Early in 2020, we put together a list of brands that would end the year as clear winners. And halfway through, we’re still feeling good about our picks. Target’s pandemic low has been replaced by a recovery surge. Ulta, CVS, Chick-fil-A, and Chipotle are already within striking distance of 2019 levels, and even Bed Bath & Beyond is showing strength in recent weeks.

The newly released CoreLogic HPI for May shows that home prices held up very well in the United States. However, most of the home prices captured in the May report were from transactions negotiated in April or March since it takes on average 30 to 45 days to settle a transaction. Many states have entered different reopening phases since the beginning of May, and as a result housing market activity has increased.

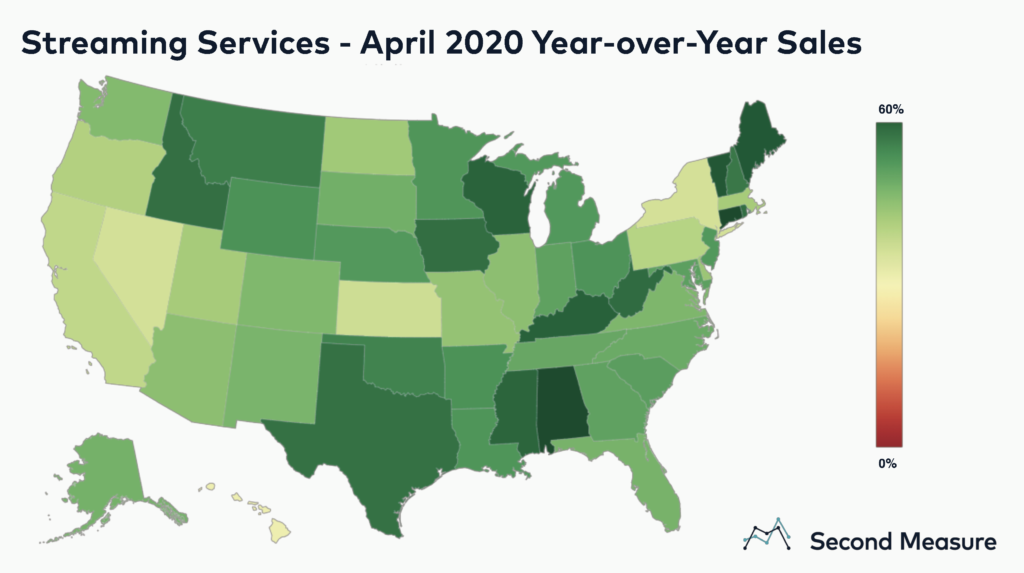

As U.S. consumers stay home amid the pandemic, they are flocking to streaming services for entertainment. The streaming industry’s sales grew 47 percent year-over-year in April 2020 compared to a 39 percent year-over-year sales increase in April 2019. Mandatory stay-at-home-orders, combined with the entry of a new market player, Disney+, and the rising popularity of socially-distant gatherings like Netflix parties, have led to the industry’s growing success.

The newly released CoreLogic HPI for May shows that home prices held up very well in the United States. However, most of the home prices captured in the May report were from transactions negotiated in April or March since it takes on average 30 to 45 days to settle a transaction. Many states have entered different reopening phases since the beginning of May, and as a result housing market activity has increased. What does that mean for June or even July home prices?

Investors of all stripes have a well-known tendency towards loss aversion and academic literature has consistently described that property owners tend to sell winners and hold losers. Therefore, at this time of market dislocation – when deal flow is down substantially and assets may be forced onto the market, either because of breached covenants or liquidity requirements – we have looked at how far prices would have to fall in the major global markets for owners to see their gains wiped out.

Back in March, as people moved indoors to comply with shelter in place policies, the search for ways to stay entertained at home skyrocketed. As previous Edison Trends research on pandemic sales shows, wine subscriptions, console video games, and online marijuana sales shot up, while rideshare usage dropped. Gaming consumers have an array of choices to stay occupied at home as they head into summer, whether rain or shine in the world outside.

The Dodge Momentum Index dropped 6.6% in June to 121.5 (2000=100) from the revised May reading of 130.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The institutional component of the Momentum Index fell 11.7% while the commercial component declined by 3.5%.

Amazingly, we’re now passed the halfway mark of 2020. The first six months of the year have been turbulent to say the least, and the first of a few different perspectives from which we’ll evaluate how multifamily has performed so far this year is from a regional perspective.

After months of wild spending patterns, June saw some signs of normalization with Restaurants, General Merchandise, and Grocers returning to growth profiles of low single-digits. But the virus has now resurged. The last week of June saw a material slowdown in spending growth, particularly in the lockdown-driven sectors; Ecommerce and Home categories slowed 20 points WoW, and General Merchandise and Grocers slowed 10 points to a 5% YoY decline.

With COVID cases rising again in Southern and Western states, the Washington Post reported that many hospitals are under renewed strain, with beds being filled to capacity. In order to measure the true number of hospital admissions, we have developed an algorithm that can track overnight stays for any period of time (by excluding staff and visitors).

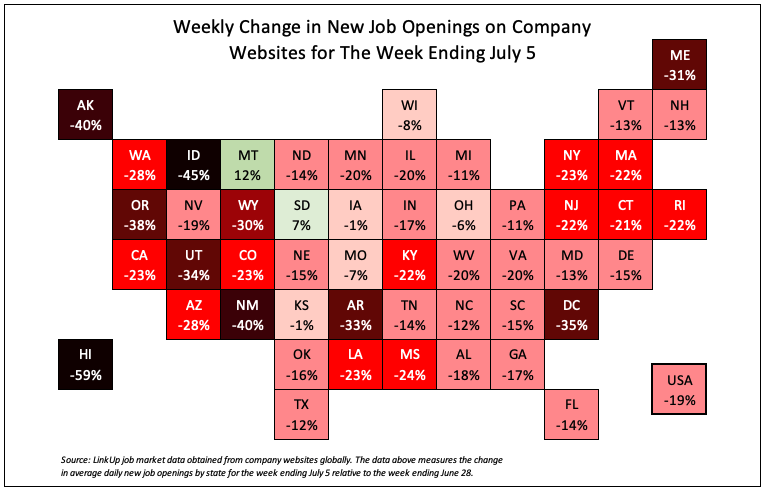

For the week ending July 5th, job openings on company websites dropped 19%, with declines in all but 2 states. It’s important to note that it was a holiday week and it’s not surprising that job openings would decline to some extent with people taking time off for the 4th. On the other hand, the horrific rise in COVID-19 cases in the U.S. in the past month or so, driven entirely by states that opened up way too fast without even the most basic, rational precautions like wearing masks, has resulted in states and businesses now closing things down.

Even after restrictions are lifted, many consumers still plan to shift their spending online. A May 2020 survey of Checkout panelists found 26% of consumers plan to shop more online at non-grocery retailers once social distancing restrictions are lifted, while only 16% plan to shop more in stores. “We’ll leapfrog three years in terms of online adoption,” said Chief Industry Advisor Marshal Cohen when asked to predict how the shift to e-commerce will play out after restrictions are lifted and a new normal sets in.

Data from Speedtest Intelligence reveals median download speed over mobile in the U.S. increased 15.8% between Q2 2019 and Q2 2020 to 29.00 Mbps. The median upload speed for mobile was 5.74 Mbps, down 15.2% from Q2 2019. Median download speed over fixed broadband increased 19.6% during the last year to 86.04 Mbps in Q2 2020, and median upload speed increased 1.5% to 11.86 Mbps in Q2 2020.

Travel was one of the first industries to get hit by the pandemic—especially business travel. Now, flights are starting to take off again. American recently announced that its July flight schedule was the strongest it’s been since March—but tickets were purchased mostly for leisure, not business. Events have shifted online and virtual meetings have become the norm. Without a vaccine, business travel will be slow to rebound—how are travel brands adjusting to this reality?

Footfall to the hospitality sector across the UK climbed to 60% of pre-lockdown levels on ’Super Saturday’, but despite reports of crowded streets in Central London, a lack of tourists and entertainment saw pubs and restaurants in the Capital see just a quarter of their usual trade. Huq’s Indicator, which tracks footfall activity across the hospitality sector in the UK, dropped to a fifth of pre-lockdown levels throughout April and May as businesses pivoted their offerings but has yet to see the bounce back that people have been hoping for.

32 percent of Americans did not make a full on-time housing payment in July, up slightly from 30 percent in June. Missed payments continue to concentrate among renters, young and low-income households, and residents of dense urban areas. Compared to last month more Americans are concerned about evictions and foreclosures, even as federal and certain local displacement protections are extended.

Big box stores such as CostCo and Sam's Club were early winners in the pandemic era as many of us stocked up in preparation for an anticipated period of lock-down. One clear winner during this period has been Amazon. Shelter in place orders have driven a spike in online shopping and the massive growth in employees at Amazon warehouses confirms the extent to which the retailer has benefited.

The popularity of plant-based meat has quietly established itself as a mainstay across the restaurant and grocery industry—in fact, the plant-based meat industry is projected to reach $85 billion by 2030. Increased adoption of veganism stemming from environmental and health concerns is expected to further escalate the demand for plant-based products. And in the wake of the COVID-19 pandemic, consumers may also be hungry for more sustainable meat options for fears over any potential meat supply chain issues amidst Covid-19.

With the COVID-19 pandemic and persistent social injustices Americans have been consuming more news. Prior to COVID-19, mobile app usage of traditional news providers was in a state of decline and only worsening. From last July through January of this year Fox News and CNN average app usage was down 18.6% and 2.5% YoY, respectively. For the same period, The New York Times averaged growth of 1.3%, however was trending significantly negative.

After two months of closure from coronavirus concerns, Las Vegas officially opened back up on June 4. Using Earnest Foot Traffic data, we examined the first two weeks since the city’s reopening to better understand its road to recovery, regional dynamics, and local vs. tourist behavior. In aggregate, foot traffic to Nevada casinos remains down 60% YoY, and while still improving, the data is seeing growth plateau.