The travel industry was one of the hardest hit over COVID, but foot traffic trends indicate that the sector has been gradually rebounding since the beginning of the year. With August in full swing, we dove into the data for some of the nation’s major hotels chains and airports to get a sense of where the travel recovery stands today. Air travel is still very much complicated by COVID, with safety precautions still causing flying to be much more burdensome than it was pre-pandemic.

Luxury sales are all about brands – aspiration for different labels to signal a level of taste and fashion. But . . . what if they’re not? Recently, a number of new players specializing in multibrand luxury have entered the space to give shoppers the ability to shop luxury brands side-by-side as they look to purchase the latest trends. In today’s Insight Flash, see how these merchants are faring in both the US and UK markets.

In a year when people have yearned for a return to normal, the rental market has been anything but. Not only are rent prices rising, they are rising tremendously fast and rising virtually everywhere. According to our national rent estimates, prices jumped over 11 percent in the first half of 2021, more than doubling the rate of inflation and more than tripling the typical rent growth we measured in the several years preceding the pandemic. Today, 87 of the nation’s 100 largest cities have fully rebounded to pre-pandemic rent prices

Zoom Video Communications (ZM) is on the cusp of its fiscal second quarter earnings report on August 30. As expected, Zoom’s momentum is fading as lockdowns ease and on-site activity returns. Shares are underperforming year-to-date, even when compared to the overall video conferencing space. That’s despite an easy FQ1 earnings beat with 191% sales growth. In short, Zoom’s risk-reward ratio has now undeniably shifted. Even though many organizations now offer a more flexible work environment, especially with the COVID resurgence, Zoom will naturally struggle to replicate its 2020 growth levels.

When we last dove into top beauty brands back in May, the sector was on its way to a full recovery as shoppers ventured out for the first time in over a year and began investing in beauty supplies once again. Now, it seems like the brick and mortar cosmetic chains are positively on fire, with visits to all retailers analyzed skyrocketing in recent months. And while the year-over-two-year foot traffic trends for April through June have been very strong, the growth in July visits was truly exceptional.

The ups and downs of aviation’s recovery continued this week with capacity increasing back up to 78.9 million seats a week, a modest increase of 0.7% and over half a million seats added. Is that growth cause for optimism? Well, at the beginning of July airlines were planning to operate some 93.3 million seats so reduced operational capacity by some 15% in the space of seven weeks before travel as they matched capacity to available demand. Key markets such as the US, Europe and China to virtually anywhere remain locked with no sign of anyone wishing to reopen their borders.

The number of streaming households outpaced homes paying for traditional TV for the first time last year. But that doesn’t mean that TV viewership is off the table when it comes to advertising. Early into the pandemic MediaRadar began tracking how our new lifestyle was impacting TV advertising. We saw increased spending from categories like toys and games and household cleaning products. At the same time, sports advertising plummeted.

The current wave of the pandemic that began around Arkansas is marching north. States in the Northeast and Upper Midwest that have largely maintained low case counts during this wave are starting to see increases in COVID case numbers. If you’re in one of these areas and have been putting off adopting pandemic precautions, it’s time to amend that decision. Cases in South Dakota have accelerated at the fastest rate in the country after more than half a million people came together for the Sturgis Motorcycle Rally last weekend.

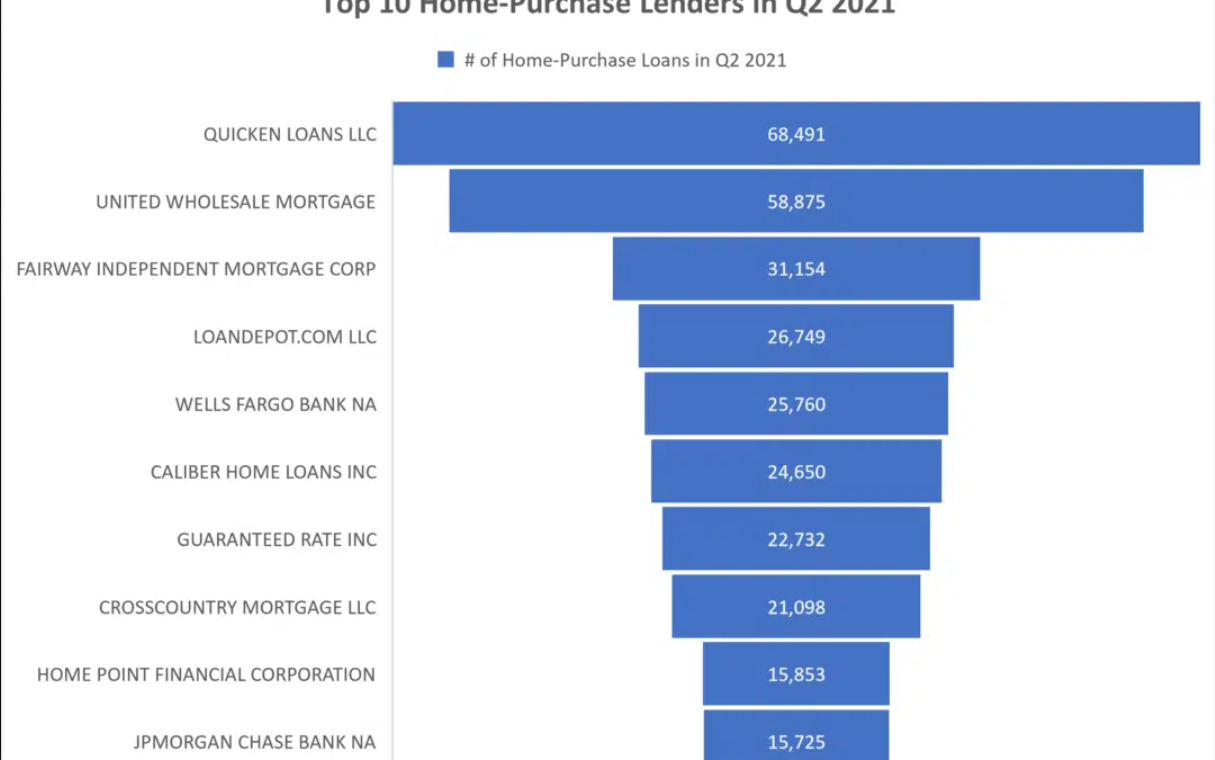

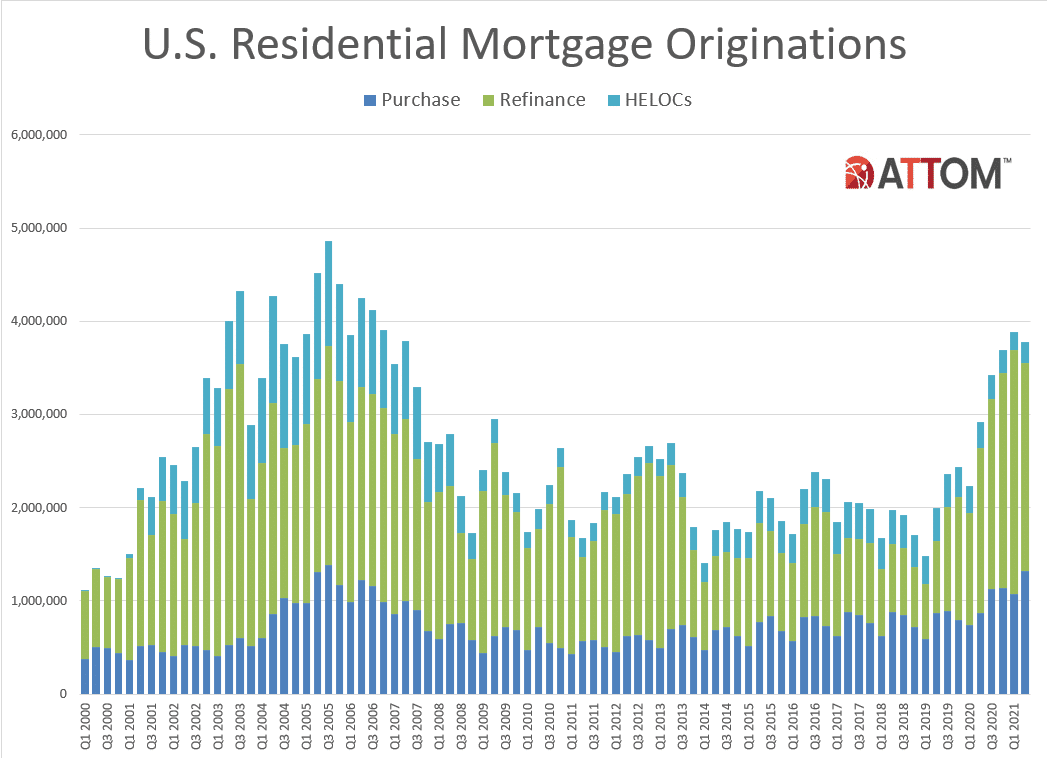

ATTOM’s newly released Q2 2021 U.S. Residential Property Mortgage Origination Report revealed that the number of mortgages secured by residential property originated in Q2 2021 in the U.S. was up 29 percent from Q2 2020, but down 3 percent from Q1 2021. According to ATTOM’s latest residential property mortgage origination analysis, the quarterly decline in overall mortgage lending in the U.S. marked the first decrease since early in 2020, as well as the first time that happened from a Q1 to a Q2 period since 2011.

Last week, Abercrombie & Fitch announced Zappos as its exclusive e-commerce partner in the U.S., with a footwear collaboration on the horizon. In today’s Insight Flash, we dig into the collaboration, comparing growth rates, demographics, and cross-shop to see where the benefits might lie. While Abercrombie & Fitch has seen spend growth steadily outperform the Apparel, Accessories & Footwear industry over the last two and a half years, Zappos has consistently underperformed.

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.78 million mortgages secured by residential property (1 to 4 units) were originated in the second quarter of 2021 in the United States. That figure was up 29 percent from the second quarter of 2020, but down 3 percent from the first quarter of this year.

It’s fair to say that the airline industry has never experienced a pandemic such as Covid-19, a near global lockdown, record industry losses, no clarity about reopening requirements and a nasty virus that has now reached a Delta variant...let’s hope it doesn’t get to a United variant! In a bizarre way, Covid-19 has been both an interesting experiment and allowed airlines to transition with words such as “pivot” and “unprecedented” frequently used, and it has created some hopefully never to be repeated moments.

With the help of summer vacation, Mainland China’s overall hotel occupancy rate showed a good upward trend in July, with the second and third week of the month reaching 2019 levels. Average daily rate (ADR) was even stronger, and when indexed to 2019, remained stable at roughly 110—meaning it was well above 2019 levels. As a result, Mainland China’s revenue per available room (RevPAR) index climbed from 87 at the beginning of the month to 117 by the end.

Regions around the world continue to see increased pandemic-related challenges, with the situation varying greatly by country. Fortunately, more than 4.6 billion doses of coronavirus vaccines have been administered in more than 190 countries, providing the tourism and hospitality industry a much-needed confidence boost, especially during the current summer months. However, with the increase in cases in many parts of the world resulting in new and extended restrictions, as well as the emergence of new virus variants, predicting future travel demand remains challenging.

Dollar and discount superstores thrived over the pandemic, and foot traffic analytics indicate that the category leaders are not slowing down just yet. Five Below, unlike many of the other discount superstores, carries neither food nor groceries and was not open as an essential business in the early days of the pandemic. But the brand is more than making up for lost time now, with monthly visits up 32.7%, 36.9%, 25,7%, and 35.2% in April, May, June, and July, respectively, compared to the equivalent months in 2019.

The news that China shut down much of its domestic aviation market at the beginning of August in response to another wave of COVID, seemingly triggered by an infected passenger who arrived from Moscow into Nanjing Airport, does not bode well for other Asian countries battling to shift from crisis to recovery mode. The Nanjing outbreak has now spread to 17 provinces across China and takes place during the peak period for domestic leisure travel.

The start of the 2021-2022 academic year is coming soon. ForwardKeys and Dragon Trail International look at the strong correlation between Chinese flight booking trends and travel restrictions for students, alongside student-focused promotions from international airlines. With outbound tourism from China still on hold, international airlines have turned their attention to one group of Chinese who will be travelling overseas in the upcoming months: students.

Total construction starts fell 3% in July to a seasonally adjusted annual rate of $854.8 billion, according to Dodge Data & Analytics. There were few bright spots during the month, with all three sectors (residential, nonresidential building and nonbuildings) moving lower in July. “Construction material prices continue their march higher and are weighing heavily on construction starts,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Lumber and copper prices have fallen in recent weeks

For many millennials, the pandemic has been anything but an obstacle to leaving their rent-based urban lifestyle behind and settling down — and for good reasons. With plummeting interest rates, the timing to buy homes and invest in wealth-building homeownership couldn’t have been more perfect. Shelter-at-home and remote work have driven a desire for larger living space and privacy which are often lacking in apartments.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in July 2021, sales for meal delivery services grew 16 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In July 2021, 49 percent of U.S. consumers had ever ordered from one of the services in our analysis, up from 42 percent a year ago.