The Dodge Momentum Index rose 3.7% in September to 130.8 (2000=100) from the revised August reading of 126.2. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index rose during the month. The commercial component rose 3.9% while the institutional component moved 3.2% higher.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending October 3, 2020, as well as volumes for September 2020.

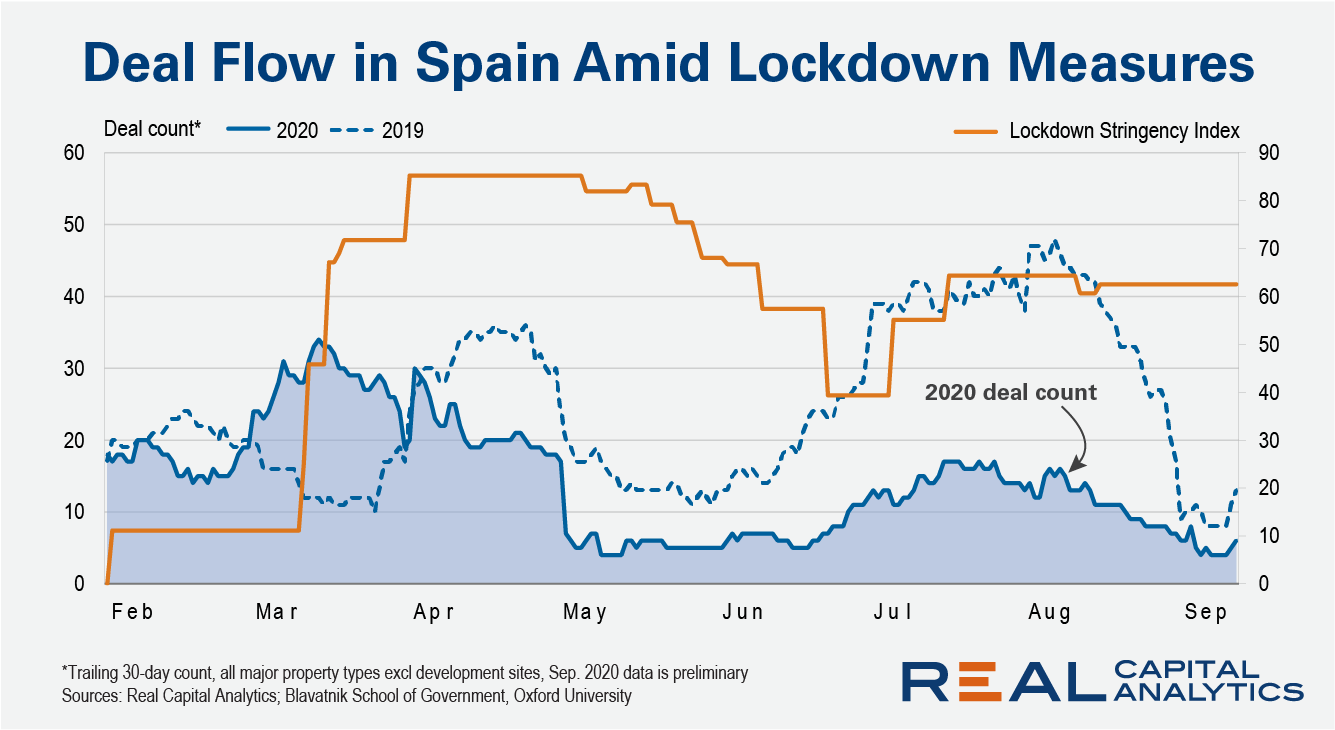

The Covid-19 pandemic has struck Spain particularly hard. Cases and total deaths from the first wave of the outbreak were among the highest in the world and a secondary surge is underway. The extent of the Spanish government’s lockdown and the resultant economic fallout has had a marked effect on the country’s commercial real estate market. Deal volume through the end of August fell 54% versus the same point in 2019 and the deal count dropped by 37%.

Amid an onslaught of negative credit news, there are some bright spots. So-called Rising Stars, sectors whose credit quality has moved from high-yield or “junk” status to investment-grade, are growing, slowly but surely.

Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continue to grow in number but at a slower pace than what we’ve been seeing for the past several months.

The last six weeks have seen customer levels across French bars, restaurants and cafes tracking neatly at around 100% of 2019 levels despite record levels of new cases over the same period. Persistent growth in visits from lockdown levels on May 9th climbed to 64% to 75pts by July 1st and even peaked at 106% on August 9th before settling into near 2019 levels in the weeks following.

Brazil, like many nations, has lifted COVID-19-related entry restrictions for travelers and provided an additional flow of demand for reopening hotels. However, reopening measures are determined on a state level. How has this affected Brazil’s recovery?

This year’s back-to-school season is unlike any in recent memory. Along with the usual school supply lists of pencils, new clothes, and lunch snacks, this year’s class also has to purchase webcams, masks, and hand sanitizer. Many schools are starting remotely, others have had in-person class dates pushed back, and several have had a later start as administrators scramble to update policies and technology.

While U.S. job openings on company websites globally rose 2% in September, continuing the steady recovery in U.S. labor demand that began in May, the rate of increase was the slowest in the past 4 months.

To say that 2020 has been a year like no other would be a staggering understatement. Our health, well being and livelihoods have been stress-tested in ways we couldn’t have imagined just one year ago. In order to make sense of the chaos, and search for some sign of light at the end of the tunnel, we took a deeper look at our jobs data to see what it can tell us about the labor market and economy amid the global pandemic.

Are you back in the office? It’s a question many of us find ourselves asking our friends and peers. The answer is, it depends. Each has their own comfort level, and it also depends largely on their role and their employer.

Back in July, LinkUp wrote an article testing the hypothesis that government stimulus was preventing workers from returning to work. The prevailing narrative was that some workers were receiving more compensation through the CARES Act than they would by returning to many low-paying jobs, so those workers were opting out and low-paying jobs were going unfilled. In our article, we concluded that LinkUp’s data did not support this claim at that time.

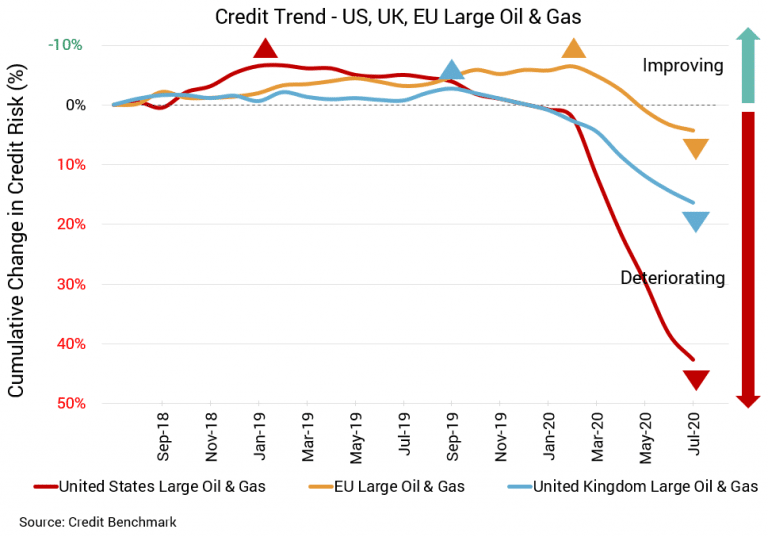

The besieged US energy sector continues to see credit deterioration, and with a multitude of problems facing the industry there is little cause for optimism. In the US, energy companies were supplying fewer barrels of gas per day even with the recovery in consumption, and shale producers are facing a cash crunch. Meanwhile, European oil producers are questioning whether it’s worth drilling.

A much more discerning grocery shopper is emerging in the wake of initial widespread panic-buying sparked by COVID-19 this past spring that led consumers to disregard prices and stock up on products and ingredients required to prepare the entirety of their family meals at home.

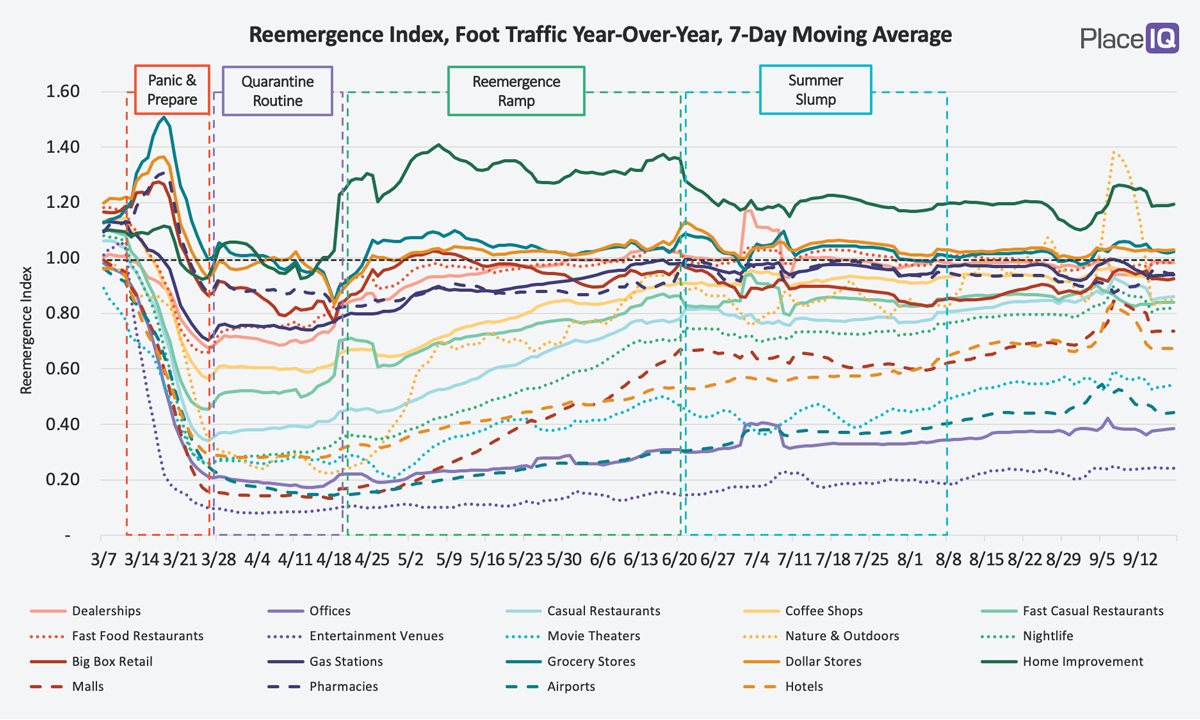

With this week, Summer is officially over. And so too our Summer Slump comes to an end, with traffic ever-so-slightly up from its August levels. Now, there’s something to note about that Labor Day spike: it’s not what it seems. Our Reemergence Index works by comparing weekday traffic year-over-year. We compare the 14th Friday in 2020 to the 14th Friday in 2019.

The return of employees to manufacturing facilities across the UK has stalled since June, with presence failing to recover beyond 60% of last year’s levels. By contrast, this seasonally-adjusted measure of daily worker presence also shows presence regaining 75% in July and growing to over 80% this month.

With the economic picture still murky, no news may be good news for the US and UK housing sectors. Credit quality has seen little change in each region with the most recent update. Recent positive signs in the US and UK markets may suggest continued stabilization. But as noted last month, the UK is experiencing its worst recession on record and the sector’s credit prospects may limited for some time. There’s more reason for optimism for the US, according to some reports.

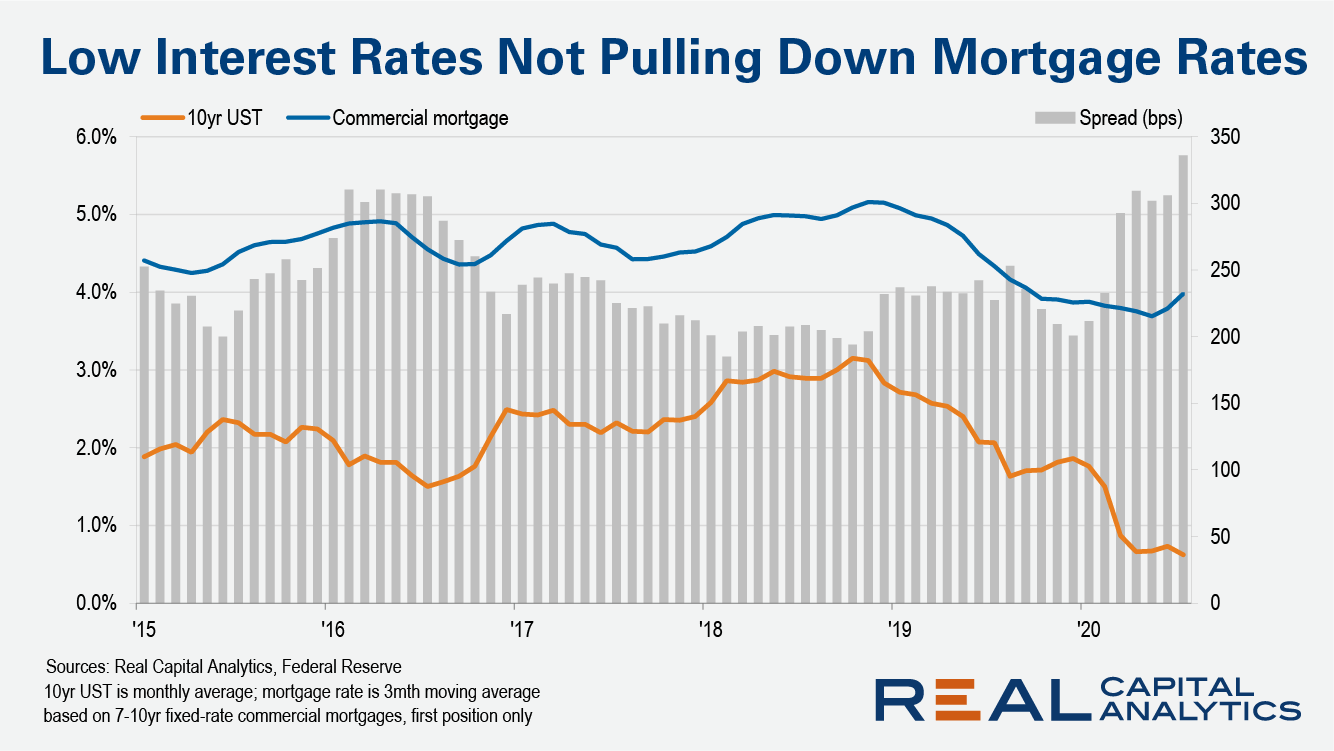

The 10yr US Treasury has averaged less than 1% every month since March 2020. Commercial mortgage rates have barely budged despite this sustained low level for the interest rate environment. In any normal period, low interest rates would be a positive sign for commercial real estate investment. Interest rates remaining at such a low level over a sustained period is a sign of weakness in the economy.

Footfall to Pubs reached a post-Covid high on Saturday, with Huq’s Daily Index climbing to almost 100% of Year-on-Year levels – a drastic change in the downward trend which had emerged over the last month as the sector grappled with an Eat Out to Help Out hangover. With unseasonably warm weather over the weekend and threats of an imminent second lockdown murmuring, punters appear to have been tempted into a final evening in the pub.

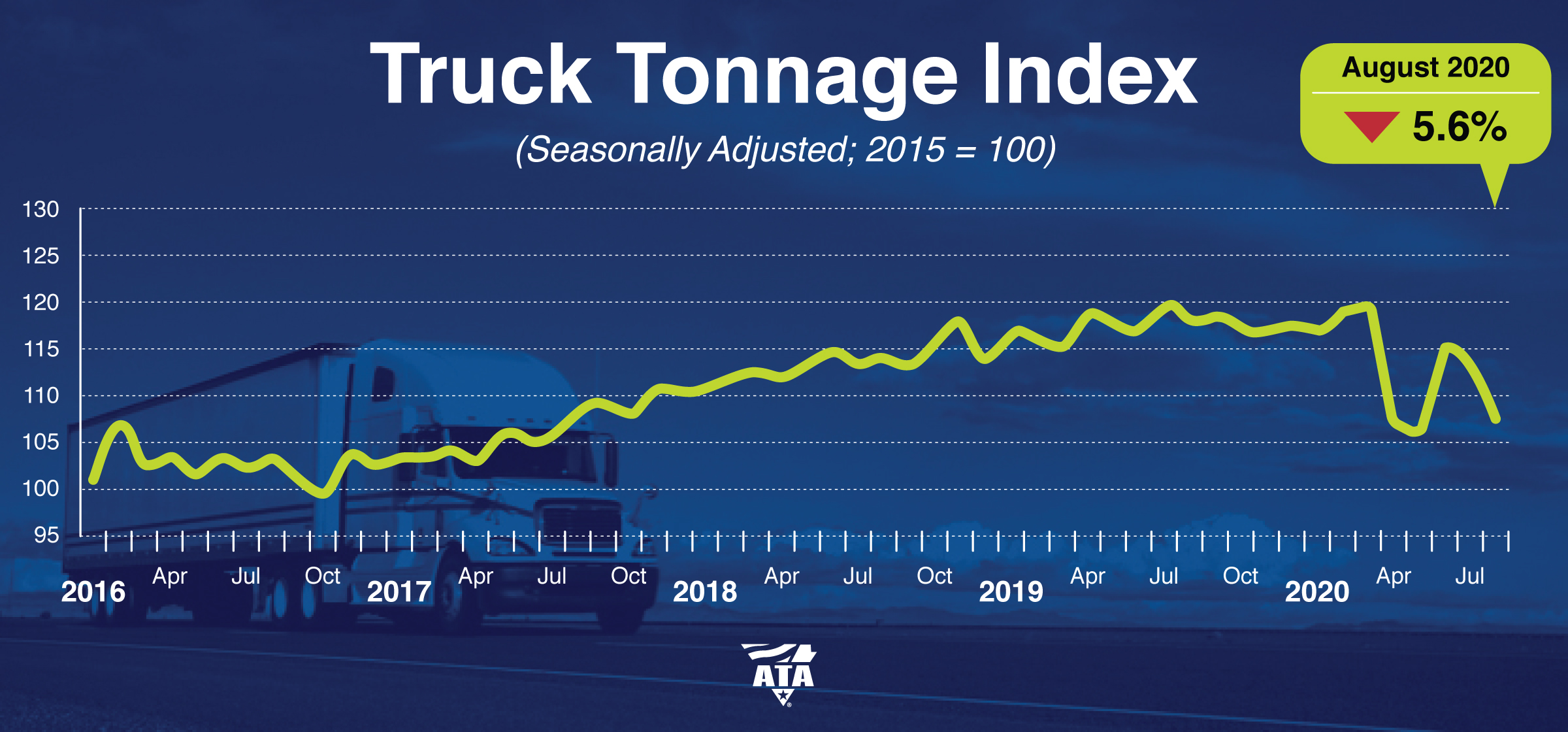

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 5.6% in August after declining 1.4% in July. In August, the index equaled 107.5 (2015=100) compared with 113.9 in July.