Research late last year indicated that travelers’ accommodation preferences had been drastically impacted by the pandemic. However, there is now greater optimism for the eagerly awaited exit from the pandemic as vaccinations continue to expand and more parts of the world “reopen.” With more reason for optimism in the travel and tourism industry, we set out to examine if sentiment toward accommodation type had once again shifted.

A collective whip around amongst European-based airlines has raised the cash to buy a new set of light bulbs and the UK Government has finally run out of excuses; this week they will announce the easing of travel restrictions from the UK, or at least they should be.

Up until recently, cruises were the fastest-growing segment of the travel industry. But as the world closed its borders in response to COVID-19, the fallout created an elevated level of concern amongst the public surrounding the health and safety aboard cruise ships. As expected, there's been a significant financial impact for all cruise lines, making it challenging for these brands to attract travelers and thus result in closures.

As we move further into the spring, much of the U.S. continues to make solid progress toward reaching comparable demand levels from 2019. As a reminder, 2019 is being used as the recovery benchmark due to the heavy pandemic impact in 2020.

Hotel performance growth appears to be on hold when compared with the solid gains seen during the spring break period. In a week-over-week comparison, U.S. hotel occupancy was flat during 18-24 April at 57.3%. On a total-room-inventory (TRI) basis, which includes temporarily closed hotels, occupancy was 54.4%. Weekly room demand increased slightly and remained above 21 million for a sixth consecutive week.

Hotel food and beverage operations have radically changed in the wake of the pandemic. From breakfast buffets to banquet dinners, service has drastically altered to keep guests safe and as stopgap against weaker demand. Several of the adjustments made due to immediate needs are likely to remain in place for the foreseeable future, according to some F&B authorities.

Domestic airline capacity, and TSA volumes, a proxy for flight demand have increased significantly in the last few months and forward-looking airline capacity data is extremely positive; exciting times (at last) but what can we read in the schedules data and looking forward what is all of this likely to mean in the coming years. We’ve had a look at some key data points. In January 2020, surrounded by uncertainty, limited confidence in vaccine roll out programmes and Covid-19 infection rates, US airlines were naturally cautious but equally thinking positively about the first half of the year. In truth, the first quarter of 2021 was a damp squib, the second quarter looks a bit soft but better than Q1 with increasing confidence about the second half of the year.

The headline numbers suggest that global airline capacity has seen a slight recovery back to 61.9 million seats this week, a 1.2% increase. However, as the weekly airline capacity was being finalized further significant capacity cuts were yet to be supplied by many of the major Indian airlines and Fiji was about to enter a lockdown; the Fiji numbers are minor but India normally accounts for around 2.6 million seats so in truth global airline capacity is probably down week on week. Hopes for that airline capacity bounce we are all hoping for and subsequent release of pent-up demand remain some way off.

With international and business travel caught in the everchanging crossfire of quarantine rules and other COVID-19 restrictions, staycations became a significant driver of the occupancy gains that have emerged since the beginning of the pandemic. STR’s Tourism Consumer Insights team continues to keep a close eye on traveler and tourism trends as the industry moves through the most optimistic point of the pandemic. The twists and turns of the pandemic have contributed to seismic changes in tourism. In this latest installment of our Tourism After Lockdown blog series, we evaluate post-pandemic recovery scenarios for domestic and international leisure travel.

After an auspicious start to its performance recovery, Mumbai’s hotel industry appeared ready to continue setting the trend for urban markets in 2021. However, a second wave of COVID-19 cases has called a temporary halt to the market’s success. Fortunately, strong domestic demand and corporate confidence, the drivers behind the market’s earlier recovery in 2020, remain poised to push performance again once cases are under control. More recently, Mumbai welcomed back corporate travelers, which helped lift demand in the first quarter of 2021. An institutional quarantine requirement helped drive demand as well, as travelers arriving from or transiting through several major world regions were required to undergo a 10-day institutional quarantine.

A strong return of leisure travel has created much cause for celebration during the early months of 2021. In the U.S., hotel room demand in March was the country’s highest level recorded since the start of the pandemic. To fully recover, however, the industry needs both leisure and the various segments of business travel to return. To track evolving trends in the tourism and hospitality industry, and examine everchanging attitudes to travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel. In this latest installment of Tourism After Lockdown, we look at the potential recovery path of business travel. In this research, travelers primarily represented the United Kingdom, other countries in Europe, and North America. Sentiment about business travel was captured among those who had previously traveled for business pre-pandemic.

Travel between the UK and the Republic of Ireland has shown resilience over the course of the last year with levels 50pts greater than between the UK and all other countries, as high-frequency mobility data suggests that Brexit has had little impact on the volume of traffic since January 1st 2021. The Index reveals that travel to and from Ireland saw a sharp drop at the start of the pandemic, however, it quickly recovered to 80% of pre-pandemic levels and has since remained 50pts greater than that of journeys between the UK and the rest of the world.

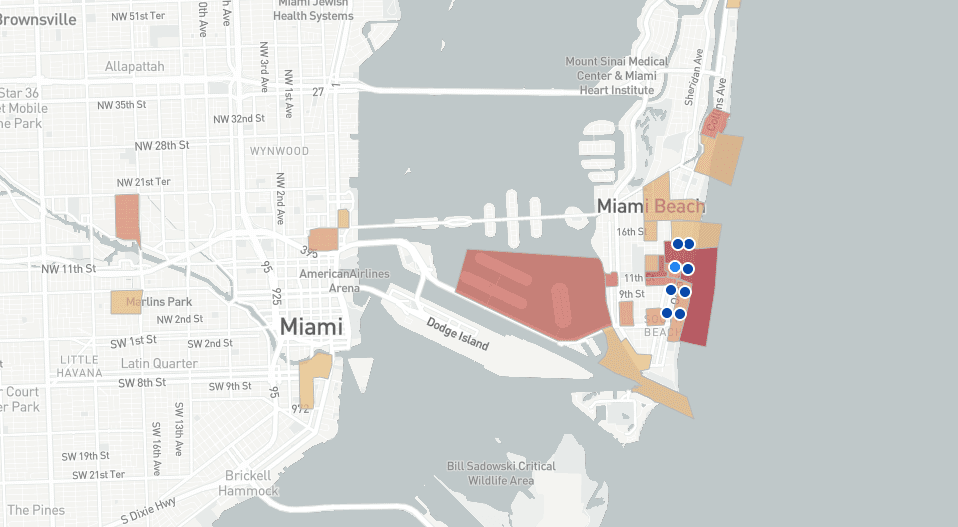

One year ago, the City of Miami Beach imposed a curfew to stop the spread of the Coronavirus. Fast forward to today, and City officials again imposed lockdowns at night – with Miami Beach City Manager Raul Aguila declaring a State of Emergency over building crowds in Miami Beach during Spring Break 2021. Visits increased to the Entertainment District over last year, yet largely moved in-tandem with last year’s trend. Yet by mid-March, visits to the Entertainment continued to surge far above last year’s count, with momentum, until a significant drop on March 21, a day after the Curfew order.

STR’s latest 51-chart demand map through 13 March 2021 shows that most states are moving closer to their levels from the same time last year. Unfortunately, those demand levels from comparable periods in 2020 were lowered substantially by the earliest pandemic lockdowns. A clear majority of states have made solid progress in shrinking the tremendous demand deficits that developed during the worst times of the pandemic. However, current bookings shortfalls from pre-pandemic times remain significant, particularly in a handful of states dominated by the largest urban markets.

Let’s begin today’s analysis and revelation with an encouraging quote from John F Kennedy: “When written in Chinese, the word crisis is composed of two characters — one represents danger, and the other represents opportunity.” Now that the tone has been set, we can reveal how some destinations are attracting longer stays as the prolonged pandemic discourages people from returning home to work from their gloomy homes. Why would you when sparkling Belize and the Canary Islands are on offer?

One year after the initial lockdowns and stay at home orders across the groble, Americans are now driving a lot more, as measured by our miles driven index. More specifically, the last three weeks Advan’s miles driven index captured an increase in traffic as high as 40% nationwide compared to the pre-pandemic levels in February 2020. As the vaccines are being rolled out people’s confidence is picking up and in combination with certain COVID-related restrictions being lifted and the advent of Spring and Spring breaks, everyone seems to be making up for lost travel.

Another one million additional seats added back week-on-week, carry on at this rate and capacity will be back to pre-pandemic levels by this time next year; if only it was that simple. Whilst the recent pattern of capacity growth is positive, new spikes of COVID in Eastern Europe and particularly Lower South America continue to cause concern whilst Japan’s airlines have announced capacity cuts of over 30% for April across their domestic networks.

Hotels in the Middle East have shown resilience throughout the pandemic, with performance at higher levels compared to other parts of the world. Those higher levels have been highlighted by the region’s key markets. Dubai was virtually the only tourist destination open for international leisure travel, while Abu Dhabi hosted the International Defense Exhibition (IDEX) in person in late February 2021 with zero quarantine requirements for international arrivals.

Optimism continues to build in the recovery with weekly capacity increasing once again week-on-week with some 57.9 million seats or nearly 58 million planned over the next seven days as the Summer Season is now only two weeks away. It may only be a 1.4% increase on last week’s capacity and we remain at 54% of pre COVID capacity levels but a steady climb in the right direction appears underway. In March some 19,502 unique airport pairs will be operated by the 407,500 scheduled flights delivering an average frequency of 25 flights per route; it’s amazing what trivia numbers can produce!

Relying on quantitively calculated, real-time air ticketing data, this week we reveal Russia as a travel market worth investing in. In 2020, there was a rise in demand for domestic travel and some markets even recovered to 2019 levels.