The market for RVs experienced a surge in demand this past summer as months quarantined at home and concerns about the potential hazards of travel led would-be vacationers to rethink their travel plans and incorporate RVs.

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in alternative accommodations.

In a recent blog post, we covered how the summer months provided U.S. hotels with an increase in leisure travelers, a welcome change that lifted the industry from the pandemic performance lows of the spring. Naturally, we expected that leisure travel to dry up and overall hotel performance to retreat due to the return to school and a persistent lack of corporate and business travel.

It’s hard to believe that Beijing’s newest airport has been open for a year already. And what a year it has been for the industry – certainly not one that any airport would have wished for in it’s inaugural year. We know however that China’s domestic air market has recovered from the COVID crisis, at least in terms of capacity – and in the month of November, domestic capacity was 10% above November 2019 levels.

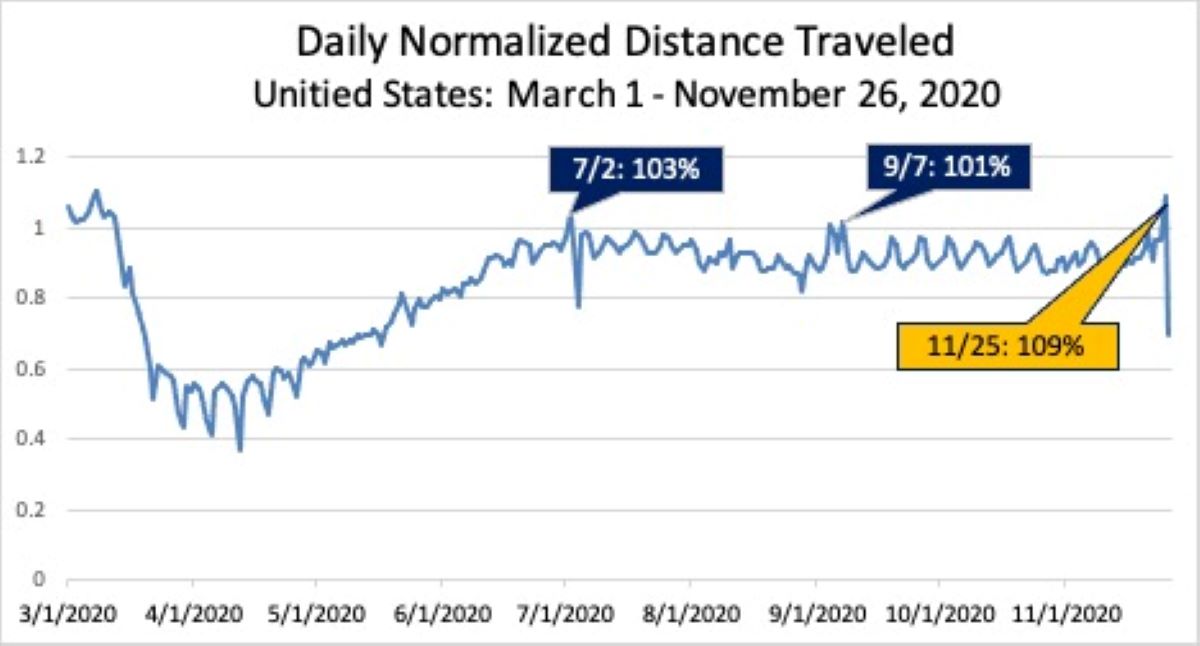

Travelers hit the road in record numbers the day before Thanksgiving, reaching a vehicle-miles traveled (VMT) of 9% above “normal” (pre-COVID) levels. To this point, VMT had only reached pre-COVID levels twice since the pandemic forced restrictions – both surrounding major holidays (4th of July and Labor Day). The third time, which happened on Wednesday, Nov. 25, topped the list.

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Latin America region. Some markets heading in the right direction

Turkey’s hotel average daily rate (ADR) has grown exponentially in recent months despite the global pandemic depressing rates most everywhere else in the world. Globally the impacts of COVID-19 have weighed heavily on hotel performance, but in Turkey, several unique macroeconomic factors have aligned to impact rate over and beyond the effects of the pandemic.

Since the arrival of Covid-19, safety has become a key concern for travelers and will remain to be so. This means the sector needs to be ready so that travel remains a safe experience, and that it is perceived as such. Right now, it seems like the safety perception is influencing the way people travel and the itineraries they take. This becomes even more apparent when looking at the performance of hubs.

Research undertaken by ForwardKeys, the travel analytics firm, reveals that despite the COVID-19 pandemic and the collapse in aviation, many Americans are planning a last-minute return to the skies this Thanksgiving, travelling to be with their families at home; taking a break in sunny Florida or hitting the slopes

Travel has been hit hard by COVID, but in some — outdoor — locations, people are flocking to boutique hotels, outdoor camping sites, and other natural settings to get some long-overdue relaxation time. In the infographic below, we highlight five of the top growing destinations globally as of September 2020.

The latest edition of the ECM-ForwardKeys Quarterly Barometer Report, published jointly by ForwardKeys and the non-profit organisation, European Cities Marketing (ECM), reveals that Europe’s most resilient cities are leisure hotspots despite the devastating COVID-19 pandemic.

As the Coronavirus tidal wave rolls its way through the world for Round Two, European cities have been tested for their resilience in Quarter Three and Four. Will the theme of “Sun and Fun” help countries stay afloat? ForwardKeys examines the latest flight data to share with you the freshest insights.

Since the week commencing the 5th October the US market has reflected a very different trend pattern to the rest of the world as the chart below highlights. Whilst the rest of the world has seen a steady decline in capacity and is now 9 points lower than at the beginning of September, the United States has seen a thirteen-point improvement; a twenty-two-point swing to use pollster terminology.

In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

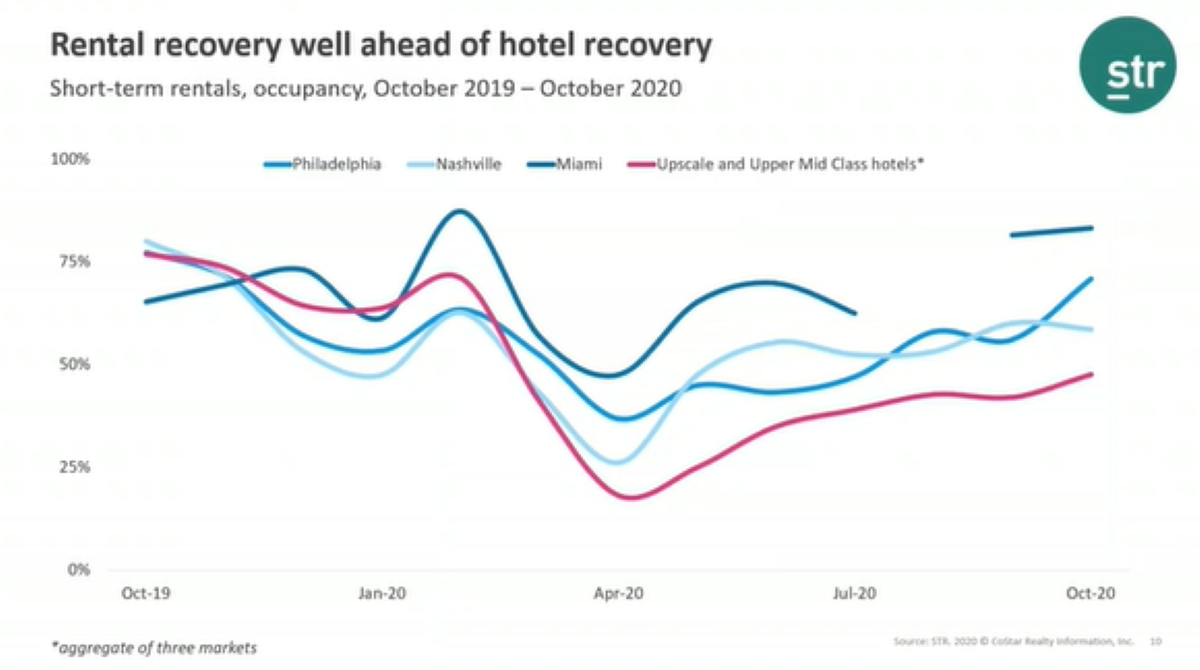

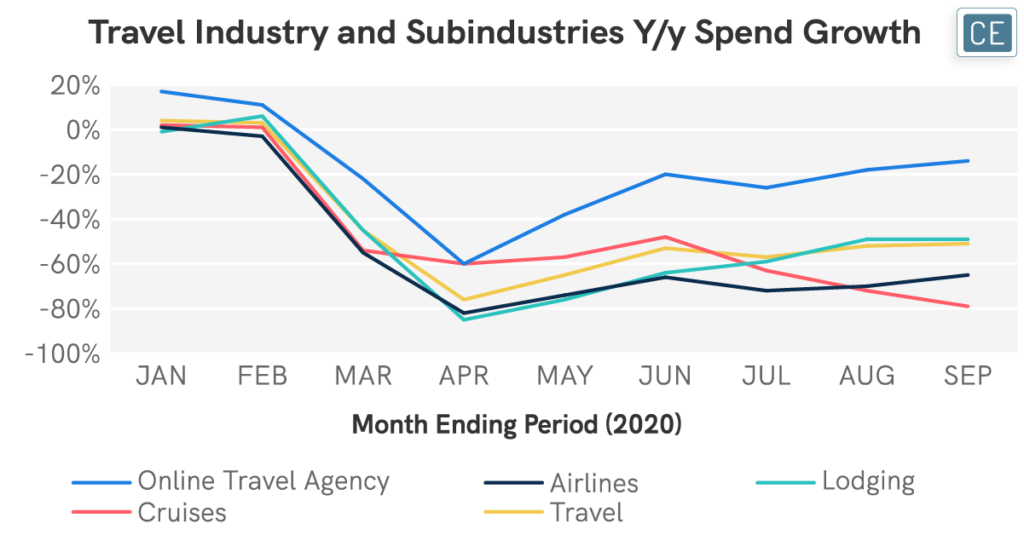

Although many sectors of the economy have seen declining sales due to the COVID-19 pandemic, the travel industry has arguably borne the worst of the declines. Cruises have been the worst-hit, with spend down -80% y/y in September. Airlines have not faired much better, with spend down almost two-thirds. Yet, other parts of the travel industry are doing comparably better.

With the holidays top of mind, data from TSA shows that there is still a significant difference in the number of travelers passing through TSA checkpoints compared to a year ago. The daily average number of travelers passing through TSA checkpoints in 2019 was 2.4 million while in 2020 it is currently hovering around 570,000 a 76% decrease.

In our recent webinar, we spent some time looking into foot traffic trends at airports in America and Europe. Location data is a very reliable proxy for airline passengers, since there are few reasons to be at an airport other than to board a plane. Precise mapping can filter out people who have come to collect or drop off passengers from those who have passed security in order to catch a flight.

In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

The global pandemic has wreaked destruction on the travel industry, with total international arrivals in the third quarter of the year down by 94% compared to the same period in 2019. As of 19th September, flight bookings globally for Q4 of 2020 were 83% behind where they were at the equivalent moment last year.

In 2019 there were 4.54 billion scheduled passengers worldwide. Analysts expected 2020 to set a new record of over 4.72 billion passengers, but instead, the coronavirus pandemic spread its tentacles across the globe, practically bringing international travel to a standstill.