There are few industries that have experienced more change in our pandemic world than healthcare. Since COVID concerns came to light, there has been no shortage of news stories about everything from scandals at the nation’s largest hospitals to AI’s role in reinventing the industry.

In the Ernest Hemingway novel The Sun Also Rises, Mike is asked how he went bankrupt. “Two ways,” he answers. “Gradually, then suddenly.” COVID-19 seems to have rewritten the financial rules: Central Banks are pushing interest rates further into negative territory and Government support for businesses and their employees has pushed Sovereign debt to levels not seen since the Second World War.

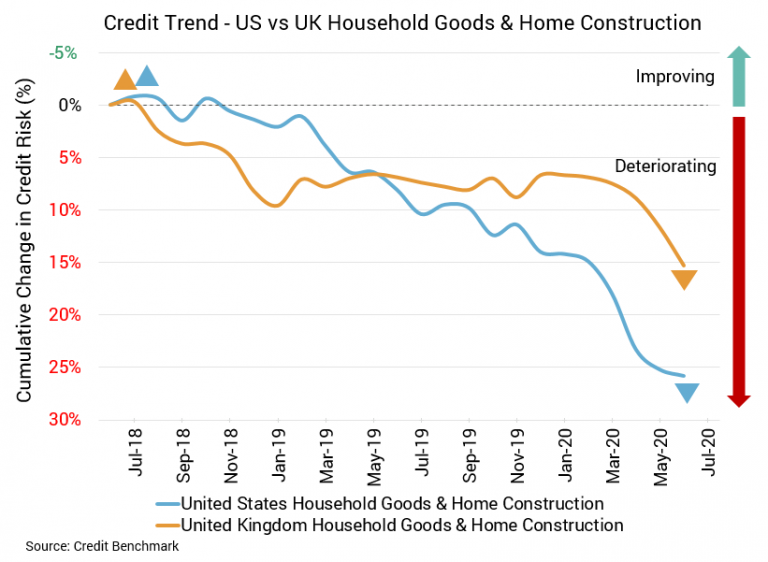

The US housing sector can breathe a (perhaps temporary) sigh of relief. The UK housing sector, however, may be taking a turn for the worse, with credit quality diminishing. There have been some positive signs in recent weeks, like rising sales, increased construction, and regulatory changes that allow for more construction. But with the UK experiencing the worst recession on record, this sector’s credit prospects may be restrained for some time.

Large industrial cities, like Detroit and Pittsburgh, have mostly been in decline over the last few decades, ushering in a new era of cities with a diverse set of industries and jobs. But in recent years that trend has reversed among technology hubs, like San Jose and Seattle. Their workforces have shifted so heavily toward engineering that they are now at risk of losing the diversity of thought that’s necessary for innovation.

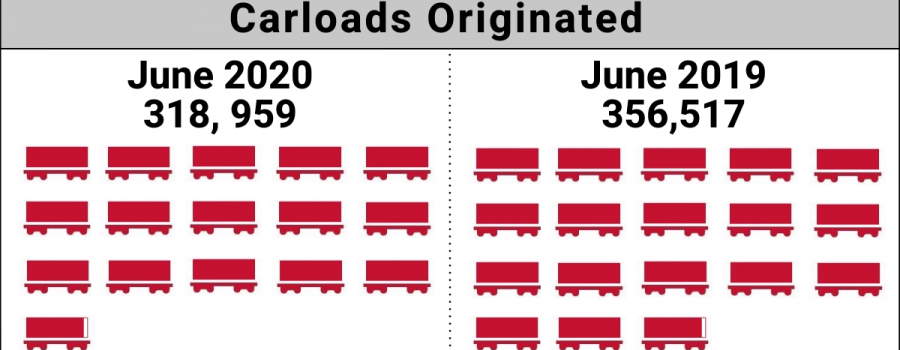

The number of carloads moved on short line and regional railroad in July 2020 was down compared to July 2019. Carloads originated decreased 12.3 percent, from 356,517 in July 2019 to 318,959 in July 2020. Grain Mill Products led gains with a 11.1 percent increase. Stone, Clay and Glass Products was up 7.8 percent, and Chemicals increased 2.0 percent. Nonmetallic Minerals led declines, down 43.6 percent.

The August CCIs have seen significant further credit deterioration for UK, EU and US Industrial companies. Credit quality continues to worsen month-on-month for UK Industrial companies, with a third consecutive month of decline. The CCI jumped down several points to register at 40.9 this month, down from 44.2 last month.

This week’s latest scheduled capacity data shows a further reduction with the loss of some 700,000 fewer seats reported this week. That’s a reduction of just one percent and exactly the same percentage of capacity at 50.6% of last year’s level as we reported for week thirty-one. This is now the third consecutive week of global capacity falling back; that seems like the beginning of a trend to me.

The past few weeks have brought some optimism as daily COVID-19 case counts have trended downward at a national level. However, regional trends in Kinsa data show that illness transmission (Rt) is rising again in many parts of the country — particularly in the southeast and central Plains regions — suggesting that this downward trend in new infections may plateau or even reverse in the coming weeks.

The number of country residents attending their offices in the Netherlands has dropped 12% from its post-lockdown high during the last week as a rise in Covid-19 cases in the country and overseas subverts the return to normal for many. Huq’s new Return-to-Work Indicator had identified growing numbers of people getting back into work after the series low in April.

COVID-19 has caused major economic damage, especially in sectors connected with travel and leisure. But in manufacturing and technology there will be some strong winners: increased factory automation, major house-building and property conversion programs, increased demand for private cars, new software to facilitate social distancing in a broad range of situations, and major supply chain restructuring.

Naphtha’s price surge in May and June has made LPG more cost effective for petrochemical crackers that are able to switch feedstocks. LPG prices moved only slightly higher during the naphtha rally, and especially so in producing regions such as the US. As a result, a favorable arb developed for US suppliers, and loadings are up to 1.78 million barrels per day this month to the highest on our records.

The UK’s residential construction industry sees activity levels steady at around 50% of pre-Covid levels following a rapid rebound from lockdown in late April, according to a new indicator published today by Huq Industries. The Huq Residential Construction Index showed worker presence fall rapidly as lockdown set in during the last week of March to around 20% of previous levels before recovering to half of normal levels just as quickly from April 20th.

In recent weeks, labor markets have appeared to stabilize as the number of new job postings has increased. But while postings have grown, the salaries associated with those postings have fallen dramatically. By tracking expected salaries from 9 million job listings since March, and controlling for changes in seniority, occupation, and city, we found that salaries have fallen by 8.8%.

The trajectories of deal volume and deal count continue to weaken for the Americas, the latest Real Capital Analytics data indicates, while in Asia Pacific and Europe the picture is little changed. The concaved path of deal volume in the Americas indicates a deepening slump. At day 220, deal volume was 37% lower than the same point in 2019 and the number of deals was down 40%, according to Real Capital Analytics data.

The world of offline retail has been dominated by two key names – Walmart and Target. The strength of these retailers has centered around a unique ability to build a powerful and sustainable brand relationship. And while the entire retail ecosystem took a hit during the pandemic, these giants included, the recovery has presented an opportunity to really compare the environments they operate in.

Customers visiting foodservice outlets in the UK rose to almost 60% of pre-lockdown levels in the last two weeks, as the government’s ‘Eat Out to Help Out’ scheme proves its worth by luring customers back into restaurants and pubs. Huq’s Restaurants & Pubs Index shows that since the scheme launched on 3 August, visits to restaurants have increased rapidly – climbing from 38pts to 55pts (a 44% increase).

Total construction starts fell 7% in July to a seasonally adjusted annual rate of $631.6 billion. The decline was due to a significant pullback in the nonbuilding segment, which fell 31% from June to July. Nonresidential building starts rose 3% while residential building starts increased 2%. Year-to-date through seven months, starts were 15% down from the same period in 2019.

One aspect of the new environment for multifamily that has become apparent over the last few months is that new supply is likely to act as a headwind for market performance as we move through 2020 and into early 2021. Apartment demand through July was half that of the same period last year, and 50,000 less units were absorbed than added in the first seven months of the year.

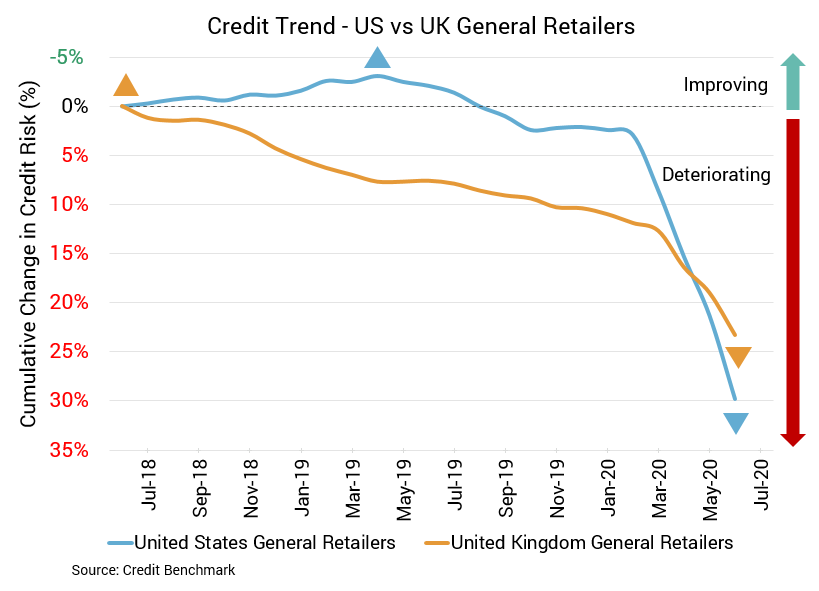

Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by.

In March and April, the home improvement sector was already showing a unique potential for a post-pandemic surge. The brands were enjoying a “lightning in a bottle” moment where essential retail status, home quarantines and an unstable economy were making their offering as valuable as possible. Yet, even for those that saw promise for the sector, the growth has been surprisingly strong and is lasting far longer than anyone could have hoped for.