It will soon be five years since Amazon acquired Whole Foods Market and made its first foray into the brick and mortar grocery space. We dove into the data to understand Whole Foods’ evolution since the acquisition, see how the legacy grocery is recovering from the pandemic’s impact and determine what may be next for the Whole Foods-Amazon partnership.

Annual federal tax refunds have been a reliable source of additional spending cash for American taxpayers. Covid-19 upended the regular February-April cadence of payments as many households received additional stimulus payouts and tax credits that almost doubled the amount normally deposited by the government. This tax season marks a return to more normal refund behavior, which could signal sales declines for retailers who benefited from consumers’ extra cash in 2020 and 2021.

The era of the true “dollar store” is coming to an end. In late 2021, Dollar Tree announced that it would increase its main price point from $1 to $1.25, ending its pricing model of 35 years and joining other discount chains in providing low-cost—but not exclusively $1—items to customers. Consumer transaction data reveals that so far in 2022, average transaction values for Dollar Tree, Inc (NASDAQ: DLTR) have been elevated, continuing its trend of increasing transaction values during the pandemic.

The fitness foot traffic recovery may be underway, but that doesn’t mean that gym-goers are returning to their pre-COVID patterns. Consumer preferences have shifted over the past couple of years and are driving major changes in many established retail categories, including the fitness space. Here, we take a look at how LA Fitness, a pre-pandemic category leader, is adapting its offering to today’s consumers through its new value-priced chain, Esporta Fitness.

2021 was a memorable year for ROBLOX. According to our analysis, the world-building game ended the year as the mobile game market's top title by consumer spend, #3 by downloads and its #2 by monthly active users (second only to PUBG Mobile). It was a remarkable 12 months. And in February 2022, the company itself revealed its latest set of key metrics, showing both strong growth in 2021and forecasting double-digit top-line growth in 2022.

There is a notable difference between young homebuyers, those aged 30 and below, and older millennial homebuyers, ages 31 to 40. Generally, older millennials have advanced further in their careers, have a more stable income and are already homeowners who are considering a move-up purchase. In contrast, younger people have more financial challenges when competing to buy homes since they are just beginning their careers; have less or no credit history; limited or no savings and generally lower levels of income.

In the free text of employee company reviews, we notice a strong and early uptick in mentions of inflation in negative reviews. Employees aren't just mentioning inflation more in general, but are distinctly mentioning it more in conjunction with compensation. At companies where multiple employees mention inflation in reviews, have average salaries been keeping up with inflation? Turns out, the reviewers were right to complain - their salaries have barely been keeping up with inflation, while other large US companies have kept up

In this Placer Bytes, we analyze retailers and restaurants – Winn Dixie, 7-Eleven, Olive Garden, and Panera Bread – whose performance could indicate how their wider sectors are performing. Grocery chains were among the clear winners of 2021, and there were some specific chains that seemed uniquely poised for a strong year in 2022. Given the success of the grocery sector over the past two years and the numerous examples of grocery chains’ success, some grocers in that mix that seemed uniquely and positively affected by the pandemic’s impact may not have been called out. Winn-Dixie was one of those chains.

Tracking airline capacity has, for a long time, been the best measure of what has happened through the Covid-19 pandemic, but nothing beats looking at the forward booking data. In this piece of analysis, we have compared both forward bookings and airline capacity as reported in the first days of March in 2021 and 2022 to gauge how strong the travel recovery is shaping up. The results are startling!

As you probably heard, Discovery and WarnerMedia are merging, which means streaming services HBO Max and Discovery+ are also merging, likely at some point in April. It's also possible that before they merge, they will engage in a bundle, similar to that of Disney+, Hulu and ESPN+. Assuming the apps merged today, we wanted to look at what the market share of the top 10 streaming subscription services in the United States would look like:

In 2021, downloads in Brazil grew 30% vs. 2019 and +63% in consumer spend, with categories like Entertainment, Gaming and Finance driving growth. Overall, Brazil saw over 10.3 billion apps downloaded in 2021, a 30% increase from pre-pandemic levels in 2019. Brazil has seen phenomenal growth in consumer spend, adding an additional $1.13 billion in 2021, $200 million more than 2020, equating to 22% growth YoY as mobile gaming and in-app subscriptions go mainstream.

Hotel performance has remained stable in most of Europe amid the war in Ukraine, and countries bordering the conflict area have seen a refugee-driven lift in occupancy. Using standard methodology, which excludes temporary closures from the pandemic, Europe’s hotel occupancy hasn’t dipped below 53% on a running 7-day basis since late February. The latest data for 20 March showed occupancy above 58%. When indexed to 2019, levels over the last few weeks have not fallen below 77% of the pre-pandemic comparables and came in above 80% on 20 March.

Our latest white paper examines recent changes in consumer behavior patterns. Over the past two years, the rise of omnichannel, shifts towards hybrid work, the growth of leisure activities, and increased economic uncertainty all contributed to rapid and unpredictable shifts in when, how, and where consumers shop. These changes impact every facet of retail strategy, from chain-level considerations like when to open stores, shelf-level arrangements on where to place products, to product-specific decisions for pricing, packaging, and marketing goods.

The first week of the season is like a typical April day, a bit of sunshine, some cloud and some ugly showers! On the positive side of the equation global airline capacity has increased back to 83.4 million, an increase of 2.6 million or 3% week-on-week. This growth had the potential to be even higher, but airline capacity in China fell by 10% (just over a million more seats) as further lockdowns impacted available airline capacity. The cloudy side of this week’s flight data is buried in the forward-looking airline capacity for the next three months in which 28 million seats have been removed through to June with over 12 million in April alone.

The Mountain-West region is the hottest housing market in the country. Of the 20 cities covered in the S&P CoreLogic Case-Shiller Home Price Index, Phoenix had the fastest year-over-year appreciation in December 2021, growing 32.5% annually. Another popular market was Denver, where prices increased 109% compared to the previous peak in August 2006. Right behind Denver was Boise, Idaho. According to the CoreLogic Home Price Insights Report, Boise real estate appreciated 22% in 2021, and the average homeowner equity increased by $64,000 from December 2020 to December 2021.

Uber just announced a partnership that will allow New York City users to take taxis on its platform. In a crowded marketplace, will this “if you can’t beat ‘em, join ‘em” strategy prove successful? In today’s Insight Flash, we take advantage of our ability to drill down into the New York City CSA to take a look at how market share has evolved recently in Ground Transportation, how demographics align between Uber and NYC taxis, as well as how loyal riders are based on cross-shop rates.

Welcome to the April 2022 Apartment List National Rent Report. Rent growth is continuing to pick up steam again, after a brief winter cooldown, with our national index up by 0.8 percent over the course of March. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth we observed in the years immediately preceding the pandemic. Year-over-year rent growth currently stands at a staggering 17.1 percent, but most of that growth took place last spring and summer.

Although the gas price hike has finally slowed down, the national average price per gallon [is still up](https://www.gasbuddy.com/go/gas-prices-fade-for-most-west-coast-keeps-rising) 71.5 cents from a month ago and $1.37 per gallon higher than a year ago. We dove into the foot traffic data to find out how rising gas prices and elevated food prices are impacting retail visitation trends. Over the week of March 7th, nationwide overall retail visits declined by 4.3% compared to the equivalent week three years ago – the most severe decline in weekly retail foot traffic over the past twelve months that wasn’t directly tied to COVID waves or holiday calendar shifts.

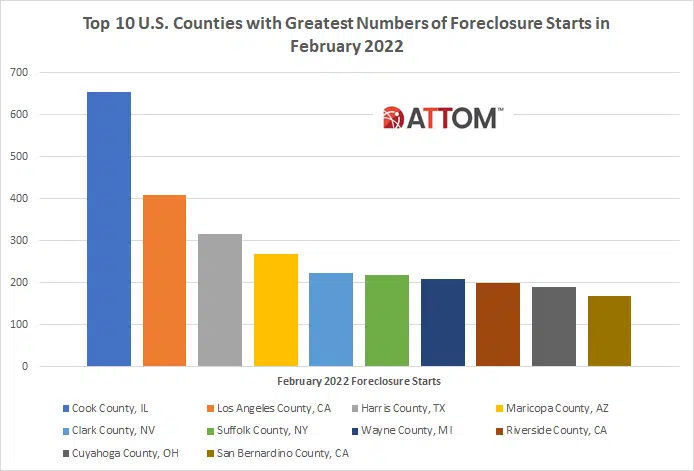

ATTOM’s February 2022 U.S. Foreclosure Market Report revealed that lenders started the foreclosure process on 16,545 U.S. properties in February 2022. That figure was up 40 percent from January 2022 and 176 percent from February 2021. According to ATTOM’s latest foreclosure activity analysis, those states that saw the greatest numbers of foreclosures starts in February 2022 included: California (1,868 foreclosure starts); Florida (1,527 foreclosure starts); Texas (1,488 foreclosure starts); Illinois (1,168 foreclosure starts); and Ohio (1,144 foreclosure starts).

The U.S. hotel industry posted its highest weekly occupancy since the end of summer 2021 with a level of 66.9% during the week of 13-19 March 2022. Boosted by Spring Break and NCAA March Madness, one-fifth of the 166 STR-defined U.S. markets reported their highest occupancy of the past 32 weeks with 12 markets achieving pandemic-era highs. For a second consecutive week, average daily rate (ADR) increased by more than 4%, pushing the weekly level 14% higher than the 2019 comparable.