The key takeaways from ATTOM Data Solutions’ newly released November 2020 U.S. Foreclosure Market Report revealed that foreclosure filings were down 14 percent from October 2020, Florida posted the highest foreclosure rate and greatest number of REOs, and while foreclosure starts were down across the nation, a few states did see monthly increases in November 2020.

Footfall to UK restaurants has risen sharply following the end of the second national lockdown, but levels remain around a fifth of what they usually are at this time of year. The Huq Index suggests that the recovery of restaurant trade could be taking more of a ‘V’ shape than the gradual recovery seen after the first national lockdown ended on 4 July

Mortgage rates have hit record lows in 2020, generating a refinance boom as borrowers seek to save on their mortgage payments. CoreLogic has been monitoring the share of outstanding mortgage debt with interest rates above the current market rates and found that a large share of current mortgage borrowers could benefit from a refinance.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

As millions of consumers are buying new homes and renovating their current homes during the COVID-19 pandemic, the retail home furnishings category has seen tremendous growth in both site traffic and spend.

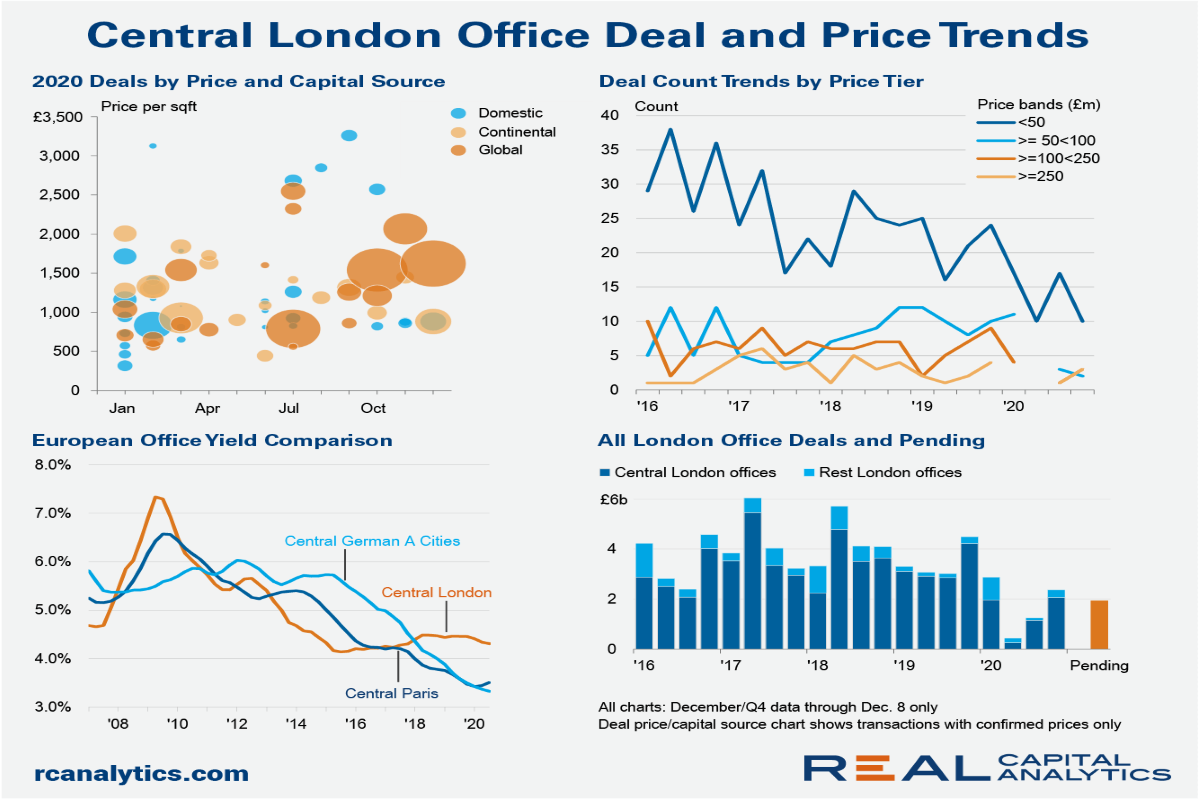

Dealmaking for Central London offices froze in the second quarter of 2020 with the onset of the pandemic. Only 10 properties changed hands, making it the weakest quarter on record, worse even than the depths of the Global Financial Crisis.

Advan analysis of footfall at US airports shows a gradual upward trend in traveller numbers, although volumes still remain significantly depressed compared to March. Comparison with TSA screened passengers shows a very high correlation over time, of over 99%.

Black Friday is traditionally associated with shoppers flocking to brick and mortar stores for blockbuster deals. However, this year online sales as a percentage of total purchases surged, suggesting shoppers mostly stayed home. Notably, 57% of Apparel & Accessories and Department Store sales occurred online during the Thanksgiving shopping period ended the following Wednesday, up from 46% in 2019.

In true 2020 fashion, just a few short months have brought dramatic changes in the labor market. Job listings have shifted from a gradual slowdown to a steady downhill slide. While the -4% decline in job listings we saw in November is the first drop in total job listings since recovery began in May,

Credit Benchmark have released the end-month Industry Monitor for November, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

Worker and traveller presence across UK ports fell 40pts during the first national lockdown before recovering to 90% of January levels, where it has held fast over the course of the last seven months. As the Brexit transition period draws to a close, and amid reports of bottlenecks across the country’s ports of entry, the Huq Index offers a high-frequency measure of activity at these locations.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 5, 2020. For this week, total U.S. weekly rail traffic was 542,203 carloads and intermodal units, up 4.8 percent compared with the same week last year.

In September 2020, 6.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from August 2020, but a 2.5-percentage point increase from September 2019, according to the latest CoreLogic Loan Performance Insights Report.

COVID’s immediate impact on driving habits was unmistakable. Motorists abandoned the roads, and passenger vehicles sat idle in garages and driveways. Long-held assumptions about driving habits no longer applied.

COVID has led to waves of downgrades across many sectors, with an unprecedented number of Fallen Angels. While there have also been some clear COVID winners, Rising Stars have so far been in a minority. But with vaccines now being rolled out, an end to the economic crisis could be in sight even for some of the hardest-hit sectors.

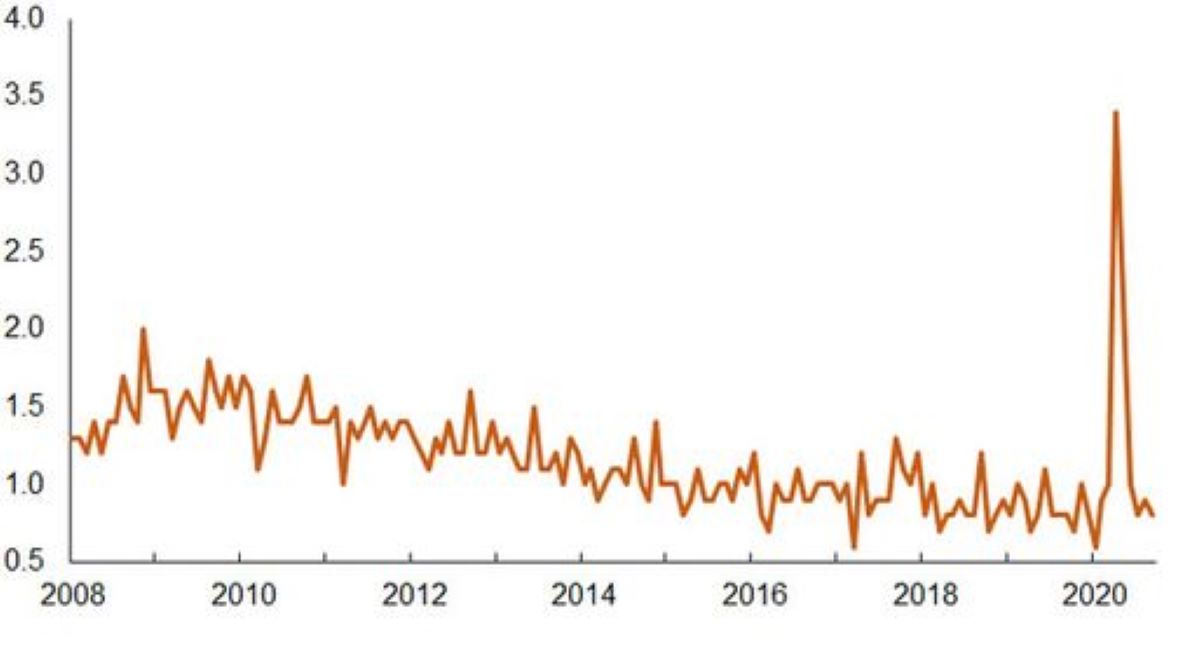

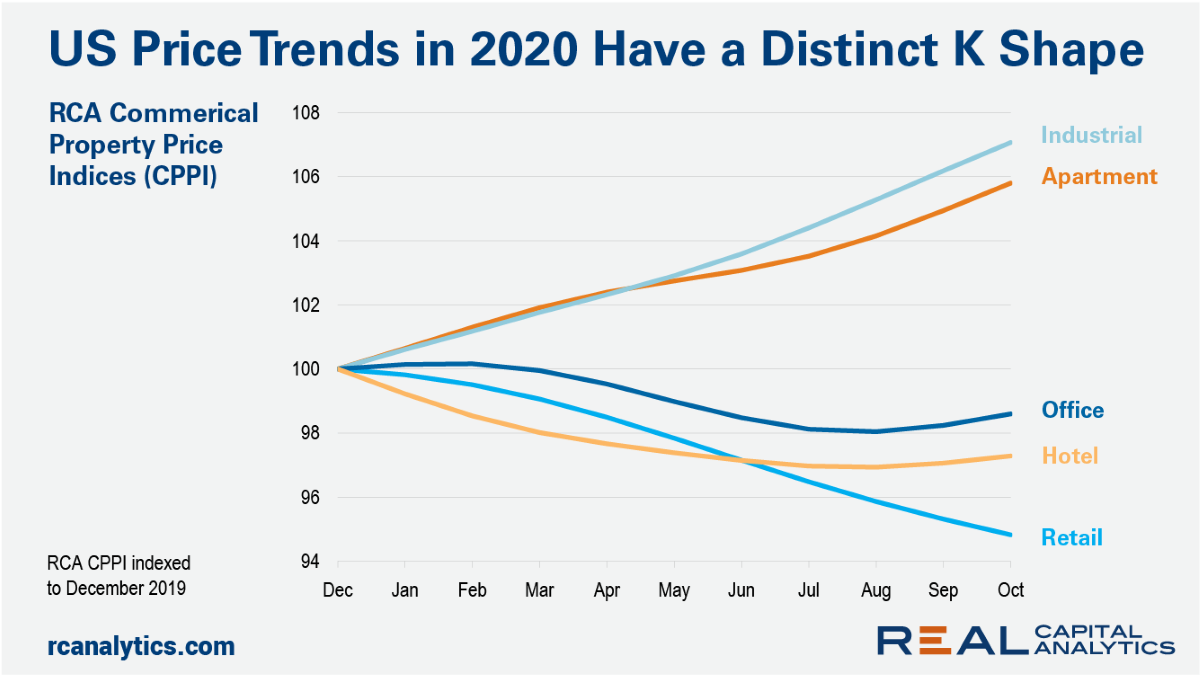

Every recession has a different impact on the performance of commercial real estate. This recession has the unique feature of savaging some sectors while boosting others. Given patterns of distress in the marketplace, the over or under performance of various property sectors in 2020 is likely to persist into 2021.

Eager shoppers appear to have flocked to the high street with the end of lockdown, causing footfall to UK clothing stores to rise to 62% of YoY levels in the last few days. Huq’s Index shows how the second national lockdown and forced closure of many stores saw footfall levels drop to just 15% of YoY levels – almost as low as they did in April.

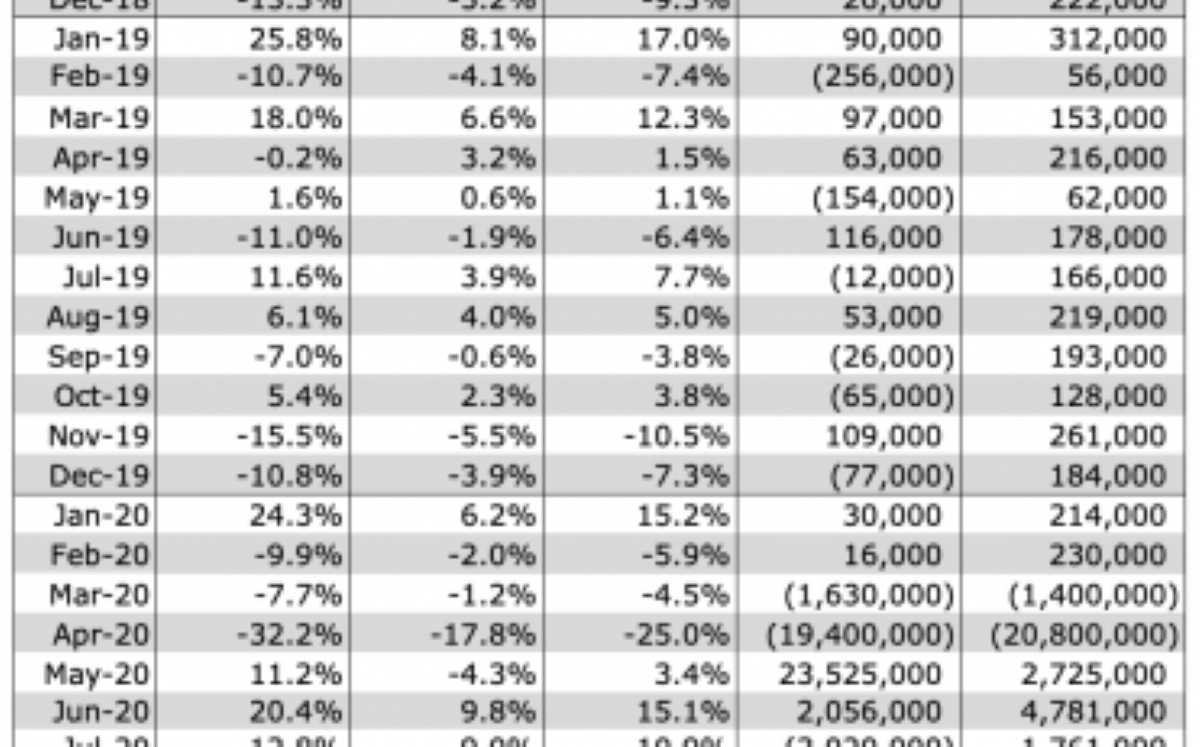

We are way behind schedule getting our non-farm payroll (NFP) forecast posted this week, and we’ll publish a bunch of additional job market data for November over the next few days, but in order to get our NFP forecast published as quickly as possible, we’ll truncate the number of charts (as well as accompanying commentary) to the two tables below.

Over the course of 2020 we have seen reports of the pandemic affecting different parts of the UK in different ways, with age, industries and travel distances suggested as possible contributors. Today we look at Huq’s measure of population mobility for England – that is, the extent to which residents of cities in different regions are travelling on average day by day.

During the early months of the COVID-19 pandemic, Envestnet | Yodlee’s Income and Spending trends noted an increase in consumer buying in large format retail which led to certain stores being overrun with customers. Spending at these retailers spiked as customers feared store closures and supply shortages.