When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in September 2021, sales for meal delivery services grew 17 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In September 2021, 50 percent of U.S. consumers had ever ordered from one of the services in our analysis, up from 44 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of a late 2020 dip, sales have been gradually recovering since April 2020. Uber sales were up 110 percent year-over-year and Lyft sales were up 87 percent year-over-year in September 2021.

While many retailers took a cautious approach to expansion following the COVID outbreak, Dollar General bucked the trend, deciding instead to launch a new concept, Popshelf, mid-pandemic. Courting a new type of customer, it plans to open up to 50 of these locations by the end of the year. Popshelf is attracting higher-income shoppers: 29% of its customer spend in 2021 came from households with annual earnings of more than $150K, while this figure was 22% at its parent, Dollar General.

The online business of Lowe’s Home Improvement has had many fits and starts over the past few years. Although our CE Transact credit card data has been accurately tracking the company’s total U.S. sales along with those of competitor Home Depot, our newly launched CE Receipt data is our first data offering to be able to break out the e-commerce channel. In today’s Insight Flash, we dig into online home improvement trends such as how online share compares to total company for Home Depot and Lowe’s, how the two stack up in terms of items per transaction

Piccoma, published by Kakao Japan Corporation, launched in 2016, and has achieved monumental success by surpassing the $1 billion milestone, 1 of only 15 non-gaming apps globally to do so to date (October 10, 2021). This is particularly impressive because all of its consumer spend came from one market: Japan. Japan is one of the world’s most lucrative mobile app markets for monetization with the highest monthly consumer spend per device.

Meituan Waimai, a food delivery app published by Sankuai Technology Company, has surpassed 100 million app downloads across iOS and Google Play worldwide. Meituan Waimai was released on Nov 19, 2013 on iOS and July 18, 2017 on Google Play. In addition to delivering international cuisines ranging from specific fast food partners such as Pizza Hut and KFC as well as local favorites such as barbecue and hot pot, Meituan Waimai also delivers soda drinks, fresh fruits, pharmacy items, and supermarket groceries.

After a brief month of year-over-two-year visit growth in July, nationwide dining visits fell once again below 2019-levels in August, and declined even further in September. To understand how current dining trends were affecting the QSR sector, we dove into in-store visits to Chipotle and Yum! Brands’s portfolio – KFC, Taco Bell, and Pizza Hut. While Chipotle has been investing heavily in its digital channels, offline traffic has been lagging behind pre-pandemic levels. But the brand has been opening new locations

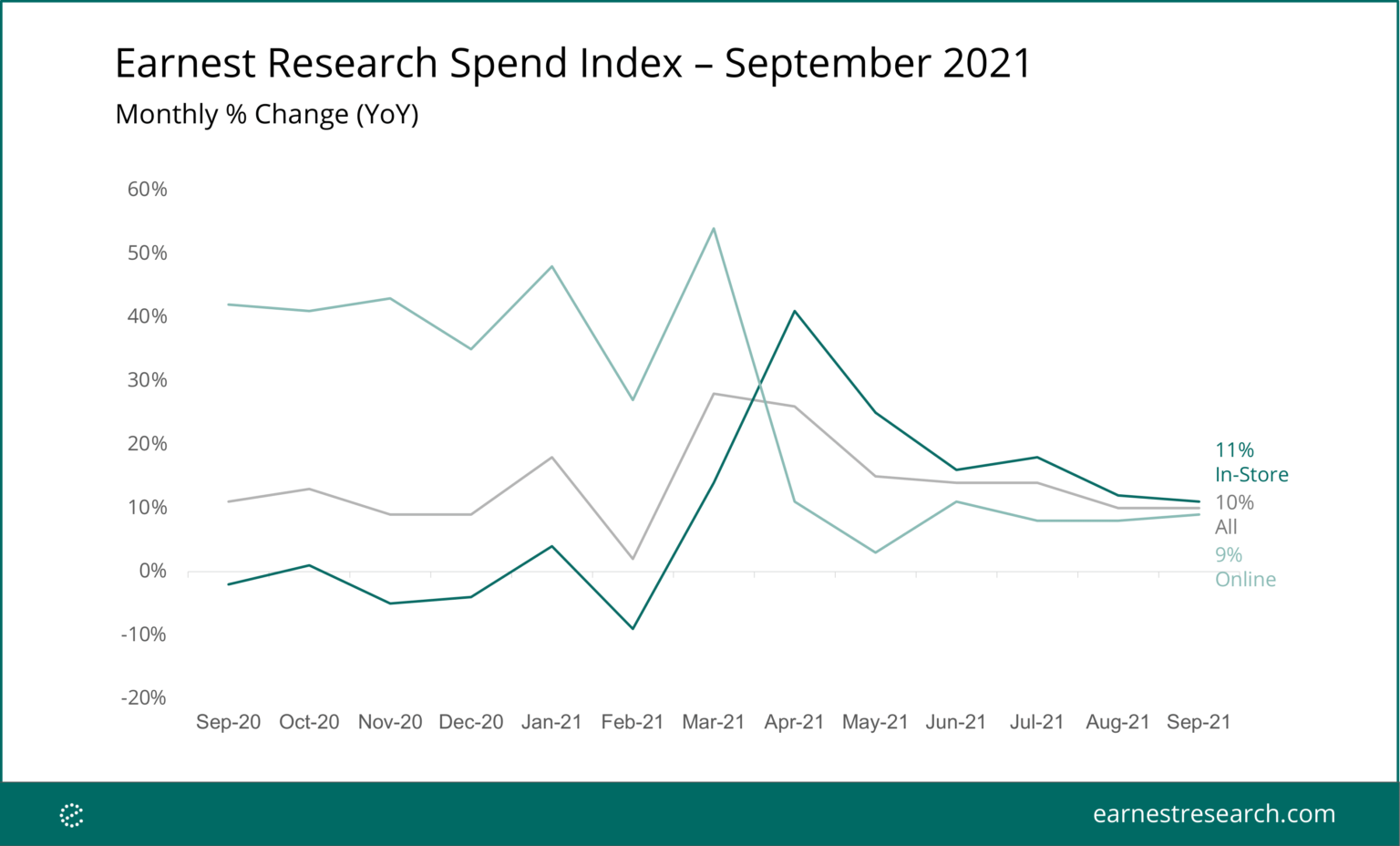

The Earnest Research Spend Index* was flat compared to the prior month with in-store growth continuing to decelerate and online accelerating slightly. Yo2Y spend accelerated 2pp both in-store and online. Foot traffic to consumer businesses was up slightly versus 2019 levels for the first month since February 2020, a sharp reversal from August suggesting a recovery in consumer activity.

The cryptocurrency market has been one of the more disruptive elements of the finance industry since it sprung to stardom in 2017. Where once cryptocurrencies seemed like a figment of the future, they’re now a household name. As key currencies rise and fall and the pundits have their say, the question is: How does the buzz surrounding cryptocurrencies translate into customer behavior online?

Had a plant-based sausage or some non-dairy cheese lately? Meat replacements and dairy alternatives have become increasingly popular over the past decade. Not only are these foods more environmentally friendly, but they are also a part of an extremely lucrative market: the plant-based food market is expected to grow at a CAGR of 11.9% from 2020 to 2027 to reach $74.2 billion by 2027.

Retail advertisers’ creative messaging has shifted during the Covid-19 pandemic as they continued to meet consumers changing needs. Top creatives in 2020 and 2021 were meaningful promotions highlighting new job opportunities, being present for the community, and even convenient pick-up options. Today, we’re taking a look at the retail category’s top three advertisers during the summer (June-September) of 2020 and 2021.

Their product might not come wrapped with a beautiful bow like consumer products—but B2B teams need to make their final Q4 sales soon. This is why it’s critical to approach their advertising team now—they’re spending the remainder of their budget and they’re planning for next year. Make sure you’re coordinating with the right contacts to get ahead of your competition. On Monday we covered the top consumer brands to watch in Q4. Here are the top B2B brands from a range of sectors to keep tabs on.

How much free time does the average working person have per day? Let's say she gets home from work at 6pm, then prepares something to eat. If she goes to bed at 11pm, that leaves around four hours in the evening. Add in some time on the commute and at lunch, and we might say the average working person has just over five hours of leisure time a day. In some markets you're probably spending all of that time in apps.

COVID-19 will be remembered in history as a pandemic. One of the things it may or may not be remembered for is the mental health pandemic that it induced. Mental Health Awareness Day this year is a stark reminder that, although there is a vaccine for COVID-19, there is no such thing for mental health and personal well-being. And while the need for mental health services has soared, the pandemic halted traditional support and treatment.

In this Placer Bytes, we dive into two classic brands – Dutch Bros. Coffee and Crocs – that have been experiencing a major pandemic boost. Although the dining industry is still struggling to reach its 2019 foot traffic level, Dutch Bros. Coffee has been on an incredible growth streak for more than a year. In the wake of the brand’s [recent IPO](https://www.restaurantdive.com/news/dutch-bros-coffee-targets-33b-valuation-in-ipo/601867/), we took the opportunity to dive into one of the most impressive success stories of the pandemic.

The end of the year is quickly approaching and it’s time to close those final ad sales. Some of the best opportunities can be found in young consumer brands. This is why we’ve analyzed the ad spending of some of the top performing startup brands from this year. These brands were first identified based on LinkedIn’s Top Startups in 2021. We sifted through the consumer brands and identified those that had the best quarter-over-quarter outlooks.

As the wider retail recovery continues, one sector that seems particularly well aligned with current trends is the pharmacy space. An increased focus on health and wellness alongside the ability to distribute COVID vaccines and administer tests has positioned leaders in the space particularly well. CVS and Walgreens returned to year-over-two-year growth by March 2021 with both brands maintaining the success throughout the summer.

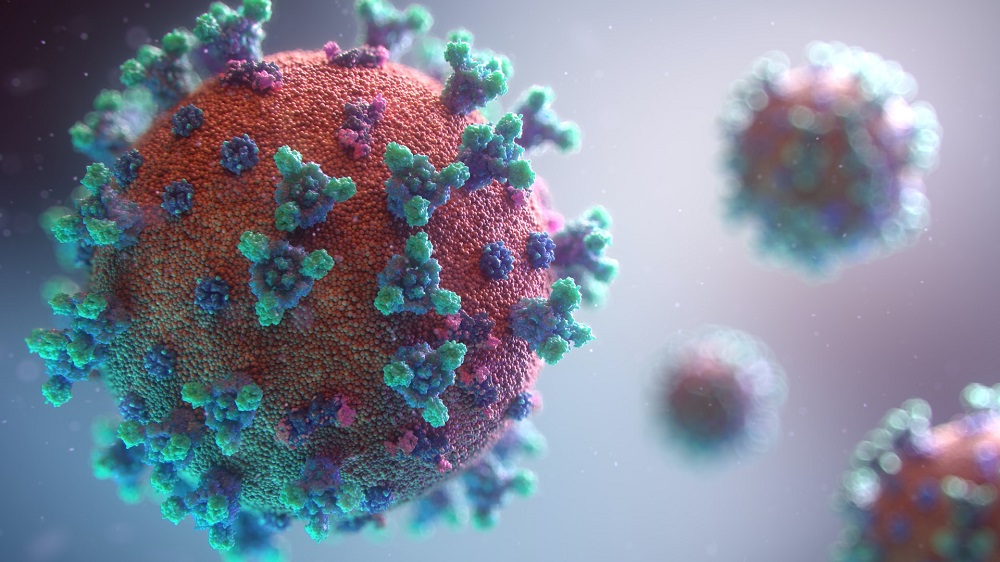

After rising unabated for the last three months, the average number of daily deaths due to COVID-19 is finally decreasing again. While around 1,800 people are still lost to the virus each day, trends suggest the COVID-19 death rate will continue to fall. The surge in deaths caused by the Delta variant topped out at just under 2,100 deaths per day, nearly the same as the peak during the first wave of the pandemic in April 2020. The 2020-21 holiday outbreak continues to be the most deadly period of the pandemic for the US when the country topped out at around 3,400 daily deaths.

This past May, following a disappointing jobs report for April, we posited that the job market was not afflicted with a labor shortage but rather a wage shortage. In subsequent months, we expanded our argument by laying out the case that the job market was suffering from a massive bid-ask spread between employers and employees. Health risks and economic devastation from COVID were obviously the primary contributors to illiquidity in the job market, but beyond those first-level factors, the pandemic incited what we called in June’s post a ‘stealth revolution.’

Following what’s trending and trendspotting are not the same. Trendspotters identify the coming trends and capitalize on them early. They stay market leaders. Think about the top brands in the market now. They are the names others turn to prepare for what’s coming. It’s why there is hype around every new iPhone launch. Yet, being on the cutting edge of the industry isn’t just reserved for the current market leaders. By keeping an eye out for industry data, you can anticipate which trends are fleeting (think clubhouse vs. TikKok), and which have lasting power to disrupt your market.