Robust top-line hotel performance indicators for the four weeks ending 11 June point to a clean transition between a rock-solid recovery during the spring to summer’s traditionally leisure-heavy travel period. With domestic leisure travel expected to remain strong, along with a recent lifting of international travel restrictions, STR expects a record-breaking summer season with numerous U.S. hotel markets to surpass 2019 comparables.

Even with gas prices skyrocketing and COVID-19 cases surging once again, this year’s summer travel season is poised to be one of the busiest on record. AirDNA reports that the booking pace for travel this spring was 49 percent higher than the same time last year, and 26 percent higher than 2019’s pre-pandemic levels. Ads for booking sites reflect this, with the top brands in the Travel Booking Services & Travel Agencies category unleashing a tidal wave of ads on streaming services like Hulu, Pluto TV, Tubi, and Peacock.

The latest data from ForwardKeys reveals that while Southeast Asia has been lagging far behind the rest of the world in its recovery from the COVID-19 pandemic, visitors from the USA are coming back in substantially greater numbers than from other origin markets. In the first five months of the year (1st January – 31st May), travel to Southeast Asia reached just 18% of pre-pandemic levels, whereas travel to Europe reached 55%, to the Americas 66% and to the Middle East & Africa 64%.

The past two weeks have seen a surge in cancelled flights at European airports, culminating in highly visible cancellations at the weekend (4-5 June). The UK saw 4% of flights cancelled on Saturday 4th June, while the Netherlands saw cancellations rise to 11% on the same day. Cancellations also rose from French and Spanish airports over last weekend, although this may simply have been the repercussions of cancellations elsewhere.

Global airline capacity bounces back this week with airlines scheduling 95.2m seats. Having seen airline capacity reach above 90m seats last week, which felt like a positive step forward, this week’s total capacity represents a definite leap. Only one country market can have such an impact in just one week and that is China, where the re-opening of Shanghai from 1 June has triggered a big increase in capacity, with totals for North East Asia increasing week on week by a quarter or 3.4m seats.

Well past the second anniversary of the pandemic, business travel is showing its first significant signs of recovery. As that recovery gains momentum, a new landscape has formed with the presence of both traditional and new forms of business travel. Amid this new landscape, however, there remains mixed consumer sentiment toward business travel as well as a large gap between current volume and pre-pandemic comparables. STR’s consumer research from May 2022 produced telling insights into this always popular topic.

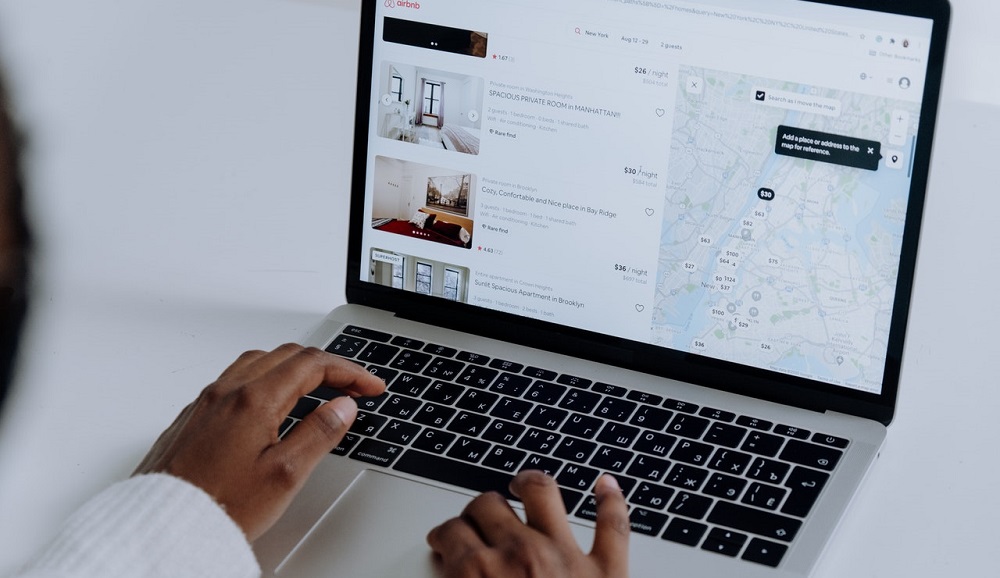

With Memorial Day Weekend beginning tomorrow in the US and clear skies ahead for summer travel in the US and UK, we take the opportunity to look at how travel has changed over the past few years. In today’s Insight Flash, we compare how the different subindustries have fared, and dig into whether ABNB has been able to continue to ride the tide of changing travel habits. The year-over-year growth for Travel in the UK has been much stronger than in the US, with all of the major subindustries more than doubling the number of transactions seen in calendar 2022Q1.

The last few months have seen a much-welcomed boost in demand for the travel industry as COVID-19 restrictions have continued to ease in many parts of the world. STR’s Market Recovery Monitor shows that around two-thirds of global markets and over 95% of U.S. markets are now in a recovery or peak position achieving revenue per available room (RevPAR) indexed to 2019 at 80 or above. Further, around 70% of U.S. markets and 40% of global markets are now achieving higher RevPAR than in pre-pandemic times.

It has been a disappointing week for global airline capacity as total seats once again falls back below ninety million with China reporting a further 25% reduction in capacity week on week. At 8.6 million seats, China is at one of its lowest capacity points since January 2020 and in the short term any significant improvement is unlikely given current lockdowns. Notwithstanding the issues in China, global capacity looks to be holding steady. Through to the end of August a further 12 million seats have been dropped by airlines around the globe of which 7 million are over the next ten days and of the 7 million virtually all are in China.

For the four-week period ending 14 May 2022, more than three-quarters of all U.S. hotel markets outperformed their comparable 2019 revenue per available room (RevPAR) on a nominal basis. Of 165 STR-defined U.S. markets, only 38 fell short of their 2019 RevPAR, which was a solid improvement from 52 underperformers in April’s “bubble” blog update. Industry RevPAR looks to be on steady footing; however, a look at RevPAR contribution shows a greater influence from average daily rate (ADR) as opposed to occupancy in many areas.

Total scheduled airline seats this week remains above the 90 million mark, a few regions have reported slight reductions in capacity leading to a total seat reduction this week of 190,000. Indications are that we should stay at this sort of level for the next few weeks by which time, with a bit of luck, China will once again be easing the latest lockdown. As always there are a few nuggets of change in the week’s data, and we are also going to look at the top twenty international airports this week compared to this time in 2019 with some notable absences, although not quite as many as in the Everton defence this weekend!

The latest air ticketing data from ForwardKeys reveals that Russian outbound tourism, already severely handicapped by pandemic travel restrictions, has fallen even further, because of Russia’s military operations in Ukraine. But affluent travellers are still flying, just not to Europe. In the week before the outbreak of war (w/c 18th Feb), outbound international air tickets from Russia stood at 42% of pre-pandemic levels; but in the week immediately after the invasion (w/c 25th Feb), issued air tickets fell to just 19%. Since then, flight bookings have sunk deeper still and have been hovering at around 15%.

All scales reported ADR growth over March 2019, ranging from +2.8% (upscale) to +26.8% (luxury) despite occupancy declines across the board. Upscale (+1.6%), upper midscale (+4.1%) and midscale (+1.0) properties posted demand growth, but each are competing with an influx of supply (+10.5%, +8.4% and +3.6%, respectively) which offsets any potential occupancy gains. Upper upscale showed the worst RevPAR decline (-8.4%), driven down by a 12.1% demand decline coupled with 4.6% growth in supply.

As we are into the third year of the Covid-19 pandemic, here are the latest developments in travel industry as of 4/18/2022. Starting off with the US airports, following a strong first quarter of 2022, despite the Omicron wave that led to thousands of flight cancelations, foot traffic picked up steam in March and is on track to hit its highest level in the next days since the beginning of 2022. Airport visits across the country are 22.5% down compared to April 2019 so far but our data indicates that the total number of visits at the end of this month will likely surpass March’s mark of approximately 112mm.

Observing, as we do at OAG, the changes in global airline capacity week by week to understand trends and patterns in air service provision, one of the most striking features over the past year has been the speed at which Chinese airlines can both remove and add capacity over a short space of time. The extent to which they do this, and the sheer size of the Chinese aviation market, has meant that what happens in China makes a difference at a global level when we look at overall air travel trends.

As there is much talk about travel recovery around the world, first with the Americas leading in 2021 and again in 2022, the travel data experts at ForwardKeys are noticing the first taste of recovery in Africa and the Middle East. International arrivals to Africa and the Middle East in Q2 of 2022 are at -33% compared to 2019 levels, above the total international outbound average of -45% and just behind the leading recovery region, the Americas (-27%). Last year this figure was at -64%, so this is a marked improvement.

Like it or not, China keeps making the headlines since the advent of the pandemic in 2020, and it’s for all sorts of reasons. From Covid containment and the strict zero policy to the closure of outbound tourism to the unstoppable desire to shop and travel – even if it’s just to neighbouring Macau or Hainan. The latest news is the lockdown of one of China’s most important financial centres: Shanghai. And now local authorities are telling Beijing residents to stay put ahead of the famous May holiday. But is it really all doom and gloom for the travel economy?

More than two-thirds of STR-defined U.S. hotel markets (113 of 165) outperformed their 2019 comparables over the four weeks ending 9 April 2022, which is reflective of the industry’s rebound toward normalcy as well as some influence from inflation. Only seven markets in total over the 28-day period reported revenue-per-available-room (RevPAR) indices below 80 (20% below 2019 levels). Late March into early April 2022 also marked a key turnaround in the number of major markets making appreciable performance gains toward historical performance levels.

The travel industry has seen its fair share of challenges over the past two years. As the wider situation begins to stabilize, will we see travel trends bounce back to pre-COVID levels? We took a closer look at Q1 2022 foot traffic data for hotels, airports, and major convention centers to find out. Travel agents are predicting that domestic tourism may return to pre-pandemic levels in 2022, as people finally get to take those trips they’d been putting off. We took a look at data to see if those predictions are reflected in the foot traffic.

Global tourism receipts were well below the pre-pandemic level in 2021 as travel restrictions and uncertainty persisted, and changing consumer behavior dented economic recovery. But now, in the spring of 2022, some two years since COVID-19 forced governments to impose lockdowns and severe travel restrictions, there are plenty of signs of optimism for the future of tourism. This is true even with potential macroeconomic and geopolitical headwinds.