Like many other sectors, the US car industry saw a sharp downturn in business when lock-down orders and business closures were at their peak in late March and April. Combined sales in April 2020 for the Big 3 US carmakers - GM, Ford and Fiat-Chrysler - were down 63% compared to the previous year according to GoodCarBadCar.net.

In this Placer Bytes, we talk about Macy’s move outdoors, Bed Bath & Beyond’s optimization efforts, and the return of the movies. Macy’s is going to test a new format, shifting away from the traditional indoor mall and focusing more on outdoor centers. And while this is a concept many have been discussing, it only takes a quick comparison to department rival Kohl’s to understand why.

U.S. Single-Family Rents Up 1.7% Year Over Year in July. Rent increases slowed across all price levels, though rents for lower-priced homes increased faster than those of higher-priced homes in July compared with a year earlier. Honolulu saw the largest decrease in rent prices, falling 1.3% from a year earlier.

Coronavirus metrics across most of the US continue to head in the right direction. We’re starting to see some upticks in traffic; most categories are slightly up. Though, not quite dramatically enough to coin a new phrase to follow the Summer Slump. Let’s see what happens next week. Interestingly, we’re seeing a jump in the tourism segment. Visits to airports, hotels, and outdoor areas are up significantly vs. a year prior.

Much needed stimulus for the UK’s restaurants industry resulted in value able gains throughout August as Chancellor Riki Sunak’s Eat-Out-to-Help-Out campaign led visits back to 85% of 2019 levels. In the fortnight since that support was withdrawn however, visits to the nation’s eateries appears to be wavering according to new data from the Huq Index for Restaurants & Pubs released today.

When we last looked at grocery shopping behavior, we noted a few key changes. Visits were shifting from weekends to weekdays and from evenings to mornings. And seemingly, these shifts were driving more time in store, along with a significant shift in visit duration for top brands. But now with the recovery in full swing, we decided to check back in on key behavioral patterns in grocery to see which trends have had staying power and which have returned to “normalcy”.

Some shutdowns in petrochemical infrastructure that took place before the August 27 landfall of Hurricane Laura are still in place, and the effects are reverberating through global olefin markets. US ethylene loadings so far this month are 11,642 metric tons. The hurricane struck near Lake Charles, Louisiana, and disrupted activity at several of the petrochemical plants located there including at Sasol, Westlake, Lotte and LyondellBasell.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

As Labor Day closed the books on what is arguably the strangest summer in modern history, we decided to take a peek in the rearview mirror and recap what happened over the last 90 days (or was it 90 years? What is time anyway?!?)

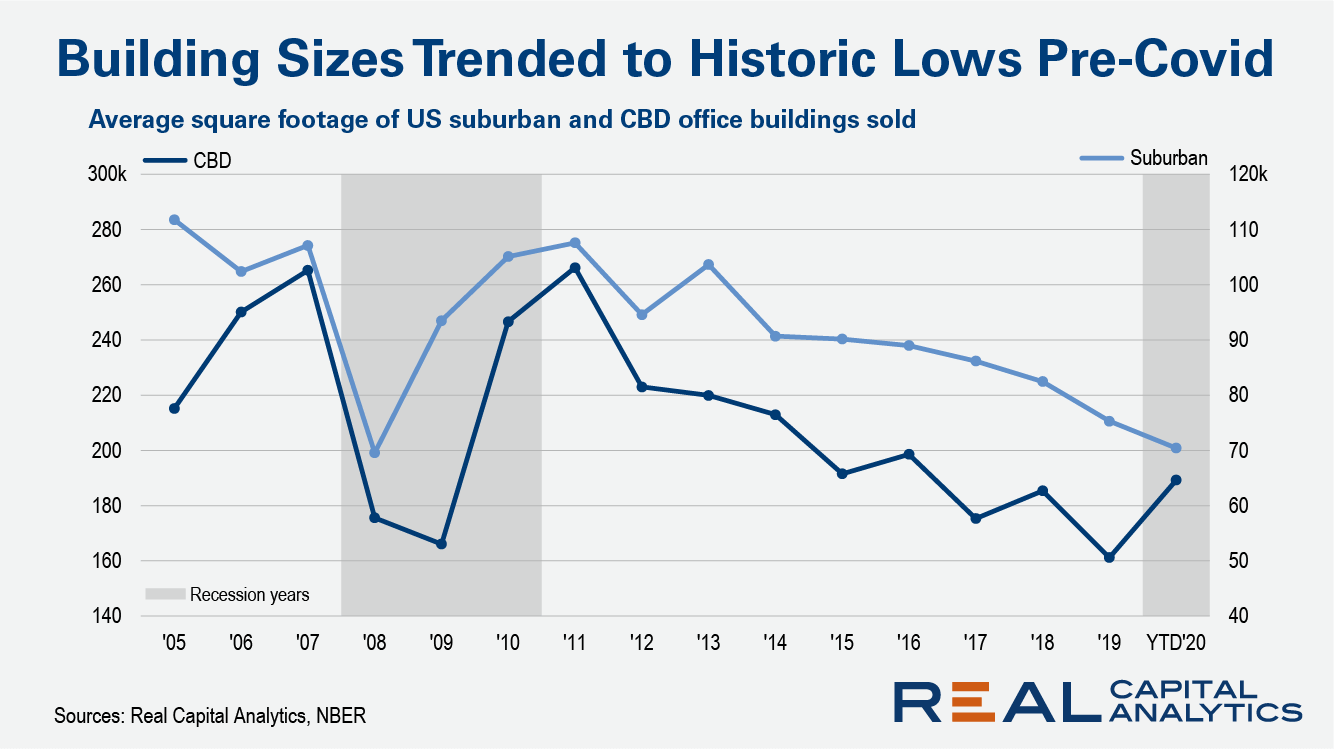

U.S. sales involving large office buildings had been on the decline throughout the economic expansion. As more small buildings sell, other measures of market health such as the dollar volume of deal activity can reveal a different meaning. A $100 billion market where half of the volume was concentrated in the purchase of expensive office towers is qualitatively distinct from a more broad-based market driven by the sale of a multitude of small buildings.

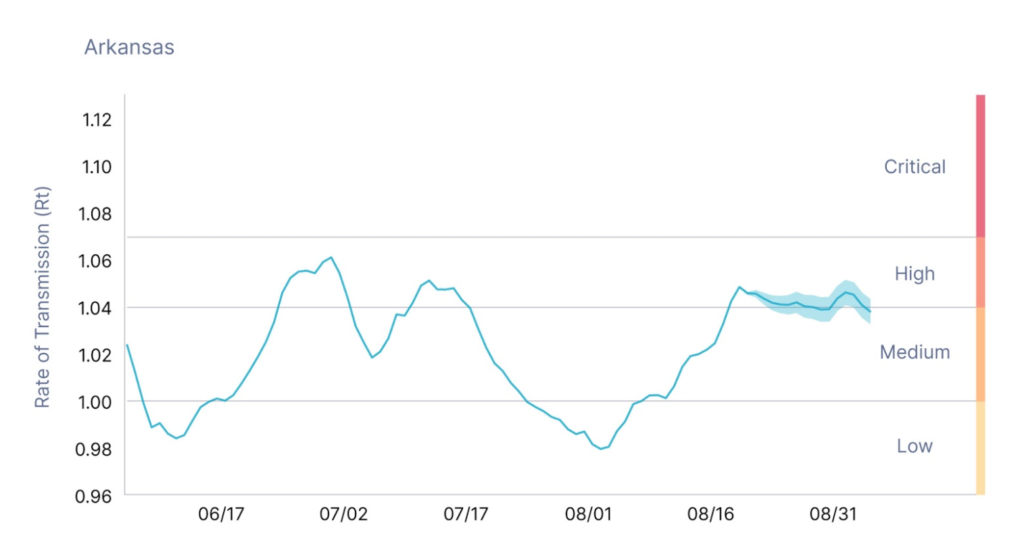

At a national level, Kinsa’s measure of illness transmission (Rt) is near 1, suggesting that COVID-19 case growth will remain relatively stable over the next few weeks. The current baseline of 40,000 new infections per day represents a dangerously high status quo as we head into the fall, when many experts fear that the start of the school year and colder weather will fuel case growth.

London’s accommodation sector has recovered at around half the pace of the rest of the UK, as mobile data suggests a lack of international tourists and subdued domestic demand for city breaks is causing a continued challenge for the capital’s hoteliers.

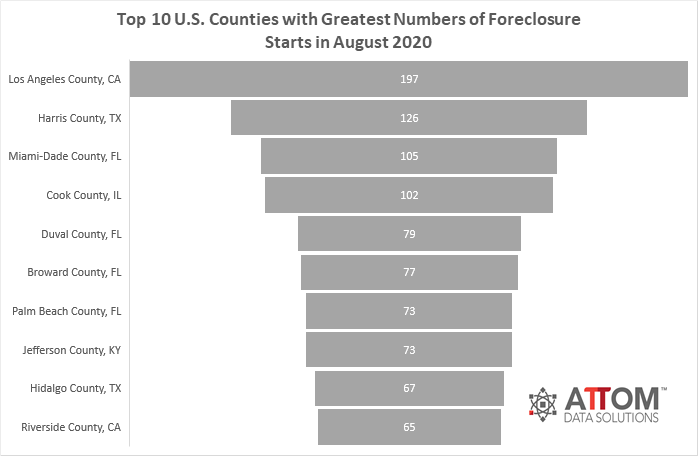

U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — saw a slight uptick in August 2020 from July 2020, with 9,889 filings reported. That number increased monthly by 11 percent, but is still down 81 percent from last year.

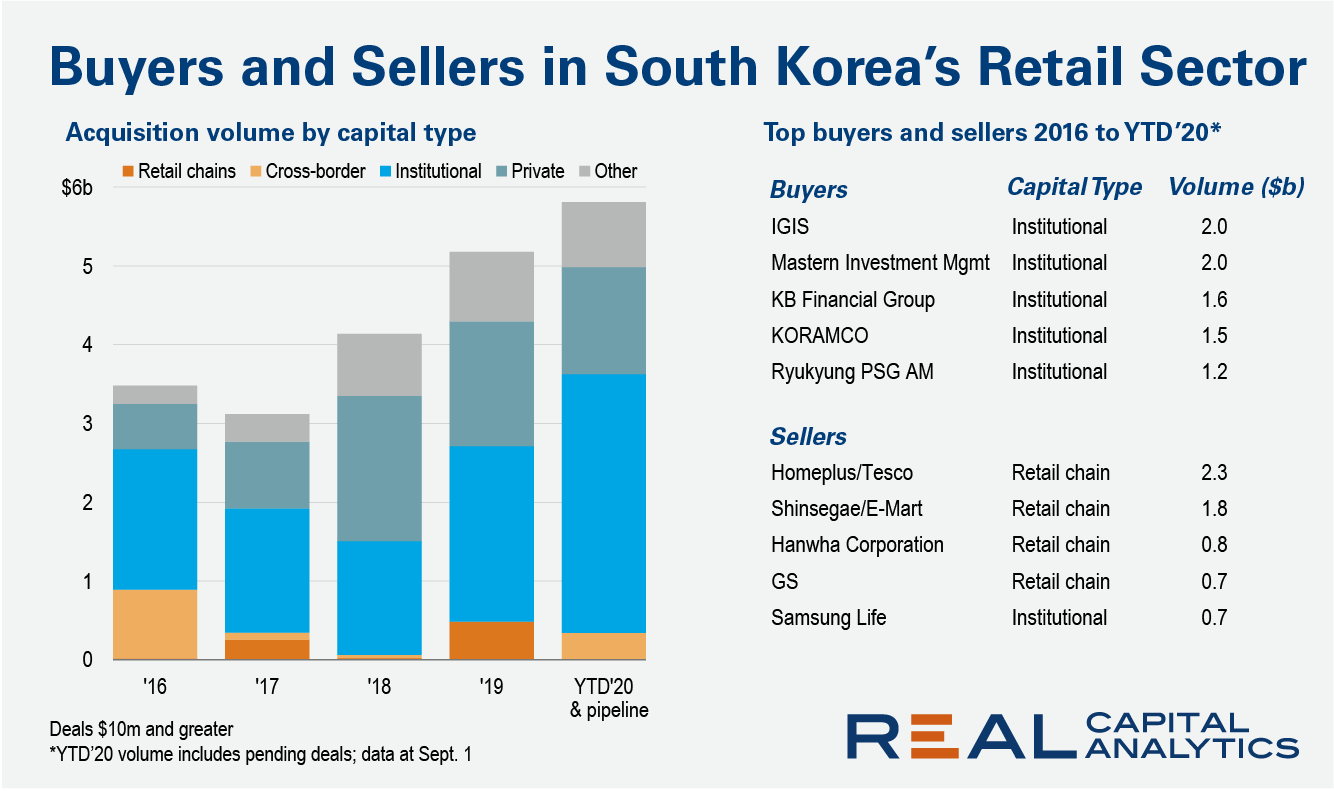

Over the first seven months of 2020, trading of retail assets has crumbled by more than half across all the major Asia Pacific economies bar one – South Korea. Should the current pipeline of deals close by year end, Korea’s 2020 retail investment total will surpass last year’s tally and could potentially become Asia Pacific’s biggest retail investment market, breaking the lock on the top three spots typically held by China, Japan and Australia.

It was hardly the golden age for department stores before the rise of COVID-19, but the pandemic raised significant questions regarding the future of these stores. So we took a look at two of the most popular department stores across four different states, Kohl’s and Macy’s, to see how both of their nationwide and state recoveries were going.

A new survey of U.S. moviegoers from Comscore (NASDAQ: SCOR), a trusted partner for planning, transacting, and evaluating media across platforms, found that audiences are feeling more confident heading to the theater thanks to the expansive safety procedures implemented by exhibitors. The survey results, captured in conjunction with Screen Engine/ASI, demonstrate another positive indicator for the global theatrical industry’s road to recovery.

There were a total of 9,889 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in August 2020, up 11 percent from a month ago but down 81 percent from a year ago. “While foreclosure activity remains over 80% below 2019 totals, there was a significant increase in foreclosure starts in August compared to July,” said Rick Sharga, Executive Vice President at RealtyTrac.

Widespread difficulty with housing costs has been a troubling constant. Despite a slight improvement in this month’s data, 29 percent of Americans failed to pay their rent or mortgage in full during the first week of September, and 8 percent had not completed their August payment by the end of the month.

The COVID-19 pandemic put tremendous pressure on the new mortgage market in the United States through May 2020. While COVID-19 has made the in-person home inspection process more challenging, it has not slowed the pace of new mortgage applications and re-financing through this time period.

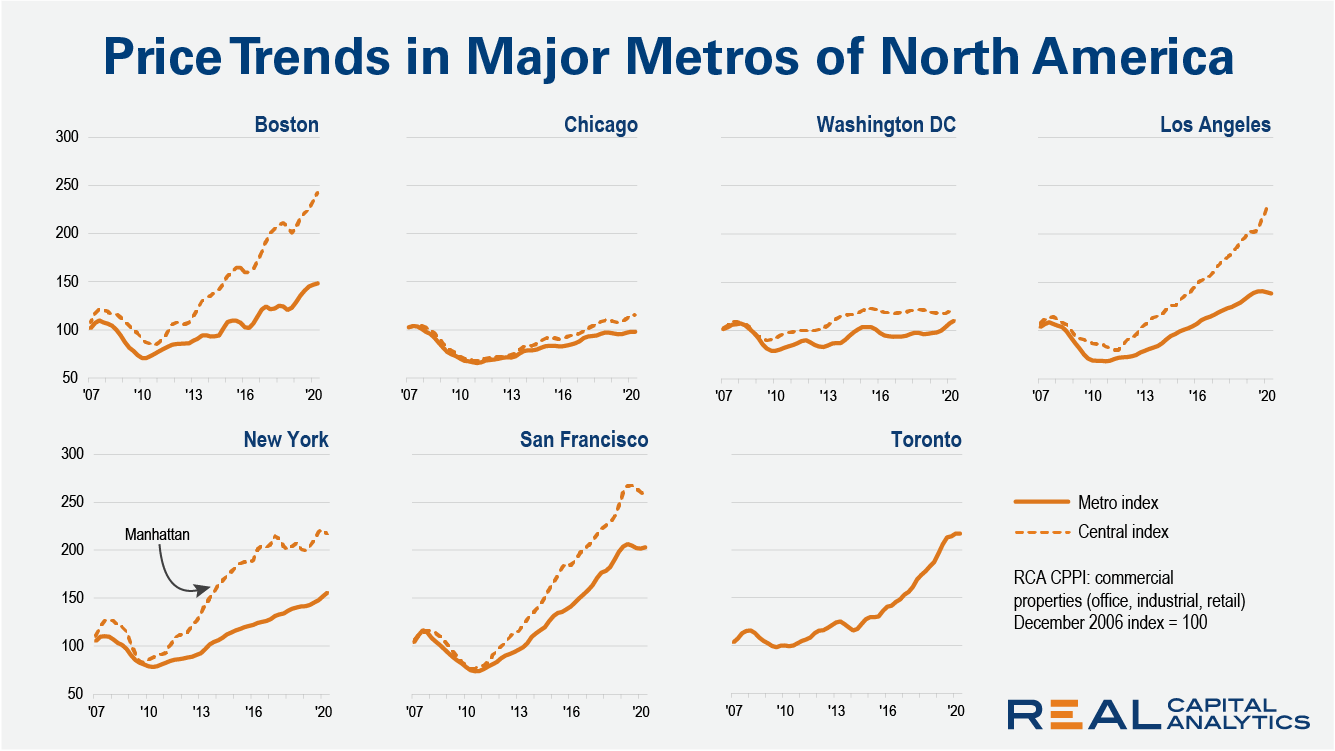

Despite historic challenges to commercial real estate deal activity in 2020, prices in most leading North American metros continued to move higher in the second quarter of the year, according to the latest RCA CPPI Global Cities report. New York metro area prices, which have lagged Manhattan price gains over the past decade, increased 9.0% from a year prior.