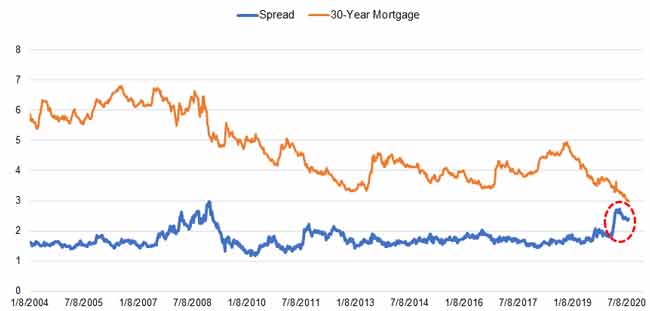

Amidst the COVID-19 pandemic, many lenders are reportedly tightening credit by raising the minimum FICO score requirement or increasing down payment requirements to 20%. The credit tightening is driven by a familiar credit market phenomenon known as flight to quality – in time of economic crisis and market uncertainty, investors tend to become more risk averse and will reduce exposures to higher risk loans or loan products.

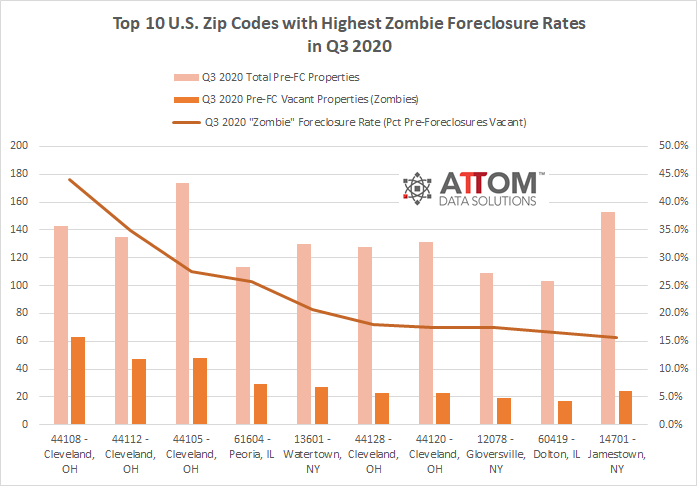

ATTOM Data Solutions’ newly released Q3 2020 Vacant Property and Zombie Foreclosure Report reveals that 1.6 percent of all homes in the U.S. are vacant, numbering 1,570,265 residential properties, with 7,960 or 3.7 percent of those vacant properties in the process of foreclosure, otherwise known as ‘zombie foreclosures.’

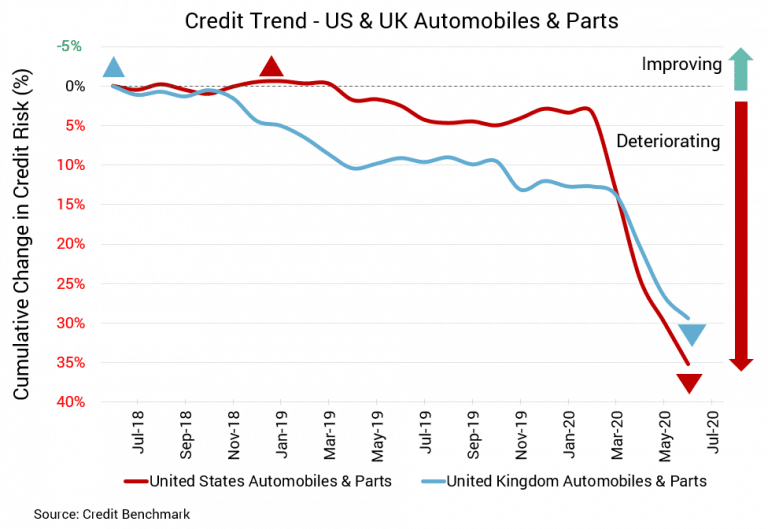

While there are some signs the US auto industry is restarting after COVID, numerous challenges remain – and that’s not even factoring in overall weakness in the economy and personal finances. Credit weakness continues, and it’s unlikely to get much better until everything else improves. Similar can be said about the UK, where car sales are on the rise but where the economy is coming off its worst drop on record.

In this Placer Bytes, we dive into At Home and the surging home goods sector and break down Michaels’s recovery. Just as the home improvement sector has seen a powerful surge in visits even as its normal seasonal peak passed, the home goods sector looks to be picking up steam. At Home was up year over year in May, June and July with visits rising 4.8%, 34.1%, and 20.6% year over year respectively.

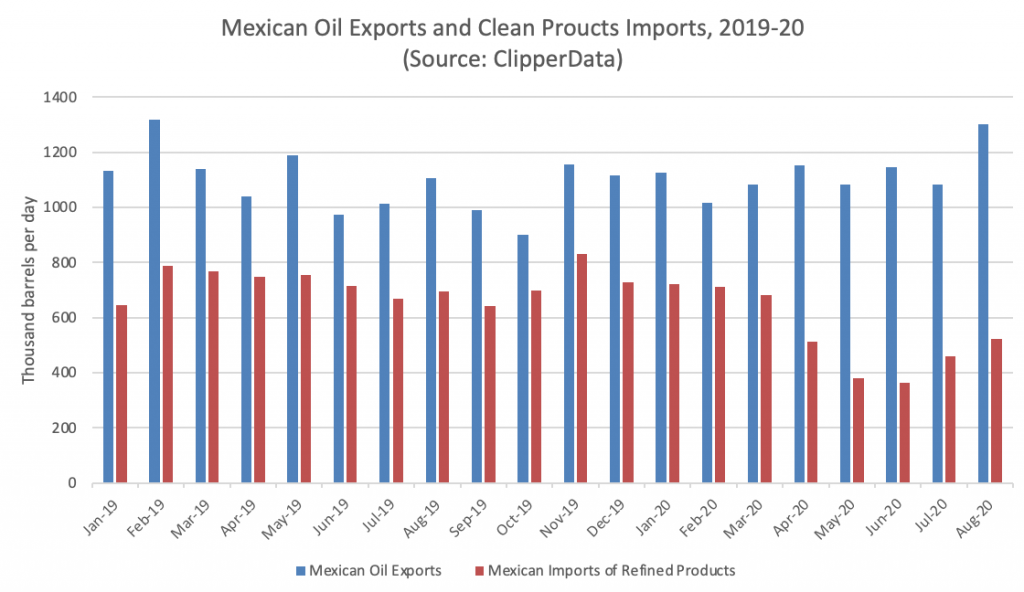

The Mexican government is falling short on its promises for the energy sector once again. President Andres Manuel Lopez Obrador (AMLO) vowed to considerably increase refinery runs earlier this year, and despite a rebound in April, Mexican crude processing has tumbled to 534,000 bpd in July. Mexico has meanwhile experienced a steady increase in clean product imports, after hitting lows in June due to the demand crimp of Covid-19.

Overall, the U.S. trade book market is having a very good year. The U.S. print book market is up 5.5% over the same time period in 2019—a 9% gain over its COVID-19 lowpoint the week after Easter. While 2020 is not a year for dependable predictions, barring another surprise, the U.S. book market is now on track to have one of its best years since NPD BookScan started tracking book data in 2004.

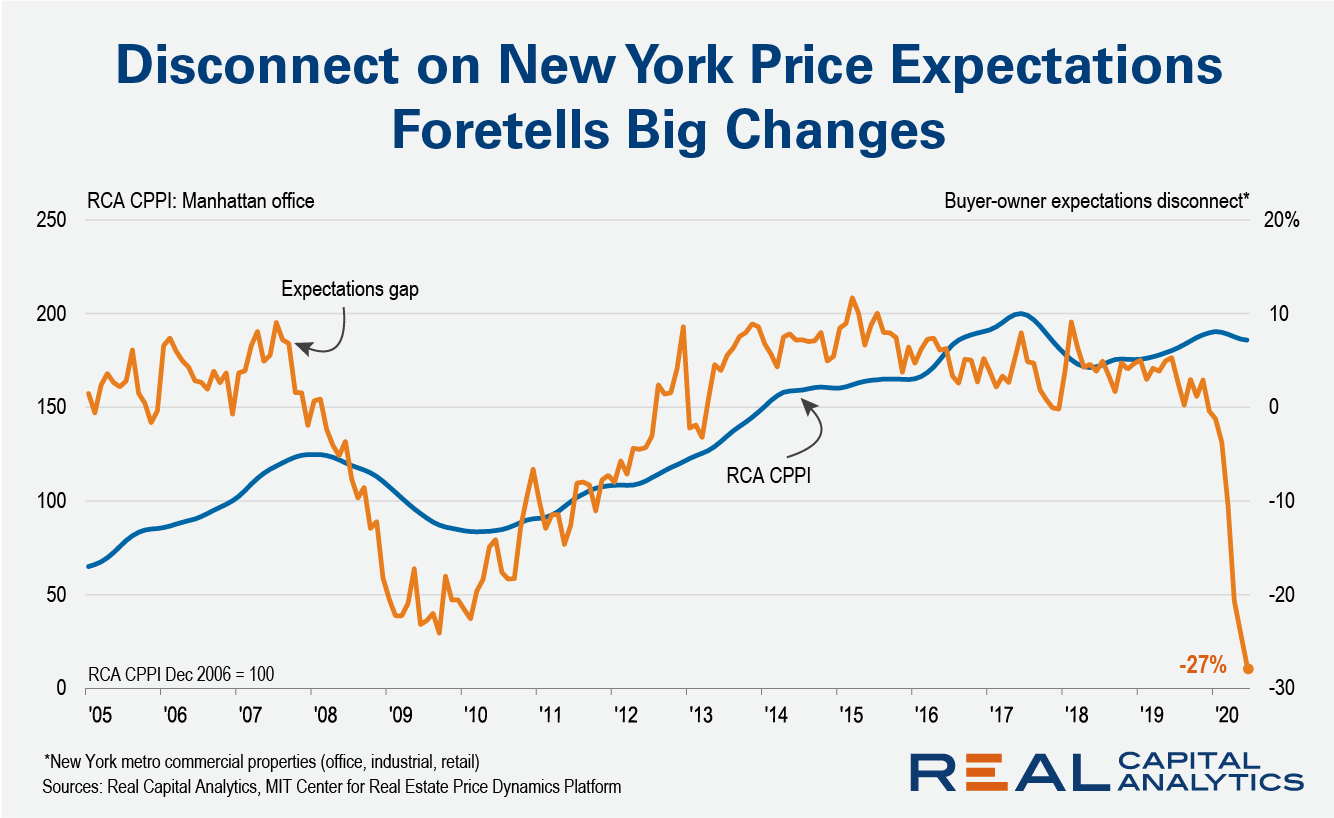

“Should I leave New York?” That is a question I am asking alongside tens of thousands of other knowledge sector workers. Many have already left and the city feels empty on my masked excursions across the bridge from Brooklyn into Manhattan. With so many of these high income workers tackling the question, commercial property prices are going to be hit. How much of a hit and for how long is the big issue.

Problems for the beleaguered US energy sector have continued to mount this year. Demand for oil plummeted, bringing down prices as competition and supplies grew. Bankruptcies continue in the industry as the broad economy continues to struggle, and it’s not clear how many firms will benefit from any improvement in prices.

The ranks of the Fallen Angels – firms whose credit quality has made the shift from investment-grade to high yield, or “junk” status – continue to grow, but the pace may be slowing down. Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies have now entered the Fallen Angel category.

Preparations for the approach and landfall of Hurricane Laura forced the shutdown of many shipping terminals and refineries, as well as several petrochemical crackers. The reduction in productive capacity may be short-lived, but comes at a time when olefins and feedstock commodities are in high demand. US LPG loadings this month are running at a pace of 1.64 million barrels per day, and would be the highest on our records if maintained.

There are few industries that have experienced more change in our pandemic world than healthcare. Since COVID concerns came to light, there has been no shortage of news stories about everything from scandals at the nation’s largest hospitals to AI’s role in reinventing the industry.

As one of the most important events of 2020, the upcoming U.S. presidential election will have a far-reaching impact on website monetization for news publishers and advertising networks. The race is heating up with both candidates investing heavily in paid marketing and looking to secure funding from supporters around the country.

1\.5 million (1,570,265) residential properties in the United States are vacant, representing 1.6 percent of all homes. The third quarter analysis shows that about 216,000 homes are in the process of foreclosure, with about 7,960, or 3.7 percent, sitting empty as so-called ‘zombie foreclosures.’. The count of properties in the process of foreclosure (215,886) in the third quarter of 2020 is down 16 percent from the second quarter of 2020 (258,024).

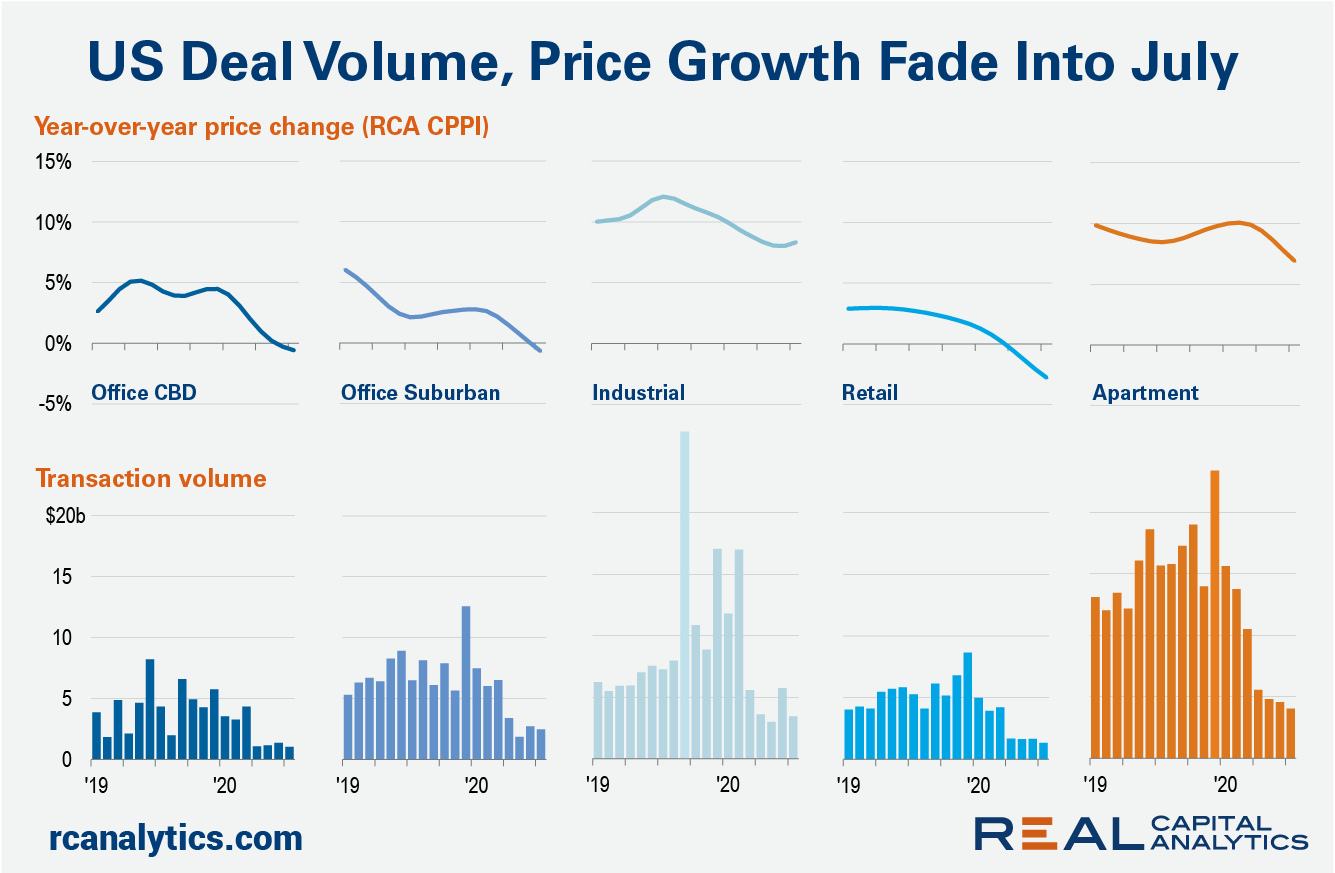

Illiquidity continued to plague the U.S. commercial real estate market in July, with volume across the property types falling at high double-digit rates, the latest edition of US Capital Trends shows. Total U.S. sales activity fell 69% versus July 2019, the fourth month in a row that the Covid-19 crisis has scuttled dealmaking.

As the country continues to navigate the coronavirus pandemic and double-digit unemployment, many renters are still moving and looking for new homes to match their changing opportunities and lifestyles. Peak moving season was busy, but the economic slowdown that accompanied Covid-19 has tempered rent growth.

Going to the pub or having a meal out continued to grow in popularity in the UK over August, as the ‘Eat Out to Help Out’ scheme helped to push pub visits over 83% for the first time since lockdown. Huq’s Restaurants & Pubs Index shows that footfall to pubs saw a sharp rise over the last week, reaching the new series high on Saturday (22 August) and that Government incentives appear to have given consumers more confidence about supporting their local.

There are few sectors that rely on the back-to-school season to the same extent as office and school supply leaders. From Office Depot to mass merchandise leaders like Walmart, the season can drive huge returns. So, how has this season played out within the context of the COVID recovery? Context is key to understanding performance, and understanding 2019’s back-to-school season goes a long way in helping to frame the current results being seen.

In the Ernest Hemingway novel The Sun Also Rises, Mike is asked how he went bankrupt. “Two ways,” he answers. “Gradually, then suddenly.” COVID-19 seems to have rewritten the financial rules: Central Banks are pushing interest rates further into negative territory and Government support for businesses and their employees has pushed Sovereign debt to levels not seen since the Second World War.

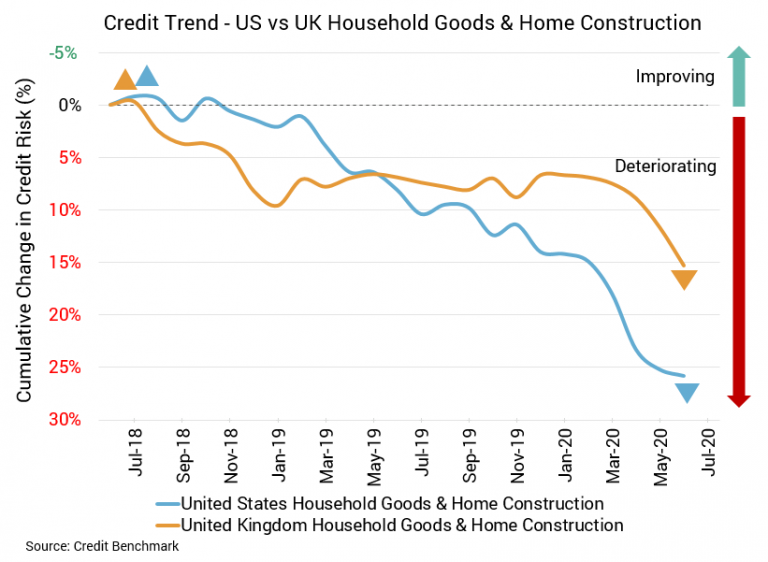

The US housing sector can breathe a (perhaps temporary) sigh of relief. The UK housing sector, however, may be taking a turn for the worse, with credit quality diminishing. There have been some positive signs in recent weeks, like rising sales, increased construction, and regulatory changes that allow for more construction. But with the UK experiencing the worst recession on record, this sector’s credit prospects may be restrained for some time.

COVID-19 forced B2B companies to change up their marketing strategies for the year. Forced to throw out events, marketers sought out alternative methods for driving brand awareness and conversions. Many event dollars were redirected to online advertising across B2B websites. Using our data, we can see the B2B industries and companies spending the most money on online advertising. Here, we share our findings.