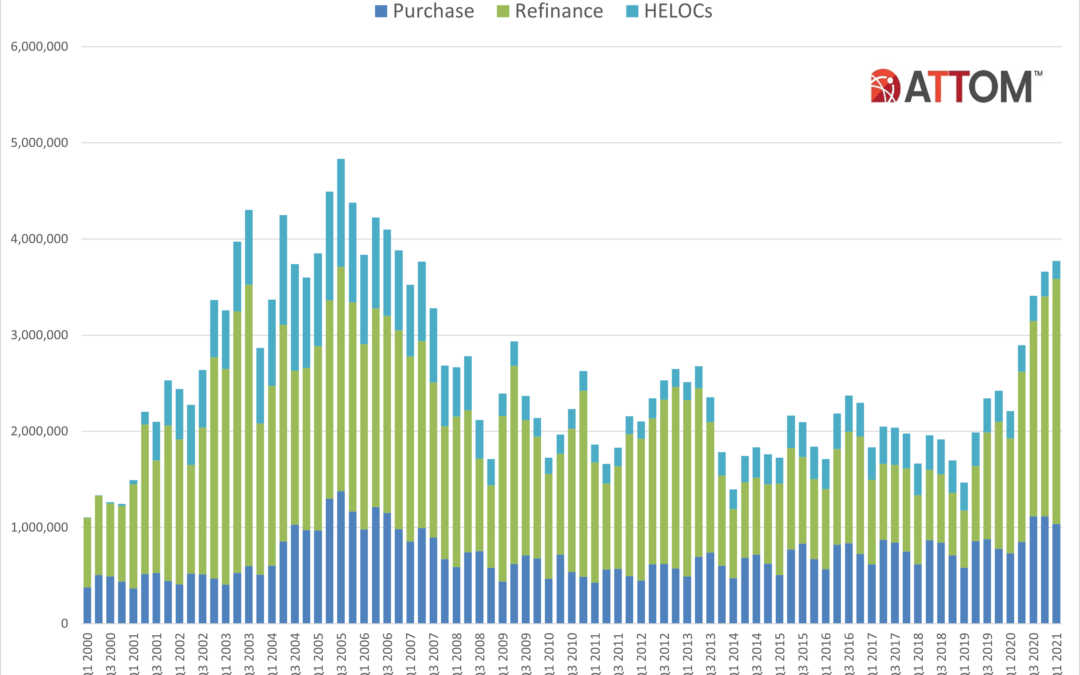

ATTOM Data Solutions, curator of the nation’s premier property database, today released its first-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.77 million mortgages secured by residential property (1 to 4 units) were originated in the first quarter of 2021 in the United States. That figure was up 3 percent from the previous quarter and 71 percent from the first quarter of 2020 – to the highest level in more than 14 years.

Office investment across Europe has plummeted since the onset of the Covid-19 pandemic. Transaction volume fell by almost one-half in the year through March compared with the prior 12 months, and the number of traded assets fell to the lowest level since 2011. Moreover, the continent’s biggest institutions are pivoting away from the office as they embrace residential and industrial. In Europe during 2020, institutional players deployed 40% of their capital on offices – the lowest ever proportion for a calendar year.

National home prices increased 13% year over year in April 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The April 2021 HPI gain was up from the April 2020 gain of 4.6% and was the highest year-over-year gain since February 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices. While a pick-up in construction and an increase in for-sale listings as more homeowners get vaccinated may help moderate surging home price growth, affordability challenges may drive some potential home buyers out of the market which could reduce demand.

Months into 2021, housing supply remains at historically low levels while the impact from the pandemic and low mortgage interest rates linger. This has meant that some potential sellers are still holding on to their properties in fear of the virus while homebuyers are flooding the market, trying to capture the benefits of low mortgage interest rates. Together, these have shrunk the already small supply of available homes.

The headline rate of U.S. property price growth accelerated in April as the industrial, apartment, retail and office indices all posted positive annual returns for the first time since the pandemic began, the latest _RCA CPPI: US_ summary report shows. The U.S. National All-Property Index grew 8.4% in April over the last year. The laggard in April was the CBD office index.

Welcome to the June Apartment List National Rent Report. Our national index increased by 2.3 percent from April to May, representing the third straight month of record-setting rent growth, going back to the start of our rent estimates in 2017. After this recent spike, year-over-year rent growth now stands at 5.4 percent nationally, and prices are now in line with where we expect they would have been if the pandemic-related rent declines of 2020 never occurred.

The increase in U.S. commercial real estate investment in April might suggest that the market is through the worst effects of the Covid-19 pandemic. Still, while there were high double-digit annual growth rates in commercial property sales for the month, all the problems from the pandemic are not yet in the rearview mirror. The good news is that deal activity is climbing. Commercial property sales were up 66% from a year earlier in April.

Relative to other European markets, the Danish market has boomed through the pandemic. Transaction volume increased 44% year-over-year in the 12 months through Q1 2021, and at a shade under €8.4 billion ($10.2 billion) eclipsed the market’s annual record high for transactions of 2017. Moreover, first quarter deals topped €3.5 billion, which makes the start of 2021 one of the best three-month periods for the market on record, catapulting the market to become the fourth most active in Europe at the start of the year.

Lack of availability of homes for sale has been the Achilles’ heel of many housing markets across the country even prior to 2020, and the COVID-19 pandemic has only exacerbated the shortfall. Since the Great Recession, the inventory of homes for sale has been on a decline and has reached its lowest recorded levels in recent months. From the 1980s to early 2000s, the annual number of homes for sale averaged 1.9 million. In 2020, the number fell below 1 million.

Three important factors in mortgage underwriting are debt-to-income (DTI) ratios, loan-to-value (LTV) ratios and credit scores. Over the course of the pandemic, we have seen a decrease in the average DTI and LTV as well as an increase in the average credit score of loan applicants. There are two possible reasons for this change: either the risk attributes of applicants have changed, or lenders’ credit underwriting standards have changed due to an uncertain economic outlook.

Global office transaction volumes plummeted in the 12 months through March. Real Capital Analytics data shows that office investment dropped 49% in the Americas, 44% in Europe, the Middle East and Africa (EMEA) and by a more moderate 14% in the Asia Pacific region. A slowdown in transactions across all asset classes was inevitable following the lockdown restrictions employed to slow the spread of Covid-19.

U.S. single-family rent growth quickened in March 2021, increasing 4.3% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 3% rate recorded for March 2020, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

Despite strong demand dating back to the third quarter of last year for the multifamily industry, rent growth was largely absent until the calendar turned to 2021. So far this year, strong demand has been sustained and average effective rent was up by a little more than 2% nationally through April. One factor that has aided that growth has been the beginning of a drawdown in lease concessions after a dramatic increase in reliance on discounts last year

The latest loan performance data from CoreLogic shows that the nation’s mortgage delinquency rate in February 2021 was 5.7%, a small increase from January’s 5.6%. The delinquency rate calculates the number of loans in various stages of distress — 30-59 days past due, 60-89 days past due, 90+ days past due, and foreclosures — as a percentage of all first-lien mortgages in servicing.

There are signs of recovery underway for a majority of commercial real estate markets in the Asia Pacific region. In the chart below, we plot deal activity for Asia Pacific’s top eight real estate markets in the first quarters of 2021 and 2020, expressed as a percentage of the average of the previous five years.

In February 2021, 5.7% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small increase from January 2021, and a 2.1-percentage point increase from February 2020 according to the latest CoreLogic Loan Performance Insights Report. The slight (0.1 percentage point) increase over January 2021 marked the first uptick in month-to-month national delinquency since August 2020.

According to the Census Bureau, the United States’ annual mover rate (the percentage of people who change residence each year) had been declining since the mid-1980s, and reached its lowest point just before the COVID-19 pandemic. This trend may have continued if not for the sudden and rapid adoption of remote work.

This month marks the 125th anniversary of the Dow Jones Industrial Average, a stock-value metric for 30 blue-chip U.S. companies. There are very few assets that have such a long valuation history, and fortunately single-family housing is one such asset. To commemorate the quasquicentennial, let’s compare how stock and home prices have fared over time.

National home prices increased 11.3% year over year in March 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The March 2021 HPI gain was up from the March 2020 gain of 4.6% and was the highest year-over-year gain since March 2006.

Dallas is booming. The market cemented its position as the #1 U.S. market for commercial real estate construction during the Covid-19 era despite the challenges of the pandemic.