Britain’s battered pub and restaurant sector is staring at its worst period of the pandemic as footfall flatlines for more than a month. The Huq Index for Restaurants & Pubs fell sharply post December 10th, and has stood at 5pts since January 9th – down 4.6pts in the last 30 days and little discernible movement in the last seven. Of the three constituent sectors, Pubs, Restaurants and QSR, Pubs have been the worst affected – reading less than 1pt over the equivalent period.

Credit Benchmark have released the January Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials.

With brick-and-mortar retail suffering due to COVID-19, several specialty players have sought haven within higher-traffic big box retailers. This is a familiar model in the beauty industry, where specialty players have long operated their own counters in department stores. This makes it unsurprising that two of the most notable tie-ups in recent months have also been in the beauty space – Target’s announced partnership with Ulta (which was reviewed in a prior Insight Flash), and now Sephora’s entry into 200 Kohl’s locations.

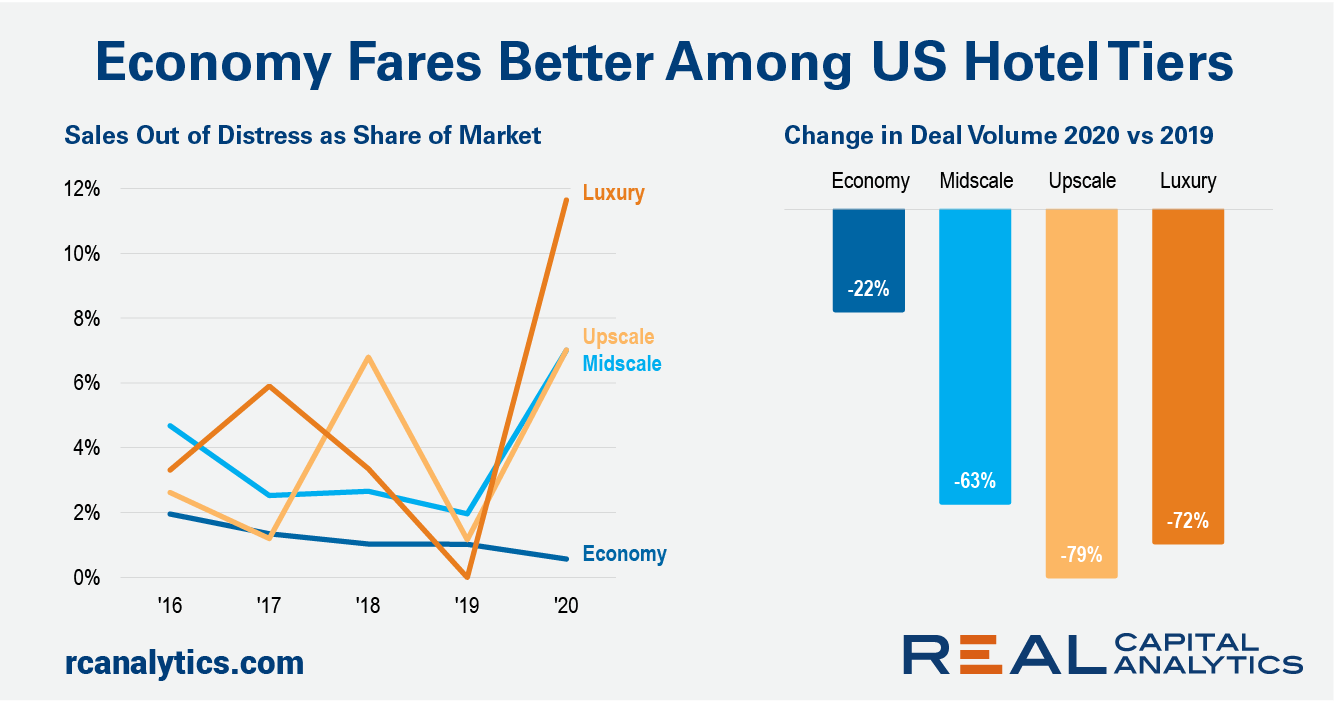

The pandemic hit the U.S. hotel sector hard in 2020. Between travel bans and the economic downturn, the impact to the sector which had already shown some cracks was swift and steep. Transaction volume in the sector fell by more than two-thirds compared with 2019, to the lowest level since 2009. However, the misery was not experienced equally across all chain scales. In 2020, investors had a clear preference for economy branded hotels.

Shares of GameStop ($GME) skyrocketed this week, spurred by a coordinated effort by investors on Reddit. The hugely popular subreddit r/WallStreetBets (WSB) has over 2 million members, composed largely of Millennial and GenZ men. Its recent focus on the old school video game retailer has blown up into an epic battle between individual investors and traditional hedge funds–and one recent calculation shows these hedge funds down a collective $25 billion short-selling $GME.

The charge to produce vaccines and treatments for the Covid-19 outbreak is reflected in the relative strength of productivity across biotechnology research and production facilities, compared with its wider industrial peers.On the 26th January, Biotech came within -9.2% of year-on-year levels – averaging 83.2pts for the month of January. By contrast, on Jan 23rd Huq’s European industrial average fell 41.5pts behind year-on-year levels, averaging 71.8pts for so far this year.

According to the latest flight data by the experts at ForwardKeys, the domestic travel outlook for the Chinese New Year has been hurt by the rise in new cases in China. To prevent the spread of the virus, the vast majority of provinces have been strongly advised by the authorities to not travel outside their residential provinces for the holiday. For those who intend to travel back to their hometowns, it will be required to submit a negative COVID-19 test 7 days before the departure date.

It was the best of times, it was the worst of times . . . actually, the COVID-19 pandemic has just been the worst of times. But it has led to interesting divergences in the US and UK grocery markets. In today’s Insight Flash, we compare the two, digging deep into relative performance and market share for Instacart in the US and Ocado in the UK, in our first-ever flash leveraging our brand-new UK dataset.

In a year dominated by headlines around the struggles of apparel, the wider athletic apparel and athleisure space outperformed. When analyzing Under Armour, Nike and Lululemon we see all three brands enjoying year-over-year growth in January and February before the pandemic brought visits to a screeching halt. The three also recovered exceptionally well with visits down just 2.1% and 9.7% year over year for Nike and Lululemon respectively in October, while Under Armour saw 8.4% year-over-year growth that same month.

Often referred to as the world’s largest mass migration, Chunyun, or the Spring Festival, can see as many as 3 billion trips being made in a more normal year. Coinciding with student breaks, and benefitting from a week of public holidays, vast numbers of students are joined by migrant workers and others returning home to spend time with their family. In more recent years, the Spring Festival is also a time when many have chosen to go on vacation, or return from overseas, causing a spike in both domestic and international air travel.

2020 was a year of consolidation and convergence among top players in the on-demand delivery service market, and 2021 begins with even further expansion of these brands into new markets. Alongside increased consumer adoption of online grocery and food delivery sales we previously reported, the convenience store market is also poised for disruption amid Amazon’s plans to launch 3,000 cashierless Go Stores, grocers Whole Foods and Kroger testing convenience-style store formats, and popular convenience chains like Sheetz stating intentions to compete with both grocery stores and quick service restaurants.

ATTOM Data Solutions, curator of the nation’s premier property database, today released its Year-End 2020 U.S. Home Sales Report, which shows that home sellers nationwide in 2020 realized a home-price gain of $68,843 on the typical sale, up from $53,700 in 2019 and $48,500 two years ago. Profits rose in more than 90 percent of housing markets with enough data to analyze and the latest figure, based on median purchase and resale prices, marked the highest level in the United States since at least 2005.

What an interesting discussion wallstreetbets and GameStop have provided for us. I can’t imagine too many people reading this article are unaware of the situation with the wallstreetbets Reddit thread and GameStop's stock price, but if you are, this is a wonderful explainer.

If you can guarantee one thing about the Health and Fitness app market it is this: downloads will explode in January, then taper during the rest of the year. Why January? Simple. It's when holiday excess and New Year resolutions inspire millions of people to get fit. But, as we know, last year was different. In 2020 it was April, not January, that saw the biggest spike in downloads of Health and Fitness apps globally at 276 million, up 80% year over year.

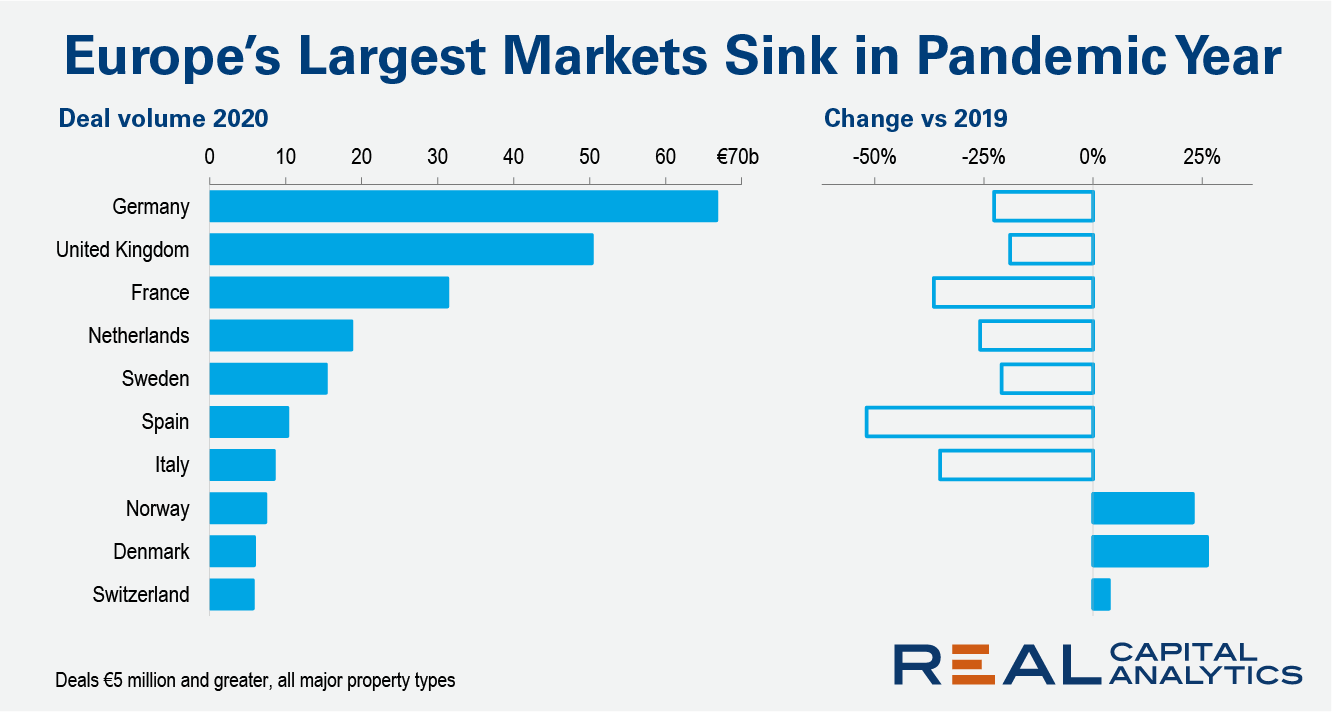

Commercial property sales activity in Europe tumbled by just over a quarter in 2020 in the face of challenges from the Covid-19 pandemic, with a steeper drop seen into the close of the year, the latest Europe Capital Trends report shows. Investment volume across all property types dropped 27% versus 2019. In the fourth quarter, activity was 44% lower than the same period a year earlier, when a record total of commercial property deals closed.

“We’re experiencing problems” was a common phrase faced by users who encountered outages during Q4 2020. We are continuing our series tracking outages in online services using Downdetector® data from Q4 2020. Once more we have focused on seven categories: cloud services, email service providers, financial services, gaming, internet service providers, social media and streaming services.

“Buy now, pay later” may as well be America’s motto. Credit has always been an important driver of the economy, but a new batch of installment payment brands making microloans to consumers have come onto the scene recently as major disruptors to more traditional credit cards.

Shopping habits changed in 2020. Instead of wandering into brick-and-mortar businesses, we spent hours window shopping on the internet. And, if you’re anything like me, you relied a little too heavily on that “Add to Cart” button for a quick rush of quarantine-style serotonin. The proof? Other than the pile of boxes in the corner of my room? US Shopping app sessions increased 65.9% YoY in Q4. A session occurs every time someone opens and uses an app. More sessions, more sales.

While COVID-19 impacted so many industries last year, real estate fared quite well. In the United States, home prices hit a record high in 2020 — just above $320,000, while the UK saw their average house price rise 7.6% compared to 2019. By forcing employees across the globe to work from home and students to learn from their bedrooms, many consumers began to flock away from cities and into the suburbs for more space.

GameStop Corp (NYSE: GME) has been the focus of the investment community for the last couple days and for a justifiable reason. A lot has been written about the technicals of the trade and the various market participants, how they affect the supply and demand and drive the stock price. But we have decided to spin it a different way and look at the fundamentals of the issuer.