Along with the Nasdaq, many eCommerce and online focused businesses soared during quarantine. The thinking was that these businesses were either gaining new customers or were getting existing customers to spend in new ways. The belief was that when quarantine ends these gains would become permanent. If these gains aren’t permanent and the sales bump was only driven by hoarding behavior or other one-time purchases, this shouldn’t drive stocks higher since it will not add to long term company earnings.

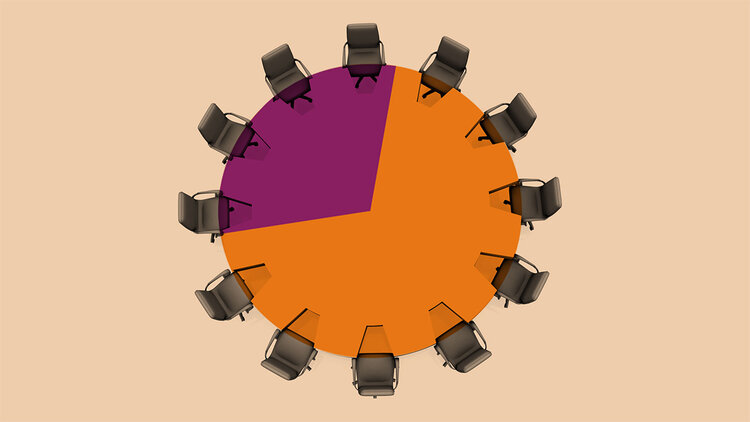

Differences in gender and ethnicity distributions are most dramatic within senior management. Representation among senior management drops most dramatically for female employees. The effect of being from two minority groups is smaller than what would be expected if the effects were independent.

It’s a busy time to work in software and IT. Businesses are transitioning their business models rapidly — and aren’t looking back. With that, there have been changes in software advertising. Cloud computing, network equipment and anti-virus/malware software were among the biggest B2B movers in May, with significant increases in spend.

Kayrros detected one restart and two outages in the week ended June 21. US facilities are operating at the lowest utilization rates since January at 58%. Exports decreased by 25,000 cm/d to hit 121,000 cm/d last week. Out of the six export terminals, only three ports exported cargoes last week: Port Arthur (Sabine Pass), Chesapeake Bay (Cove Point), and Calcasieu Lake (Cameron LNG).

As states begin to loosen shelter-in-place restrictions, various factors have led to an improved landscape for the travel and transportation industry. Although it must be said – progress has been slow. Part One of this blog analyzes spending on travel and transportation compared to 2019. Part Two will focus on insights related to commuting. In an April blog post, we analyzed data which showed dramatic decreases in travel-related consumer spending during the second half of March and into April.

It’s no secret that Google updates its SEO algorithm at least once a year. The reason for this is that Google wants the most engaging content to rank high and appear on the first page of the search engine, and for less relevant content to drop down. Naturally, as people’s interests change, the algorithm must also change to achieve that goal. This means that as content gains relevancy, the algorithm changes will move results higher in the ranks.

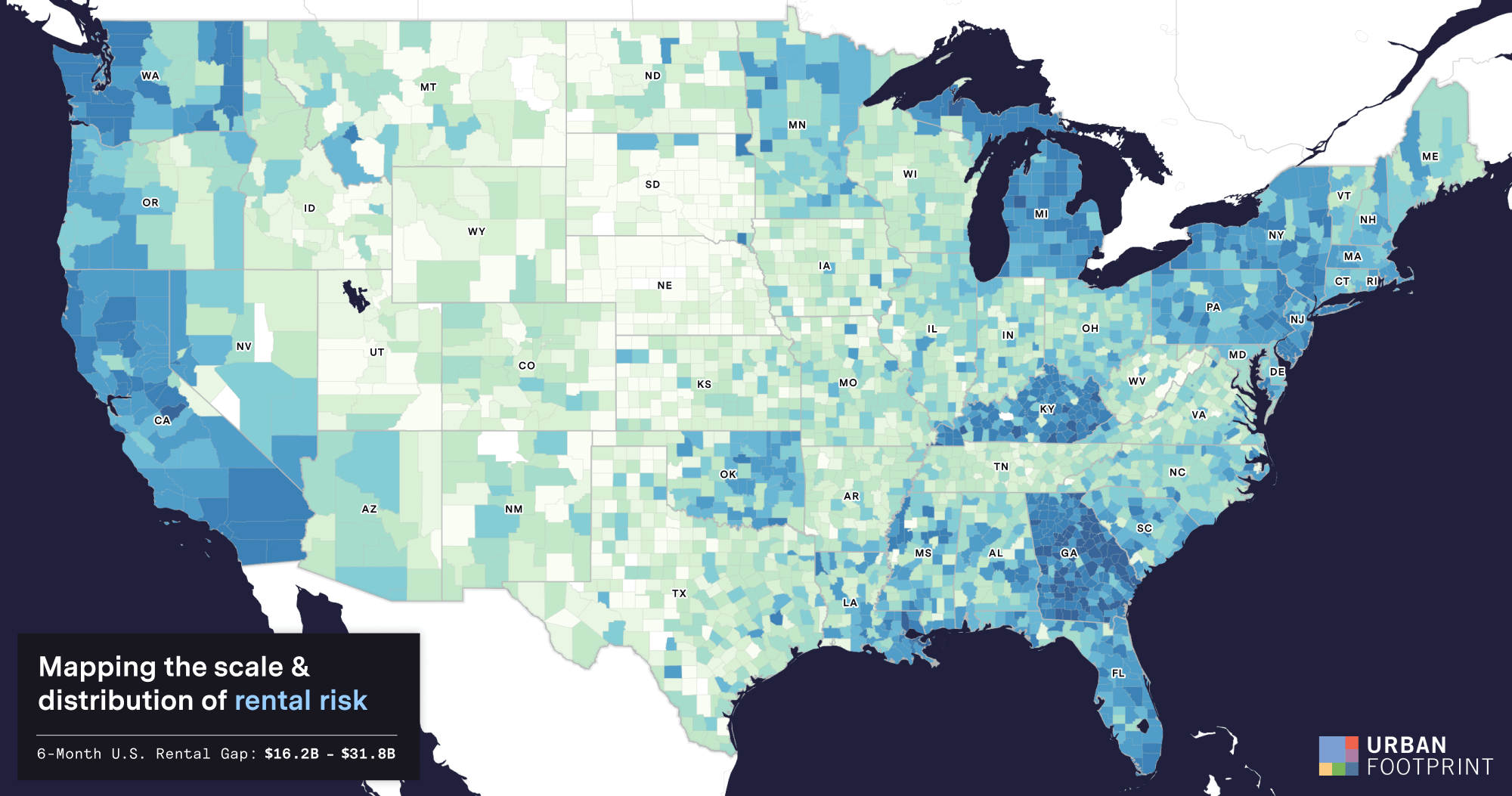

As the COVID-19 pandemic continues to batter the U.S. economy with an unprecedented surge in unemployment, many American families are facing a new threat to their livelihood: eviction. This looming reality adds new and urgent questions about the fate of our economy: How many American families will face eviction without additional financial assistance after the federal CARES Act Pandemic Unemployment Assistance (PUA) expires on July 31, and where will these evictions be geographically concentrated?

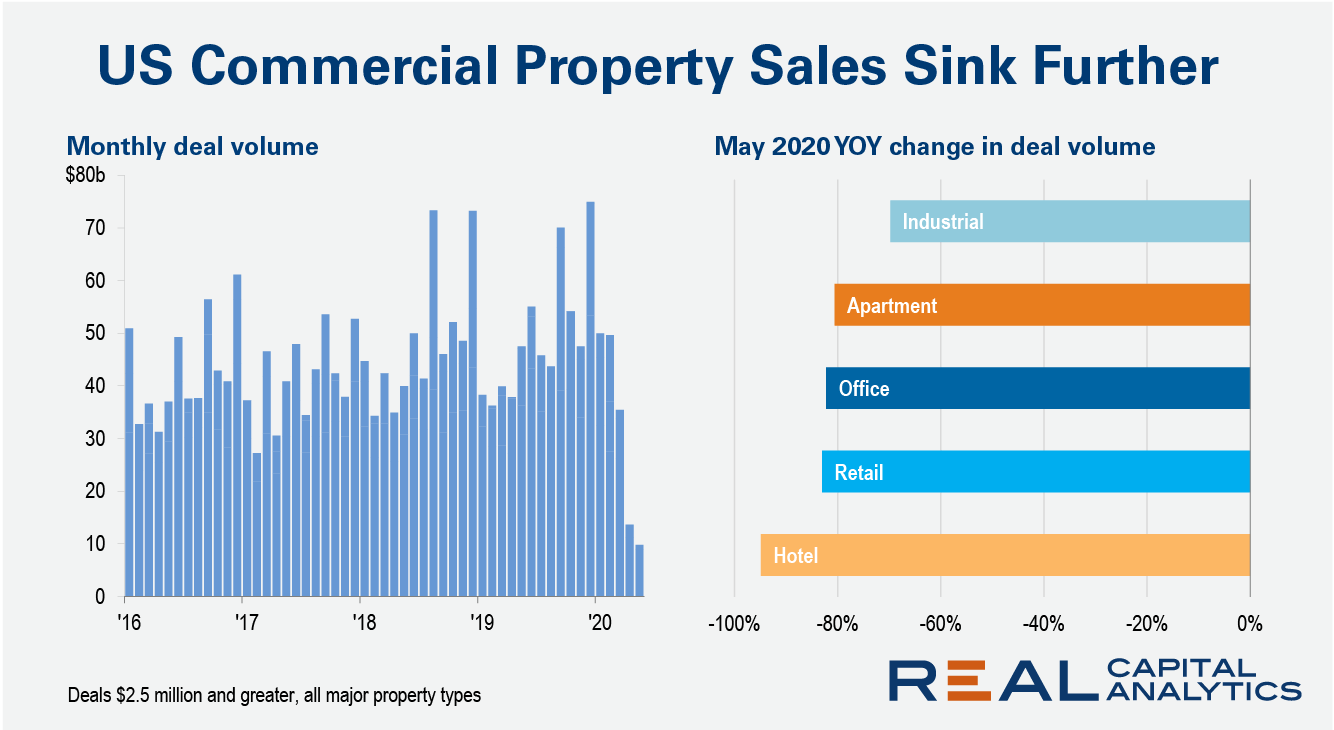

Sales of U.S. commercial property sank again in May as the Covid-19 crisis kept investors on the sidelines, the latest edition of US Capital Trends reports. Transaction volume fell to the lowest level for a May since 2010 and none of the major property types escaped the continuing rout.

Footfall to Italy’s hospitality sector has hit 90% of pre-lockdown levels, as appetite for the country’s restaurants, cafes and bars continues to grow. Hospitality in Italy saw a bigger rise in footfall than any of its European counterparts following the easing of lockdown measures at the start of May and this steady upward trend has reached record highs in the last week.

As one of the sectors hit hardest by the pandemic, hotels, resorts and leisure facilities are hoping that the summer may offer a recovery in the form of reduced case numbers and fewer cancelled vacations. A critical period for the industry, a bounce back in July and August could help mitigate some of the losses from the past few months. Our analysis of foot traffic, using our Hotel, Resort and Leisure Index, shows a very mixed picture across different states.

Such are the societal consequences of the coronavirus pandemic and the speed at which events have unfolded, that playful variations on the calendar terms BC and AD have begun to appear in the press: if 2020 is the year of the coronavirus, then BC now stands for Before Coronavirus; AD has been replaced with AC, which stands for After Coronavirus.

The most recent data from May and early June 2020 suggest that a modest recovery in the auto industry is ongoing, with market-wide shoppers in May 2020 rising 24 percent and sales rising 57 percent from the record lows of the previous month.

Who needs cardio? Watching the trajectory of fitness companies since the advent of coronavirus is enough to get anyone’s heart rate up, no treadmill required. Unsurprisingly, the pandemic has been tough for the fitness business to navigate. On Monday, California-based 24 Hour Fitness filed for bankruptcy and announced plans to close 135 of its 445 locations.

It’s no secret that the restaurant industry has been hit hard by COVID-19 and it will take a significant amount of time for many to bounce back to normal levels under ongoing restrictions. In fact, many thought that the combination of the pandemic and already struggling brands could signal serious problems for sit-down chains.

Americans are moving less today than ever before, but some suspect the coronavirus will reignite mobility. Our survey finds that because of the pandemic, 17 percent are now more likely to move by year’s end. But another 30 percent say they are more likely to stay where they are.

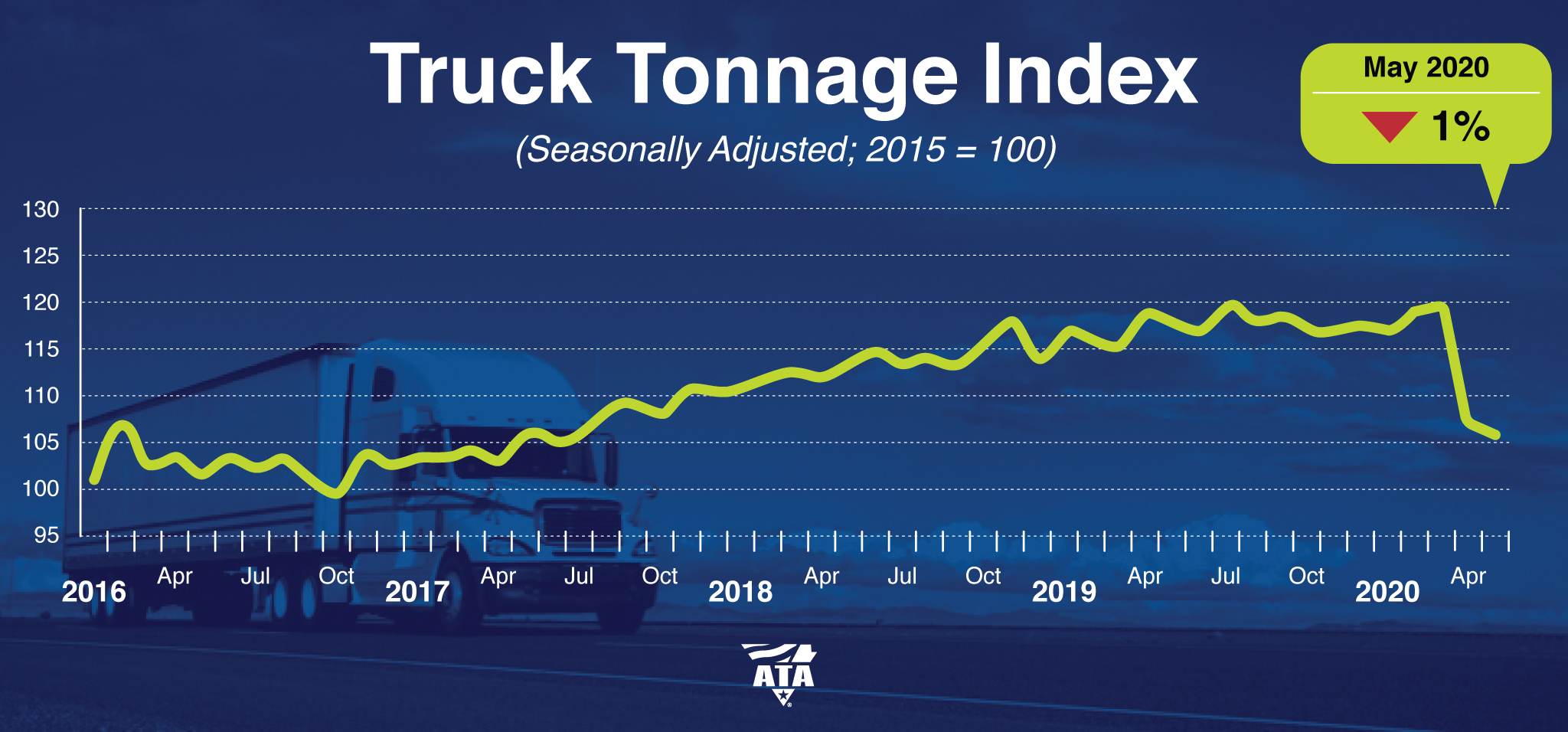

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index contracted 1% in May after falling 10.3% in April. In May, the index equaled 106.1 (2015=100) compared with 107.2 in April.

As a result of COVID-19, by mid-March restaurants in most parts of the United States began suspending operations. According to research from 1010data, year-over-year sales in fine-dining, casual-dining and fast-casual establishments quickly plummeted 91%, 77% and 49%, respectively.

Footfall across consumer-facing shops and stores in the Far East and US has dropped by up to 10 points in the last week, as Huq’s geo-data suggests that social distancing measures and fears of a second wave could be subduing the return to ‘normal’. Huq’s ‘All Consumer’ Indicator, which tracks footfall across shops and stores around the world, showed an initial increase in activity from the end of April as countries began to lift lockdown measures.

Credit Benchmark have released the June Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials.

With most of the country now in some stage of economic re-opening, the lockdown phase of the COVID-19 response is, at least for now, behind us. The road back to pre-pandemic normalcy is likely to be a rocky one and uncertainty abounds. Before looking ahead, let’s take a look at how stabilized properties performed in April and May while much of the country was under some form of shelter-in-place policy.