Week twenty-three of the Covid-19 crisis and the lowest week on week change in capacity reported. 39.911 million seats this week compared to 39.960 million last week represents less than one tenth of a percentage point change in capacity as airlines around the world wait for July and further clarity around lockdowns, corridors and bridges.

Digital games revenue totaled $10.2B in May, down 3% from April’s record-breaking total of $10.5B. Games continued their lucrative streak in May even though the month had few major game releases and an easing of COVID-19 lockdowns. Digital console revenue fell 27% from April to May due to fewer new releases, but a 3% growth in mobile earnings offset this gap.

In this Placer Bytes, we dive into the recovery for two particularly interesting brands, Nike and Tuesday Morning. Then we break down four Darden restaurant chains to analyze their post-pandemic trajectories. Nike is a critical retail trendsetter. One of the most important narratives that had been driving retail in late 2019 was the rise of product and DTC brands expanding their owned offline presence, and no brand exemplified this trend better than Nike.

At the beginning of this year, one of the biggest headlines in the hotel sector was a measly growth in revenue per available room (RevPAR) in 2019. According to STR, the hotel industry recorded a 0.9% increase in RevPAR in 2019 - the lowest annual increase since 2009. At the time, STR had predicted that in 2020, overall RevPAR will only grow by 0.5% as an increase in supply would outpace growth in demand.

Although COVID-19 accelerated declines in occupancy since the beginning of March in Australia and Oceania, the region has started to see a progressive occupancy increase. Australia and New Zealand have seen spikes in occupancy during the weekends. New Zealand posted its highest occupancy level during the last weekend of March, while Australia reached its highest occupancy level during the first weekend of June.

When looking at velocity and recovery, most categories fit neatly into three clusters. Those locations still empty included Entertainment, Offices, Airports; those beginning reemergence included Shopping Malls and Hotels; and those steadily reemerging included Fast Casual Dining and Coffee Shops. However, there were a couple outliers – and one category we’ve found intriguing is Auto.

Key Industries across Europe have plateaued following an initial growth spurt post-lockdown, with footfall to Chemical, Biotechnology and Defence manufacturing plants dropping by around 10pts in the last week. According to Huq’s ‘Key Industries Indicator’, these three staple industries saw an initial flurry of activity post lockdown but this rising trend plateaued here and has yet to see another surge.

Brent crude prices have more than doubled since the lows of late April, and while part of that is a reflection of the demand-driven recovery we’ve seen on a global basis, it is also the result of global oil producers throttling back on exports. While this recent discipline is to be commended, let us not forget what got us into this mess.

The approaching summer holiday period in the northern hemisphere is a critical time for the travel and hospitality sectors. With travel restrictions still in place, however, there remains a lot of uncertainty about what this summer will bring for companies that rely on tourism during this peak travel season.

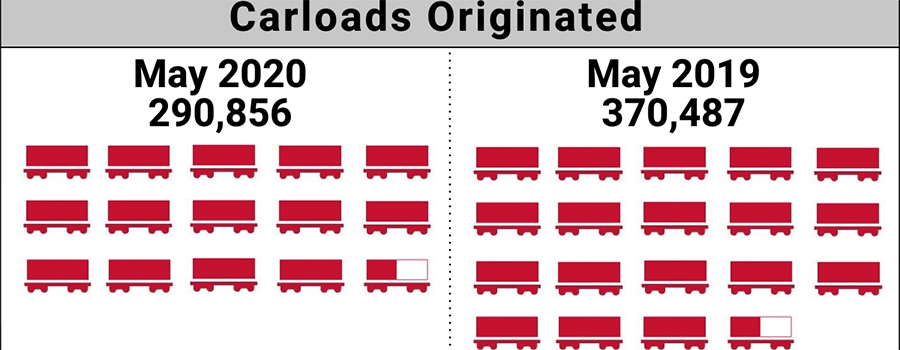

The number of carloads moved on short line and regional railroad in May 2020 was down compared to May 2019. Carloads originated decreased 21.5 percent, from 370,487 in May 2019 to 290,856 in May 2020. Stone, Clay and Glass Products was the sole gain, with a 0.7 percent increase. Motor Vehicles and Equipment led declines, down 80.9 percent.

While digital consumption peaked in late April and has slowly declined since, total digital visits across ten key categories remains 37 percent higher for the week of May 25, 2020 than for the week of February 3, 2020.

Apparel was among the hardest-hit sectors during the pandemic, with potentially huge ramifications coming from this downturn. So, we decided to break down the early recovery and highlight three sectors that could surge in the coming months.

The impact within the U.S. pet retail industry has been substantial, with sales numbers fluctuating at historic proportions. During the month of March, as shelter-in-place orders went into effect across the U.S., pet owners rushed to load-up their pantry with essential pet food and supplies. Sales numbers skyrocketed during the second and third week of March, netting 40% and 51% growth, respectively.

Programmatic advertising is in a strange state. User engagement is high as ever with higher consumption of media, yet at the same time, demand from advertisers has been record-low, explains Andrew Casale at AdAge. Budgets have been cut and ad categories paused. In April, we saw this result in an overall drop in programmatic spend, but now as the economy reopens, that initial slump has rebounded.

When plummeting demand due to COVID-19 and increased OPEC output drove WTI prices to historic lows in March, operators reacted immediately, cutting well completion activity to bare minimums in every basin except the Delaware. Though drilling activity was also reduced, operators kept enough drilling rigs running to drive a spike in DUC inventories to the highest level in four years.

A hotel’s overall performance is the sum of its parts. Though the bulk of revenue is derived from the renting of rooms, there are other arrows in a hotel’s quiver that can generate cash flow, such as restaurants, bars, meetings and events, spas, golf, parking, retail and more. Therein lies the rub: COVID-19, for now, has all but vanquished these ancillary revenue streams, a blow especially to luxury and full-service hotels that typically offer these services.

Investment from overseas players into the Central London office market has tumbled in the first five months of 2020 to the lowest level since 2009, Real Capital Analytics data shows. The Covid-19 shutdown, Brexit concerns and shifts in international flows are behind the collapse.

Vessels laden with crude waiting offshore China for more than seven days – which we classify as floating storage – has climbed above 50 million barrels for the first time. This increase is less related to China running out of onshore storage – Ursa Space Systems sees storage utilization running at \~65% of total capacity.

Amidst stock market volatility and uncertainty during the COVID-19 pandemic, new research from Comscore (Nasdaq: SCOR) shows consumer interest in brokerage and investment accounts and financial education increased significantly during the first quarter of 2020 as account application and opening volumes reached all-time highs.

J.C. Penney recently announced the closures of 154 stores across 38 states. We decided to look at the affected stores to find out how their human traffic patterns have been impacted by COVID-19 policies in their respective states. In general, we found that J.C. Penney stores that are closing are actually getting more visitors currently than stores that will stay open.