Customer footfall across Italy’s hospitality sector has increased by in excess of 500% following the easing of Covid-19 restrictions on 18 May, however it remains at around a third of pre-lockdown levels as the ‘shape of recovery’ remains unclear.

According to Huq’s Key Industries Indicator for Italy, customers visiting the country’s bars, cafes and restaurants even climbed to the point of exceeding footfall to supermarkets for the first time since enforced closures came into effect on 11 March.

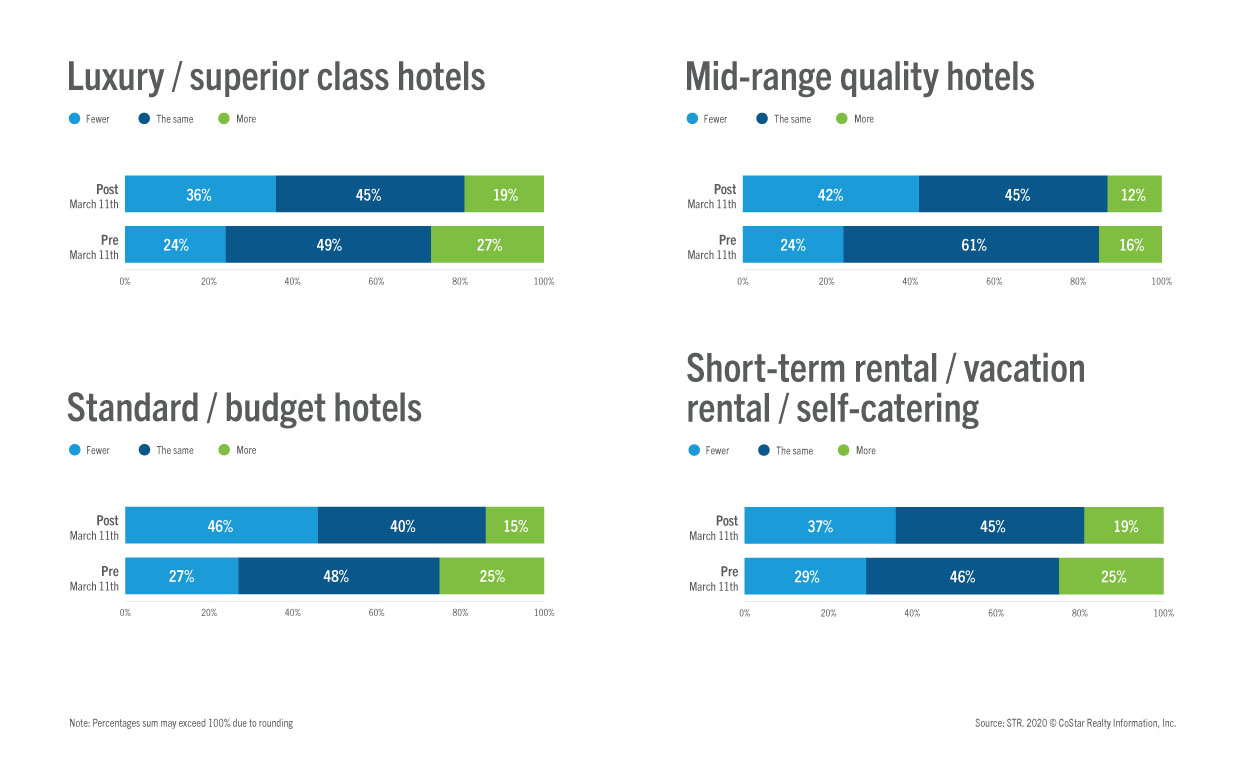

As the COVID-19 pandemic reshapes the world of travel, we investigated the impact on accommodation choices among international travellers. This piece builds on our analysis of propensity to travel in key English-speaking countries, in which we learned that desire for travel has declined but remains strong overall.

Its been a record breaking positive week for weekly capacity growth; we have broken through the 30 million weekly seat mark! That remains some 83 million seats below the same week last year or a “modest” 73% lower but with two weeks of consistent growth the numbers are at last growing; it must be spring!

According to data from mobile app data provider Apptopia, daily usage of mobile applications for major international hotel brands has recovered half of its COVID-19 loss. Shortly after China began locking down citizens, usage of mobile applications from companies such as Marriott, Hilton and Intercontinental dropped by nearly 20%. As of data as recent as May 17th it appears that these applications have recovered half of their lost usage.

STR data for 3-9 May 2020 showed continued modest gains in U.S. hotel occupancy compared with previous weeks, but a similar level of year-over-year decline in the three key performance metrics.

In some countries the number 111 is believed to bring bad luck. In cricket it is called a “Triple Nelson”, feared by Australian cricketers more than an English bowling attack, but we might just be at the moment when after 111 days from the 20th January that we begin to see some modest capacity growth at a global level.

After months of being closed, Disney announced that it would reopen its Shanghai park with added social distancing precautions. Tickets for the May 11th opening went on sale the previous Friday and sold out almost immediately. Disney limited the number of visitors to the park to 30% of its normal capacity based on requirements from the Chinese government.

Based on foot traffic data from Advan Research, the last four weeks have shown a resurgence in visits to gas stations. It appears that people have quarantine fatigue after being locked in their homes for nearly two months.

Visits to gas stations reached a national low during the week ending April 5th. According to figures from Advan, traffic was down 38.1% from the yearly average and down 36.5% from the first week of April 2019.

Airbnb hosts in Texas are seeing a rebound in bookings and occupancy, according to new data provided by AllTheRooms Analytics, a provider of short-term rental and Airbnb data and analytics.

Texas Airbnb 30-day occupancy rates, a measure of the percentage of properties listed on Airbnb that are booked over the next 30 days, reached 18.9% on the 30th of April.

This represents a 19% increase from the lowest point, which was recorded as 15.9% on the 22nd March; 9 days after Governor Greg Abbott declared a state of disaster on March 13th.

As the COVID-19 pandemic took hold of the globe these past weeks, comscore has continued to see the downturn in visitation to travel sites. With society still adhering to social distancing guidelines, consumers continue to avoid unnecessary travel and visitation to travel sites is still 55-65 percent lower than volumes we saw during the week of February 3, 2020.