There was a location data report published last month called ‘Malls Rise Once Again’ that caught people’s attention. It claimed that malls have made a ‘full COVID recovery’ and have as many visitors as in 2019. We at Advan live and breathe location data, so our intuitive response was ‘no way, how have we missed this… ’. The reality is, while mall traffic has certainly been improving, it is still down 22% versus 2019. If the visitation estimates for such big, and therefore easier to measure, properties are so off from reality

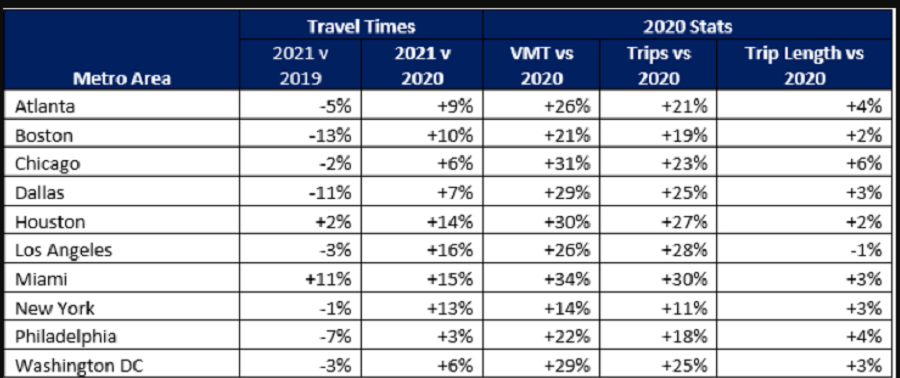

Despite the COVID-19 Delta Variant, holiday travelers hit the road Labor Day weekend, seeing more traffic congestion than last year. Some people assumed that Labor Day weekend travel would perhaps even be lighter than last year. Yet the latest data from the Labor Day holiday shows people still have a strong desire to get out of town. Travel was especially strong in Miami this Labor Day. Travel times were +11% higher than in pre-COVID 2019 and 15% higher than in 2020. Further, Miami saw a +34% increase in miles-traveled versus last year and saw a +30% increase in trips.

Company performance often differs across geographies. Often, more than one data source is needed to get a complete view. CE Transact provides this view in both the US and the UK. For a company like Abercrombie & Fitch, the data has been highly predictive in both markets. In today’s Insight Flash, we compare channel trends and brand growth across the two geographies. For the most part, online spend growth has surpassed offline spend growth for Abercrombie & Fitch in both the US and the UK since January 2020.

In our Quarterly Index, we noted that the pent-up consumer demand for home furnishings gave many home goods chains a visit boost in Q2 2021 – but some brands, like Bed Bath & Beyond and Tuesday Morning, were still struggling. With Q3 almost behind us, we dove into the foot traffic data to uncover the summer recovery trajectory of these two brands. While brands like Home Goods and At Home have succeeded in tapping into the emergence of home nesting – July visits were up 28.6% and 16.9%, respectively

Whilst the popularity of some of the world’s busiest domestic airline routes remains undiminished during the pandemic, there has been a considerable shift in the international busiest airline routes. In August 2019, 8 out of 10 of the Top 10 busiest global international routes operated within Asia on key business trunk routes, typically operating with high daily frequency and catering to time-sensitive business travellers.

The Dodge Momentum Index dropped 3% in August to 148.7 (2000=100) from the revised July reading of 154.0. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial planning component lost 2% in August, while the institutional component fell by 6%.

In June 2021, global ecommerce company Etsy announced that it would acquire Depop, a UK-based resale marketplace that has also been gaining traction in the US. Consumer transaction data shows that during the pandemic, a growing percentage of U.S. customers at Depop have also been making purchases at Etsy. Additionally, cross-shoppers between the two companies are more likely to buy more frequently at each company compared to customers who only shop at one of the companies.

The Revolving Door, the movement of public sector employees to private sector companies, is a heavily scrutinized Washington D.C. phenomenon. The movement between regulators and the companies they regulate can be problematic: when lobbyists turn into regulators, and vice versa, the transparency and fairness of regulatory policy is potentially jeopardized. With our data spanning hundreds of millions of careers, we detect the inflows and outflows of regulators. The charts below show the most frequent transitions out of and into the largest regulatory bodies in the US.

“A lot has changed” we wrote in our 2019 global roundup of internet speeds based on the Speedtest Global Index™. Little did we know how much was about to change. But two things remain the same: the internet is getting faster and the Speedtest Global Index is still a fantastic resource for tracking improvements on a global and country level (if we do say so ourselves). Today we’re taking a look back at how much internet speeds have increased over the past four years and which countries have seen some of the largest gains.

The inflation statistics this summer have captured headlines. Economic policy mavens often look at a price index excluding food and energy, referred to as the core price index, which tends to be more stable over time and a less noisy barometer of underlying inflationary trends. Newsworthy was the spike in core inflation: the Consumer Price Index, or CPI, measured a jump in core inflation to 4.5% in June, the highest in 30 years. Rent comprises 40% of the core CPI price index. Tenant rent and housing characteristics are used to impute an “equivalent” rent for owner-occupied homes in the index.

Shopee, headquartered Singapore, has become the top shopping app in Latin America. Shopee originally launched in Southeast Asia but in October 2019, brought its mobile app to Brazil. Now the country is its largest market as judged by monthly active users, overtaking Indonesia. Latin America and Southeast Asia are both emerging growth markets and Shopee's app is the largest ecommerce app in both of them.

Allbirds, the San Francisco-based startup known for its sustainable footwear collections, recently filed for an IPO. Initially launched as a DTC sneaker company, Allbirds has been growing its retail footprint over the last few years while also expanding into apparel categories. As Allbirds prepares for its public debut, consumer spending data reveals how returning customers and holiday sales have contributed to sales growth, as well as how the company’s retail locations in select metro areas have fared during the pandemic.

The summer brought positive signs for retail brands across the country with the big box giants, malls and even department stores seeing a needed boost. But with August in the rearview mirror, how much did the summer really contribute to the retail recovery? July and August brought a clear shift in consumer foot traffic, pushing many retail leaders back to positions of growth. Walmart saw visits up 2.9% and 3.9% in July and August when compared to the same months in 2019 – an especially impressive achievement considering the heights hit during that season.

It is only September, but the challenges of surviving the forthcoming winter season were highlighted over the weekend by the collapse of Philippine Airlines, who filed for bankruptcy. It has been a sad but inevitable outcome for the carrier. The airline has 22 aircrafts of varying ages, sizes, engines, and conditions for sale before they relaunch in early 2022. Good luck to all the staff impacted by this development. This week also saw South African Airways confirm that they will relaunch on the 23rd of September after a fifteen-month break.

The cigarette industry has faced a declining customer base for years—and COVID didn’t help. As more people quit smoking, cigarette producers are shifting their strategies. Philip Morris, owner of six of the world’s 15 top cigarette brands including Marlboro, is now changing course and pursuing a “smoke-free future.” In doing so, it is investing heavily in healthcare alternatives and respirable pharmaceuticals. The most recent CDC data found that 14% of Americans were regular smokers in 2019.

Ola, let’s talk about the food delivery market in Brazil. With Brazil covering almost half of the Latin America food delivery market, it is definitely the most important battlefield for on-demand food delivery companies. According to Measurable AI’s e-receipts data panel in Brazil: iFood, Rappi and UberEats are currently the three major players in the Brazil food delivery market. As of Q2 2021, iFood leads the market with over 80% market share, and UberEats comes next with around 10%. UberEats had a higher market share from March to July in 2020 at over 25%, but the momentum stopped soon after.

National home prices increased 18% year over year in July 2021, according to the latest CoreLogic Home Price Index (HPI®) Report . The July 2021 HPI gain was up from the July 2020 gain of 5.3% and was the highest 12-month growth in the U.S. index since the series began in 1976. The increase in home prices was fueled by low mortgage rates, low for-sale supply and a rebounding economy. Projected increases in for-sale supply and moderation in demand as prices grow out of reach for some buyers could slow home price gains over the next 12 months.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through July 2021 with forecasts from July 2022. Home prices nationwide, including distressed sales, increased year over year by 18% in July 2021 compared with July 2020 and increased month over month by 1.8% in July 2021 compared with June 2021 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).

In this Placer Bytes, we dive into the recoveries of GameStop, Dave & Buster’s and AMC to gather insights on experiential retail and retail’s recovery overall. The wave of excitement surrounding GameStop’s stock had little to do with the retailer’s offline performance, but it does appear that the buzz is working in the brand’s favor. Comparing weekly visits to 2019 since the start of the year reveals a steady and consistent reduction in the visit gap. And while the initial rush of retail reopenings in March drove a short spurt of comparative growth

With the end-of-summer holiday around the corner, COVID-19 cases continue to increase for most of the country, but the epicenter of the outbreak is shifting. This week saw 165,000 new cases per day, up from July’s low point of less than 15,000 daily cases. Sadly, hospitalizations and deaths continue to increase as well, although at lower levels than previous waves. In good news: Vaccinations picked up steam in the wake of the official FDA approval last week. More than 800,000 shots per day were administered on average this week, up from July’s low of ≈500,000 shots per day.