The biggest institutional investors into Europe’s commercial property market set a new record for apartment investment in 2020. Nearly 30% of total acquisition activity was focused on the residential for rent and student housing sector last year, according to Real Capital Analytics data.

In October 2020, 6.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from September 2020, but a 2.4-percentage point increase from October 2019, according to the latest CoreLogic Loan Performance Insights Report.

Applications by prospective tenants for a rental home generally pick-up each spring. The President’s declaration of a national emergency on March 13 triggered Shelter-In-Place restrictions and disrupted the seasonal rise. By the end of March applications for rental homes were down 42% from the same period one year earlier.

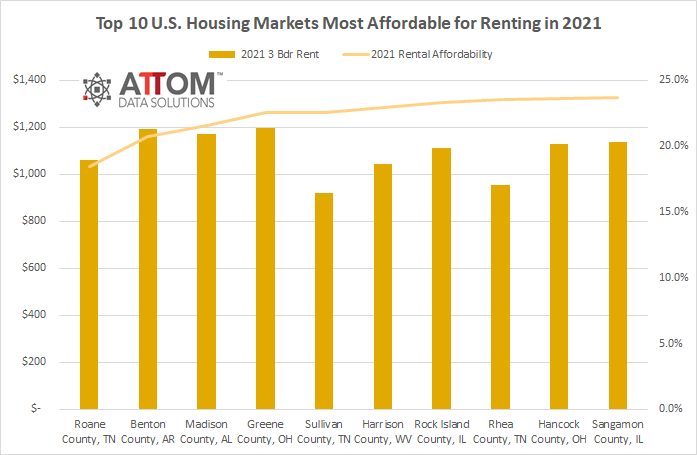

According to ATTOM Data Solutions’ newly released 2021 Rental Affordability Report, owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 63 percent of the U.S. counties analyzed. The annual report noted this trend is occurring despite median home prices increasing more than average rents over the past year in 83 percent of those counties and rising more than wages in almost two-thirds of the nation.

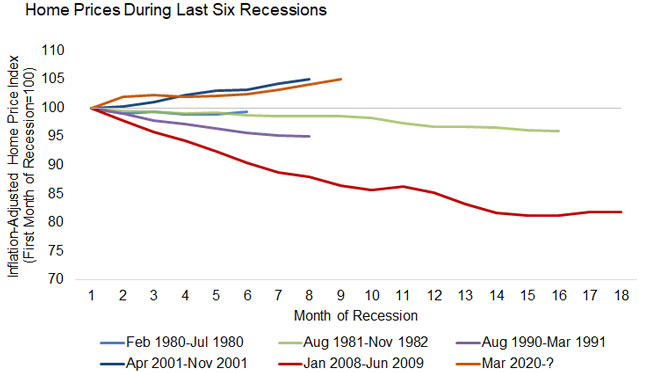

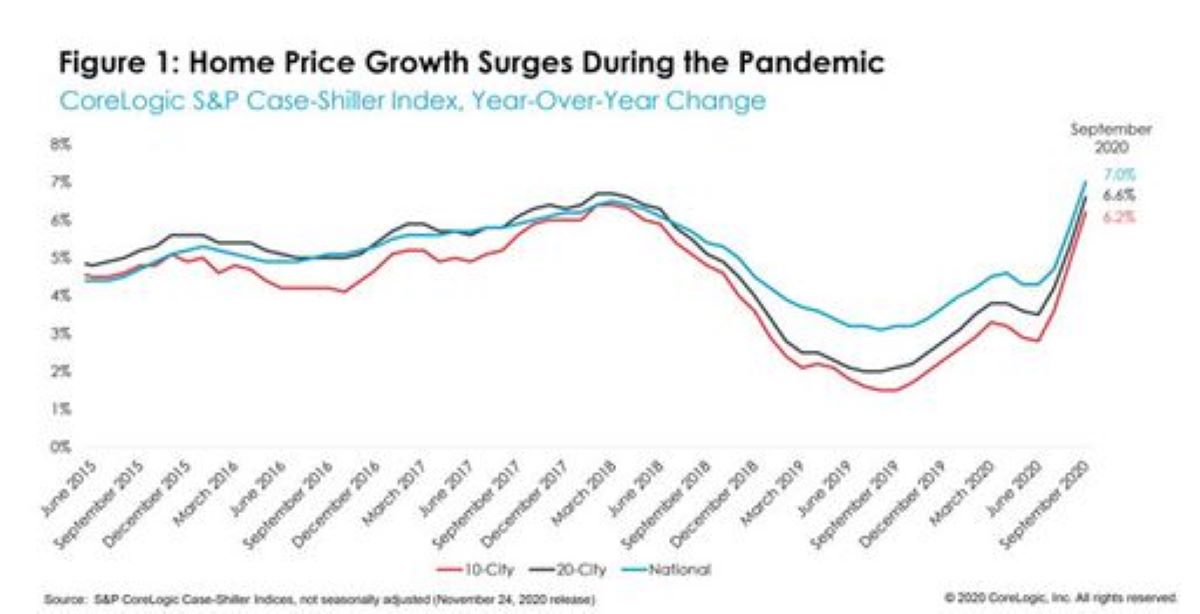

National home prices increased 8.2% year over year in November 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The November 2020 HPI gain was up from the November 2019 gain of 3.7% and was the highest year-over-year gain since March 2014. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

Average Wage Below Level Needed To Afford Typical Home in the U.S.; Affordability Worsened in Fourth Quarter in 55 Percent of Housing Markets; Median Home Prices Up At Least 10 Percent in Most of Nation

In what has been a year of upheaval, one area of normalcy for the multifamily industry has been the flow of new units into the market. After some initial delays in the early days of the pandemic, the new construction pipeline ramped back up to deliver about as many units as were delivered in both 2018 and 2019.

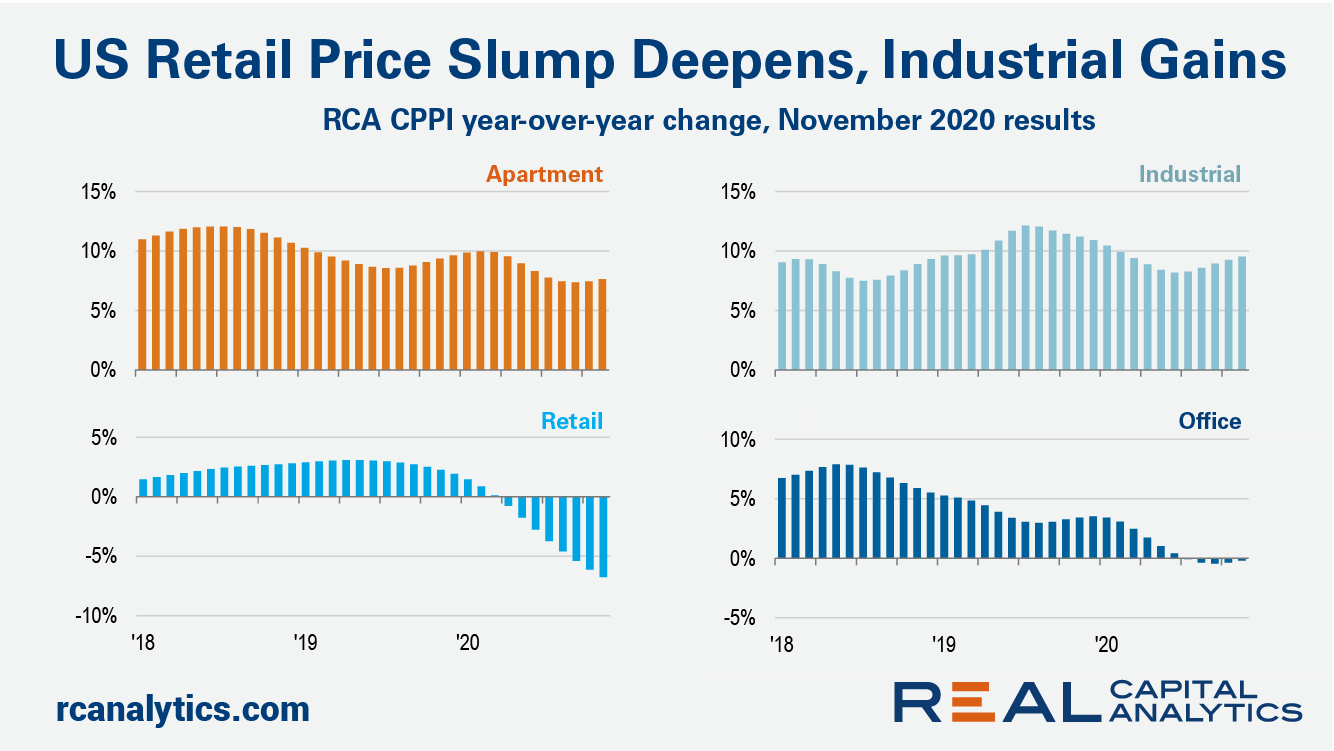

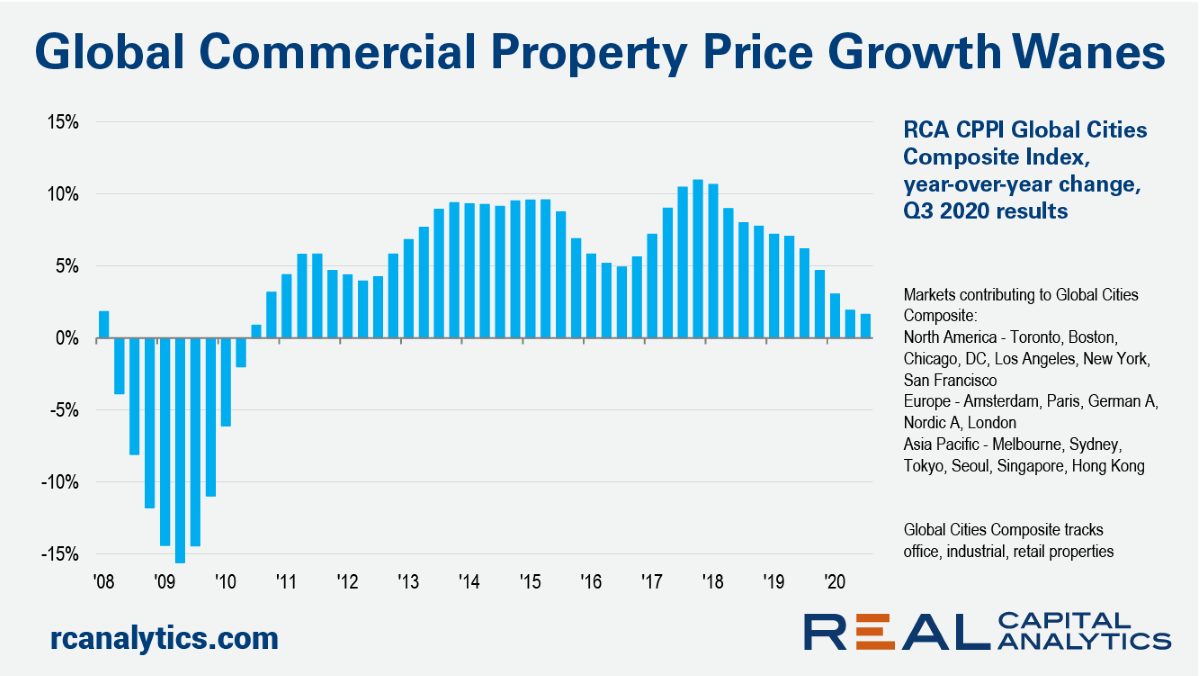

The U.S. national rate of commercial property price growth rose in November at the fastest annual clip since the beginning of the pandemic on the back of continued strong industrial and apartment price gains. The US National All-Property Index increased 5.7% from a year ago, the latest RCA CPPI: US summary report shows. In the retail sector meanwhile, the slump in prices deepened.

10,042 U.S. Properties Received a Foreclosure Filing in November 2020, Down 14 Percent from Last Month; Florida tops out with the highest foreclosure rate, leading the nation in REO filings; Foreclosure Starts Uptick Monthly in Missouri, Indiana and Georgia

After years of steady price increases, 2020 brought the nation’s rental market to a halt. Typically rents rise during the busy summer season, but this year apartments across the country are on average renting for about two percent less than they were pre-pandemic.

Into the final weeks of 2020, RCA’s tracking of global commercial real estate activity shows that the Americas region has been worst affected by the Covid-19 pandemic in the year so far.

Buying a foreclosed home in the United States isn’t always as sweet a deal as it looks on paper. It could sit in a distressed neighborhood or come with a long list of costly repairs, not to mention old liens that the bank didn’t pay off before putting it up for sale.

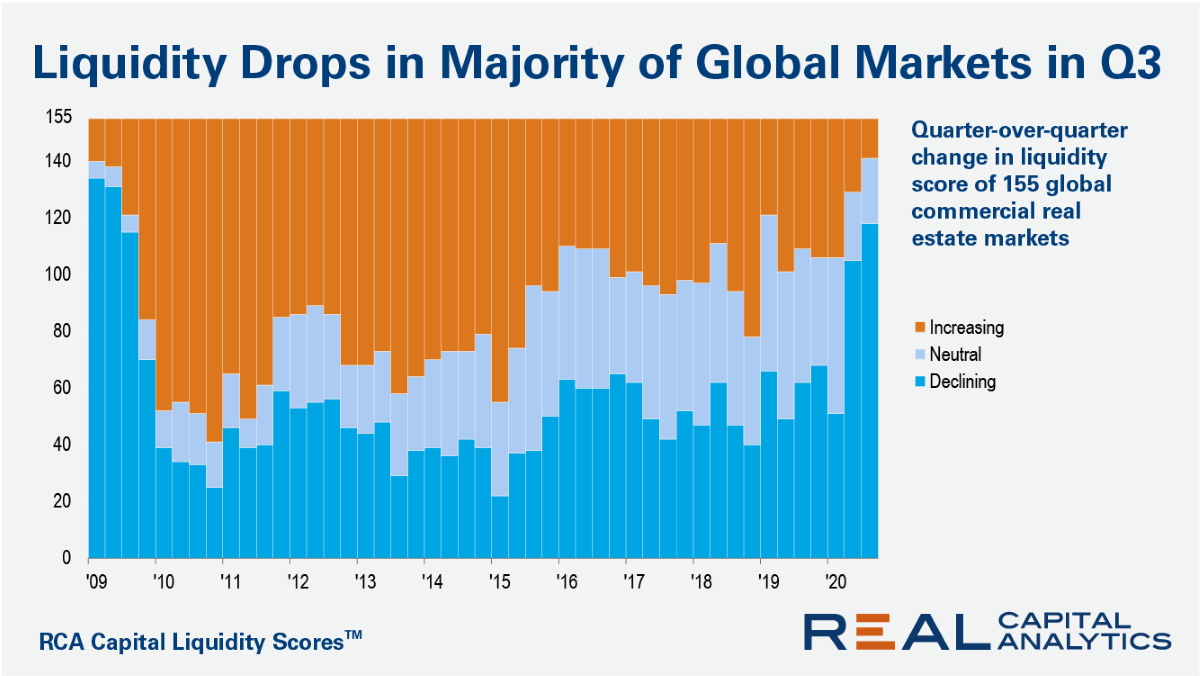

Market liquidity fell in 118 of 155 global commercial real estate markets in the third quarter of 2020, a widening swathe of liquidity declines than seen in the second quarter of the year, according to the latest update of the RCA Capital Liquidity Scores.

2020 was a truly unprecedented year. With it behind us, let’s look ahead at three housing market trends that are likely during the next three years. First, exceptionally low mortgage rates are likely to be around for an extended period. We expect 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years.

National home prices increased 7.3% year over year in October 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The October 2020 HPI gain was up from the October 2019 gain of 3.5% and was the highest year-over-year gain since April 2014. The pandemic has shifted home buyer interest toward detached rather than attached homes as detached homes have more living area and tend to be located in less densely populated neighborhoods.

With the peak summer renting season behind us, we are now entering the time of year when fewer moves normally take place, causing a seasonal dip in rent prices. And although this year’s peak season was significantly disrupted due to the COVID-19 pandemic, our national index has stabilized back to a more typical trend over the past few months. Rents fell by 0.5 percent this month, which is consistent with what we’ve seen in the past.

While 2020 has left little to be surprised about, the home purchase market has surprised for the better. Strong home buying activity continued to soar into autumn, with September reaching the strongest annual growth since pre-Great Recession.

Through the roller coaster year that has been 2020, one area of normalcy for the multifamily industry has been the extent of new construction activity. Though there were some delays earlier in the year, deliveries are on pace to be nearly to the level seen in 2018 and in 2019.

The global rate of commercial property price growth waned in the third quarter of 2020 as transaction activity continued to stumble amid the worldwide health crisis, the latest RCA CPPI Global Cities report shows.

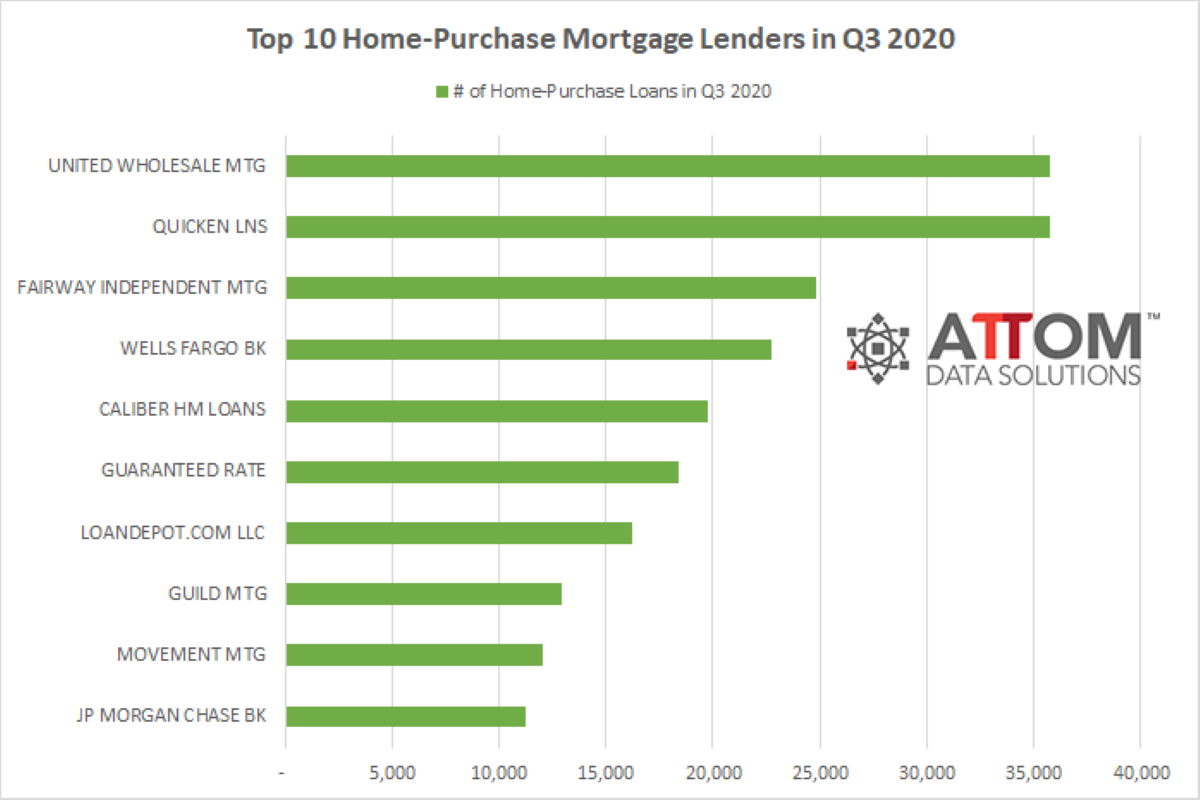

ATTOM Data Solutions’ newly released Q3 2020 U.S. Residential Property Mortgage Origination Report shows that 3.25 million mortgages secured by residential property were originated in Q3 2020 in the U.S. The report noted that figure was up 17 percent from Q2 2020 and 45 percent from Q3 2019, to the highest level in 13 years.