of renters (and homeowners) entered August with unpaid bills. Over 20 percent owe more than $1,000.

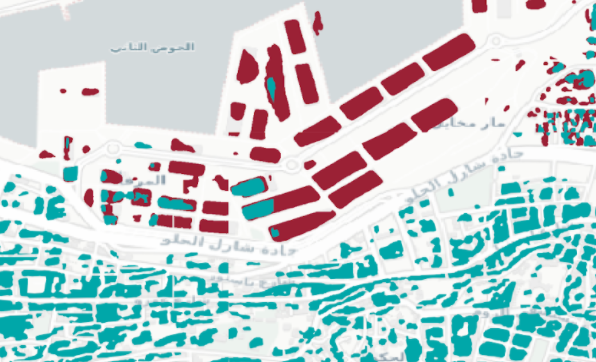

At least 135 people were killed and 5,000 wounded as of August, 5 2020 (5:20 pm EST), in the Beirut explosion. With hundreds reported missing and a lack of clarity regarding the cause of the explosion, geospatial analytics helps government analysts, NGOs, and first responders gain critical visibility into the catastrophe and have the potential to save lives. Overlaying computer vision results from May and August show exactly which structures were destroyed in the explosion in one single image.

The past 30 weeks have seen the number of cancelled flights go through the roof as a result of the global pandemic, causing disruption to passengers, airlines and airports. Last week we looked at how airlines managed schedules during Covid. This week take a look the cancellation disruption and management at country level and how they got it under control.

As INRIX reported earlier, vehicle miles traveled (VMT) is returning to pre-COVID level in states across the country. At a slower pace, cities have begun to reach their pre-COVID, February levels of traffic – yet many are still behind their normal, seasonally-adjusted VMT. In addition, the time of day people are traveling has shifted considerably under COVID-19, especially in the AM commute.

When we think about the jobs in highest demand during the coronavirus crisis, healthcare and other medical professionals immediately spring to mind. What with stories of doctors and nurses working themselves to exhaustion to keep up with the onslaught of COVID-19 patients, it would seem those tackling the crisis head-on could at least cross job security off their list of worries. But this isn’t the case.

With one of the world’s largest airlines making nearly 800 schedule changes in one day and at the same time having to release over 17,000 dedicated employees, the challenges of running a scheduled airline are not getting easier. Global capacity has crept up to 60 million seats this week; some 4% up on last week and breaking through the halfway point to recovery; well at 50.4% of last year’s capacity it’s a positive statement!

Global exports of liquefied natural gas in July totaled approximately 28.7 million tons on board 474 vessels, much lower than July 2019’s pace of 31.7 million tons, with a reduction of loading from the US & Pacific regions. Approximately 27.6 million tons arrived on 471 vessels at import terminals in July, compared to 30.8 million tons in July 2019.

Dining is a category that has continued to change regionally, nationally, by category, even by meal time. With the nation still in what we’re calling a traffic Summer Slump, restaurants are reacting in real time to manage official guidelines and the safety and preferences of diners. The stall – or slump – in reemergence remains visible in our latest analysis.

There is a strong narrative present in today’s media that the $600 a week provided by the CARES Act is creating a disincentive for Americans to return to work. This narrative can be seen in Washington as politicians argue over the pros and cons of extending some benefits of the CARES Act. In this post we will examine whether LinkUp’s job listing dataset can provide support to this narrative.

Many families were caught financially unprepared with the sudden onset of the pandemic in the U.S. earlier this year. The national unemployment rate spiked from a 50-year low of 3.5% in February 2020 to an 80-year high of 14.7% in April. And while the sudden loss of income was partly muted by an income tax refund and enhanced unemployment insurance payments for eligible taxpayers and workers, nonetheless, many homeowners are struggling to stay on top of their mortgage loans, resulting in a jump in non-payment.