CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. single-family home rental costs posted an 11.4% year-over-year increase in August, marking the fourth straight month of annual deceleration. Even so, rental costs remained elevated, with annual growth running at about five times the rate than in August 2020 in the midst of the COVID-19 pandemic.

Despite high inflation and rising menu prices, full-service restaurants (FSRs) have been staging a comeback. Consumer transaction data reveals that for major FSR competitors—Bloomin’ Brands (NASDAQ: BLMN), The Cheesecake Factory Inc (NASDAQ: CAKE), Cracker Barrel Old Country Store Inc (NASDAQ: CBRL), Darden Restaurants (NYSE: DRI), Denny’s Corp (NASDAQ: DENN), and Dine Brands Global (NYSE: DIN)—sales in the third quarter of 2022 were higher than they were in the same quarter of 2019.

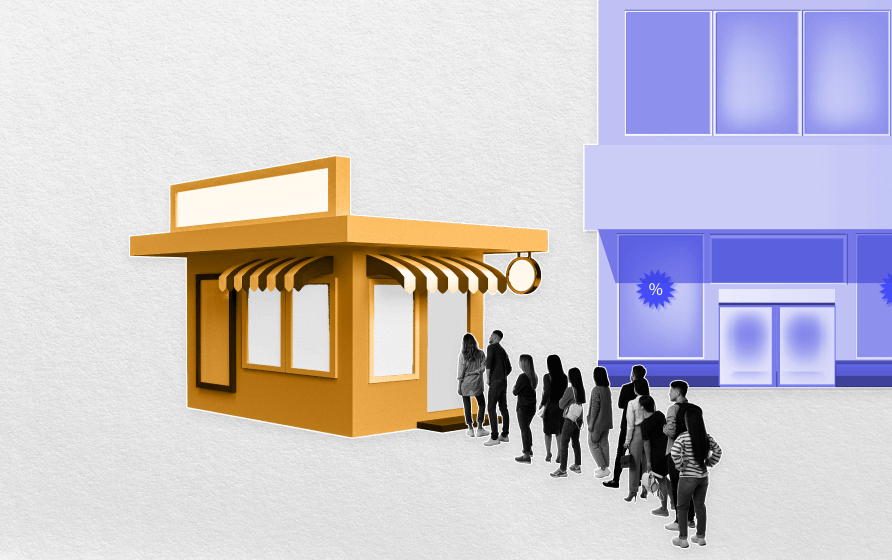

Our latest white paper looks at six brands that are leading their category and continuing to attract visitors amidst ongoing inflation and tightening consumer budgets. Below is a taste of our findings. Inflation has taken center stage over the past few months. With the current price hikes affecting daily spending, shoppers are increasingly considering “trading down” – substituting their regular brands with lower-priced alternatives. But although consumers are adopting a more value-conscious behavior, foot traffic data indicates that the true state of retail is not as bleak as may be expected.

After more than two years of remote work, many companies are unlocking their office doors and asking employees to come back. In fact, about 50% of companies want workers back in the office 5 days a week. Much to their dismay, many of their employees don’t want to return—at least not every day. According to a Gallup study, more than 90% of the 70mm remote-capable employees say they don’t want to go back to the office full-time. Either way, with the return-to-office policies going into effect, people are putting on their fancy clothes, restarting their daily commutes and dropping their kids off at daycare.

Pet supply companies saw their sales rise early in the pandemic, as many U.S. consumers adopted pets during the pandemic lockdowns. In the case of Chewy (NYSE: CHWY), a digitally-native pet supply company, sales remain elevated more than two years into the pandemic, Bloomberg Second Measure’s consumer transaction data shows. A closer look reveals, however, that the company’s year-over-year growth in sales slowed down between January and August of 2022, compared with the corresponding periods in 2020 and 2021, while customer counts during most months of 2022 remained relatively consistent year-over-year, but higher than in 2020 and 2019.

In the past two years, many creditworthy borrowers have taken advantage of ultralow interest rates to refinance their mortgages. As of July 2022, 80% of outstanding home mortgage loans had interest rates below or equal to 4%. However, rising interest rates have significantly reduced refinancing opportunities. With interest rates hovering around 6% and higher in September, refinancing activity has plummeted. Instead, home equity lines of credit (HELOCs) and home equity loans are gaining popularity as homeowners seek to tap their accumulated equity.

Target Deal Days have come a long way since the company first launched the event in 2018. Initially scheduled to overlap with Amazon’s Prime Day, the Deal Days slowly but surely took on a life of their own. In October 2021, Target kicked off the extended holiday shopping season with its first independent Deal Days event and the second Deal Days of the year, in a move that is now being used by Amazon. And this year, Target’s October Deal Days took place October 6th to 8th 2022 – almost a week before Amazon’s first-ever second Prime Day of the year scheduled for October 11-12.

Today’s cost of living increase for Social Security is the highest in 40 years. With recent inflation hitting those on a fixed income particularly hard, such a large increase is likely to provide much-needed relief to senior citizens. In today’s Insight Flash, we dig into spending patterns for those aged 65+ using our access to demographic data, seeing how spend has trended recently overall for this group and which subindustries and companies are most likely to benefit from extra dollars in these shoppers’ pockets.

The average sums that buyers are parting with for a down payment are at an all-time high for all homes purchased in the United States. After falling during the housing crisis of the Great Recession (2008-2009), the average down payment amount has steadily increased. However, since the onset of the pandemic in early 2020, the average down payment sum surged, reaching a record high in May 2022. Home prices play a significant part in the size of down payments, and with increases in home prices over the last few years, average down payments have followed suit.

Global airline capacity has bounced back as a combination of both lockdowns in China and the end of Golden Week has resulted in airline capacity moving back to 97.2 million. In a nutshell, all that increase is down to the growth in China, although quite how long before the next capacity cut is anyone’s guess.t. This week’s capacity data would be very quiet if it wasn’t for that one major change in China.

To reduce Europe’s dependency on Russian oil and gas, the European Commission recently introduced a new joint action plan for more secure and renewable energy. The announcement included policies mandating the installation of solar panels on new buildings and plans to double the deployment rate of heat pumps. But does the European labor market have enough talent to install all these solar panels and heat pumps? Job postings at renewable energy companies more than tripled shortly after the announcement. During the spike, more than 20,000 green jobs were added, before demand normalized again.

The brick-and-mortar apparel category has faced a unique set of challenges. Two years of a pandemic drastically changed the nature of in-person shopping and gave way to the most significant consumer price index jump in 40 years. Still, the segment had plenty of bright spots – including the five apparel brands featured here. As previously explored, the shoe category has performed impressively over the past few years, and this continues to be true, especially for one of the fastest-growing chains identified.

Ookla® recently commented on the outcome of the 5G spectrum auction and how Indian consumers are ready to upgrade to 5G networks. We now have data from Speedtest Intelligence® to show early 5G performance across select cities as well as an indication of the growth of the number of 5G-capable devices.

Macro pressures in the UK are likely to put the squeeze on Grocery profits for the end of the year. With a recent warning by Tesco highlighting the impact of tighter consumer wallets, in today’s Insight Flash we do a pulse check on UK Grocers. Subscribers can track this data as the last three months of the year play out, seeing the extent to which conditions deteriorate or whether they improve and which grocers are most impacted.

STR’s global bubble chart update shows steady top-line performance indicators around much of the world during the four weeks ending 24 September 2022. While most countries maintained their recovery pace since our previous update, China’s struggles continued while other Asian countries saw a pickup in recovery pace. Among the 48 countries with room supply of more than 50,000 hotel rooms, 12 posted occupancy above 75%, which was one more than the previous 28-day period. Average daily rate (ADR) softened after the summer peak as only four countries recorded a level of $250 or above, which was two countries less than previous four-week period.

With a post-pandemic prime shopping period behind us, we wanted to investigate consumer spending habits, considering the context of reemergence and macroeconomic factors. With the knowledge that people pulled back on shopping through mid-August, we looked at transaction metrics for major back-to-school retailers leading up to the first day of school. Back-to-school signifies not only children returning to school but also a return to consumers’ typical routines and needs. Warehouse Clubs and Big Box stores saw the highest bump from this change – about 16% in late August.

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 5.7% (2000=100) in September to 183.2 from the revised August reading of 173.4. The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. In September, the commercial component of the Momentum Index rose 2.9%, while the institutional component also increased, seeing a double-digit gain of 11.7%.

Wawa, a leader in the gas and convenience store space, recently announced plans to nearly double its store count by 2030. The chain is also testing a new drive-thru channel to sell its fresh food offerings. We dove into the foot traffic data to take a closer look at Wawa’s success and see what the company’s standalone drive-thru’s performance reveals about Wawa’s QSR potential.

With warnings that inflation could exceed 20% by the start of next year, plans to introduce a tighter rent cap for tenants in the social rented sector are being discussed, to try help insulate some of the most vulnerable from the current cost of living crisis. However, this rent cap could negatively impact housing associations and affect their ability to maintain and improve existing residents’ homes and deliver more new affordable housing.

Bed Bath & Beyond has survived the test of time as one of the last remaining big box brick-and-mortar category killers. But recent performance has lagged, and reports of debt restructuring call into question how much longer the business model can survive. In today’s Insight Flash, we review the Bed Bath basics to showcase how equity investors might have been able to get ahead of the company’s large drops in share price, and how potential bondholders can better understand the risk profile compared to others in the space, by banner, and by channel.