Customers visiting foodservice outlets in the UK rose to almost 60% of pre-lockdown levels in the last two weeks, as the government’s ‘Eat Out to Help Out’ scheme proves its worth by luring customers back into restaurants and pubs. Huq’s Restaurants & Pubs Index shows that since the scheme launched on 3 August, visits to restaurants have increased rapidly – climbing from 38pts to 55pts (a 44% increase).

Total construction starts fell 7% in July to a seasonally adjusted annual rate of $631.6 billion. The decline was due to a significant pullback in the nonbuilding segment, which fell 31% from June to July. Nonresidential building starts rose 3% while residential building starts increased 2%. Year-to-date through seven months, starts were 15% down from the same period in 2019.

For millennials, first-time homebuyers (FTHBs), and down-sizing baby boomers, condos can be the most reasonable option when buying a property. Their values and lifestyle drive them toward buying condos because they tend to be more affordable than single-family homes and because condos typically come with a lower maintenance burden and are mostly located in urban cores.

Early on in the pandemic, many industries slashed advertising spend due to uncertainty and hurting sales numbers. As the initial shock softened and sales began to return, so did the advertising dollars. While not all consumer industries have recovered, these three sectors are increasing their advertising spending.

One aspect of the new environment for multifamily that has become apparent over the last few months is that new supply is likely to act as a headwind for market performance as we move through 2020 and into early 2021. Apartment demand through July was half that of the same period last year, and 50,000 less units were absorbed than added in the first seven months of the year.

Even five months into the pandemic, many industries are still experiencing the effects of COVID-19. However, U.S. housing activity has notably pushed past the early turmoil it experienced. After several months of hesitation, housing indicators are beginning to show growth once again.

Office workers in the US and UK have been among the most reluctant of nations to return to working from their offices, as Huq’s geo-data reveals office attendance across these two countries has yet to surpass 20% of what it was prior to the pandemic. This slow progress in office attendance stands in contrast to other countries in Europe, where both France and Spain for example have seen significantly more office attendance over the last month.

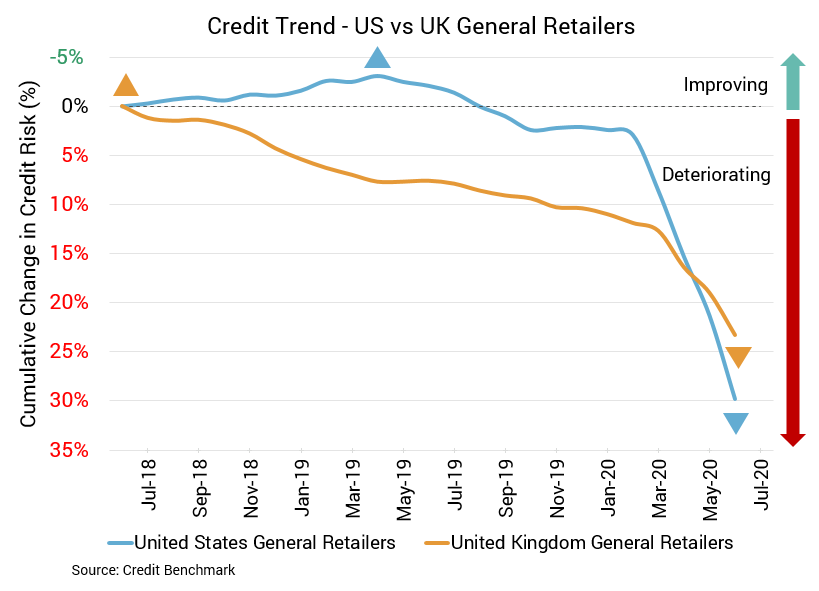

Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by.

Yesterday, August 13, the Zillow ($ZG) app achieved its highest number of daily active users (DAU) in its lifetime with 2.17 million. The app also saw a record number of app sessions (just under 6 million), and its daily downloads were the highest they've been since 2017 (about 54,000). This comes just after Zillow reported an impressive Q2 and exceeded earnings expectations.

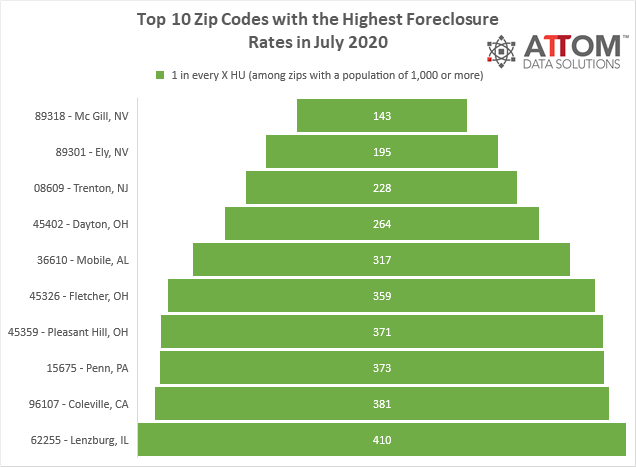

ATTOM Data Solutions’ newly released July 2020 U.S. Foreclosure Market Report shows that U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — are continuing a downward trend amid the Coronavirus pandemic, with 8,892 filings reported in July 2020. According to ATTOM’s latest foreclosure activity report, foreclosure filings in July 2020 are down four percent from June 2020 and 83 percent from July 2019.

In more ways than have yet to be realized, the novel coronavirus (COVID-19) pandemic has changed the day-to-day lives of nearly every consumer the world over. This is especially true for office workers with traditional nine-to-five day jobs, where in-person meetings were the standard and the dress code called for something more formal than leisurewear.

Even staple categories like grocery are facing upheaval as COVID-19 continues to impact U.S. consumer spending. While grocers themselves have seen some shifts in spending behavior, the largest change has taken place among delivery services, which saw sales increase 146 percent year-over-year.

There were a total of 8,892 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in July 2020, down four percent from a month ago and 83 percent from a year ago. “Even as mortgage delinquency rates climb, foreclosure activity continues to be artificially low due to moratoria put in place by the Federal and State governments,”

In March and April, the home improvement sector was already showing a unique potential for a post-pandemic surge. The brands were enjoying a “lightning in a bottle” moment where essential retail status, home quarantines and an unstable economy were making their offering as valuable as possible. Yet, even for those that saw promise for the sector, the growth has been surprisingly strong and is lasting far longer than anyone could have hoped for.

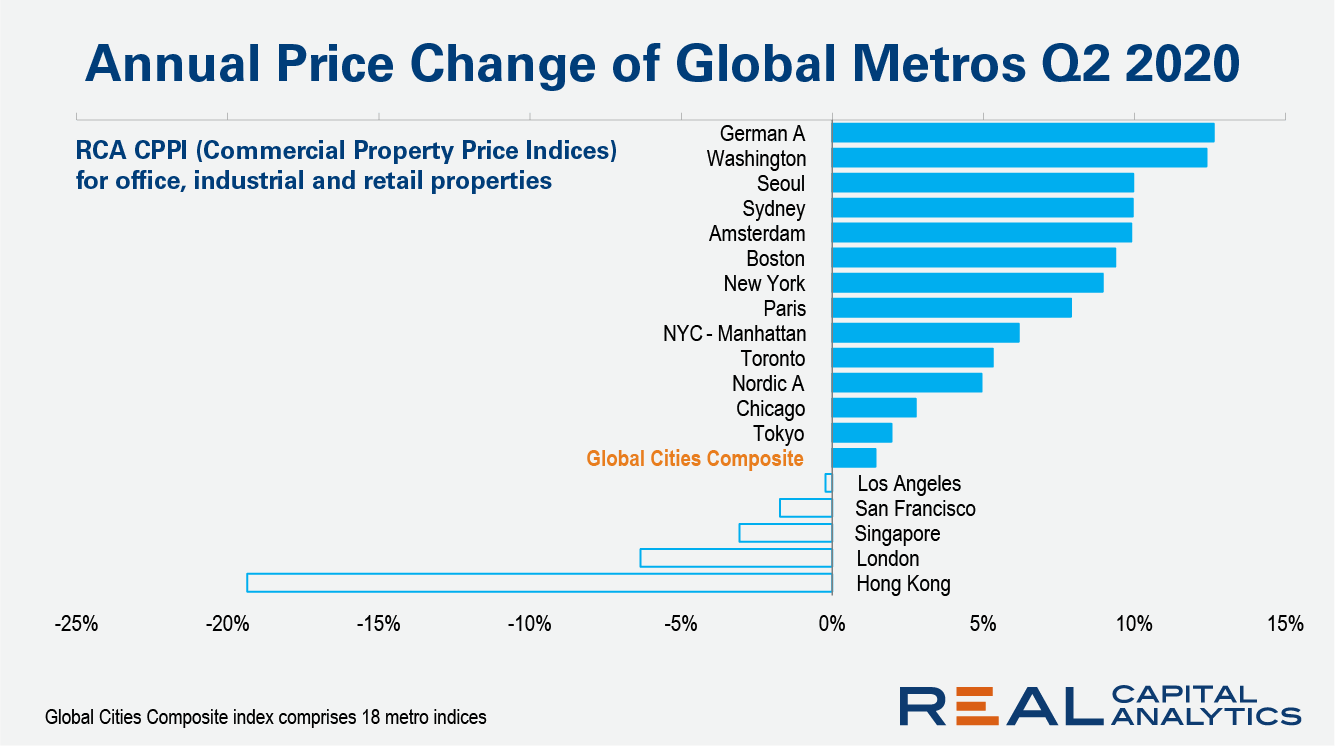

Eight of the 18 indices in the Global Cities Composite Index posted decreasing prices over the last quarter and of those cities, five posted declining returns over the year, as seen in the latest RCA CPPI Global Cities report. The Global Cities Composite Index slowed in the second quarter to 1.4% year-over-year as the effects of the global pandemic brought real estate transactions to a halt.

At the beginning of 2020, B2B print publications received less advertising dollars than the previous year. COVID-19 only accelerated that trend. Here, we dive into how the pandemic is affecting B2B print and the advertising trends shaping the shifts publishers face.

While multifamily performance in 2020 has not been what the industry had grown accustomed to in the latter half of the last decade, it is not as though occupancy and rent gains have entirely disappeared across the country. With that in mind, let’s look at some markets that have led the way in either average occupancy growth or average effective rent growth since the start of the second quarter – with one caveat.

As the United States has bounced between planned openings and closures, businesses which rely on consumer interaction have had to adapt to keep up. To truly observe the experience, one need not look further than traditional malls across the country. Many stores have adhered to regulations that require a reduction in hours, reduced occupancy, and other restrictions to help prevent the spread of the COVID-19 virus.

Consumers are looking for activities to help them stay occupied and healthy as COVID-19 necessitates social distancing. As a result, a number of outdoor categories have experienced explosive growth, our Retail Tracking Service data shows. Typically, June is a critical selling month for the outdoor industry. In this article, we explore five outdoor activities consumers have flocked to and analyze how June 2020 dollar sales stacked up to last year.

The proportion of workers travelling to their offices is holding steady at around 18% of pre-lockdown levels in the UK, as Huq’s high-frequency geo-data offers clues as to the impact of the new a work-from-home norm. Office-based workplace presence dropped to near-zero when lockdown came into effect at the end of March with presence seeing a slight increase towards the end of May as it ended.