The recovery of the UK’s Restaurants and Pubs sector continues to take longer than hoped, with Huq’s mobile geo-data showing that footfall across these businesses has slowed to just 25% of pre-lockdown levels in the last week. According to Huq’s Foodservice Index, Restaurants and Pubs in the UK saw a steady increase in footfall to around third of pre-lockdown levels following ‘Super Saturday’ on 4 July, however the trajectory of this recovery appears to have been short-lived.

It has become clear that the effects of the pandemic are far from behind us, and the economy does not appear on track for the quick V-shaped recovery that many had originally hoped for. While this economic weakness continues to be reflected in sluggish rent growth, our national rent index actually inched up slightly by 0.1 percent over the past month, the first monthly increase since the start of the pandemic. That said, year-over-year growth still stands at just 0.2 percent nationally, and many markets are continuing to see notable declines in prices.

Sprouts was a brand in the midst of a very strong run heading into 2020. Between 2018 and 2019, the brand saw visitor growth of 3.2% and 2020 kicked off with small, but respectable year- over-year visit increases of 0.2%, 3.5%, and 2.1% for January, February, and March respectively.

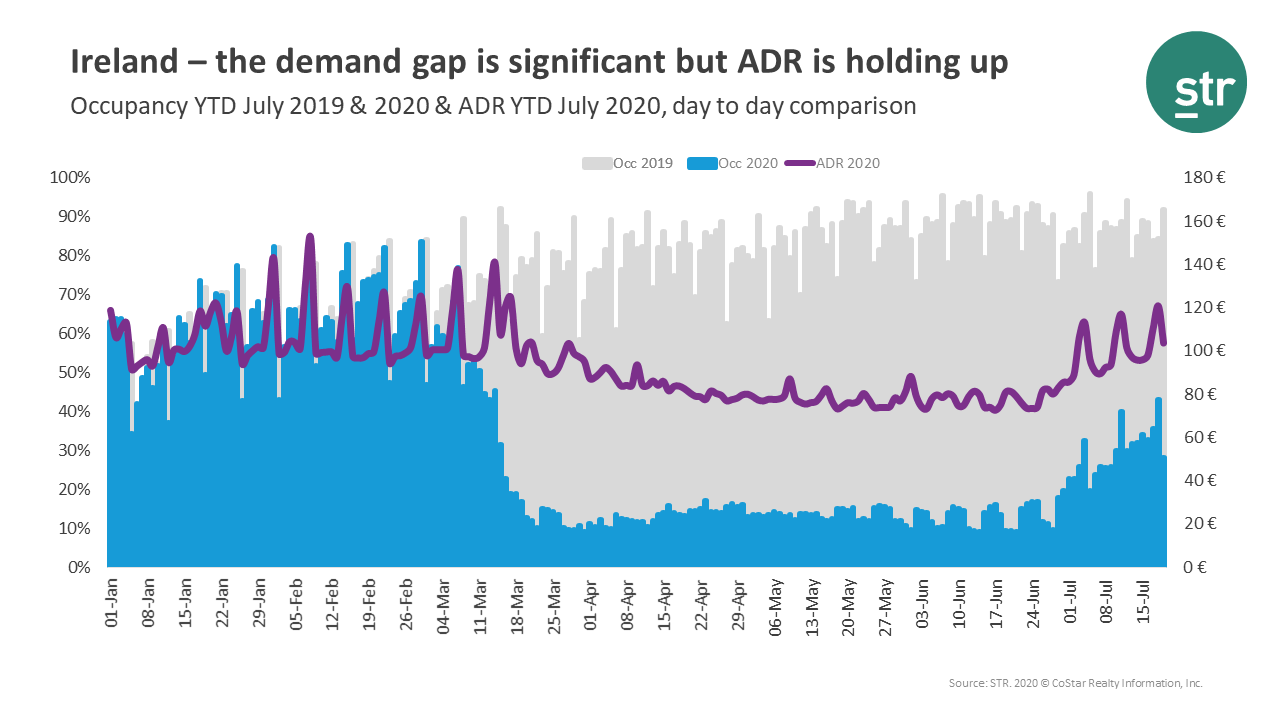

While ADR has declined since the end of 2019, the decline is modest compared to Ireland’s significant demand loss over the same period. Peaks in rate over the past few weeks indicate healthy weekend leisure travel.

“Unprecedented” is a word we’ve heard a lot over the past 5 months. It’s a term which very much applies to the airline industry. Never before have airlines had to adjust so rapidly and at such scale to a changing external environment.

Tensions have ratcheted up in recent days, as hackers reportedly linked to China have stolen data from an Australian defense contractor – a move which could be the catalyst of a further breakdown in relations between the two countries.

In this Placer Bytes we take a bite out of McDonald’s, dive into the data surrounding Yum! Brands and check in on The Cheesecake Factory. One of the top QSR players, McDonald’s had a strong start to 2020. Monthly traffic for the brand was up year-over-year 7.9% and 13.4% for January and February respectively.

XR hardware and consumer software revenue is now projected to reach $6.9B in 2020, up from a prior estimate of $6.3B. Popular VR headsets were hard to come by in Q2 as COVID-19 disrupted supply chains just as consumer demand for in-home entertainment rose. Continued strong demand, combined with new headsets launching in the second half of the year like the HP Reverb G2, mean VR hardware earnings are expected to generate $2.5B in 2020 and rise slightly year-over-year.

The recovery of Key Industrials across Europe appears to have plateaued in the last three weeks, as high-frequency geo-data shows that following a sharp rise at the end of June, footfall to manufacturing plants has held at around 65% of pre-lockdown levels. According to Huq’s ‘Key Industries Indicator’, which measures the number of employees attending workplaces across a range of sectors, Defence, Chemicals and Biotechnology continue to be the busiest in comparison to pre-lockdown levels (all around 65% in the last few days).

Domestic travel hit its lowest COVID levels in mid-April. As people came out from their homes, local exploration was on the rise. Now, with the recent surge in COVID cases, time spent traveling is dropping once again. Here we share how this turbulent ride is impacting travel advertising.

In the upcoming week, an estimated 890 public companies will report their 2Q performance. While next week will have even a larger number of companies reporting, the world’s leading companies – including Apple, Amazon, Alphabet, and Facebook – will be reporting this week. As always, we’ve prepared digital insights on the companies that are reporting. This week, we have earnings insights on Apple, Paypal, Spotify, Shopify, Expedia, and Next UK. Keep in mind that all the data below is desktop data only.

Specialty outdoor retailers are showing strong recovery amidst slower growth in the retail sector. In spite of national park restrictions and summer camp closures due to COVID-19, the second quarter of 2020 saw year-over-year sales growth skyrocket for fishing, hunting, and boating companies, as U.S. consumers sought safer ways to enjoy their free time.

Footfall to Italy’s Restaurants, Cafes and Hotels has risen exponentially since the end of June, with levels now double what they were in January as seasonal trade appears to be returning. According to Huq’s ‘Key Industries’ Indicator, Italy’s hospitality’s sector has seen the fastest rate of recovery in Europe and it was the first country to see the recovery rate of footfall to restaurants and cafes rise above that of supermarkets.

It’s fair to say we could all use a change of scenery right now. Over the last few weeks, we keep hearing about the mundane vacation. Friends and colleagues have been renting or borrowing houses for a week or two if only to answer email and video conference from a different couch, cook from a different kitchen, visit a different grocery store, and hike a new trail. These places are relatively close by – only a road trip away.

Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of these are companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment-Grade to “Junk” – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.

Last month’s swing from near-neutral credit quality to pronounced deterioration for UK Industrial companies continued for a second month in similar severity. The CCI for this month is 44, a very slight worsening from last month’s CCI of 44.4. Recent output figures indicated that industrial manufacturing and production in the UK improved from April to May against expectations.

In 2020, much of Russia has experienced higher precipitation than normal for the critical mid-May to mid-June period. These rainfed wheat production areas, both winter and spring wheat, rely on June rains to support Russia’s record wheat production (see FAO Crop Calendar). However, July 2020 rainfall has been lower than normal in southern Russia and this could adversely impact Spring Wheat production.

Starbucks and Dunkin’ Donuts are two of the most well-known and well-loved brands in the country. And while they were hit hard by the pandemic, recovery is underway for both. The shutdown meant more than closed stores and work from home, it represented a fundamental shift in the normal patterns of behavior for most people in the country.

Home sellers nationwide realized a gain of $75,971 on the typical sale, up from the $66,500 in the first quarter of 2020 and from $65,250 in the second quarter of last year. The latest figure, based on median purchase and resale prices, marked yet another peak level of raw profits in the United States since the housing market began recovering from the Great Recession in 2012.

As the presidential campaign ramps up, there has been discussion about how different social platforms are managing political ads. After the 2016 election, there is a lot of debate surrounding the role of social media in free speech, fact checking and its role in democracy. Each social platform has a different stance. Here’s the latest.