2020 was a great year for Xiaomi. As a starter, its solid online channels helped absorb the negative impact from Covid-19. Its new models (many featuring 5G at a steep discount vs. T1 players) outperformed the old ones which speaks volumes about the company’s strength in innovation. Furthermore, Xiaomi benefited from consumers shifting away from Huawei. Looking ahead, will Xiaomi continue its strength in 2021? How popular will the new models like Redmi K40 and Mi 11 Pro be?

Stripe has soared past SpaceX and pushed past Instacart to become the most valuable startup in the country. Earlier in the month, the company announced a new $600 million round of funding that included investors like Sequoia Capital, Fidelity Management, and Ireland’s National Treasury Management Agency and puts Stripes current valuation at $95 billion. For those keeping track, the figure has nearly tripled since Stripe’s previous valuation of $36 billion last year. With this most recent round of funding Stripe, which builds software that allows businesses to process payments online, has become the most valuable private company to come out of Silicon Valley–and it’s little wonder why.

Given the positive news of late and the broader trends around the pandemic, it’s tempting to start this post by noting that things seem to be slowly but surely starting to return to normal. But of course, that’s an entirely absurd notion. I’m not sure normal is still a thing. And in any event, the world is just about as bat-shit crazy as ever and the best that can be said is that maybe, just maybe, we’ve let up ever so slightly on the accelerator as we barrel down the highway toward the cliff of irreversible insanity. There’s a decent chance, in fact, that we drove off that cliff years ago and still have no idea.

Following the recent news that Ford is expected to halt production for two weeks in April due to chip shortages, and given our recent study on this exact subject few months back we wanted to take a closer look and quantify how the largest US carmakers and the industry as a whole is currently affected. Employee counts are often times the right metric produced by our foot traffic data to analyze industrial companies. Looking at the employee traffic at the US plants for the three major carmakers it is clear that we are consistently for the last seven or so months at subdued levels of production, with March being the first month showing al recovery.

Lululemon has been one of the most successful companies to translate pre-pandemic to post-pandemic prosperity. While some of this has been due to style trends favoring athleisure wear over business casual for work-from-home, the company has also made several successful strategic decisions to support this growth. In today’s Insight Flash, we leverage the online/offline channel breakouts available in CE Transact US and CE Transact UK transaction data, as well as the Men’s vs. Women’s product categorization available in CE Web, to better understand the drivers of this growth. In both the US and UK, Lululemon’s success has far outpaced the Footwear/Athletic Apparel subindustry.

As if Netflix’s latest documentary Seaspiracy wasn’t enough to make us really ponder the fate of our oceans, last week a huge shipping container was blown off course and became stranded in the Suez Canal. The 200,000-ton, 400-meter long (1,312-foot) ship blocked the infamous waterway for about a week before finally being freed from the shoreline. The Suez Canal accounts for approximately 30% of the world’s daily shipping container freight and is a critical link for trade between Europe and Asia. It’s estimated that the shutdown of the canal was holding up $9.6 billion each day, or $6.7 million a minute.

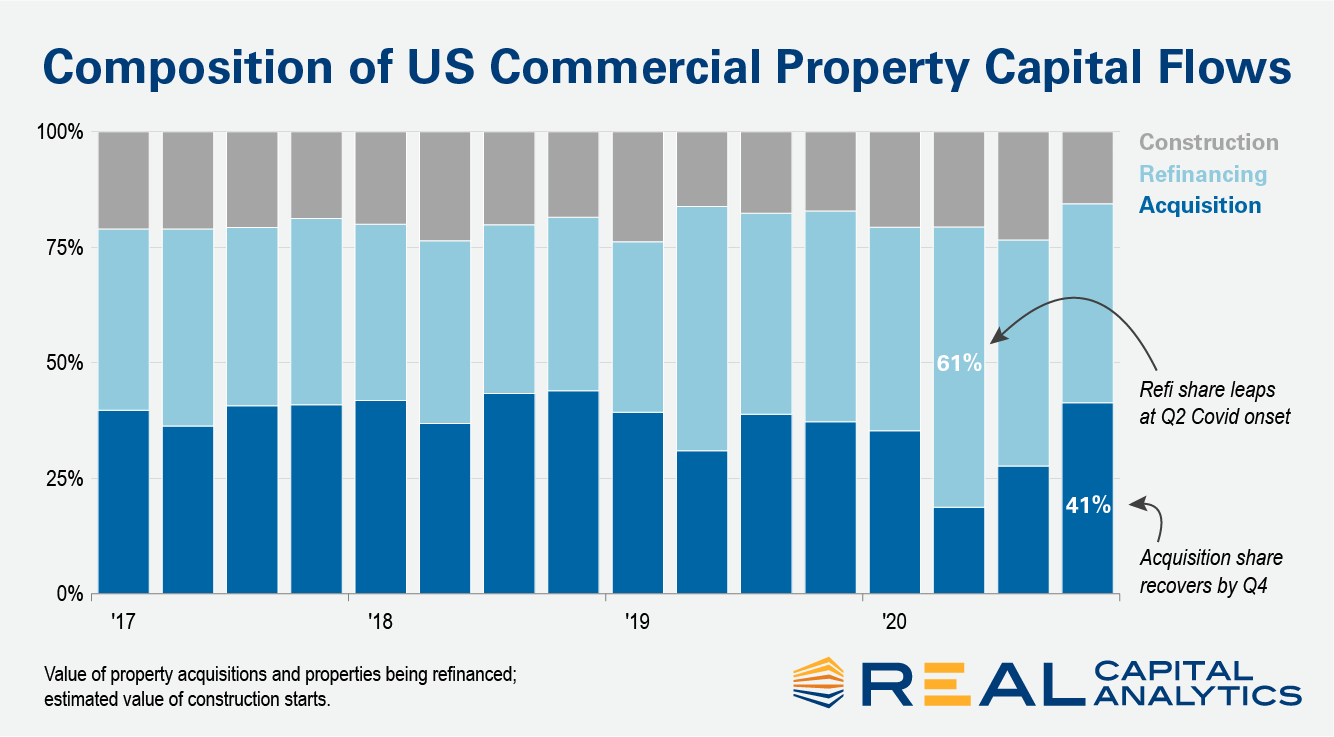

Deal volume contracted in 2020 due to economic uncertainty but did not result in a price collapse like that seen during the Global Financial Crisis (GFC). Capital flowing into other structures helped support pricing during this downturn. Into the second quarter as new acquisitions fell, financing activity picked up some of the slack in the capital stack. The value of properties refinanced represented 61% of all capital flows to commercial real estate in the quarter. This figure was well above the 19% share represented by new acquisitions.

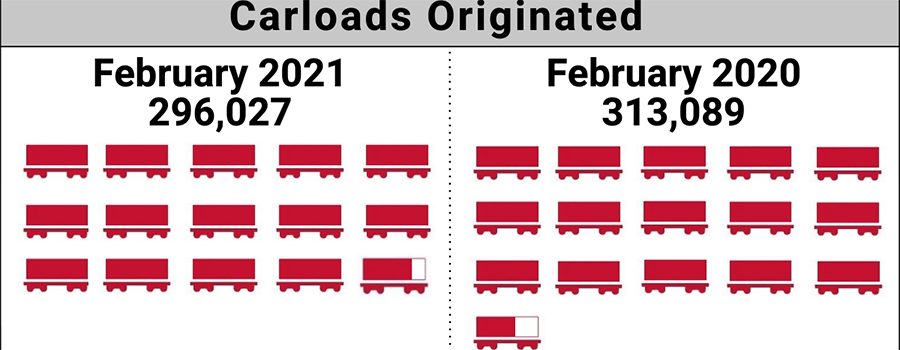

The number of carloads moved on short line and regional railroad in February 2021 was down compared to February 2020. Carloads originated decreased 5.4 percent, from 313,089 in February 2020 to 296,027 in February 2021. Coal led gains with a 42.3 percent increase. Grain was up 23.0 percent, and Trailer and Container increased 1.4 percent. Crushed Stone, Sand and Gravel led declines, down 42.5 percent. Chemicals, Food and Kindred Products, Metals and Products, Waste and Scrap Materials, Nonmetallic Minerals, Lumber and Wood Products, Metallic Ores, Pulp, Paper and Allied Products, Petroleum Products, Stone, Clay and Glass Products, Motor Vehicles and Equipment, Grain Mill Products and Other Carloads were also down in February.

Restaurants and bars in California have experienced a surge in visits over the last two months, with footfall reaching a post-pandemic high of 78% as the state’s vaccine roll out gathers pace.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending March 27, 2021. For this week, total U.S. weekly rail traffic was 521,731 carloads and intermodal units, up 16.1 percent compared with the same week last year. Total carloads for the week ending March 27 were 232,561 carloads, up 6 percent compared with the same week in 2020, while U.S. weekly intermodal volume was 289,170 containers and trailers, up 25.8 percent compared to 2020.

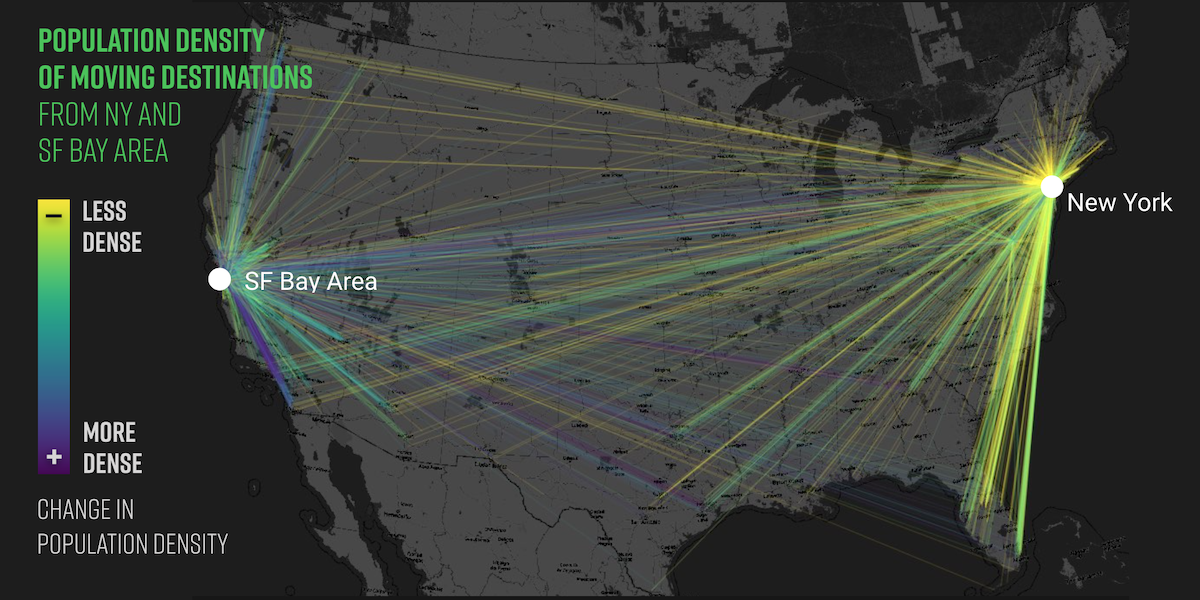

As a result of the pandemic, there has been a significant shift happening in major cities with many, if not most, seeing an exodus of residents. This has led some to speculate that the impact on city-oriented retail could be especially severe. Looking at net change in populations across some of the larger CBSAs in the country shows a clear pattern of decline. In January 2021, the New York CBSA saw a year-over-year difference of -1.2%, while San Francisco, Los Angeles, and Boston saw declines of 2.4%, 1.9%, and 1.7% respectively. While these drops are not massive, they are heavily offset by new residents making their way to fill gaps in these areas. And there are powerful indications that what is truly taking place is less about an exodus than a revival.

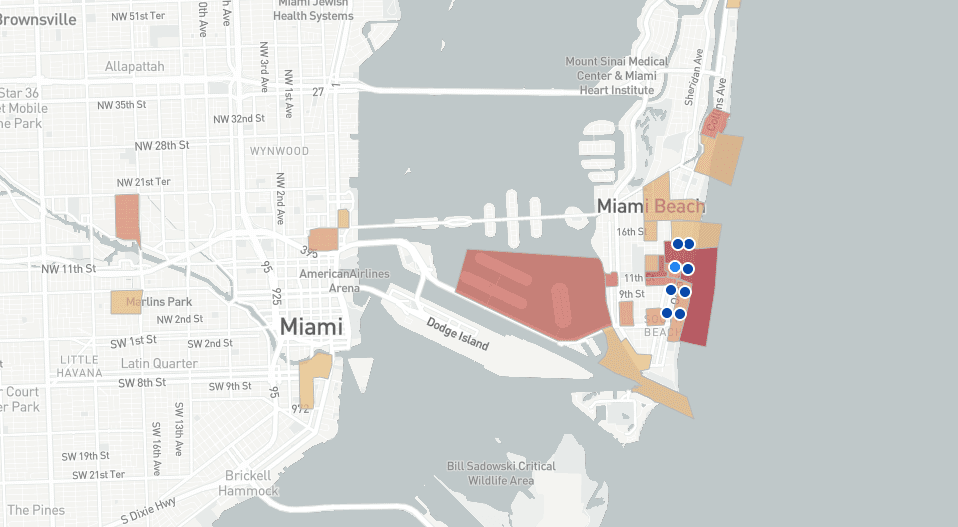

One year ago, the City of Miami Beach imposed a curfew to stop the spread of the Coronavirus. Fast forward to today, and City officials again imposed lockdowns at night – with Miami Beach City Manager Raul Aguila declaring a State of Emergency over building crowds in Miami Beach during Spring Break 2021. Visits increased to the Entertainment District over last year, yet largely moved in-tandem with last year’s trend. Yet by mid-March, visits to the Entertainment continued to surge far above last year’s count, with momentum, until a significant drop on March 21, a day after the Curfew order.

In this Placer Bytes, we dive into the recent recovery data from pharmacy leaders CVS and Walgreens and analyze their potential in the coming months. Visits to Walgreens, Rite Aid and CVS locations were trending in a very positive direction in late 2020. While the sector saw the same dip that other retailers did because of a resurgence of COVID cases, by December visits were again moving in a positive direction. CVS saw monthly visits down just 2.7% year over year, while Walgreens and Rite Aid were down 6.2% and 24.2% respectively – marking the lowest visit gap for Rite aid since the start of the pandemic.

In today’s Insight Flash, we take advantage of our newly launched UK channel data for industries and subindustries in our UK Brand Universe to examine how online shopping behavior has changed over the last year. With over 1,400 brands tagged for online and offline spend, it becomes clear that there are significant differences in industry share online versus offline as well as which industries and subindustries have seen the largest growth. Even from a high-level share perspective, major differences can be seen between how UK residents spent online versus offline in the last year.

The annualized turnover rate for over-the-road truckload drivers held steady in the last three months of 2020, according to the American Trucking Associations’ Quarterly Employment Report. In the fourth quarter, the turnover rate for truckload fleets with more than $30 million in annual revenue was unchanged at a 92% annualized rate, while the churn rate for smaller truckload carriers dipped two percentage points to 72%.

Driving through any big city is rarely a pleasure, but for Londoners, a move towards private transport, LTNs and cycle lanes is causing congestion that could test even the most patient drivers. Huq’s high-frequency geo-location data records the speed of drivers across the UK’s A-Road network throughout the pandemic to provide an up-to-date measure of delays. The indicator shows that congestion in London saw a significant increase of over 30pts in cases with traffic volumes still well below what it was before the pandemic.

While the past year has made good news a rarity, we’re happy to say we’ve found a bright spot: job listings in the U.S. are back to pre-covid levels. (We’ll pause here for a collective ‘woo hoo!’). Make no mistake, with the pandemic still far from over, we remain in historic and uncharted territory. Unemployment was still at 6.2% in February, and we are in the midst of a female recession with countless women now missing from the labor force. However, when little feels familiar or certain, it is encouraging to see good news in the job listings numbers. We anticipate employment numbers will also continue to rise, as job listings are generally predictive of future hires. We saw job demand continue to rise since the pandemic crash witnessed last spring, and 2021 has largely seen that growth continue.

Due to the COVID-19 pandemic, over a year ago a large portion of US schoolchildren were forced to move their studies online as physical schools closed for safety reasons. At the same time, many adults who were sheltering in place and couldn’t entertain themselves out of the house turned to online education to pass the time. How have these trends held up over the last year? And what do they signal about Coursera’s upcoming IPO? In today’s Insight flash, we look at overall subindustry trends, how those differ by demographic, and which companies have done the best job bringing customers back after their first purchase.

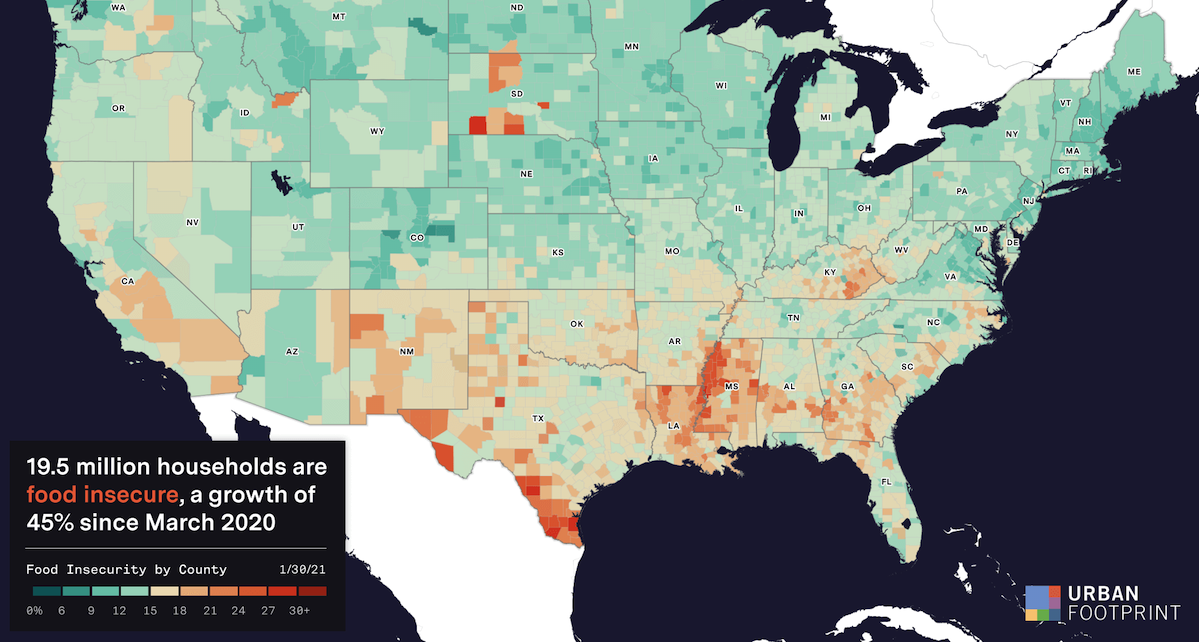

Hunger is an acute challenge for far too many American households. This was true before the COVID-19 pandemic, and it is even more pressing today. Across the US, 19.5 million households are food insecure—defined as those without the financial resources needed for consistent access to enough food—a growth of 45% since March 2020. More acutely, nearly 12.2 million of these households report food insufficiency, or not having enough food to eat at some point in the last week. This striking number suggests that existing relief programs and aid are not meeting their needs.

As we mark one whole year of living through the COVID pandemic, much has changed in our daily lives. There is significant interest in understanding changes to many of our regular behaviors, including how we work, learn, and shop. What will become permanent, and what will “return to normal”? For example, much has been made about an “urban exodus” during the pandemic – people leaving cities for the more relaxed countryside. But is this true? If so, what does it mean for transportation?