You don’t need a data analyst to tell you people are going outside a lot more these days. Camping sites are nearly impossible to come by. You can’t find an RV to rent. Bikes are sold out everywhere. These trends illustrate a pattern we’ve observed during COVID: if an activity is nearby, safe, and cheap people will flock to it. Beaches and forests are often within driving distance, outdoors, and (generally) lend themselves well to social distancing. This is a summer of road trips.

The number of Brits present in countries across Europe reached a new high on the day the Government ended its 14-day quarantine rule for returning travellers on Friday (10 July) According to Huq’s European Travel Indicator for GB Residents, which tracks the change in British residents present in countries across Europe, the number of ‘Brits abroad’ regained 59% of pre-lockdown levels as they were permitted to travel to other countries without the need to self isolate upon return. However, this rise only corresponds to 38% of 2019 levels.

The RV market in the US looks like it may have found a new client base during the pandemic. As reported by the New York Times, companies like Cruise America, the largest RV rental company in the US, typically count on overseas visitors for about 40% of their bookings.

While April marked the low point of engagement in 2020 to date for travel brands, Comscore’s figures showed an increase in consumer interest across several travel categories beginning in May, signaling that the industry may have started to see a recovery.

Last week we were very close, this week we have broken through the 50 million weekly seats mark which is great news, however, at 53.8 million we remain at just 45% of the capacity available in the same week last year. And just to give you some historic context in 1996, the earliest online year for OAG data there were some 52.6million seats; we have come a long way in those years!

Looking at visits to hotel and home sharing sites provides a good indication of interest in holidays. In all EU5 countries there was an increase in visits in May 2020 when compared with April 2020. For Germany and Italy, the visits index jumped above March 2020 levels, with 56% and 36% increases, respectively. For Spain and France visits to hotel and home sharing sites/apps almost returned to March 2020 levels, which is positive. The UK lags behind them.

40%. 50%. 60%. Industry commentators are simply guessing when it comes to the fraction of airline routes and networks that we will see back by the end of the year. What we do know is that they will inevitably be reduced. They will be smaller because there will be fewer passenger flying for some time, and airlines will scale back networks in response to lower demand.

The number of Germans travelling overseas has climbed to 75% of pre-lockdown levels over the last two weeks, according to the latest data from Huq’s new ‘European Travel Monitor’. The Monitor shows that German residents have been among the fastest in Europe resume international travel. The number of residents leaving Germany relative to pre-lockdown levels is followed by a rise in residents from France travelling abroad (62% of pre-lockdown levels) followed by Netherlands residents (60%) and the UK (42%).

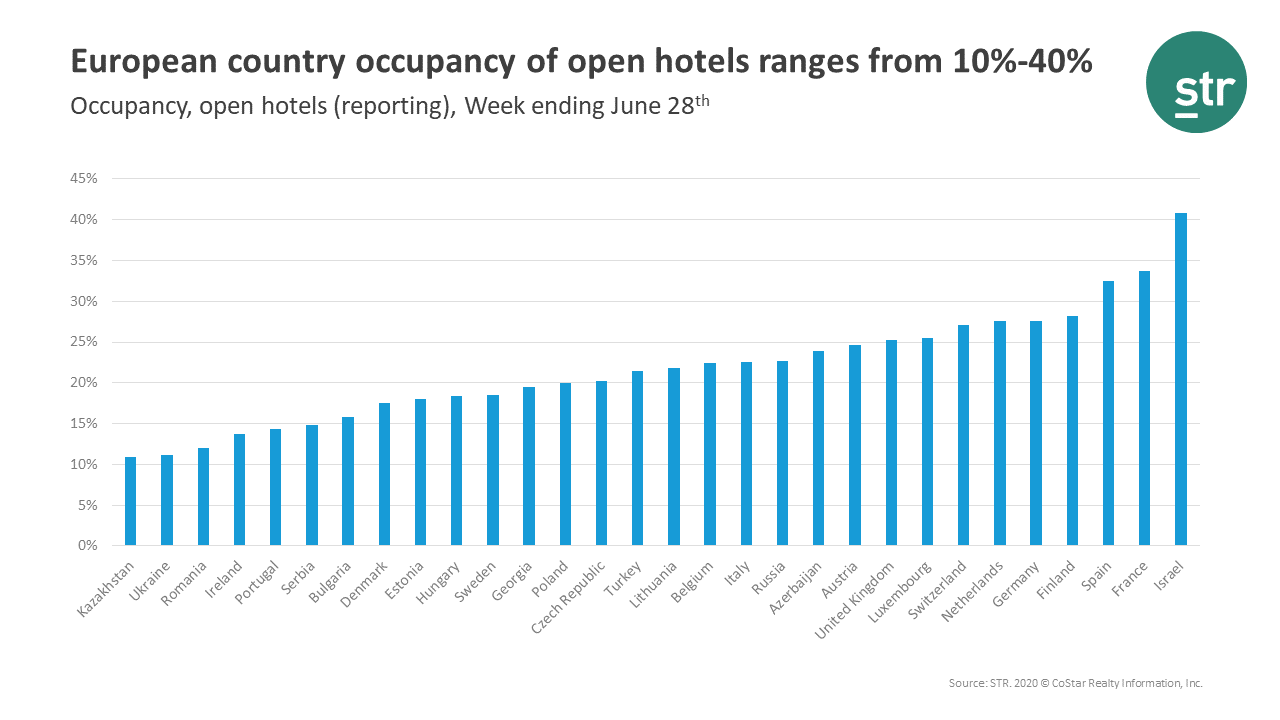

For the week ending 28 June, occupancy of open hotels in European countries ranged from 10%-40%. Among those countries, Israel posted the highest occupancy level (41%), followed closely by France (34%) and Spain (32%). Regional markets in Europe are leading the recovery while main cities have lagged. For example, Finland Provincial posted the country’s highest occupancy level (66%), while Helsinki occupancy was 23% for the week ending 28 June.

The COVID-19 pandemic has caused unprecedented challenges for global hospitality, with travel restrictions and lockdown measures forcing hotel closures and performance declines that exceed the levels witnessed during the global financial crisis and other challenging times for the industry. An area of the industry where the impact continues to evolve is business on the books, or reservations booked for future dates.

Today’s data from Huq’s new European Travel Monitor indicates that the reasons for British overseas travel during recent months have been closely inline with those permitted – essential work, family and ‘returning home to a main residence’. This new monitor – which measures the proportion of European country-residents present in popular destinations across southern Europe – also reveals that Sweden has been the only country to demonstrate some semblance of normality over the period since March, with residents 6x more likely to travel than their British counterparts.

For many airlines the Europe to United States market is the most profitable part of their network. July is traditionally one of the most lucrative months, the business market remains strong, leisure traffic picks up and yields are at their strongest for many carriers; that tradition is not happening this year for sure. With the European Union and United Kingdom classifying the United States as a Red-Light destination then only the chosen few or those seeking quarantine will be able to travel.

Memorial Day weekend historically marks the unofficial start of summer travel. But this year, it also served as a bellwether of whether consumers would be ready to travel again. Our purchase insights show that, in the near term, travel post-COVID may be considerably changed.

With restrictions lifted early in the state, and given its popularity as a vacation destination, hotel traffic has seen a steady rise since mid-April. As of the third week of June, traffic in Florida hotels was 43% below the start of the year. Though with case numbers rising again over the past several days we may see a reversal of the trend as we head into July.

The first official week of Summer has resulted in the largest week on week growth in capacity during the Covid-19 event with some 8.2 million seats added back around the globe and a week on week percentage increase of 21%. We may also be heading for a week with a very high rate of cancellations as airlines wait for demand to respond but let’s worry about that next week!

The travel and hospitality category generally continues along a weak recovery trend much as it has since mid-April when visitation bottomed-out between -60% and -80% for most brands. That’s up to a national average of within \~50% of pre-COVID levels, as of this writing. The motel sector is recovering faster on the whole than the hotel sector, though the states leading the recovery charge could soon face a second wave of restrictions.

Since Europe was locked down earlier than North America, it has also started opening up sooner. As a comparison, we looked first at foot traffic in European airports to see whether there are any early signs of a pick-up in visitors coming into the peak holiday period. Overall traffic remains fairly depressed, but there are some signs of growth, particularly in Greece, which depends heavily on tourism income.

The travel market, including OTAs and vacation rental apps, took a nose dive at the start of the pandemic, as countries put strict travel bans and social distancing orders in place. In the past month or so, some of those restrictions have lifted, and it looks like people are itching to get out of the house. Vrbo Vacation Rentals by Homeaway.com has increased daily net new installs 113% over the past two months.

STR data ending with 23 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded in April.

With Italy and Spain both hoping to welcome tourists back for the summer season over the next five weeks, data from the Huq Daily Distances Indicator suggests that as boarders open, Italian residents’ appetite for a summer slew of overseas visitors could be far greater than among their Spanish counterparts.