Along with the Nasdaq, many eCommerce and online focused businesses soared during quarantine. The thinking was that these businesses were either gaining new customers or were getting existing customers to spend in new ways. The belief was that when quarantine ends these gains would become permanent. If these gains aren’t permanent and the sales bump was only driven by hoarding behavior or other one-time purchases, this shouldn’t drive stocks higher since it will not add to long term company earnings.

As one of the first states to reopen, many eyes are on Georgia to understand the impact. After nearly 2 months into the reopen, many state officials are quick to point out that there hasn’t been a rebound in new COVID cases. To give context for this lack of infection rebound we take a look at credit card receipt data from Yodlee to understand how open the state actually is.

Constantly shifting quarantining rules, mandatory mask wearing on airplanes and social distancing have left many asking whether the European summer vacation ritual will take a breather this year. With airlines such as American announcing increasing demand and air prices severely depressed it looks like summer is still on the calendar, although it’s going to be anything but normal.

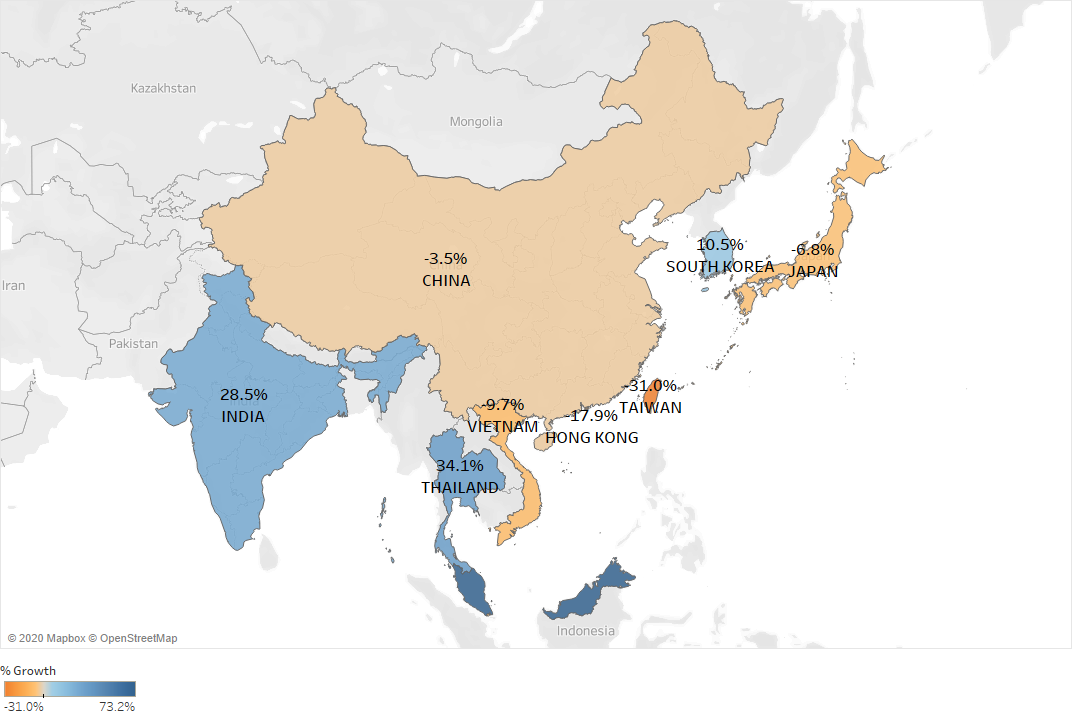

All eyes continue to look to China as a barometer for what a recovery might look like elsewhere from the COVID shock. China’s recovery is now almost two and a half months old for a majority of cities that were shut down. We worked with data from Jigaung to understand how the recovery has been progressing.

When COVID initially hit there was an enormous shift in consumer behavior across the economy. Online video services like Zoom saw user counts explode from 10M to over 200M users. Similar growth was seen across online workouts, online video, ecommerce and online events. One form of online interaction that didn’t see this boost was online dating.

Using mobile app data from Apptopia we can see the number of downloads and sessions for these apps both within the United States and internationally.

Student loans of $1.59 Trillion in the United States are now the second largest category of consumer loans behind only Mortgage loans. With students now taking classes remotely there is little opportunity to work part time either at school or at nearby businesses to pay off those loans.

The key to any economic recovery in the US is relaxing social distancing. Many businesses such as restaurants, gyms, doctors and hotels can’t operate profitably at 50% or lower capacity. Most restaurants run on razor thin margins, so filling seats and cramming them together is essential for their survival. In this article we examine the year to date recovery of the restaurant industry in the US.

As people around the world quarantined, the first thing people turned to in these desperate times was toilet paper. The second thing they turned to was Netflix, or Hulu or a host of other online video providers. The surge of Netflix hours had many concerned that the Internet would crash.

As businesses around the world locked down, Zoom (ZM) allowed employees to continue to connect and allowed commerce for online businesses to function with little disruption. Now that the company’s stock has run, where can investors turn to play the work from home theme?

According to data from mobile app data provider Apptopia, daily usage of mobile applications for major international hotel brands has recovered half of its COVID-19 loss. Shortly after China began locking down citizens, usage of mobile applications from companies such as Marriott, Hilton and Intercontinental dropped by nearly 20%. As of data as recent as May 17th it appears that these applications have recovered half of their lost usage.

Americans have surprised the world with much of their behavior during the worst pandemic in the last hundred years. In the initial stages of the COVID outbreak things seemed to make more sense. At first it was masks and cleaning supplies that were in short supply. After that it was toilet paper, web cams and in-home workout equipment. Now the object of America’s desire is burgers.

Global social distancing among countries, which had mostly been moving in lockstep, has now diverged materially. Despite large daily COVID-19 case count increases, places like Australia, the United States, Brazil and most of Eastern Europe and Southern Africa have seen large increases in retail and recreation traffic.

Not every country is experiencing the impact of the COVID-19 shutdown in a similar manner. By examining data from Datamyne, a leading provider of customs import and export data, we can see that each country’s experience is unique.

Data from online intelligence firm LikeFolio shows that online purchase intent data for Peloton has remained steady over the past month, up roughly 1000% versus pre-COVID levels. This impact could clearly be seen in Peloton’s earnings last week as the company guided revenue growth up 128% for the current quarter. LikeFolio analyzes social media data to accurately surface shifts in consumer spending behavior, product sentiment and purchase intent.

After months of being closed, Disney announced that it would reopen its Shanghai park with added social distancing precautions. Tickets for the May 11th opening went on sale the previous Friday and sold out almost immediately. Disney limited the number of visitors to the park to 30% of its normal capacity based on requirements from the Chinese government.

China’s Jiguang is one of the country’s leading providers of geolocation information. By analyzing their data we can look across China to better understand how the country is snapping back post the re-opening of Wuhan and the rest of the country.

According to data from leading consumer credit agency Equifax, limits for newly issued bank credit cards collapsed as COVID accelerated within the United States. Average origination credit limits compressed from $5,000 in early January, dipping as low as $3,500 in April. At the same time overall bank card balances had decreased more than 5% between early March and mid April. This balance reduction is equal to the total increase in US bank card balances from a year ago.

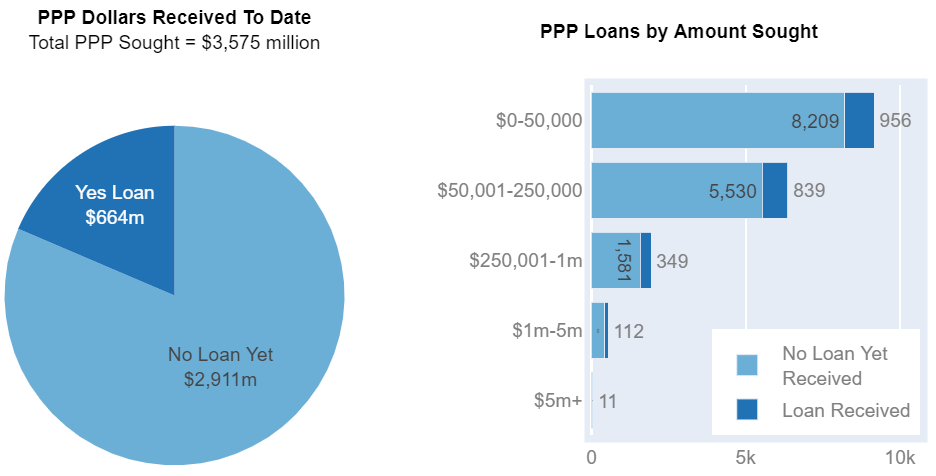

With many businesses shut down, legislators rushed in to help keep businesses afloat and to help keep their employees paid. The U.S. Small Business Administration (SBA) and the US Treasury announced on March 27th, 2020 that $349B had been authorized to the Paycheck Protection Program (PPP). By April 16th this money had been exhausted, and on April 24th an additional $310B was made available.

With COVID-19 leading to a massive increase in unemployment, many creditors are allowing consumers to defer payments, causing reduced visibility into the health and credit worthiness of many US consumers.

According to data from leading consumer credit agency Equifax, the total amount of consumer loans delinquent more than 60 days dropped by more than 25% month over month for the week ending April 20th. This compares to a maximum decline of 8.5% over the previous 12 months. At first glance one could view this decline as a positive, potentially signaling that people are paying off their bills and are therefor less delinquent. The reality unfortunately isn’t a positive one.

With the US economy mostly shut, the impact to consumer spending has been dramatic. By examining transaction data from leading data provider 1010data, we can see the extent of the magnitude of damage to the consumer economy.

Prior to the European travel ban which went into effect in mid-March, weekly consumer spending in the US was fluctuating between -5% and 5% in terms of year over year growth. Within two weeks after the travel ban was implemented, credit card expenditures tracked by 1010data had falled 46%. After two weeks of bouncing along this spending trough, the US consumer has finally started to show signs of reacceleration. Peak weekly spending for the past four weeks has improved sequentially YoY: -35%, -34%, -32% and had recovered to -30% as of a week ago.