Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Container imports into the United States in April fell by 8.4% in terms of gross tonnage versus April 2019. Containers coming from Mexico, Germany and Japan were the most heavily impacted of the larger US trading partners with declines of 43%, 33% and 17% versus a year ago.

Data from a leading customs data provider, Descartes Datamyne, showed US imports continuing their decline throughout the month of April, ending the month at the lowest levels. Most ocean containers, especially those from Asia, sit on docks and then transit on the water for several weeks before arriving into the United States. As factories across the world only began shutting down in Mid March, the full impact of the global quarantine is unlikely to be felt until May or June.

Stripping out oil imports, April showed no material decline in overall imports. With businesses mostly shut down across the US, this signals the start of a potentially dangerous inventory build cycle. With significantly larger inventories than normal and faced with a “new normal” of likely decreased consumer demand for many products, factories face the risk of complete shutdowns which could last multiples as long as the original lockdown.

Tech M&A has been decimated, literally and etymologically. Spending on acquisitions so far in April is tracking to just one-tenth the level we have recorded for average months in recent years. And even as the value of tech deals this month plunges to an eight-year low, there doesn’t appear to be any uptick on the horizon.

According to 451 Research’s M&A KnowledgeBase, the coronavirus pandemic and accompanying economic slowdown has knocked tech M&A spending in the first half of April to just $2bn. Assuming the rest of the month continues at the same funereal pace, the amount spent by all acquirers around the world for the entire month would be lower than the amount some buyers have spent in a single transaction. For reference, the M&A KnowledgeBase shows 25 individual tech deals announced in 2019 that were valued at more than $4bn.

As paltry as the current acquisition activity is, there isn’t much coming after the few transactions that have already been announced. Pipelines have been hollowed out to historic levels because of uncertainty. That came through clearly in a special 451 Research survey of senior investment bankers, where we sought to quantify the devastating impact of the coronavirus outbreak on the tech M&A market. (See the full report.)

In our Flash Survey: Technology Investment Banking Outlook, half of the respondents said coronavirus has derailed at least one of every four deals they were working on before the outbreak. But highlighting the depth of the current crash, among this bearish group, one in four bankers (24%) said at least half of the transactions they were working on in February are no longer moving ahead, either temporarily or permanently.

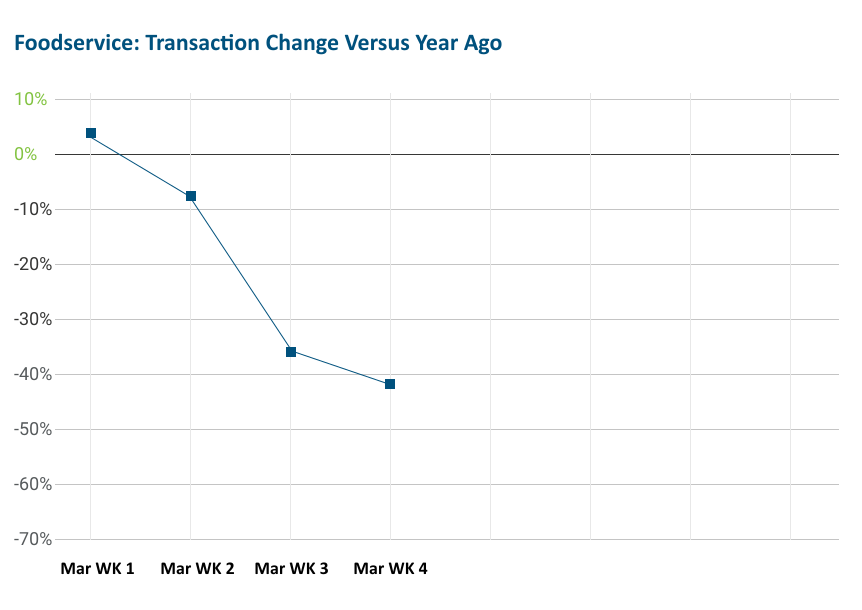

According to research and data firm The NPD Group, restaurant customer transactions dropped by 42% in the fourth week of March (week ending March 29) compared to the same week year ago.

“The transaction declines partially reflect the struggle of on-premise restaurants to pivot to off-premise models,” says David Portalatin, our food industry advisor. “Many restaurants that are attempting to make the move are doing so with limited menu offerings and without the benefit of drive-thru lanes, he added.”

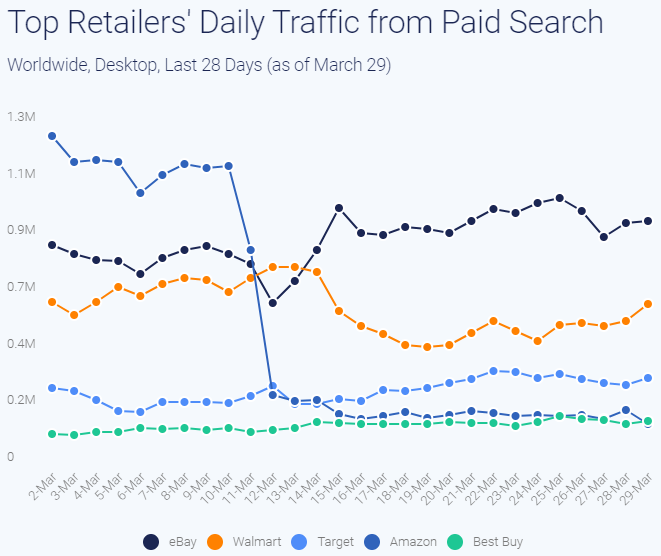

On March 11th, Amazon put a halt to its spending on Google Ads to counterbalance the increased demand due to the COVID-19 outbreak. By March 12th, their paid search traffic was down 90% from the previous day, and by March 25th, this decision had already cost it 11.2M visits. Amazon seems to have completely removed itself from the competition for essential goods, effectively leaving one million daily visits on the table for other competitors to take.

Video games are another story, though, and remain a significant source of revenue for Amazon. Despite the overall decrease in PPC spending, the mega-retailer continues to bid on video game-related keywords to capitalize on the recent surge in stuck-at-home online gaming during the coronavirus pandemic. In March, Amazon-owned subsidiary, Twitch, was up in traffic by 15% YoY, worldwide.

Meanwhile, eBay is ahead of the game (pun intended). Just days after Amazon’s decision, the competitor marketplace upped its investment on high-volume keywords such as “toilet paper,” “n95 mask”, and “hand sanitizer” by 60%, which has brought in an incremental 330K visits to the site every day.

Just days after Amazon’s decision to cut Google Ad spend by 90%, eBay upped its investment on high-volume keywords such as “toilet paper,” “n95 mask”, and “hand sanitizer” by 60%, which has brought in an incremental 330K visits to the site every day.