Mobility data mapped against new cases of Covid-19 across Paris and London since the start of the year reveals a startling link between population mobility, and the spread of the virus. When set alongside one another, population mobility within cities shows a strong inverse correlation with the number of new cases being identified. Cases rising when populations are more mobile, and decrease rapidly when movements are reduced.

The nation’s overall delinquency rate was 7.1% in June. All states logged annual increases in both overall and serious delinquency rates in June. In June 2020, 7.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), slightly lower than the May 2020 rate of 7.3%, but a 3.1-percentage point increase from June 2019.

The growth in visits to Restaurants over the course of August is plateauing, with the Huq Index for Restaurants & Pubs falling 17% from its recent high at the end of the Chancellor’s ‘Eat Out to Help Out’ scheme. Has the boost delivered by the scheme produced a lasting result? How will recent gains continue over the coming weeks without the same levels of government support? Over 100m meals were bought through ‘Eat Out to Help Out’ in August, and Monday-to-Wednesday became the new ‘weekend’ for many restaurants.

With rising infection rates and concerns about the looming virus season, the COVID crisis is clearly far from over. But with the first wave behind us, it is possible to see the past six months of market volatility in its broader context. The S&P500 is now higher than it was in February 2020, having at one stage lost one third of its value. The VIX spiked from a mid-February level of 14% to a mid-March high of 85%, and currently trades at 33%. The Global BBB spread\[1\] tripled from 1.5% to 4.5% and currently sits at 1.7%.

The Dodge Momentum Index increased 1.8% in August to 126.5 (2000=100) from the revised July reading of 124.2. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In August, the commercial component rose 3.3%, while the institutional component moved 1.2% lower.

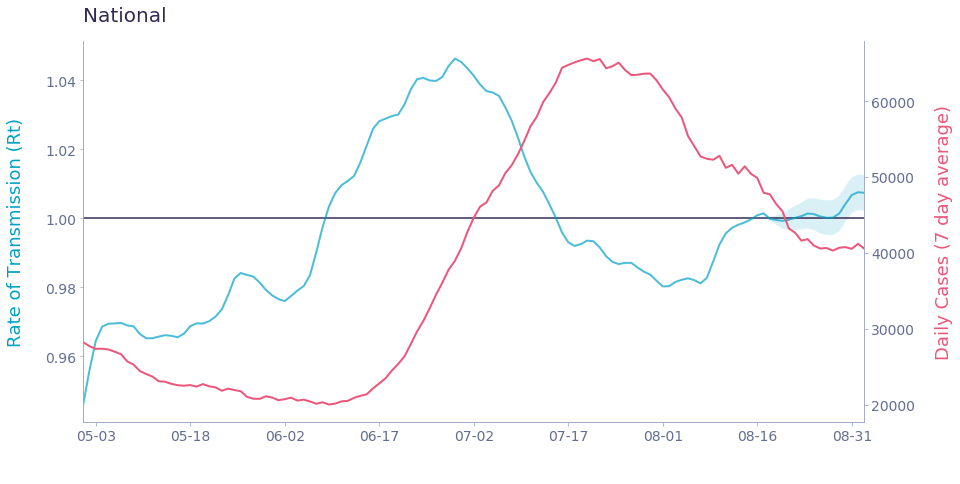

There are some regions with modestly elevated illness transmission – Southern California, for example – but no states are showing alarmingly high rates of illness spread. At a national level, Rt has leveled off around 1 for the past few weeks, suggesting that we will not see major changes in case numbers in the coming weeks.

Car factories across Europe have recovered two-thirds of their 2019 productivity during July and August, with worker presence at these locations doubling post lockdown. Huq’s Big-6 Industrials Index, which measures footfall to more than 750 of Europe’s production facilities across Defence, Biotechnology, Chemicals, Automotive, Aerospace and Food Production, has seen activity at car manufacturing facilities increase from around 33% of last year’s levels to almost 70% over the summer.

With COVID-19 disrupting businesses throughout the nation, there is reasonable concern regarding the impact of the pandemic on construction trends. Every quarter, CoreLogic publishes the Quarterly Construction Insights report, which digs into critical pieces of the construction economy in the U.S. and Canada, such as changes in material and labor costs, permits for new construction, and construction employment. Here are some of our key findings for Q2 2020.

Labor demand continued to rise in August, with steady gains in total, new and removed job openings across the U.S. that continued the steady gains seen in June and July. The LinkUp 10,000, a metric that measures the job openings for the 10,000 global employers with the most job openings in the U.S. for the month, rose 3.6% in August.

The Pacific region does not normally garner much attention in the LPG market because trade flows are typically very small relative to other parts of the world, but exports from Australia are very strong this month. Loadings in the country are up 60% in August and 23% year-over-year to 125,000 barrels per day, and would be the highest on our records if maintained through month-end.

Global exports of liquefied natural gas in August totaled approximately 31.2 million tons on board 479 vessels, lower than August 2019’s pace of 32.5 million tons on 483 vessels, with a drop in loadings from the US & Pacific regions. Approximately 30.8 million tons arrived on 474 vessels at import terminals in August, compared to 32.9 million tons in August 2019.

McKinsey, in a recent article “Meet the next-normal consumer” noted that companies will need data to increase their investment in insights to stay ahead of change and as critical to helping shape a positive future. In fact, in times of unprecedented change leveraging data and analytics to create insights to changing consumer behaviors can fuel successful corporate strategies.

The U.S. job market is making a recovery according to data from LinkUp. Through the middle of August, over one million new positions were published which is in line with numbers from a year ago. The rebound in job postings in July and August is especially encouraging considering the sharp decline in hiring as a result of the COVID-19 economic shutdown.

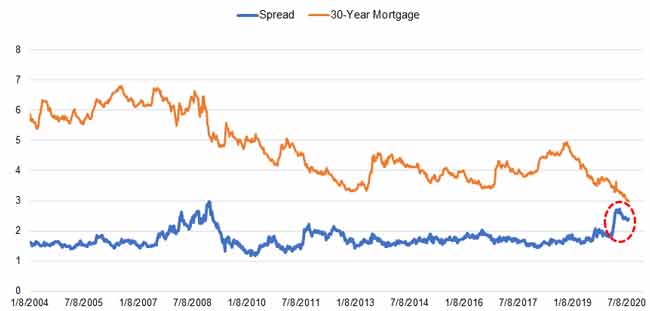

Amidst the COVID-19 pandemic, many lenders are reportedly tightening credit by raising the minimum FICO score requirement or increasing down payment requirements to 20%. The credit tightening is driven by a familiar credit market phenomenon known as flight to quality – in time of economic crisis and market uncertainty, investors tend to become more risk averse and will reduce exposures to higher risk loans or loan products.

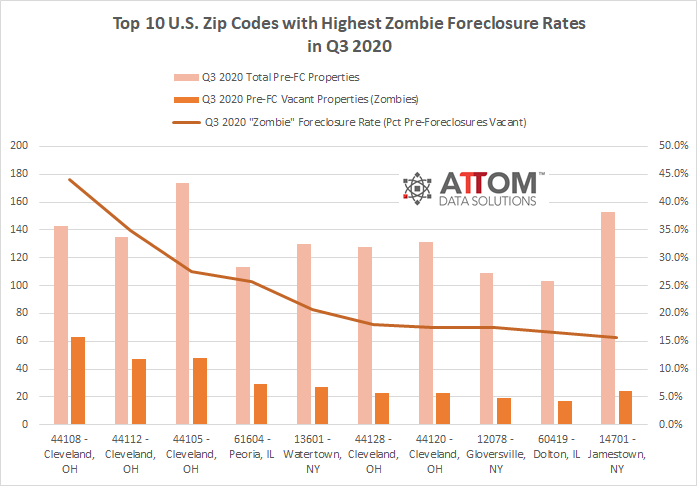

ATTOM Data Solutions’ newly released Q3 2020 Vacant Property and Zombie Foreclosure Report reveals that 1.6 percent of all homes in the U.S. are vacant, numbering 1,570,265 residential properties, with 7,960 or 3.7 percent of those vacant properties in the process of foreclosure, otherwise known as ‘zombie foreclosures.’

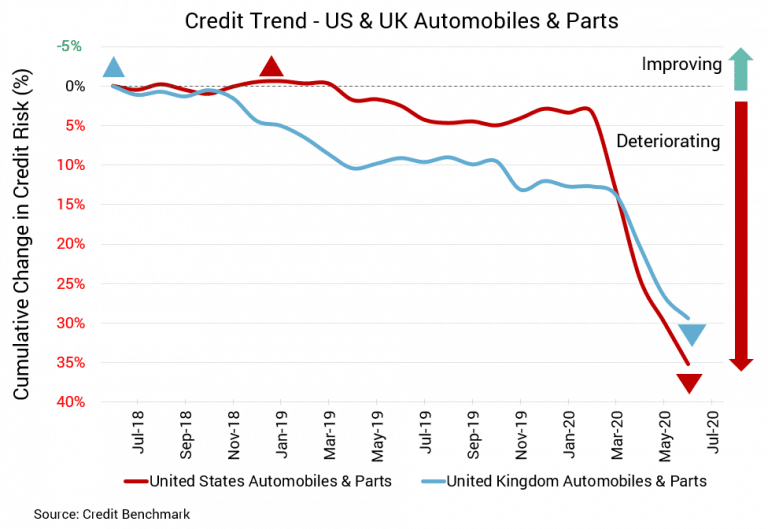

While there are some signs the US auto industry is restarting after COVID, numerous challenges remain – and that’s not even factoring in overall weakness in the economy and personal finances. Credit weakness continues, and it’s unlikely to get much better until everything else improves. Similar can be said about the UK, where car sales are on the rise but where the economy is coming off its worst drop on record.

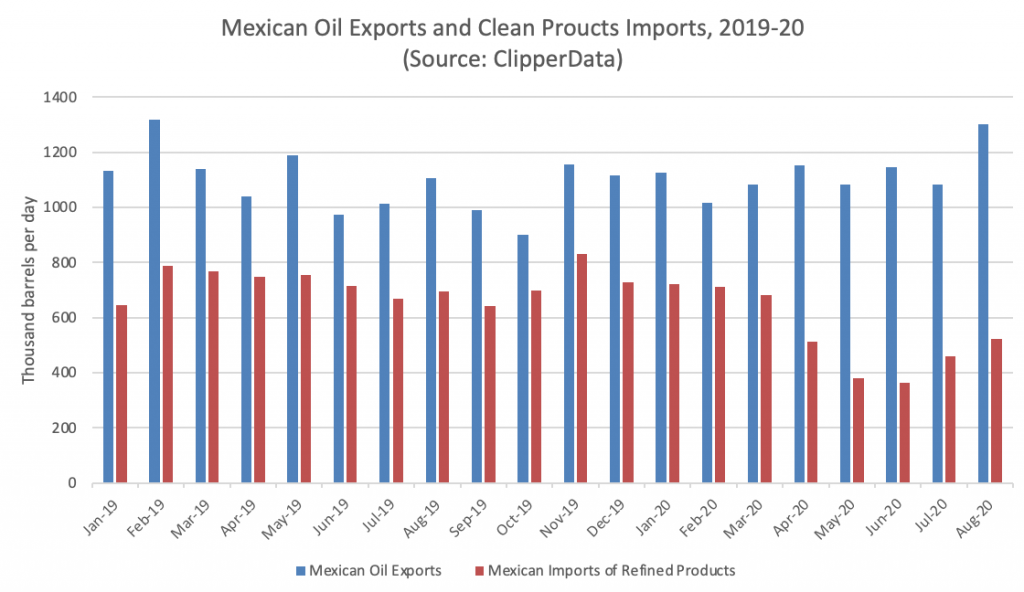

The Mexican government is falling short on its promises for the energy sector once again. President Andres Manuel Lopez Obrador (AMLO) vowed to considerably increase refinery runs earlier this year, and despite a rebound in April, Mexican crude processing has tumbled to 534,000 bpd in July. Mexico has meanwhile experienced a steady increase in clean product imports, after hitting lows in June due to the demand crimp of Covid-19.

Problems for the beleaguered US energy sector have continued to mount this year. Demand for oil plummeted, bringing down prices as competition and supplies grew. Bankruptcies continue in the industry as the broad economy continues to struggle, and it’s not clear how many firms will benefit from any improvement in prices.

The ranks of the Fallen Angels – firms whose credit quality has made the shift from investment-grade to high yield, or “junk” status – continue to grow, but the pace may be slowing down. Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies have now entered the Fallen Angel category.

Preparations for the approach and landfall of Hurricane Laura forced the shutdown of many shipping terminals and refineries, as well as several petrochemical crackers. The reduction in productive capacity may be short-lived, but comes at a time when olefins and feedstock commodities are in high demand. US LPG loadings this month are running at a pace of 1.64 million barrels per day, and would be the highest on our records if maintained.