The twists and turns of the COVID-19 pandemic have contributed to seismic changes in tourism, which has included the cessation of international travel for some countries. As a whole, we have witnessed long-lasting shifts in consumer behavior and attitudes, producing an increase in active travel, soaring levels of e-commerce and, yes, even ballooning rates of pet ownership.

Mainland China hotel performance is steaming, while occupancy in the Asia Pacific region (excluding Mainland China) presents low occupancy levels overall. U.S. occupancy has remained mostly flat in recent weeks even with a lift from post-natural disaster demand. Recovery in Europe, Australia and New Zealand is also flattening.

Covid-19 and its influence on government decisions regarding its national borders, airports, and flights have dented the once strong international tourism sector. International arrival numbers are down by -94% worldwide with Asia seeing the dip at -97.4% – the hardest-hit region is clearly heavily reliant on air travel as the main source of tourism. However, the recent resurgence of the domestic market in Asia suddenly paints the future for hoteliers, tour operators, duty-free stores, and airlines with some promising colours.

When examining the top five most booked destinations in the Caribbean over summer, we noticed that the same countries also are faring best in terms of forward-bookings and flight searches too. The lucky five are the US Virgin Islands, the Dominican Republic, Aruba, Puerto Rico, and Jamaica.

Throughout 2020 scheduled airlines have been looking for glimmers of hope in a recovery, but it looks like the last hope of the year Thanksgiving will be memorable this year for all the wrong reasons. The summer season saw a small spike in demand and then a rapid settling back to the new normal demand levels; labour day showed a similar pattern and the end of year holiday currently looks like being worse than both of those events.

In the week that Qantas introduced flights to nowhere that sold out in ten minutes it is perhaps no surprise that scheduled airline capacity also went nowhere significant in the last week. Although we have slipped below the 57 million weekly seat market to 56.9 million, week on week capacity is only down by some 98,000 seats which seems like a small victory given that this is the seventh consecutive week of declines. Maybe there is a future in flying to nowhere.

How does Europe compare to other regions in the recovery cycle? China hit a 69.4% occupancy level on 18 August, the highest level during the time of the pandemic. Since that date, however, China has started to fall back a bit. During the first weekend of September (4-6 September), the market posted 57.6%, 57.5% and 57.9% occupancy levels, respectively.

Overall, Envestnet | Yodlee COVID-19 Income and Spending trends data shows that consumer spending in the summer resort category has recovered since bottoming out in April 2020. For this analysis, we looked at spending in resort towns during summer to see if the pandemic affected areas that would usually be bustling during vacation months. In our analysis, we took a closer look at U.S. towns like Truckee, California; Aspen, Colorado; Jackson Hole, Wyoming; and others.

London’s accommodation sector has recovered at around half the pace of the rest of the UK, as mobile data suggests a lack of international tourists and subdued domestic demand for city breaks is causing a continued challenge for the capital’s hoteliers.

The first full week of September capacity follows the recent trend and we are now into the fifth consecutive week of capacity declines from what looks like the peak capacity week of the 3rd August. Project the current trend forward to the year end and global capacity will fall below 40 million in the last week of December; that will not be a happy Christmas for the airline industry. The last full week of December 2019 saw some 106.8 million scheduled seats, so we appear to be heading for less than half of global capacity by year end.

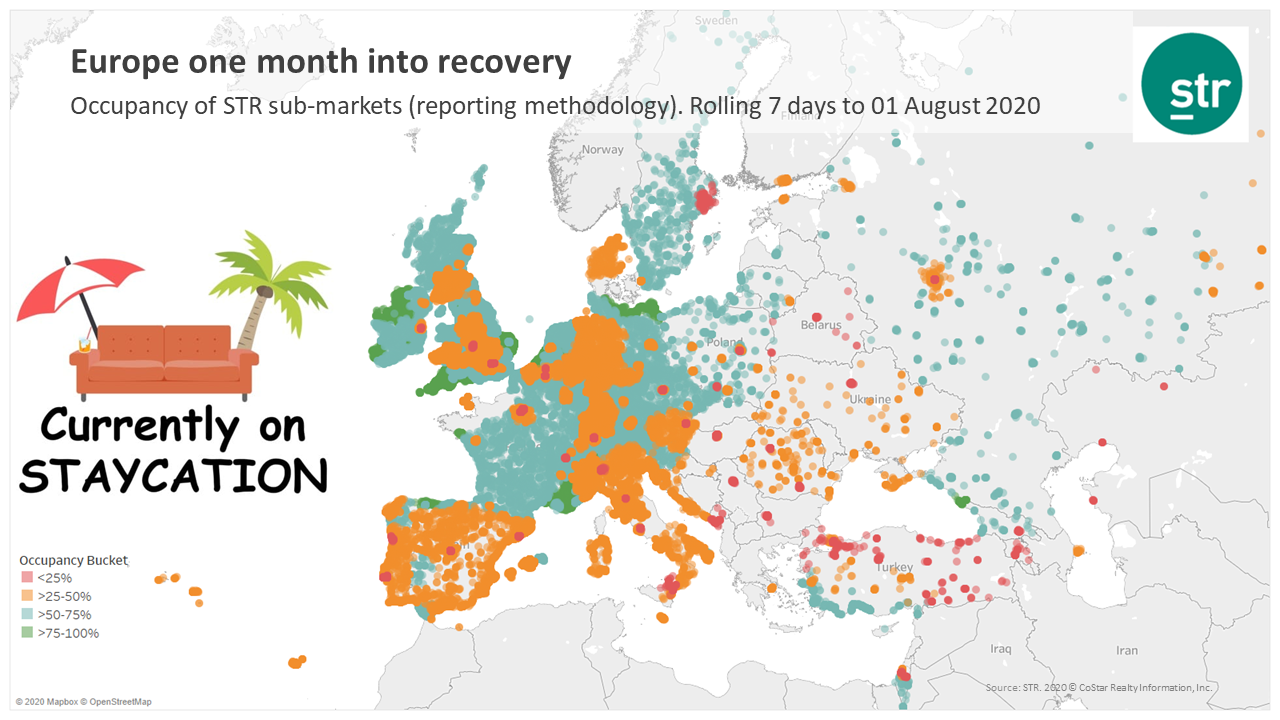

While Germany boasts the most open hotels in Europe, U.K. hotels are opening the fastest having started July with 70% of hotels closed and ending the month at just 20% hotels closed. European hotel occupancy is significantly healthier moving into August, with coastal markets in many countries experiencing the strongest recovery.

Airbnb, which now offers over six million places to stay in the world, is showing a strong rebound in the United States. According to Airbnb accommodation booking data from Airbtics, prior to the coronavirus pandemic the average US state was experiencing a strong weekly booking of 116% YoY.

July and August are two of Europe’s most important months for hotels with travellers spread across the continent on summer holidays. However, it is no secret that summer looks much different this time around for Europe due to the global impact of the COVID-19 pandemic. Occupancy (for reporting hotels) for the week ending with 18 July shows that most European countries are somewhere between 20-40% in occupancy.

From the second week of February all four of the chains we analyzed saw a steep and prolonged fall in stock price through to the first week of April, when they began to rebound. Extended Stay America in particular has experienced a healthy share price recovery, with its stock back to only 10% below where it was in February, which is worse than S&P’s 0.9% gain but better than its competitors; Marriott’s share price is still 40% lower than it was pre-COVID and Hilton’s hovering around -30%.

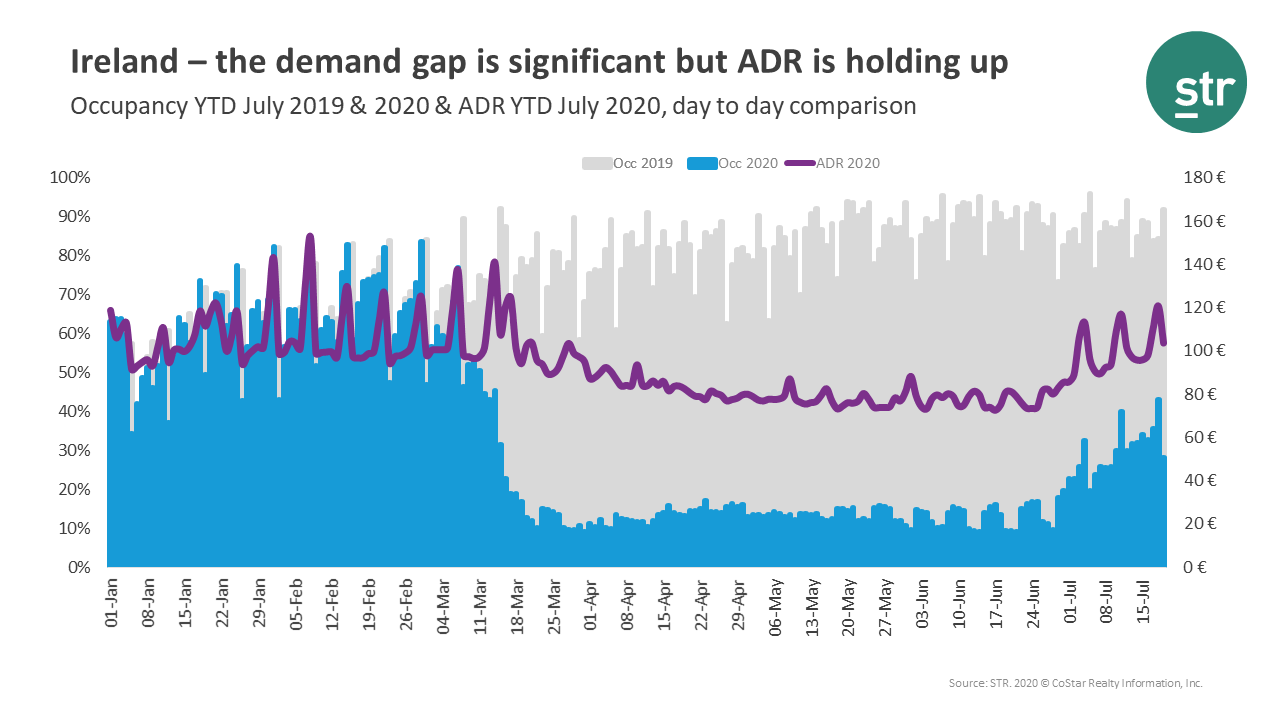

While ADR has declined since the end of 2019, the decline is modest compared to Ireland’s significant demand loss over the same period. Peaks in rate over the past few weeks indicate healthy weekend leisure travel.

“Unprecedented” is a word we’ve heard a lot over the past 5 months. It’s a term which very much applies to the airline industry. Never before have airlines had to adjust so rapidly and at such scale to a changing external environment.

Footfall to Italy’s Restaurants, Cafes and Hotels has risen exponentially since the end of June, with levels now double what they were in January as seasonal trade appears to be returning. According to Huq’s ‘Key Industries’ Indicator, Italy’s hospitality’s sector has seen the fastest rate of recovery in Europe and it was the first country to see the recovery rate of footfall to restaurants and cafes rise above that of supermarkets.

It’s fair to say we could all use a change of scenery right now. Over the last few weeks, we keep hearing about the mundane vacation. Friends and colleagues have been renting or borrowing houses for a week or two if only to answer email and video conference from a different couch, cook from a different kitchen, visit a different grocery store, and hike a new trail. These places are relatively close by – only a road trip away.

In today’s Financial Times, European Economics reporter Valentina Romei and Data Visualisation journalist John Burn-Murdoch reveal how an overall plateau in economic activity points to headwinds for the region. Among other datasources including Google, OpenTable and Refinitiv, the FT uses data from Huq’s European Travel Monitor to reflect how international travel across ten countries is recovering from the effects of Covid-19.

Following the lifting of restrictions both domestically and for visitors from overseas, holiday favourites Spain and Italy have recovered 87% and 78% of 2019 levels respectively. Greece meanwhile is flat through June-July at around -150% of year-on-year levels. To provide additional context, the UK stands at just 22% of of latest year’s equivalent value while throughout lockdown Sweden experienced an average maximum drop to around 55% of year-on-year levels, and is now above or inline with 2019 at 105%.