Home prices rose a whopping 20% over the past year and rents on single-family homes were up 13%, according to the CoreLogic national Home Price Index and Single-Family Rent Index. With prices up more than rent, is it a sign that homes are overvalued? Price growth that outstrips rent gains over an extended period could be a sign that homes are overvalued if capitalization rates, otherwise called cap rates, had remained unchanged. A cap rate is used by real estate professionals to convert net operating income on an investment property into a market value.

If you are a homeowner living in California, Florida or parts of Missouri and have not already had installed solar panels or new roofing with a PACE loan, there is still a good chance that you know a friend or neighbor who has, or you’ve been pitched by private contractors selling PACE. PACE is an abbreviation for Property Assessed Clean Energy. As the name indicates, PACE provides financing for green and renewable energy home improvements, although it is not limited to such. Retrofitting properties with energy upgrades is costly, and PACE provides incentives such as 100% long-term financing.

Welcome to the May 2022 Apartment List National Rent Report. Rent growth is continuing to pick up steam again, after a brief winter cooldown, with our national index up by 0.9 percent over the course of April. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth we observed in the years immediately preceding the pandemic. Year-over-year rent growth currently stands at a staggering 16.3 percent, but most of that growth took place last spring and summer.

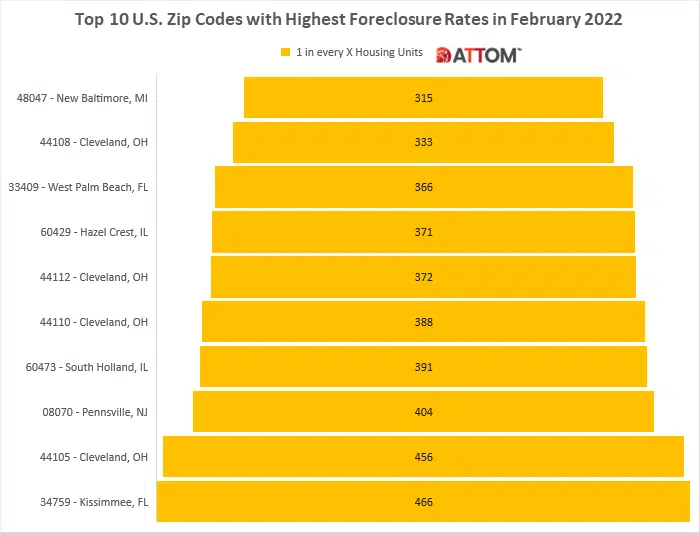

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, today released its Q1 2022 U.S. Foreclosure Market Report, which shows a total of 78,271 U.S. properties with a foreclosure filing during the first quarter of 2022, up 39 percent from the previous quarter and up 132 percent from a year ago.

Total construction starts fell 12% in March to a seasonally adjusted annual rate of $903.8 billion, according to Dodge Construction Network. Nonresidential building starts lost 29%, in part due to the start of three large manufacturing facilities in the prior month. When those three large projects are removed, nonresidential starts in March would have risen 10%. Residential starts also fell 3%, and nonbuilding starts lost 2%. Year-to-date, total construction was 9% higher in the first three months of 2022 than in the same period of 2021. Nonresidential building starts rose 26%, residential starts gained 3%, while nonbuilding starts were 1% lower.

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. rent prices continued their double-digit gains in February, rising 13.1% from one year earlier to hit another new record as the highest in the history of the index. Warmer areas of the country again posted the largest price hikes, with rents in Miami up 39.5% from February 2021.

Australia’s construction sector has faced many headwinds due to Covid, with constrained supply pipelines causing delays in shipments of necessary materials, lockdowns hampering progress on much construction activity, and, more recently, significantly rising costs. However, over the last two years, there has still been significant investment in building new assets, thereby increasing the amount of stock and the size of the investment market.

The nation’s overall delinquency rate was 3.3% in January. All U.S. states and metro areas posted year-over-year decreases in delinquencies.In January 2022, 3.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from January 2021 according to the latest CoreLogic Loan Performance Insights Report . This is the lowest recorded overall delinquency rate in the U.S. since at least January 1999.

Recent price indexes show that inflation is at a 40-year high. Supply chain disruptions have led to a spike in prices for various goods, which has added to the cost of construction and delayed home completions. Housing is a big part of every family’s monthly spending, so when housing costs go up, it also adds to inflation measurement. Rent is the main way that housing costs enter U.S. inflation metrics. For owner-occupied homes, the government estimates a rental equivalent to assign value to the flow of housing services.

Liquidity fell in some of Europe’s leading real estate markets in 2021 despite acquisition volume on the continent reaching a new annual record, the latest update of RCA’s _Capital Liquidity Scores_ shows. A shift in investors’ sector preference is behind the weaker outturn, and also explains the leap in liquidity in other markets. In Central Paris, liquidity fell by 3% to a four-year low at the end of 2021, and liquidity in Frankfurt dropped to its lowest level since 2014. In Milan, liquidity dropped by 7% year-over-year to its lowest score since 2015.

There is a notable difference between young homebuyers, those aged 30 and below, and older millennial homebuyers, ages 31 to 40. Generally, older millennials have advanced further in their careers, have a more stable income and are already homeowners who are considering a move-up purchase. In contrast, younger people have more financial challenges when competing to buy homes since they are just beginning their careers; have less or no credit history; limited or no savings and generally lower levels of income.

Welcome to the April 2022 Apartment List National Rent Report. Rent growth is continuing to pick up steam again, after a brief winter cooldown, with our national index up by 0.8 percent over the course of March. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth we observed in the years immediately preceding the pandemic. Year-over-year rent growth currently stands at a staggering 17.1 percent, but most of that growth took place last spring and summer.

U.S. commercial property price growth continued apace in February as all four major property types posted double-digit annual price growth. The US National All-Property Index rose 19.4% from a year ago and 0.8% from January, the latest _RCA CPPI: US_ report shows. Industrial prices climbed 28.5% from a year prior, the fastest annual rate among the major property sectors in February and a record for any property type since the inception of the RCA CPPI. In June 2021 industrial price growth surpassed its previous high, seen prior to the Global Financial Crisis, and growth has accelerated every month since.

In response to the outbreak of COVID-19 and the resulting economic shocks experienced by the U.S. and global economies, the Federal Reserve slashed its target interest rate to nearly zero and kept it between 0% and 0.25% from March 15, 2020, until March 16, 2022, when the Fed announced it will raise the target interest rate by 25 basis points to 0.25-0.5%. For existing homeowners, the resulting low interest rates meant opportunities for billions of dollars of savings in mortgage interest, prompting millions of homeowners to refinance their existing mortgage for a lower rate.

After a historic 2021 in which apartment demand and rent growth rocketed well beyond their typical ranges, the expectation for 2022 could be broadly summarized as “robust, but not 2021”. National rent growth projections for this year have commonly been in the 5-7% range across various sources. This is based partially on the thinking that supply constraints, a fully re-opened economy, and remaining high demand would continue rent growth momentum even if that growth likely peaked in 2021.

France stood out among Europe’s largest property markets in 2021, posting a lower level of commercial real estate deal activity than during the pandemic-disrupted 2020. Of the top 10 European markets in 2021, only the Netherlands also registered a decline. Weakness in France’s office market was the culprit. Offices account for around 60% of the amount spent on French property since 2007 and the uncertainty affecting the sector has had an outsized effect on the market as a whole. Other more in-demand European sectors — namely apartment and industrial — have not compensated.

U.S. single-family rent growth increased 12.6% in January 2022, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). January marked the 10th consecutive month of record-level rent growth. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. Annual rent growth in January 2022 was more than triple the gain recorded in January 2021 and more than quadruple the increase from January 2020.

According to ATTOM’s February 2022 U.S. Foreclosure Market Report, foreclosure filings in February 2022 were up 11 percent from January 2022 and 129 percent from February 2021. ATTOM’s latest foreclosure activity analysis found there were a total of 25,833 U.S. properties with foreclosure filings reported in February 2022. The report noted that lenders repossessed 2,634 of those properties through completed foreclosures (REOs), down 45 percent from January 2022 but up 70 percent from February 2021.

The nation’s overall delinquency rate was 3.4% in December. All stages of delinquencies showed year-over-year decreases in December. In December 2021, 3.4% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) , which was a 2.4-percentage point decrease from December 2020 according to the latest CoreLogic Loan Performance Insights Report. This is the lowest recorded overall delinquency rate in the U.S. since at least January 1999.

Global commercial property market liquidity continued to grow at the end of 2021, as buyers returned to the market in numbers after almost two years of a pandemic that had stymied investment activity. Liquidity was up year-over-year in 94 of 155 markets and up on a quarterly basis in 77 of 155, the latest _RCA Capital Liquidity Scores_ report shows. For 17 markets, liquidity was at a record high at the close of last year.