Last week we were very close, this week we have broken through the 50 million weekly seats mark which is great news, however, at 53.8 million we remain at just 45% of the capacity available in the same week last year. And just to give you some historic context in 1996, the earliest online year for OAG data there were some 52.6million seats; we have come a long way in those years!

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items. By analyzing industry-level data, consumer spending trends can provide insight into which sectors of the economy are recovering fastest.

Early in 2020, we put together a list of brands that would end the year as clear winners. And halfway through, we’re still feeling good about our picks. Target’s pandemic low has been replaced by a recovery surge. Ulta, CVS, Chick-fil-A, and Chipotle are already within striking distance of 2019 levels, and even Bed Bath & Beyond is showing strength in recent weeks.

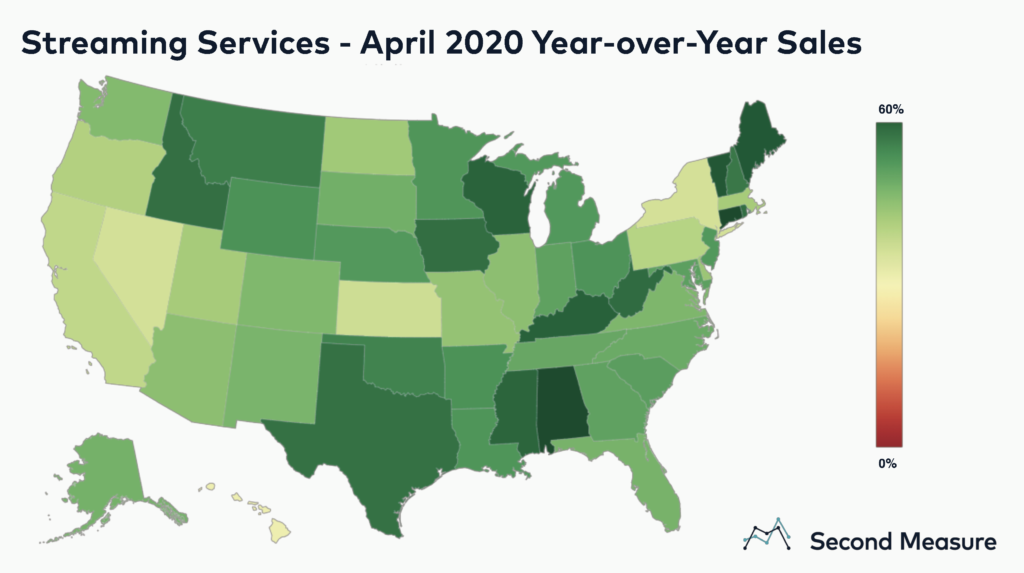

As U.S. consumers stay home amid the pandemic, they are flocking to streaming services for entertainment. The streaming industry’s sales grew 47 percent year-over-year in April 2020 compared to a 39 percent year-over-year sales increase in April 2019. Mandatory stay-at-home-orders, combined with the entry of a new market player, Disney+, and the rising popularity of socially-distant gatherings like Netflix parties, have led to the industry’s growing success.

After months of wild spending patterns, June saw some signs of normalization with Restaurants, General Merchandise, and Grocers returning to growth profiles of low single-digits. But the virus has now resurged. The last week of June saw a material slowdown in spending growth, particularly in the lockdown-driven sectors; Ecommerce and Home categories slowed 20 points WoW, and General Merchandise and Grocers slowed 10 points to a 5% YoY decline.

Data from Speedtest Intelligence reveals median download speed over mobile in the U.S. increased 15.8% between Q2 2019 and Q2 2020 to 29.00 Mbps. The median upload speed for mobile was 5.74 Mbps, down 15.2% from Q2 2019. Median download speed over fixed broadband increased 19.6% during the last year to 86.04 Mbps in Q2 2020, and median upload speed increased 1.5% to 11.86 Mbps in Q2 2020.

Travel was one of the first industries to get hit by the pandemic—especially business travel. Now, flights are starting to take off again. American recently announced that its July flight schedule was the strongest it’s been since March—but tickets were purchased mostly for leisure, not business. Events have shifted online and virtual meetings have become the norm. Without a vaccine, business travel will be slow to rebound—how are travel brands adjusting to this reality?

Big box stores such as CostCo and Sam's Club were early winners in the pandemic era as many of us stocked up in preparation for an anticipated period of lock-down. One clear winner during this period has been Amazon. Shelter in place orders have driven a spike in online shopping and the massive growth in employees at Amazon warehouses confirms the extent to which the retailer has benefited.

40%. 50%. 60%. Industry commentators are simply guessing when it comes to the fraction of airline routes and networks that we will see back by the end of the year. What we do know is that they will inevitably be reduced. They will be smaller because there will be fewer passenger flying for some time, and airlines will scale back networks in response to lower demand.

Small businesses have cut and reallocated their advertising budgets—often funneling dollars from local channels to Google and Facebook. “Ad spend piping into local channels will be significantly reduced for the long haul,” said Jed Williams, chief strategy officer at Local Media Association. Dollars that traditionally go to billboards, local TV and radio are now going to major digital platforms, as the return on investment is much easier to measure and justify.

At the start of 2020, we made our predictions for the year’s winners and our boldest was Bed Bath & Beyond. So, this might be confirmation bias, but when we saw how quickly its visits have been returning to normal, even with store closures being announced and fewer stores than a year prior due to the pandemic, the excitement in the air was palpable. Weekly visits for the brand were down just 22.0% year over year the week of June 15th, compared to being down 71.9% just a few weeks prior.

As states began to reopen and elective procedures began happening again, medical and big pharma brands drastically increased their advertising spend. In early March spend was up roughly 15% YoY. With the initial shock of COVID, the YoY spend dropped, but by the beginning of April, it was up 71% YoY. Twenty-three different companies are currently working on a coronavirus treatment and/or vaccine, but these companies are not the largest spenders in advertising.

Each monthly credit update brings more bad news for the energy sector. Even with positive signs, such as increased air travel and the gradual reopening of the economy, demand remains suppressed. Default risk continues to surge and shows no sign of immediate improvement.

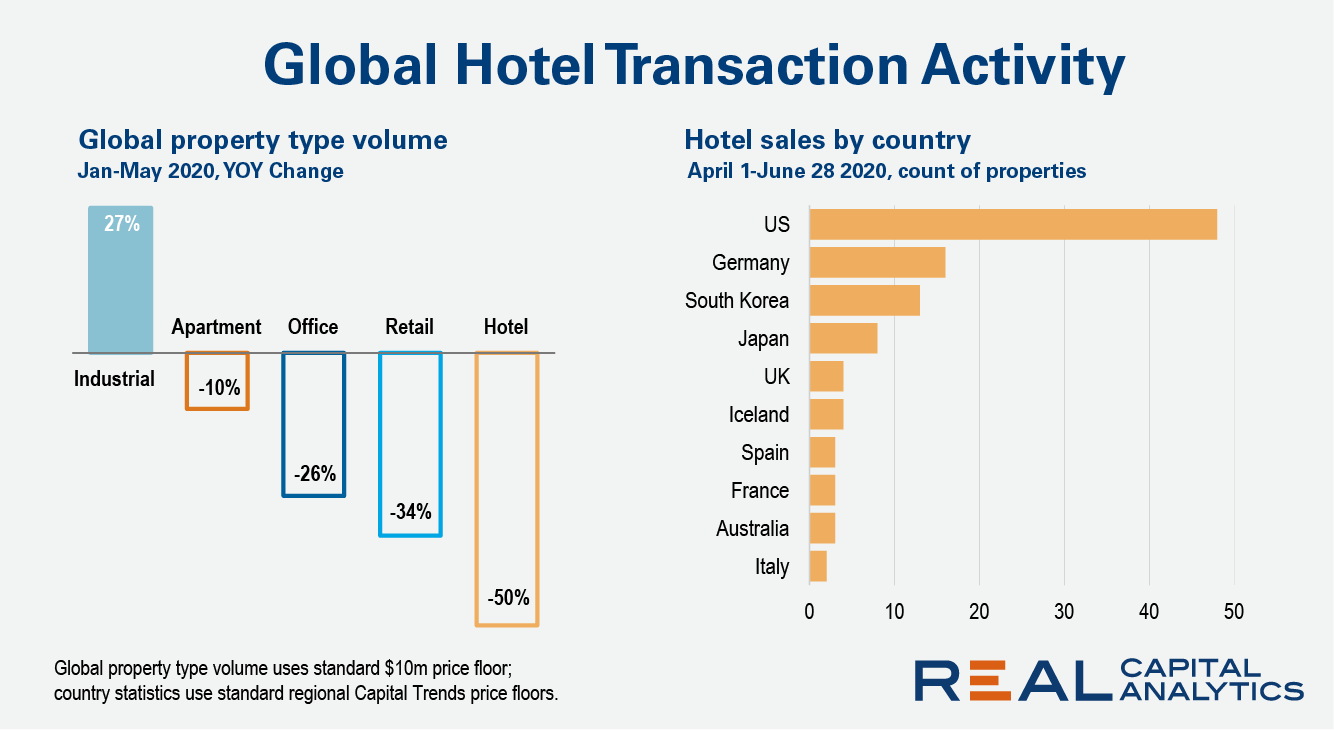

Globally, hotels have been the asset class most impacted by the Covid-19 crisis. Sales of hotels were down by one-half in the first five months of 2020 in comparison with 2019 and just 113 hotels have sold worldwide since the start of April. By way of comparison, more than 850 sold in the second quarter of 2019.

Yes, it was considered essential retail during the pandemic, but Target was still hit very hard. The year kicked off incredibly well, but visits saw a significant downturn, especially compared to superstore competitor Walmart. While Walmart’s traffic never dipped below 20.0%, Target saw visits drop 32.2% compared to the same month in 2019.

Along with the Nasdaq, many eCommerce and online focused businesses soared during quarantine. The thinking was that these businesses were either gaining new customers or were getting existing customers to spend in new ways. The belief was that when quarantine ends these gains would become permanent. If these gains aren’t permanent and the sales bump was only driven by hoarding behavior or other one-time purchases, this shouldn’t drive stocks higher since it will not add to long term company earnings.

According to data provided by the Association of American Railroads (AAR), total carloads and intermodal traffic in the United States is down 22.0% YoY for the week ending May 16. This represents only a marginal improvement from the 23.3% YoY decline for the week ending April 18, the low point for the year.

Today’s consumers are inundated with information and content – much of which may not be relevant or accurate. Yet during a pandemic, it’s more important for brands than ever that consumers can rely on their updates.

As the Chinese retail sector begins the road to recovery, it’s becoming clear that a reopening and a rebound aren’t completely synonymous. Despite China’s early start to the reopening phase, our Consumer Sentiment Study from May 2020\[1\] shows across industries, a large portion of consumers in China spent or planned to spend less than they did prior to the crisis.

The Luxury Goods sector has had phenomenal success over the past ten years. Growing global middle classes and readily available credit have paved the way for a social media-driven explosion of demand for high quality brands.