Our latest white paper draws on Crexi’s commercial real estate data insights and Placer.ai’s foot traffic intelligence to show how recent migration trends and overall population growth are uniquely impacting the local retail space in six growing cities. Below is a taste of our findings. To find out which up-and-coming markets made the cut, what is driving retail recovery in each area, and unique ways CRE players can capitalize on these changes

One emerging use case for Consumer Edge data is better understanding real estate investments, both for real estate investors and for companies looking at the best other tenants to position themselves with. In today’s Insight Flash, we illustrate how either of these groups would think about a potential location strategy based on which subindustries are growing fastest locally, which other tenants are most likely to be cross-shopped, and which businesses are retaining their in-store appeal.

Welcome to the October 2022 Apartment List National Rent Report. Our national index fell by 0.2 percent over the course of September, marking the first time this year that the national median rent has declined month-over-month. The timing of this slight dip in rents is consistent with a seasonal trend that was typical in pre-pandemic years. Assuming that trend continues, it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market.

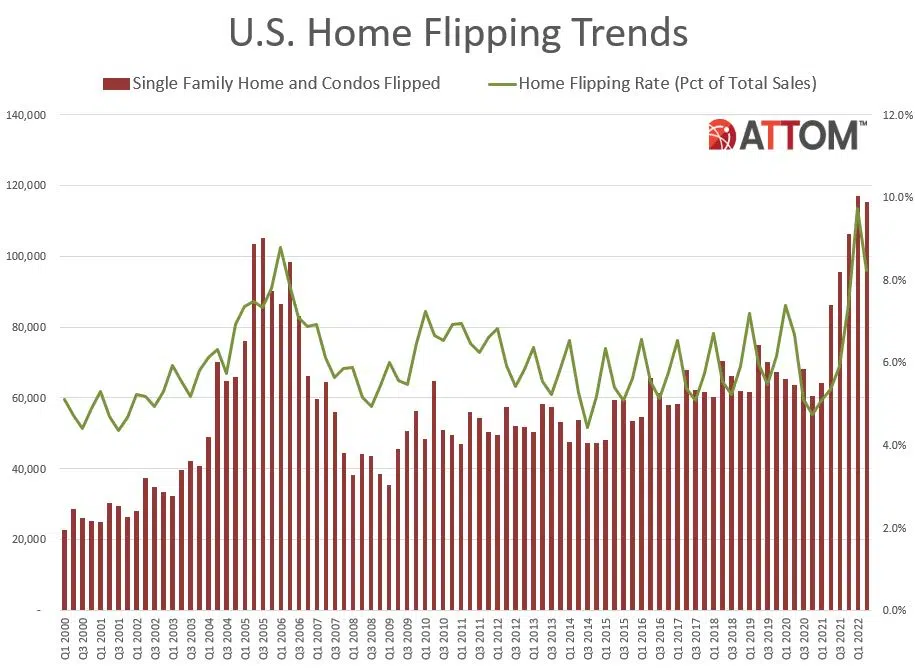

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Home Flipping Report showing that 115,198 single-family houses and condominiums in the United States were flipped in the second quarter. Those transactions represented 8.2 percent of all home sales in the second quarter of 2022, or one in 12 transactions. The latest portion was down from 9.7 percent, or one in every 10 home sales, in the nation during the first quarter of 2022, but still up from 5.3 percent, or one in 19 sales, in the second quarter of last year.

Although U.S. single-family rent growth was up by 12.6% in July year over year, the gains continued to slow from the historic high recorded in April. CoreLogic observes similar price growth relaxation in most major metro areas tracked in the SFRI, including popular Sun Belt cities that have seen rental costs skyrocket. Miami’s 30.6% annual price gain again topped the country in July but is down from the 40.8% year-over-year growth recorded in March 2022. Phoenix, which posted a 12.2% annual gain in July, saw rental cost growth drop by 6 percentage points from March.

After large increases in mortgage fraud risk for much of 2021, our 2022 Annual Mortgage Fraud Report shows a 7.5% year-over-year decrease in fraud risk at the end of the second quarter of 2022. The decline is partially due to the recalibration of our scoring model in the first quarter of 2022. However, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through July 2022 with forecasts through July 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

Demand for second homes surged after the onset of the COVID-19 pandemic nearly doubling the pre-pandemic demand level in late 2020. Flexibility to work remotely, coupled with record-low interest rates, induced the hike in second home demand in 2020 and 2021.Though remote work remains common in 2022 and will for the foreseeable future, low interest rates have vanished, while home prices are at record highs. As a result, home affordability has decreased for all, whether looking to buy a primary residence or a second home.

Welcome to the September 2022 Apartment List National Rent Report. Our national index rose by 0.5 percent over the course of August, half the rate of growth compared to last month. This marks a deceleration of the rental market that follows a typical, pre-pandemic trend. This year rents have risen slightly faster than they did before the pandemic, but significantly slower than they did in 2021 when rent inflation was at its peak. So far in 2022 rents are up 7.2 percent, compared to 14.8 percent at this point in 2021. Year-over-year growth has slowed to 10 percent, down from a pearl of nearly 18 percent at the beginning of the year.

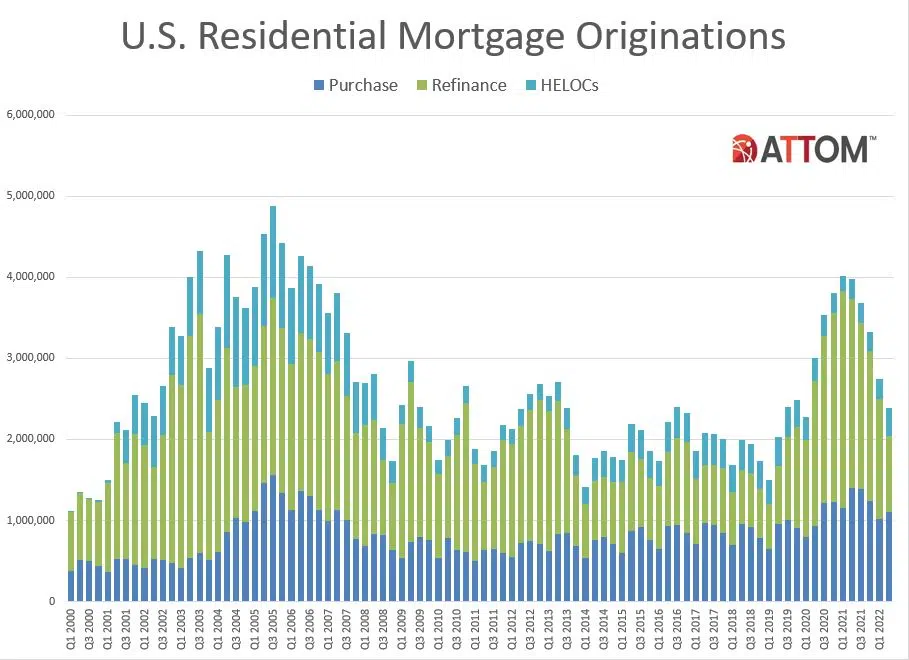

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 2.39 million mortgages secured by residential property (1 to 4 units) were originated in the second quarter of 2022 in the United States. That figure was down 13 percent from the first quarter of 2022 – the fifth quarterly decrease in a row – and down 40 percent from the second quarter of 2021 – the biggest annual drop since 2014.

Multifamily rent growth has garnered plenty of attention over the last 12 or 18 months. For the majority of that time, the focus was on the unprecedented rate of the growth – at least in the modern era. Over the last month or so some of the conversation has shifted to discussing a slowdown in growth. The aim of this month’s newsletter will be to add some additional clarity and context to the discussion.

New homes have experienced the same record price appreciation that the overall market has seen in the past two years. In June, the annual appreciation for new home prices was 17%, which is only slightly below 20% for existing homes1. To develop a more complete picture of the overall market, we must also look at the number of sales — and those tell a different tale.

CoreLogic©, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. Single-family rent prices remain elevated, up 13.4% from one year earlier, but have continued to relax compared with growth seen earlier this year. This deceleration could be partially due to worries over an impending economic slowdown, even though the job market added 528,000 positions in July, returning the employment rate to its level prior to the COVID-19 outbreak

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through May 2022. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through June 2022 with forecasts through June 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

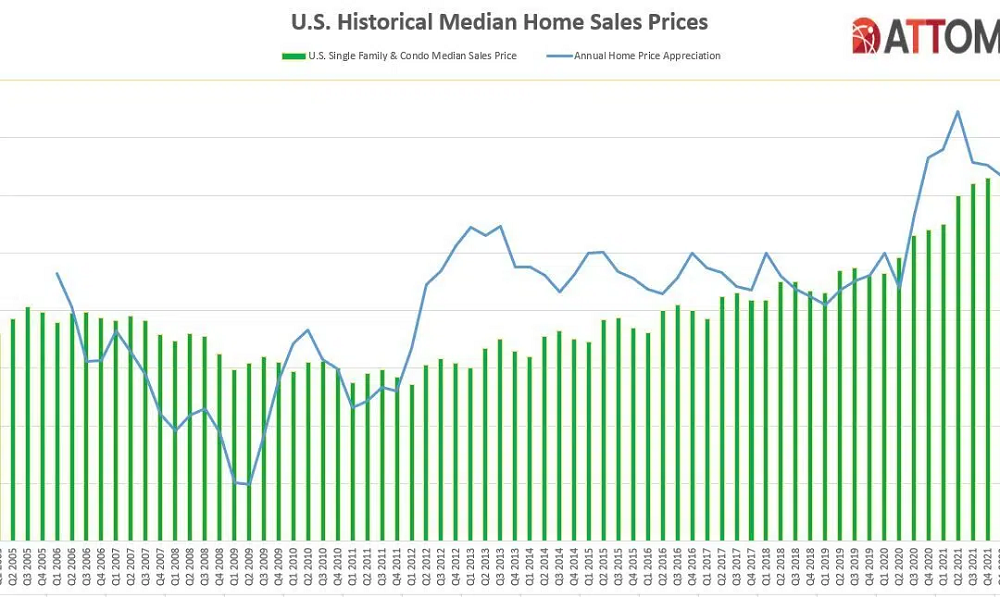

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales across the United States hit another new record of 55.5 percent following the largest quarterly gain in a decade.

Welcome to the August 2022 Apartment List National Rent Report. Our national index rose by 1.1 percent over the course of July, a slightly slower rate of growth than we observed last month. So far this year, rents are growing more slowly than they did in 2021, but faster than they did in the years immediately preceding the pandemic. Over the first seven months of 2022, rents have increased by a total of 6.7 percent, compared to an increase of 12.0 percent over the same months of 2021. Year-over-year rent growth currently stands at 12.3 percent, but has been trending down since the start of the year from a peak of 18 percent.

During the first six months of the year, the value of commercial and multifamily construction starts in the top 20 metropolitan areas of the U.S. increased 24% from 2021, according to Dodge Construction Network. Nationally, commercial and multifamily construction starts increased 18% year-to-date. In the top 10 metro areas, commercial and multifamily starts rose 28% in the first six months of 2022 compared to that of 2021.

Household composition refers to the group of individuals who live together in a household, and how they relate to one another. Historically, changes in household composition have been fairly gradual and reflect cultural and economic shifts that unfold over generations. But the household shifts that resulted from the COVID-19 pandemic were rapid, and have had a dramatic effect on housing affordability.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its Midyear 2022 U.S. Foreclosure Market Report, which shows there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022. That figure is up 153 percent from the same time period a year ago but down just one percent from the same time period two years ago.