Following the longest period of economic growth in the U.S., the onset of the COVID-19 pandemic led to a decline in economic activity and a resultant recession. According to the National Bureau of Economic Research, February 2020 marked the end of the expansion that began in June 2009 and the beginning of a recession.

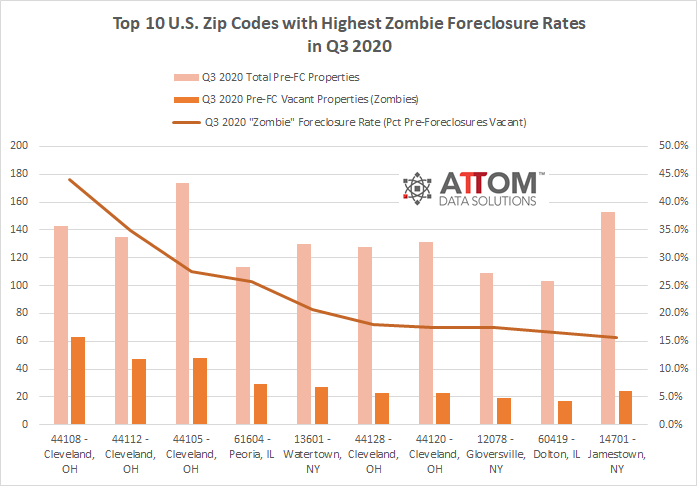

ATTOM Data Solutions’ newly released Q3 2020 Vacant Property and Zombie Foreclosure Report reveals that 1.6 percent of all homes in the U.S. are vacant, numbering 1,570,265 residential properties, with 7,960 or 3.7 percent of those vacant properties in the process of foreclosure, otherwise known as ‘zombie foreclosures.’

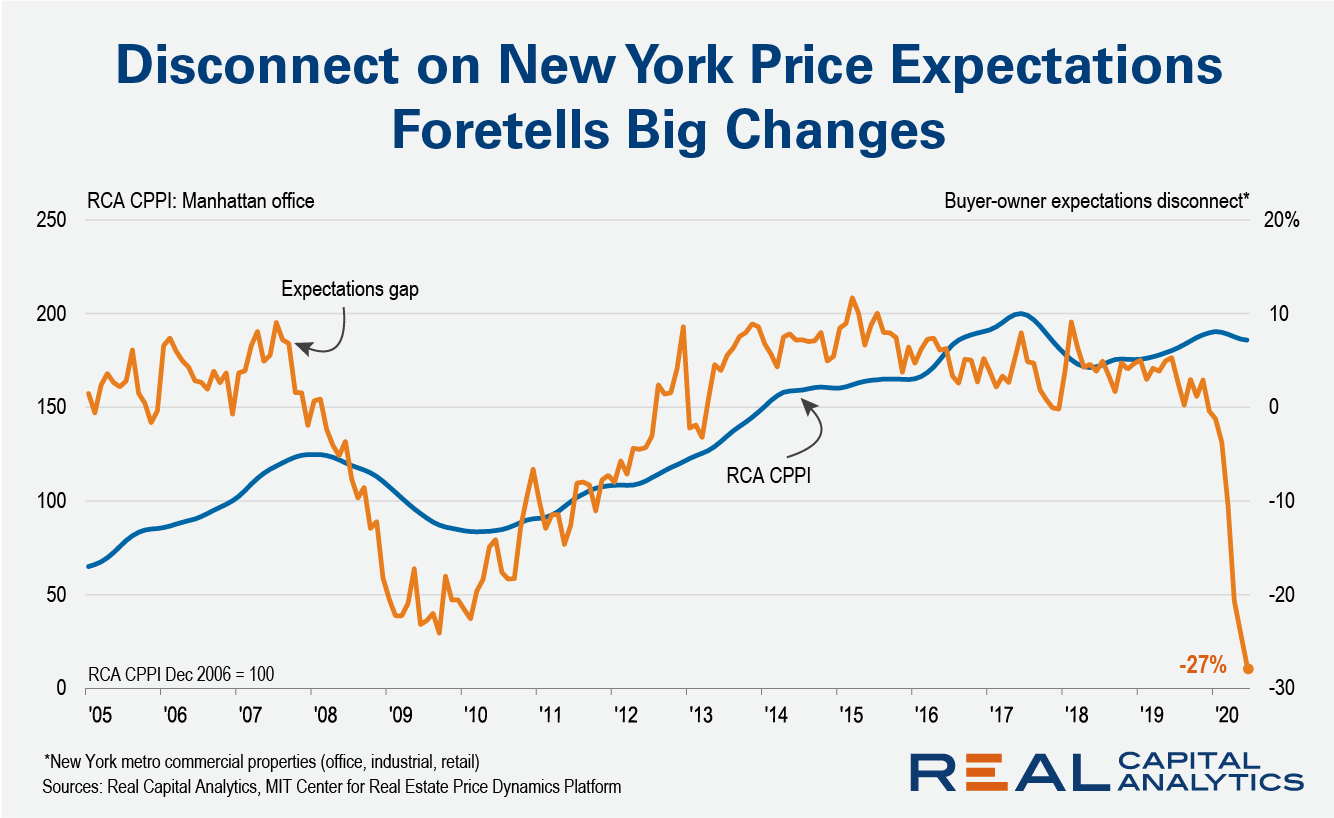

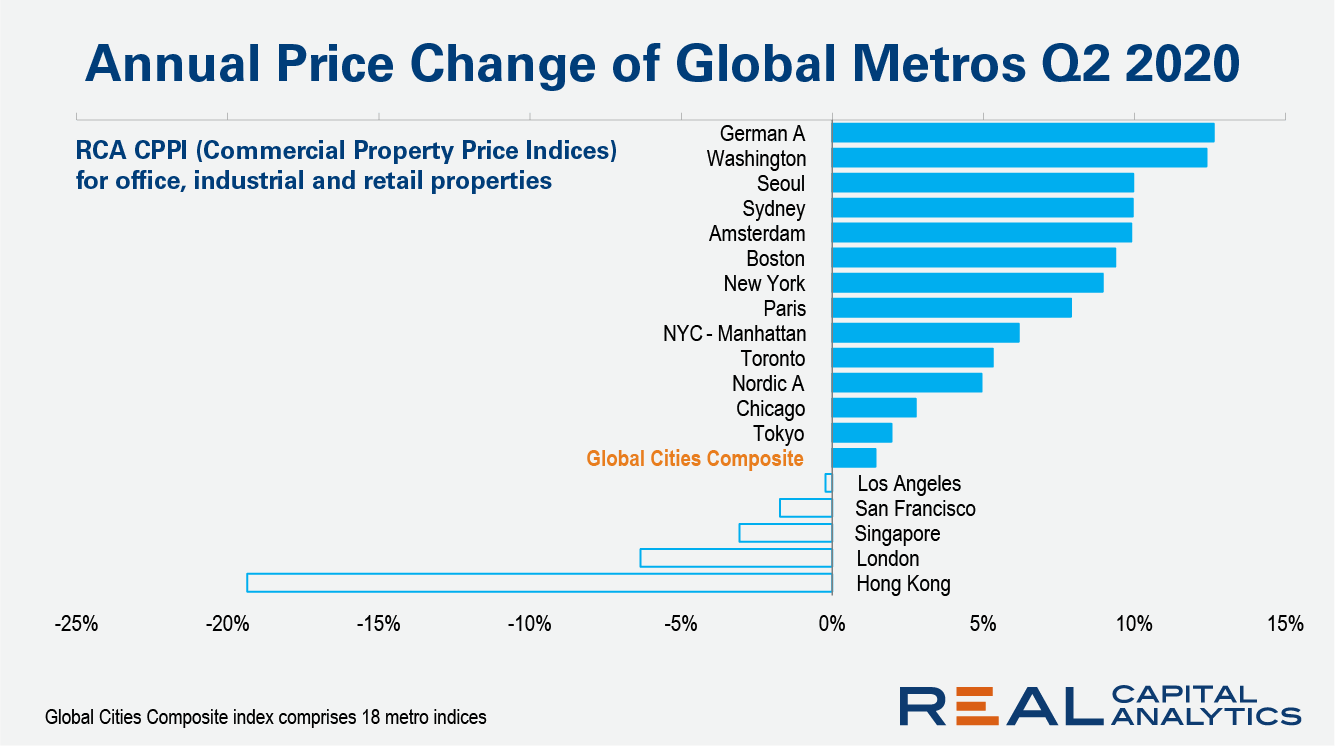

“Should I leave New York?” That is a question I am asking alongside tens of thousands of other knowledge sector workers. Many have already left and the city feels empty on my masked excursions across the bridge from Brooklyn into Manhattan. With so many of these high income workers tackling the question, commercial property prices are going to be hit. How much of a hit and for how long is the big issue.

1\.5 million (1,570,265) residential properties in the United States are vacant, representing 1.6 percent of all homes. The third quarter analysis shows that about 216,000 homes are in the process of foreclosure, with about 7,960, or 3.7 percent, sitting empty as so-called ‘zombie foreclosures.’. The count of properties in the process of foreclosure (215,886) in the third quarter of 2020 is down 16 percent from the second quarter of 2020 (258,024).

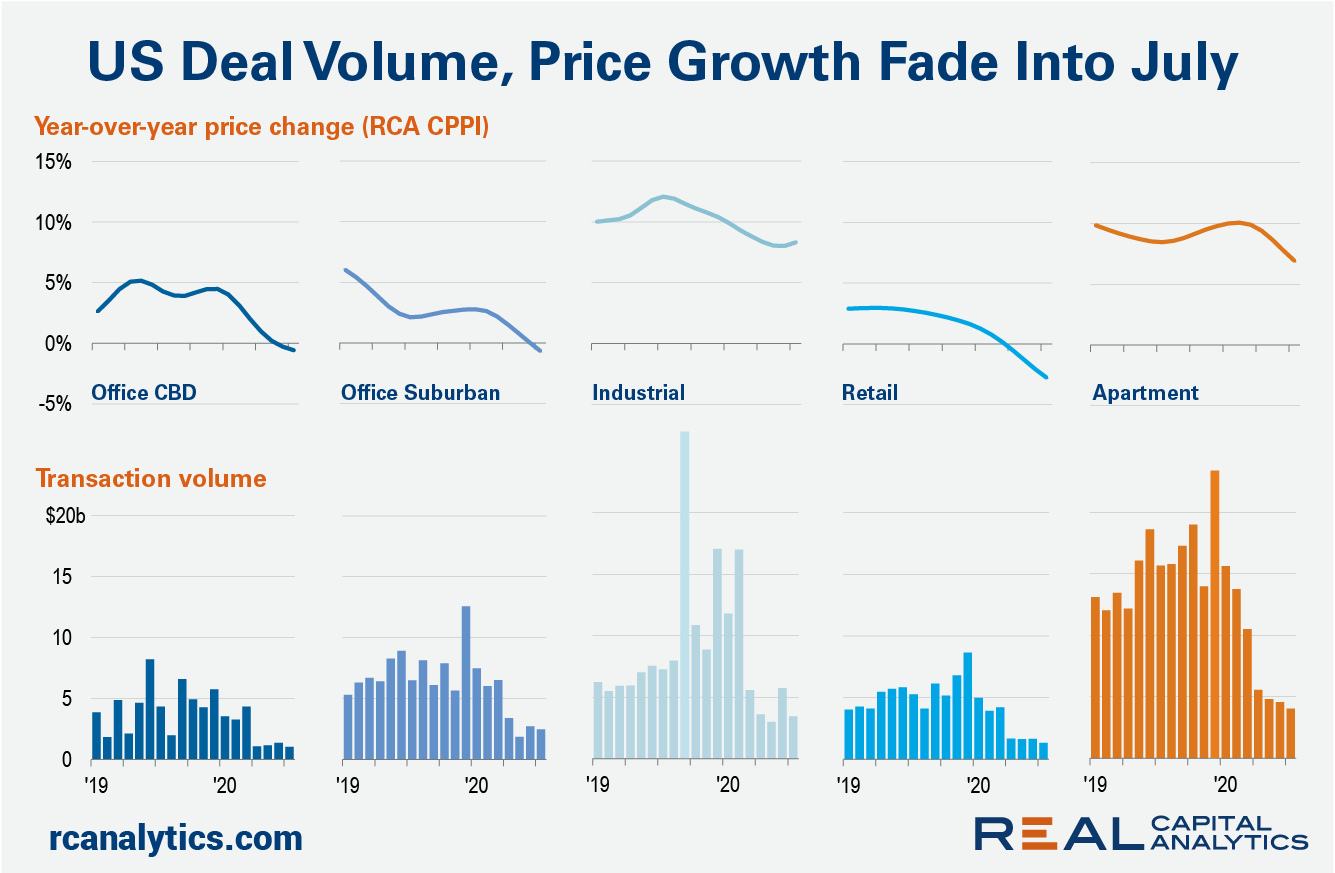

Illiquidity continued to plague the U.S. commercial real estate market in July, with volume across the property types falling at high double-digit rates, the latest edition of US Capital Trends shows. Total U.S. sales activity fell 69% versus July 2019, the fourth month in a row that the Covid-19 crisis has scuttled dealmaking.

As the country continues to navigate the coronavirus pandemic and double-digit unemployment, many renters are still moving and looking for new homes to match their changing opportunities and lifestyles. Peak moving season was busy, but the economic slowdown that accompanied Covid-19 has tempered rent growth.

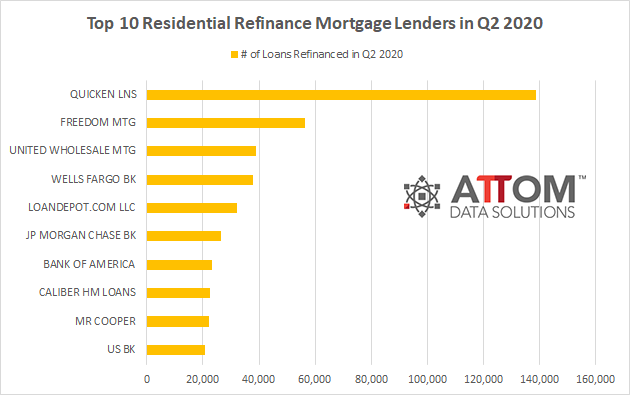

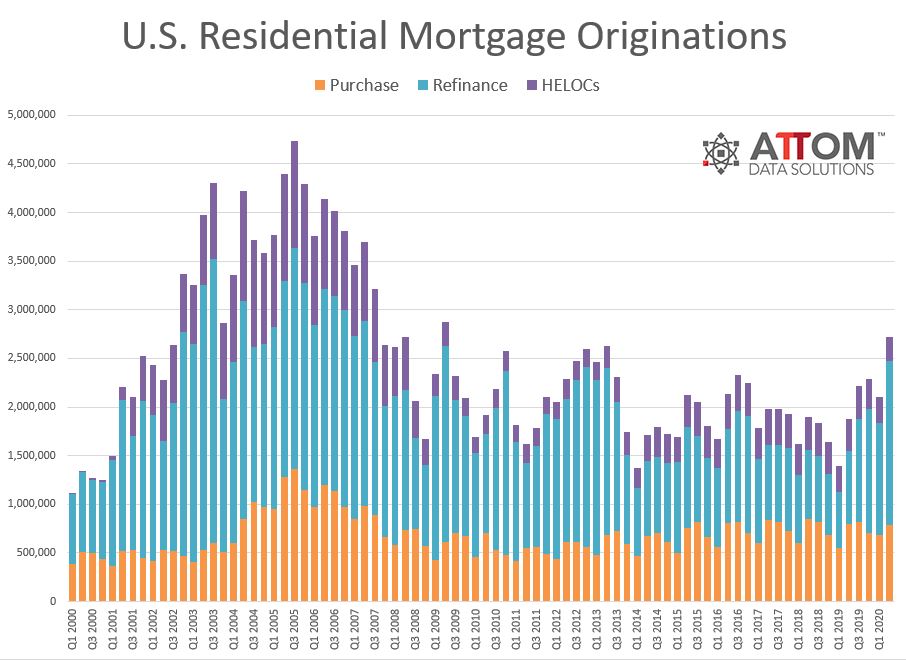

There were 1.69 million refinance mortgages secured by residential properties (1 to 4 units) in Q2 2020. That number is up almost 50 percent from Q1 2020 and more than 100 percent from Q2 2019, to the highest level in seven years. With interest rates hovering at historic lows of around 3 percent for a 30-year fixed-rate loan, refinance mortgages originated Q2 2020 represented an estimated $513 billion in total dollar volume.

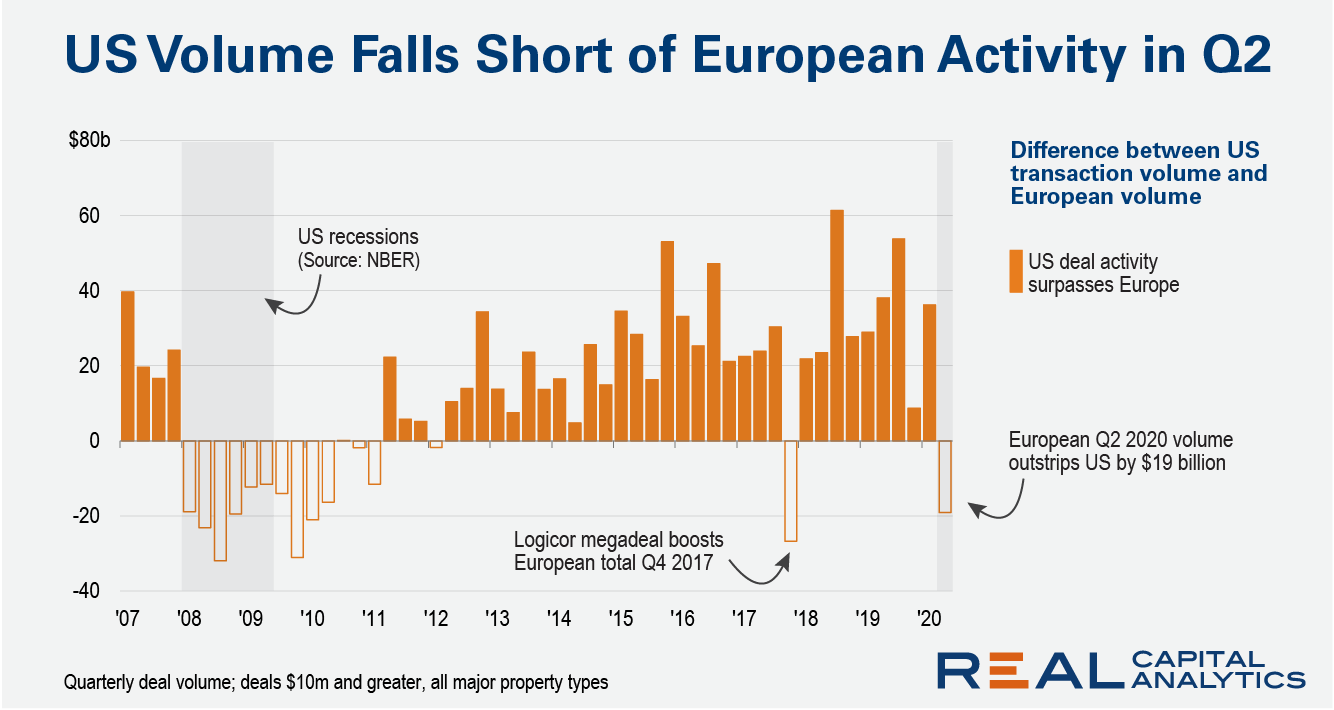

In normal periods the U.S. is the largest, most liquid region for commercial real estate deal activity worldwide. In the second quarter, however, Europe surpassed the U.S. as a hub for investment. Trends into July are not looking favorable for the U.S. Commercial real estate exists to support the needs of a local economy and deal volume can be a sign of the expectations for the health of that local economy.

1\.69 million refinance mortgages secured by residential properties (1 to 4 units) were originated in the second quarter of 2020 in the United States. That figure was up almost 50 percent from the prior quarter and more than 100 percent from the same period in 2019, to the highest level in seven years.

U.S. single-family rent growth continued to downshift in June, increasing 1.4% year over year in June 2020, a sharp slowdown from the prior year, and the lowest growth rate since May 2010, according to the CoreLogic Single-Family Rent Index (SFRI). Lower-priced rentals continued to prop up national rent price growth, which has been an ongoing trend since April 2014.

Total construction starts fell 7% in July to a seasonally adjusted annual rate of $631.6 billion. The decline was due to a significant pullback in the nonbuilding segment, which fell 31% from June to July. Nonresidential building starts rose 3% while residential building starts increased 2%. Year-to-date through seven months, starts were 15% down from the same period in 2019.

For millennials, first-time homebuyers (FTHBs), and down-sizing baby boomers, condos can be the most reasonable option when buying a property. Their values and lifestyle drive them toward buying condos because they tend to be more affordable than single-family homes and because condos typically come with a lower maintenance burden and are mostly located in urban cores.

One aspect of the new environment for multifamily that has become apparent over the last few months is that new supply is likely to act as a headwind for market performance as we move through 2020 and into early 2021. Apartment demand through July was half that of the same period last year, and 50,000 less units were absorbed than added in the first seven months of the year.

Even five months into the pandemic, many industries are still experiencing the effects of COVID-19. However, U.S. housing activity has notably pushed past the early turmoil it experienced. After several months of hesitation, housing indicators are beginning to show growth once again.

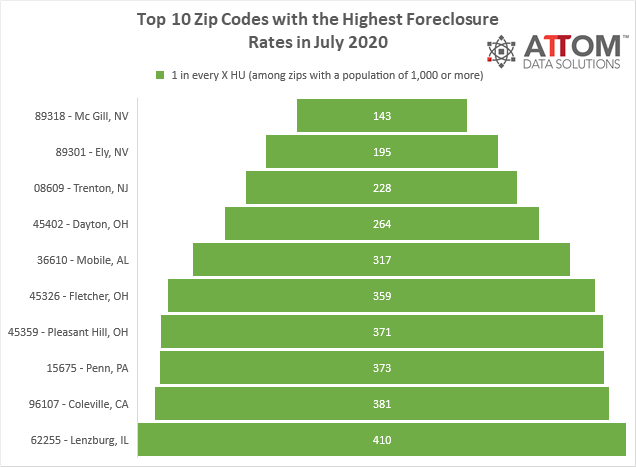

ATTOM Data Solutions’ newly released July 2020 U.S. Foreclosure Market Report shows that U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — are continuing a downward trend amid the Coronavirus pandemic, with 8,892 filings reported in July 2020. According to ATTOM’s latest foreclosure activity report, foreclosure filings in July 2020 are down four percent from June 2020 and 83 percent from July 2019.

There were a total of 8,892 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in July 2020, down four percent from a month ago and 83 percent from a year ago. “Even as mortgage delinquency rates climb, foreclosure activity continues to be artificially low due to moratoria put in place by the Federal and State governments,”

Eight of the 18 indices in the Global Cities Composite Index posted decreasing prices over the last quarter and of those cities, five posted declining returns over the year, as seen in the latest RCA CPPI Global Cities report. The Global Cities Composite Index slowed in the second quarter to 1.4% year-over-year as the effects of the global pandemic brought real estate transactions to a halt.

While multifamily performance in 2020 has not been what the industry had grown accustomed to in the latter half of the last decade, it is not as though occupancy and rent gains have entirely disappeared across the country. With that in mind, let’s look at some markets that have led the way in either average occupancy growth or average effective rent growth since the start of the second quarter – with one caveat.

n May 2020, 7.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)\[1\], the highest overall delinquency rate since August 2014, according to the latest CoreLogic Loan Performance Insights Report. The May 2020 overall delinquency rate jumped 1.2 percentage points from the prior month as the impact of the coronavirus pandemic and resulting recession made it difficult for borrowers to make their monthly mortgage payments.

For the fourth straight month, roughly one-in-three Americans failed to make a full, on-time housing payment. Late and unpaid housing bills are accumulating, putting financial strain on many families and deepening concerns of near-term evictions and foreclosures. As federal and local eviction bans continue expiring across the nation, 32 percent of renters (and homeowners) entered August with unpaid bills. Over 20 percent owe more than $1,000.