The classic experience of road tripping across the country has gained momentum during the pandemic. Concerns about the potential hazards of other forms of travel have led vacationers to hit the road in a Recreational Vehicle (or RV). There are a myriad of stories of how this demand has transpired. Some travelers are looking for alternatives to hotels and view an RV as a more controlled environment.

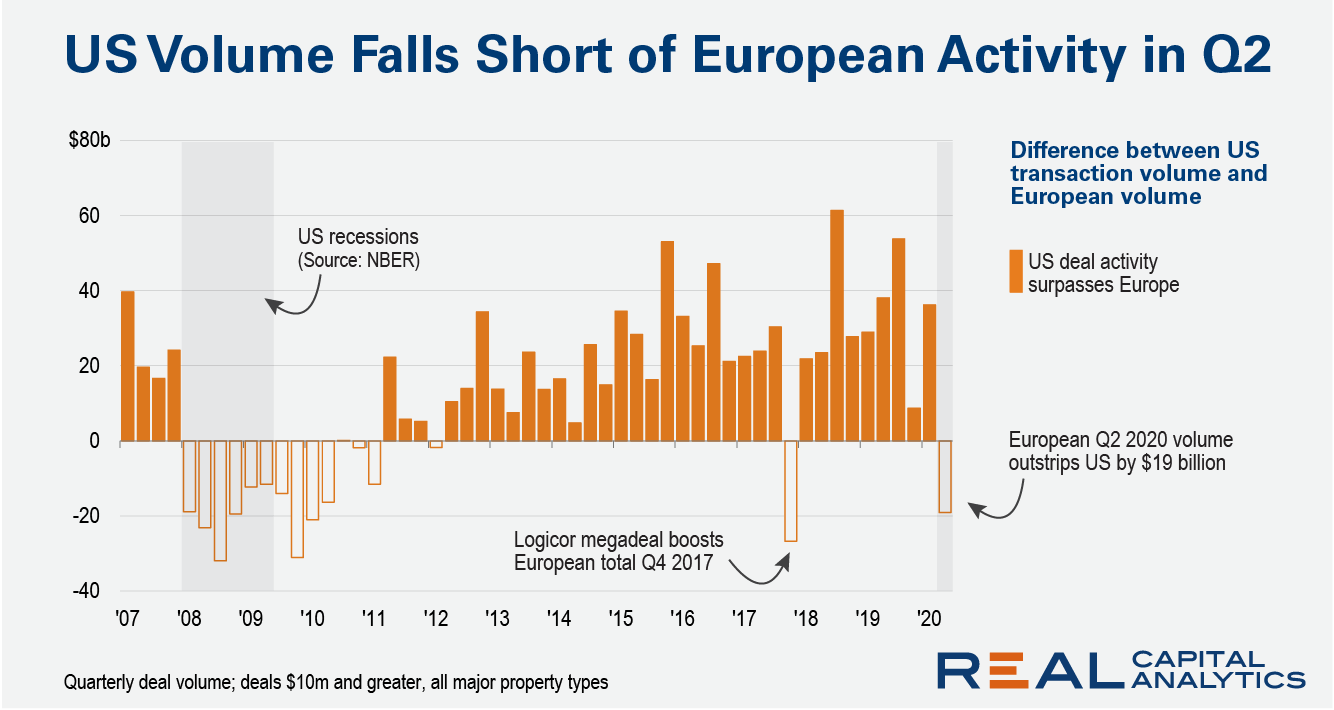

In normal periods the U.S. is the largest, most liquid region for commercial real estate deal activity worldwide. In the second quarter, however, Europe surpassed the U.S. as a hub for investment. Trends into July are not looking favorable for the U.S. Commercial real estate exists to support the needs of a local economy and deal volume can be a sign of the expectations for the health of that local economy.

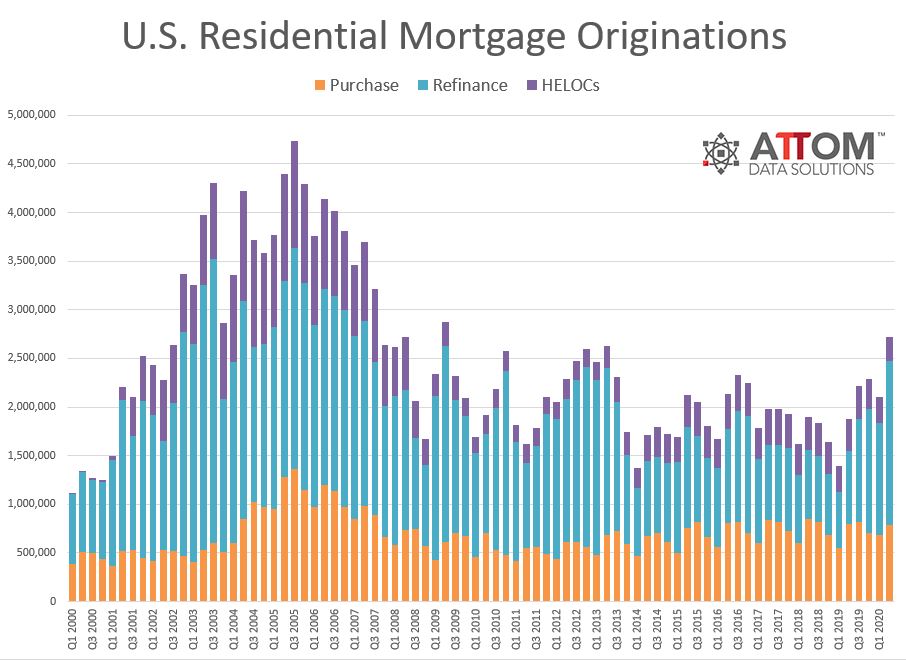

1\.69 million refinance mortgages secured by residential properties (1 to 4 units) were originated in the second quarter of 2020 in the United States. That figure was up almost 50 percent from the prior quarter and more than 100 percent from the same period in 2019, to the highest level in seven years.

In this Placer Bytes, we dive into BJ’s continued rise, what Dick’s Sporting Goods performance tells us about back-to-school, and the brands that could benefit from Stein Mart’s closures. When we last checked in on BJ’s Wholesale it was becoming clear that COVID helped to re-establish the brand within the wholesale category.

Though the COVID-19 pandemic is occupying all attention at the moment, hurricane season has begun and natural catastrophes do not take a holiday. Forecasts for 2020 project higher than average hurricane activity, implying higher levels of devastating storm surge. Heading into hurricane season, the prospect of confronting a large natural catastrophe like a hurricane or flood during the coronavirus crisis may seem daunting.

The number of country residents attending their offices in the Netherlands has dropped 12% from its post-lockdown high during the last week as a rise in Covid-19 cases in the country and overseas subverts the return to normal for many. Huq’s new Return-to-Work Indicator had identified growing numbers of people getting back into work after the series low in April.

Events were central to B2B marketing prior to COVID-19. “The number one thing B2B companies spend money on is events,” explained VP and principal analyst of B2B marketing at Forrester Research Laura Ramos. “Now, some companies say they need to figure how to generate demand in other ways, but if we were good at using other methods, we wouldn’t have relied so much on events.”

In this Placer Bytes we break down the data surrounding three major apparel retailers – Gap, Old Navy and Ross Dress for Less. Gap was in the headlines quite a bit toward the end of the 2019 and beginning of 2020, with news that it called off plans to spin-off its Old Navy brand, and would be closing hundreds of stores globally in the next two years. So, as Gap goes through some changes, we dove into the most recent data to see how the brand is recovering.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that, through the end of July, sales for meal delivery services grew 150 percent year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In July, 33 percent of American consumers had ever ordered from one of the services in our analysis, up from 26 percent a year ago.

COVID-19 has caused major economic damage, especially in sectors connected with travel and leisure. But in manufacturing and technology there will be some strong winners: increased factory automation, major house-building and property conversion programs, increased demand for private cars, new software to facilitate social distancing in a broad range of situations, and major supply chain restructuring.

Naphtha’s price surge in May and June has made LPG more cost effective for petrochemical crackers that are able to switch feedstocks. LPG prices moved only slightly higher during the naphtha rally, and especially so in producing regions such as the US. As a result, a favorable arb developed for US suppliers, and loadings are up to 1.78 million barrels per day this month to the highest on our records.

U.S. single-family rent growth continued to downshift in June, increasing 1.4% year over year in June 2020, a sharp slowdown from the prior year, and the lowest growth rate since May 2010, according to the CoreLogic Single-Family Rent Index (SFRI). Lower-priced rentals continued to prop up national rent price growth, which has been an ongoing trend since April 2014.

When the going gets tough, the tough open a brokerage account. Well, that’s not exactly the saying, but that seems to be what is occurring across the country as the pandemic has set in. According to Envestnet | Yodlee spending trends data, new online brokerage accounts were opened at very high rates in March 2020, compared to the previous month. Interestingly this phenomenon has occurred across all income groups, as shown from our Income and Spending Trends Data.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. Though rideshare is beginning to bounce back, in July, Uber and Lyft sales were down 72 percent and 68 percent, respectively, year-over-year.

The UK’s residential construction industry sees activity levels steady at around 50% of pre-Covid levels following a rapid rebound from lockdown in late April, according to a new indicator published today by Huq Industries. The Huq Residential Construction Index showed worker presence fall rapidly as lockdown set in during the last week of March to around 20% of previous levels before recovering to half of normal levels just as quickly from April 20th.

There were few stories that captivated the fast food industry like the ‘Chicken Wars’ of 2019. And much of this went far beyond the initial surge and centered around the fundamental shift it caused for Popeyes – leading to a near year-long run of ongoing growth. But, the next round is on its way and the combination of new competitors and a rising giant in the sector could make for an interesting season as the Chicken Wars hit their first anniversary.

In recent weeks, labor markets have appeared to stabilize as the number of new job postings has increased. But while postings have grown, the salaries associated with those postings have fallen dramatically. By tracking expected salaries from 9 million job listings since March, and controlling for changes in seniority, occupation, and city, we found that salaries have fallen by 8.8%.

The trajectories of deal volume and deal count continue to weaken for the Americas, the latest Real Capital Analytics data indicates, while in Asia Pacific and Europe the picture is little changed. The concaved path of deal volume in the Americas indicates a deepening slump. At day 220, deal volume was 37% lower than the same point in 2019 and the number of deals was down 40%, according to Real Capital Analytics data.

In week six of earnings season, retail giants are stepping into the spotlight, and we’ve got earnings insights ahead of their reports. The six companies we’re covering today – Walmart, Target, Alibaba, Nvidia, Home Depot, and Lowe’s – have a total market capitalization of $1.8 trillion, so while the Apples and Microsofts of the world have already reported, now isn’t the time to tune off.

The world of offline retail has been dominated by two key names – Walmart and Target. The strength of these retailers has centered around a unique ability to build a powerful and sustainable brand relationship. And while the entire retail ecosystem took a hit during the pandemic, these giants included, the recovery has presented an opportunity to really compare the environments they operate in.