Container capacity on all major trade lanes has been severely reduced, with the deepest cut planned for Asia – Red Sea at 14%. The world’s most active trade lane has taken a 10% haircut, while Asia – US West Coast has been dialed back 8%.

Student loans of $1.59 Trillion in the United States are now the second largest category of consumer loans behind only Mortgage loans. With students now taking classes remotely there is little opportunity to work part time either at school or at nearby businesses to pay off those loans.

Game spending totaled a record-breaking $10.5B in April 2020, showing the continued strength of the medium during the COVID-19 crisis. Lockdowns that began during March had an even greater impact on gaming habits in April as they continued for the entire month in many regions.

The majority of STR participating hotels are closed across Europe. As of 30 April, Barcelona showed the largest percentage of closures (96%), followed closely by Madrid (95%) and Athens (92%). Moscow and Saint Petersburg closures, however, were the lowest in Europe, at 15% and 19%, respectively.

Life under lockdown has presented the Foodservice industry with its biggest challenge for a generation and footfall under forced closures has dropped by well over 90%. However, Huq’s Foodservice Indicator, which tracks footfall activity across Restaurants, Quick Service Restaurants (QSR) and Pubs, shows footfall to pubs has been increasing while offering some clues as to how certain businesses have adapted during this period to maintain a presence and survive.

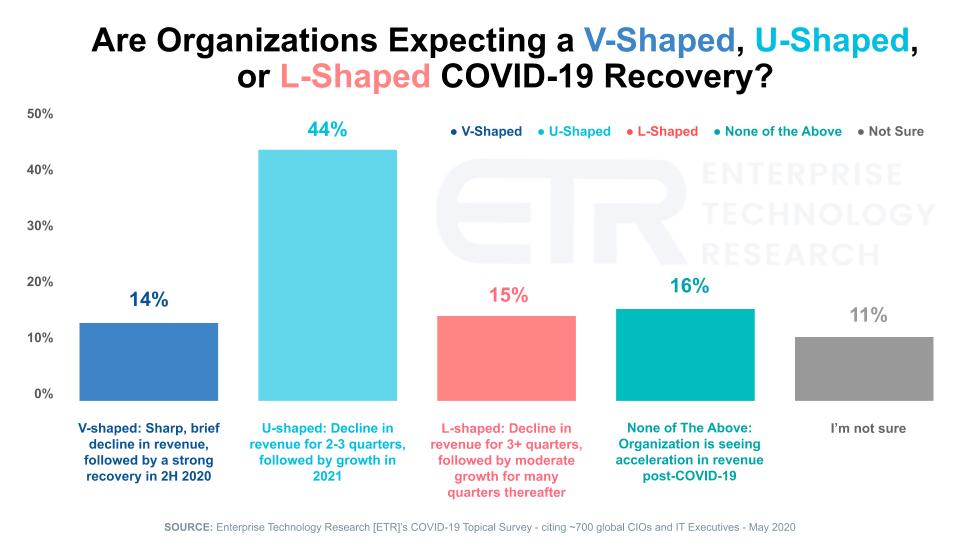

ETR launched its Summer Emerging Technology Study last Thursday afternoon to gauge CIO sentiment levels across 300+ private enterprise technology companies. As a follow up, we asked these same high-level IT decision makers to provide insight as to the type of recovery their organization expects due to COVID-19. Specifically, we gauged whether their organization is expecting a V-shaped, U-shaped, or L-shaped recovery due to COVID-19.

The BBB cliff has been widely discussed and the growing number of recent “Fallen Angels” shows that a number of corporates are falling over the cliff edge.

With the US economy on pause, many companies are struggling to remain profitable. As we have seen in prior crises, advertising budgets tend to be the first expenses to be cut. This leads to the inevitable layoffs at media companies, advertising agencies, and internally at companies.

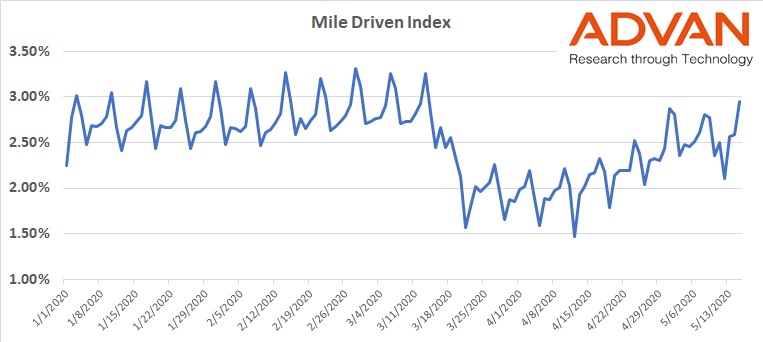

The key to any economic recovery in the US is relaxing social distancing. Many businesses such as restaurants, gyms, doctors and hotels can’t operate profitably at 50% or lower capacity. Most restaurants run on razor thin margins, so filling seats and cramming them together is essential for their survival. In this article we examine the year to date recovery of the restaurant industry in the US.

Auto manufacturers have been preparing plant restarts for weeks, balancing county ordinances, financial concerns, demand shock, and protecting the safety of their workers.

Orbital Insight has been closely monitoring U.S. and international auto production, plant by plant, to help investors quantify the economic impact of COVID-19 on the autos sector and recovery by geography and brand.

The month of May underlined the volatility expected in global demand as markets wrestled with the fallout from the COVID-19 virus pandemic and the resultant regional lockdown measures. The Seasonally Adjusted Annualised Rate (SAAR) has fallen to just 49 million units in April 2020, from 91 million units in December 2019.

Latin America is increasingly becoming an epicenter of the global coronavirus (COVID-19) disease 2019 pandemic. The shock on the region's economies is worsening, in turn depressing energy consumption.

COVID-19 hits Latin American economies that are already weakened, with already dampened energy demand growth expectations. Mexico's economy stagnated in 2019 amid policy uncertainty, Brazil is shaking off years in the doldrums, Argentina is trying to refinance its massive debt, and Chile recently endured nationwide social protests.

Based on web data, we have observed a notable deterioration in multifamily and single-family rentals trends during April-20.

COVID-19’s impact was so profound that even the Lease Over Lease Δ change did not exhibit the seasonal improvement in Apr-20 from Mar-20 levels for all publicly traded residential REITs (except one company that might be more focused on rate versus occupancy).

As people around the world quarantined, the first thing people turned to in these desperate times was toilet paper. The second thing they turned to was Netflix, or Hulu or a host of other online video providers. The surge of Netflix hours had many concerned that the Internet would crash.

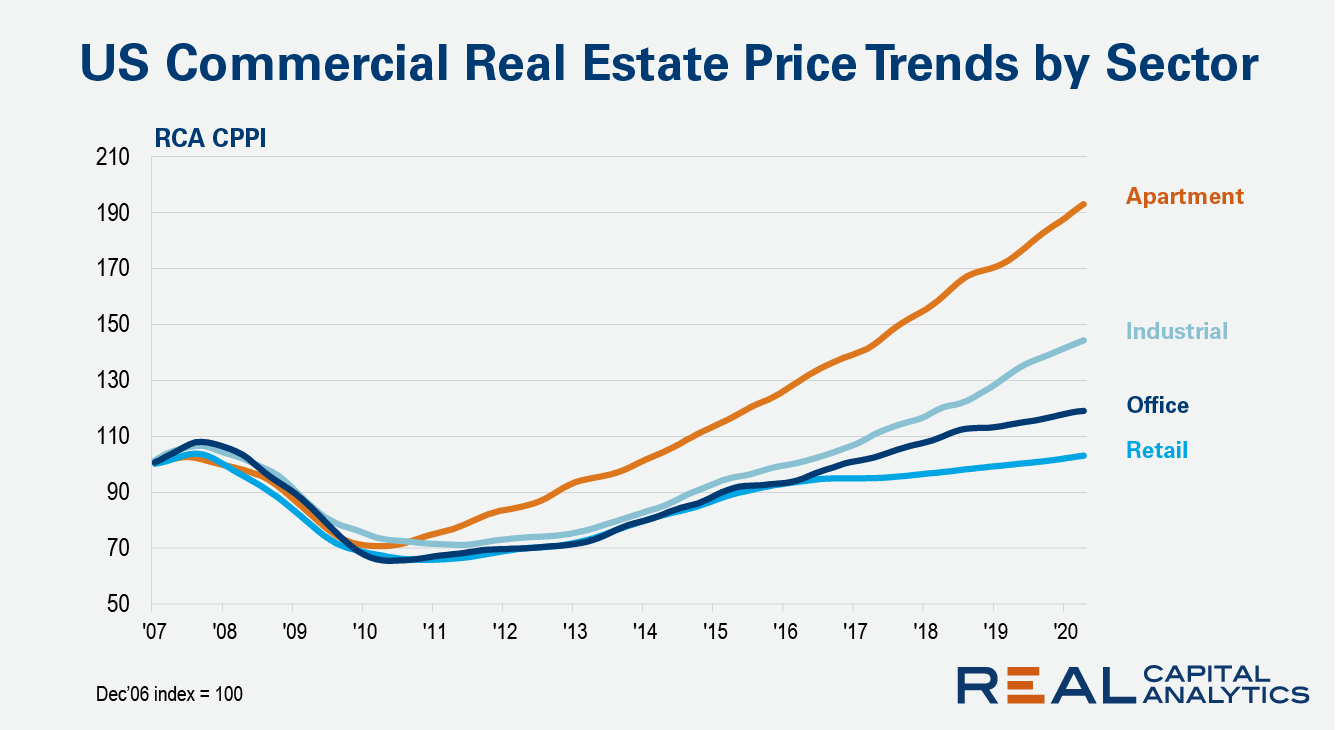

The headline rate of annual U.S. commercial property price gains came in at 6.5% in April, little changed from the growth rate seen in 2020 so far, the latest _RCA CPPI_ summary report shows. The US National All-Property Index gained 0.5% from March.

Geolocation data gives us an almost infinite number of ways to track and measure the extent and impact of relaxing social distancing measures, such as we are starting to witness in many states across the country.

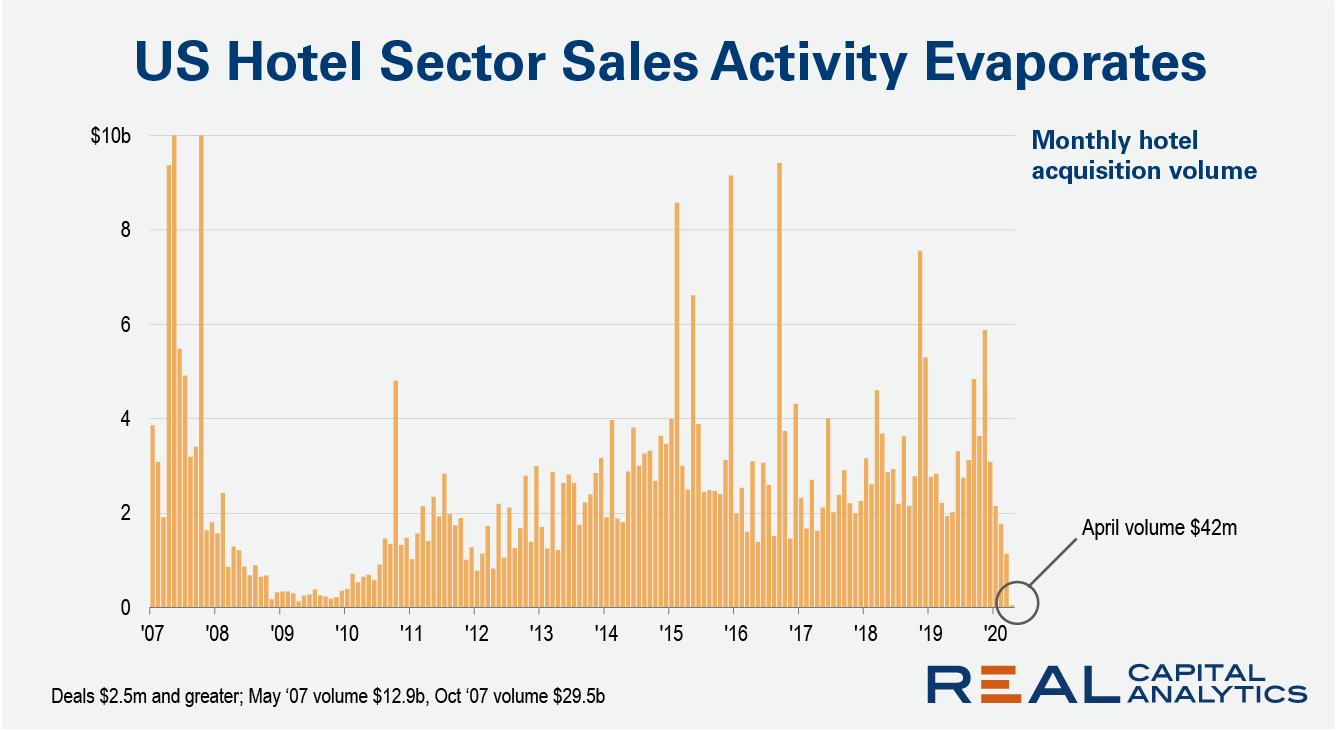

In the month of April fewer than 10 hotel properties changed hands across the entire U.S. We have never seen this level of illiquidity in the hotel market. It is effectively a frozen marketplace.

Hotel sector investment activity was already spinning downward even before the economic crisis wrought by Covid-19. A construction glut in key markets and challenges from upstarts such as Airbnb had put the sector under pressure.

As many Americans continue sheltering in their homes due to the coronavirus pandemic, meal delivery sales have reached new heights. Our data reveals that, through the end of April, meal delivery services saw sales nearly double year-over-year, collectively. As Uber is reportedly working on a deal to acquire Grubhub, these thriving businesses are in the spotlight during the COVID-19 era, while Uber’s rideshare business has taken a major hit.

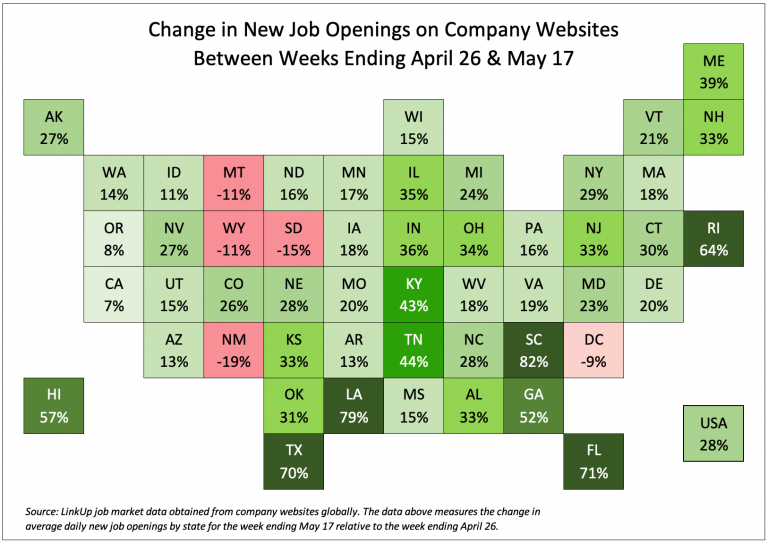

As states begin relaxing lockdown restrictions and opening up their economies, we are analyzing our job market data closely for indications of how quickly the labor market might recover at a local and national level.

Based on Transactions in April, DoorDash takes #1 Spot with 45%, Ahead of Uber Eats (28%) and GrubHub (17%)