Navigating companies through mergers and acquisitions is a challenging task, and managing the transition process requires thorough consideration. Our previous research on mergers and acquisitions found that the geographic and role diversity of merged companies predicts future stock performance. Beyond financial metrics, it is equally important to evaluate employee sentiment and hear what they have to say about acquisitions. This week, we analyze employee sentiment in acquired companies using data from over 25,000 acquisitions between 2010 and 2020.

The past few years have seen Ulta Beauty exceeding all expectations, even as economic headwinds impacted many retail categories. The company has shown an ability to withstand the dual pressures of a pandemic and inflationary concerns, highlighting the broad appeal of beauty and self-care. With the first few weeks of 2023 behind us, we take a closer look at 2022's performance and see how the brand is faring into 2023.

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, advanced 1.9% in February to 203.0 (2000=100) from the revised January reading of 199.3. In February, the commercial component of the DMI rose 1.4%, and the institutional component increased 2.9%. “The Dodge Momentum Index returned to growth in February after falling 9% last month,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “The continued elevation in the DMI should provide hope that construction activity will grow in 2024. Owners and developers tend to put projects into planning until well after economic conditions weaken.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through January 2023 with forecasts through January 2024. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

Amid a highly-anticipated earnings season for retailers, off-price chain Burlington (NYSE: BURL) reported earnings that beat investors’ expectations in the fourth quarter of 2022. Ahead of Burlington’s holiday quarter earnings announcement, Bloomberg Second Measure transaction data projected $2.78 billion in revenue—within two percent of Burlington’s reported revenue—while the mean consensus estimate was more than 5 percent lower than reported revenue, at $2.60 billion.

Impressively, especially considering the wider economic context, mall visits have been consistently tracking closely to year-over-year (YoY) levels for months. Yet, our January mall update showed YoY growth for the first time since July of 2022 – a potentially very strong sign to kick off the year. However, the comparison to an Omicron affected January in 2022 set up a far easier comparison than other months, putting an added importance on February performance to gauge the true state of the mall recovery.

For homebuyers, affordability, job opportunities and outdoor amenities are major driving factors for relocation. Our previous analysis showed that homebuyers who relocated to another metro in recent years often chose metros adjacent to their current location and/or had a lower cost of living. Although homebuyers were weighing these considerations before COVID-19, the migration rate to cities featuring these factors grew during the pandemic. With the combination of low for-sale inventory, low interest rates and a shift to a more flexible working environment, more people moved out of expensive metros in search of affordability, outdoor amenities and warmer weather.

The share of single-family home purchases made by investors\[1\] held steady in the fourth quarter of 2022. After falling to 21% in June of last year, the share of investor purchases rose to 26% in September and has remained about the same since. Figure 1 shows that the investor share plateaued in the fourth quarter of last year at around 2 percentage points lower than its high of 28% in February 2022; however, this is still much higher than at any time pre-pandemic.

The sportswear and sporting goods market experienced a boost during the early stages of the pandemic as fitness moved offline and people stocked up on home equipment. And though offline fitness has rebounded following its COVID-induced slump, the sports retail segment continues to grow. With 2023 already underway, we look at the changes in visits to two of the biggest names in the segment – DICK's Sporting Goods and Hibbett Sports – to see how these brands performed in 2022 and what we should expect from the category this year.

In 2022, high inflation impacted sales trends across various retail sectors in the U.S.—from big-box stores and discount chains to grocery companies. While inflation began easing in mid-2022, food prices have remained elevated throughout 2022 and into 2023. Amid rising food prices, discount grocery chain Grocery Outlet (NASDAQ: GO) saw its sales in the first two months of 2023 grow more than in comparable periods of 2021 and 2022, Bloomberg Second Measure transaction data shows. Apart from food price hikes, another possible factor behind the company’s sales growth is expansion into new markets. Additionally, our data shows growth in average transaction values, possibly due to a shift towards shopping for value.

As spring break season approaches, tracking school calendar data becomes critical for predicting travel demand across the U.S. The swings from one academic year to another can generate substantial waves in hotel performance, since vacation scheduling directly impacts over 50 million public K-12 students across the country, not to mention their families.

Through the first 26 days of the tax filing season, the average refund size is down 7% YoY to $2,377 in Earnest Analytics’ IRS Payments dashboard, in-line with reported figures**. The IRS began accepting and processing tax returns on January 23, 2023 and Americans have until April 18, 2023 to file. As the tax season kicked off, the IRS warned taxpayers should expect smaller refunds in 2023 relative to 2022 due tax law changes such as the elimination of the Advance Child Tax Credit and Recovery Rebate credit to claim pandemic stimulus payments.

STR’s global “bubble chart” updated through 17 February 2023 showed generally strong performance to kickstart the year. Among all countries with room supply of more than 50,000 rooms, Israel, Switzerland, Singapore, France and the United Arab Emirates led in revenue per available room (RevPAR) on an actual basis. If you recall, Israel, Switzerland and Singapore were among the top five in RevPAR during 2022 and that strength has continued early 2023.

When a company posts a job opening, how long does it take for them to fill it? When a worker loses their job, how quickly do they find another? These questions get at the same underlying relationship between available jobs and the workers able to take them—which is often called the “tightness” of the labor market. The longer it takes for employers to fill positions, the tighter the labor market. Average time-to-fill across the US economy dropped in the pandemic, then surged to a new high, where it persists now.

The car wash category has seen significant visit growth in recent years, outperforming the pre-pandemic era. Visits accelerated in 2021 as consumers pulled out of COVID restrictions with stimulus dollars in hand, eager to head out on the highways. And in 2022, back-to-the-office trends and pent-up demand for going out caused car wash traffic to reach new heights. We dove into the visit metrics in the car wash category to take a closer look at the trends driving strong foot traffic and assess where the space is headed in 2023.

This week, MediaRadar reviewed advertising from the week of February 6, 2023, and compared it to ads that ran the week of January 30, 2023. On March 1, 2023, MediaRadar will share a monthly advertising index. Automotive advertisers increased over 140% WoW to $175mm+ invested. This occurs after three consecutive weeks of ad spend declining. Automotive models were 91% of the total spend and spiked over 125% WoW.

As forecasted, Phoenix’s hotel industry ranked second all-time among Super Bowl host markets in average daily rate (ADR) and revenue per available room (RevPAR) during the weekend of the big game. While the market’s rankings were as forecasted, the values that produced that status were different than projected. ADR ($538) and RevPAR ($468) beat forecasts, while occupancy (86.9%) was lower. When adjusting for inflation (real), Phoenix’s ADR and RevPAR were easily all-time highs for the market.

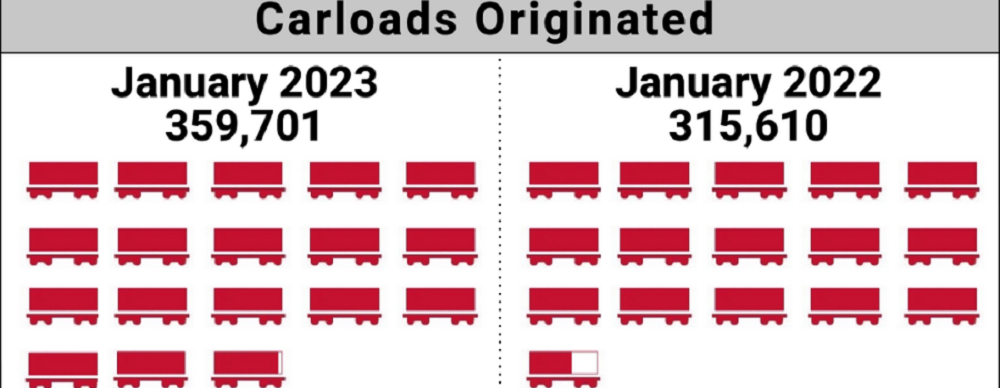

The number of carloads moved on short line and regional railroads in January 2023 was up compared to January 2022. Carloads originated increased 14 percent, from 315,610 in January 2022 to 359,701 in January 2023. Coal led gains with a 47.3 percent increase. Crushed Stone, Sand and Gravel and Nonmetallic Minerals were also up significantly, increasing 33.6 percent and 31.8 percent, respectively.

Last week, the retail world woke up to the news that Tuesday Morning – the discount home goods brand – had filed for bankruptcy for the second time in the company’s history. Tuesday Morning’s first bankruptcy filing in 2020 – a result of the challenges of operating during a pandemic – led to the permanent closure of roughly a third of the brand’s locations.

On February 22, 2023, The TJX Companies (NYSE: TJX) announced that its revenue for the fiscal quarter ending on January 28, 2023 (FY23 Q4) was $14.52 billion, a 5 percent increase from the previous year. The report, which was the first among major off-price retailers during the first earnings season of 2023, exceeded analysts’ revenue expectations.