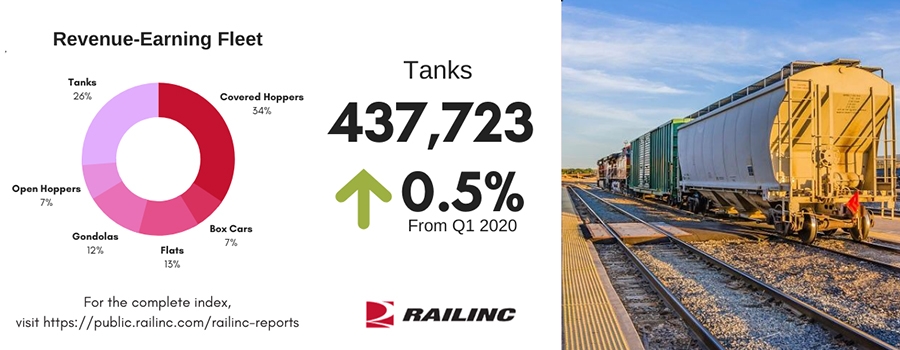

All but one car group decreased from the last quarter, the exception being Tanks, up 0.1 percent. Intermodal led declines, down 5.0 percent, followed by Hoppers, down 1.7 percent. Box Cars and Miscellaneous decreased 1.5 and 1.1 percent, respectively.

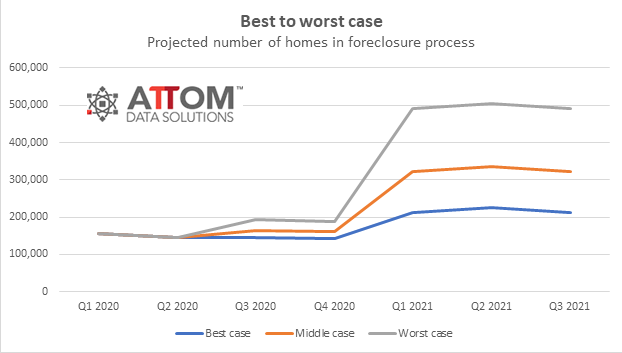

The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages – an offshoot of the worldwide Coronavirus pandemic that has cast a shadow over the nation’s eight-year housing market boom.

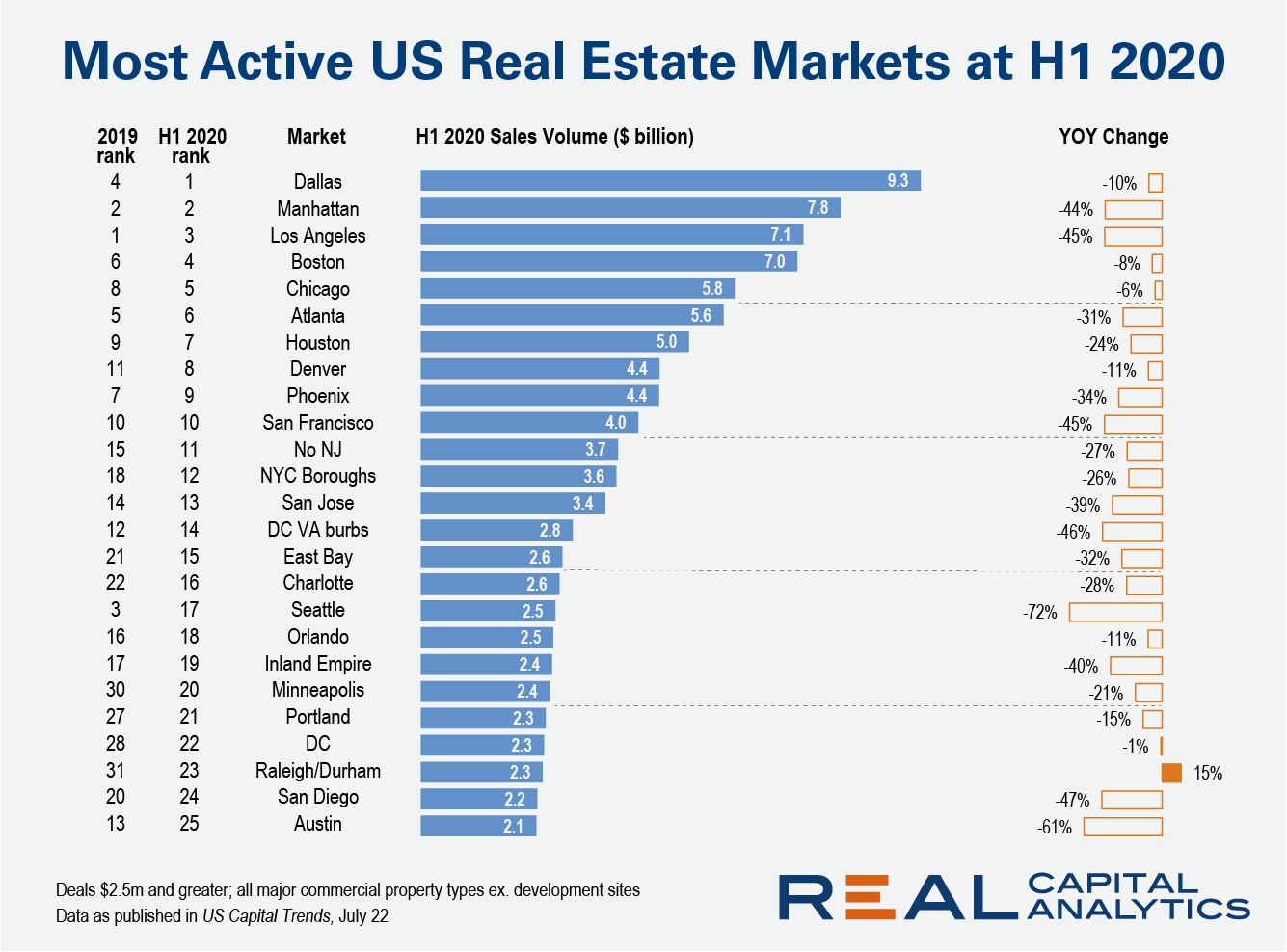

For the first time ever, Dallas ranked as the #1 U.S. commercial property market at the halfway mark of the year, despite a dip in investment activity. Dallas overtook Manhattan and Los Angeles, where sales activity fell by more than 40% compared to the first six months of 2019 as the Covid-19 crisis scuttled dealmaking and sidelined investors.

Problems in credit quality abound, yet few sectors are seeing deterioration like the US energy sector. Supplies remain elevated as demand remains lower, and the economy remains weakened as new COVID-19 cases surge throughout the country. So great is the strain for the sector that Deloitte projects up to $300 billion in write downs or impairments, and the list of bankruptcies is growing.

Looking at national rideshare trends, the gradual recovery of the industry is obvious. Both leading merchants have now regained about 25% of the ground they lost since their high points earlier in March. This slow but steady increase began mid-April and has continued since then, although spending from late June to early July showed a bit of a drop.

From the second week of February all four of the chains we analyzed saw a steep and prolonged fall in stock price through to the first week of April, when they began to rebound. Extended Stay America in particular has experienced a healthy share price recovery, with its stock back to only 10% below where it was in February, which is worse than S&P’s 0.9% gain but better than its competitors; Marriott’s share price is still 40% lower than it was pre-COVID and Hilton’s hovering around -30%.

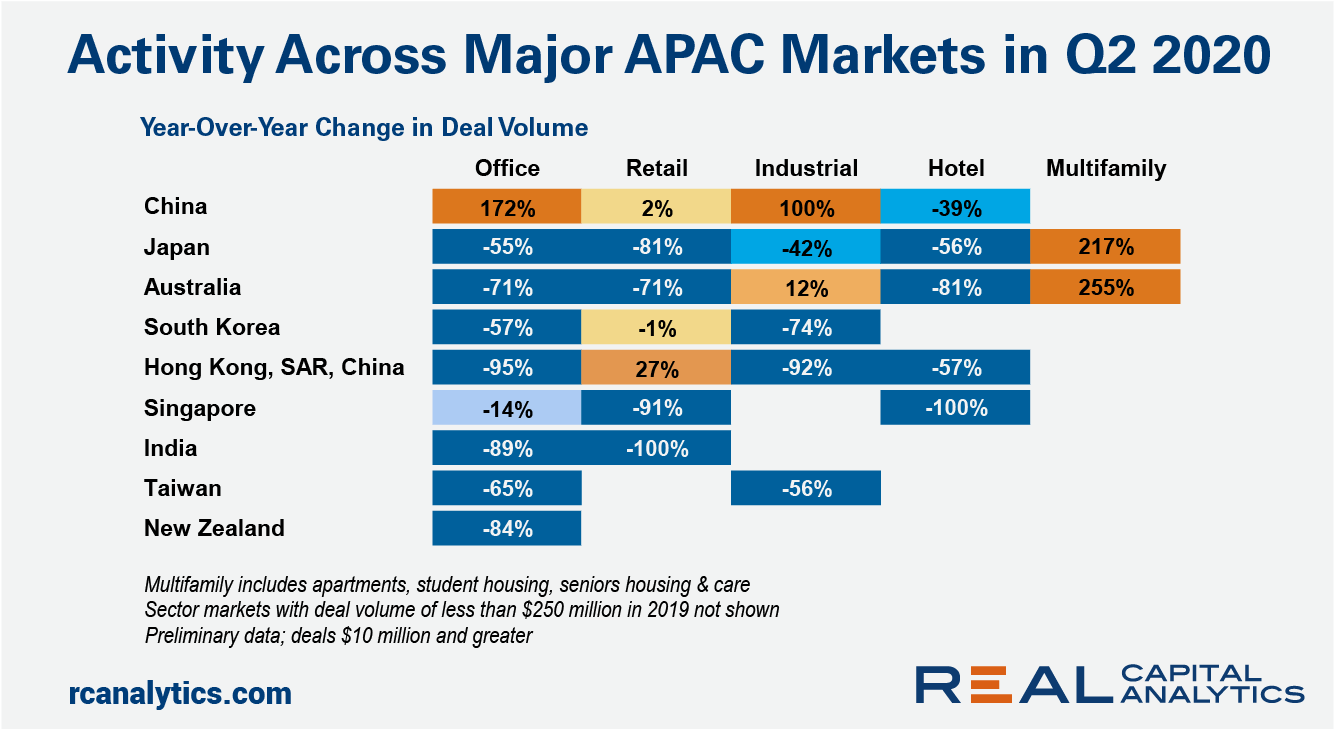

China’s commercial real estate market rebounded in the second quarter of 2020, while the worsening economic outlook took its toll on investment sentiment across the majority of sector-markets in the region. The demand for Chinese office skyscrapers leaped, with nine buildings priced over $250 million changing hands in the quarter.

The recovery of the UK’s Restaurants and Pubs sector continues to take longer than hoped, with Huq’s mobile geo-data showing that footfall across these businesses has slowed to just 25% of pre-lockdown levels in the last week. According to Huq’s Foodservice Index, Restaurants and Pubs in the UK saw a steady increase in footfall to around third of pre-lockdown levels following ‘Super Saturday’ on 4 July, however the trajectory of this recovery appears to have been short-lived.

It has become clear that the effects of the pandemic are far from behind us, and the economy does not appear on track for the quick V-shaped recovery that many had originally hoped for. While this economic weakness continues to be reflected in sluggish rent growth, our national rent index actually inched up slightly by 0.1 percent over the past month, the first monthly increase since the start of the pandemic. That said, year-over-year growth still stands at just 0.2 percent nationally, and many markets are continuing to see notable declines in prices.

“Unprecedented” is a word we’ve heard a lot over the past 5 months. It’s a term which very much applies to the airline industry. Never before have airlines had to adjust so rapidly and at such scale to a changing external environment.

Tensions have ratcheted up in recent days, as hackers reportedly linked to China have stolen data from an Australian defense contractor – a move which could be the catalyst of a further breakdown in relations between the two countries.

The recovery of Key Industrials across Europe appears to have plateaued in the last three weeks, as high-frequency geo-data shows that following a sharp rise at the end of June, footfall to manufacturing plants has held at around 65% of pre-lockdown levels. According to Huq’s ‘Key Industries Indicator’, which measures the number of employees attending workplaces across a range of sectors, Defence, Chemicals and Biotechnology continue to be the busiest in comparison to pre-lockdown levels (all around 65% in the last few days).

Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of these are companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment-Grade to “Junk” – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.

Last month’s swing from near-neutral credit quality to pronounced deterioration for UK Industrial companies continued for a second month in similar severity. The CCI for this month is 44, a very slight worsening from last month’s CCI of 44.4. Recent output figures indicated that industrial manufacturing and production in the UK improved from April to May against expectations.

In 2020, much of Russia has experienced higher precipitation than normal for the critical mid-May to mid-June period. These rainfed wheat production areas, both winter and spring wheat, rely on June rains to support Russia’s record wheat production (see FAO Crop Calendar). However, July 2020 rainfall has been lower than normal in southern Russia and this could adversely impact Spring Wheat production.

Home sellers nationwide realized a gain of $75,971 on the typical sale, up from the $66,500 in the first quarter of 2020 and from $65,250 in the second quarter of last year. The latest figure, based on median purchase and resale prices, marked yet another peak level of raw profits in the United States since the housing market began recovering from the Great Recession in 2012.

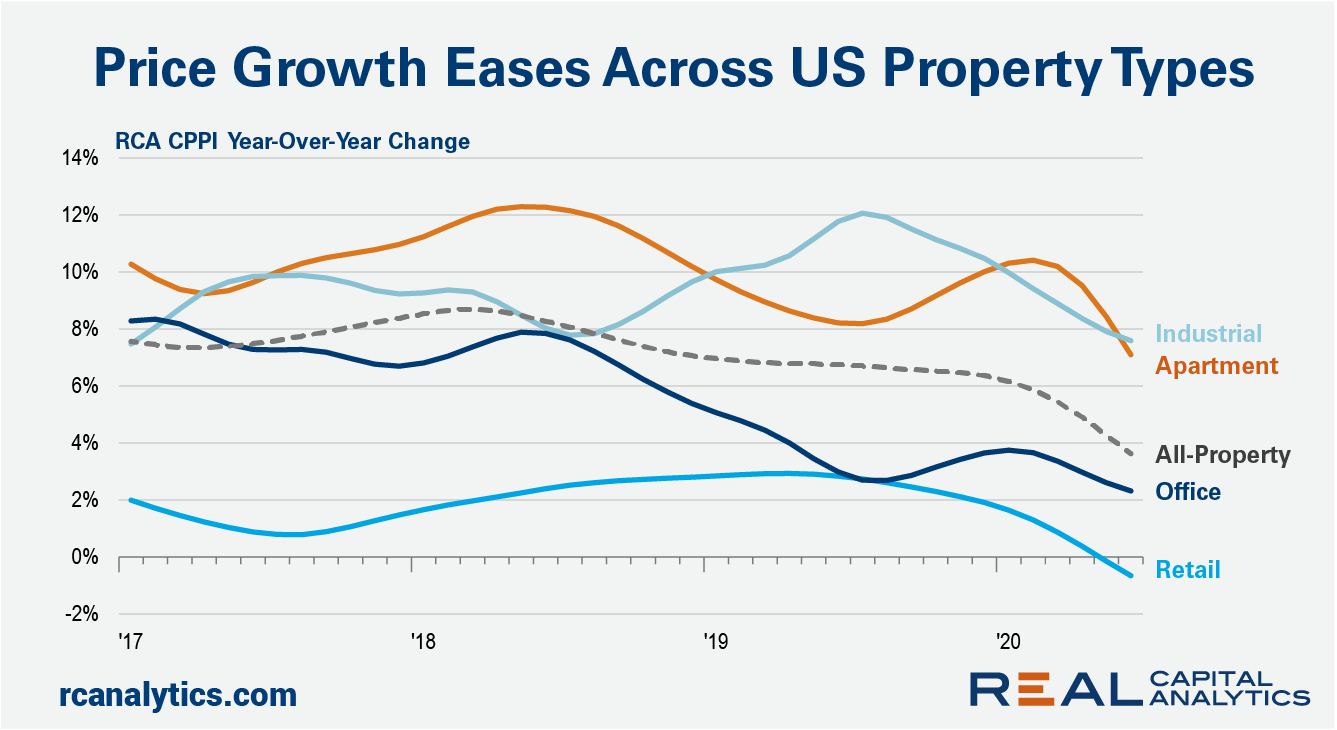

Commercial property price growth slowed in June across all U.S. property types, dragged down by the continued impact of the health and economic crisis. The US National All-Property Index was flat in June from May and gained just 3.6% year-over-year, the latest RCA CPPI summary report shows. Retail prices fared the worst of the sectors, dipping 0.3% from May and down 0.7% over the past year.

Earnest continues to monitor the consumer response to the resurgence of coronavirus cases across parts of the U.S. In this refresh, we take a look at spending and foot traffic in the first half of July across states and categories, and drill-down into Restaurant and Home categories in Florida and New York. Additionally, we provide a brief check-in on Amazon’s delayed Prime Day, and review how alcohol sales are performing in light of the resurgence.

The US faces a deep coronavirus crisis as new cases are surging to record highs in many states. Texas was one of the first states to reopen in May with restaurants, retail stores, malls and even theaters to allow to reopen at limited capacity. Looking at the mid-May data, the foot traffic in Texas at Advan’s consumer discretionary index was down about 35% compared to the pre-COVID era and kept increasing through mid-June, adding a 15% increase to -20%.

Kinsa’s data show that illness transmission accelerated in many states over the past few weeks, and this trend is now translating into growing COVID-19 cases in states like Louisiana, South Carolina and Tennessee. But two of the states that are on our watchlist – Pennsylvania and Michigan – have not yet seen significant growth in cases. Our data suggest that may be about to change.