As consumers navigate through a pandemic-defined holiday season, we took the opportunity to dig into the start of this season’s behavior utilizing our spend, foot traffic, and retail pricing data, as well as our newly launched income data. Our analysis is an overview of sales data to date* this season. We will be evaluating the full holiday performance after the New Year.

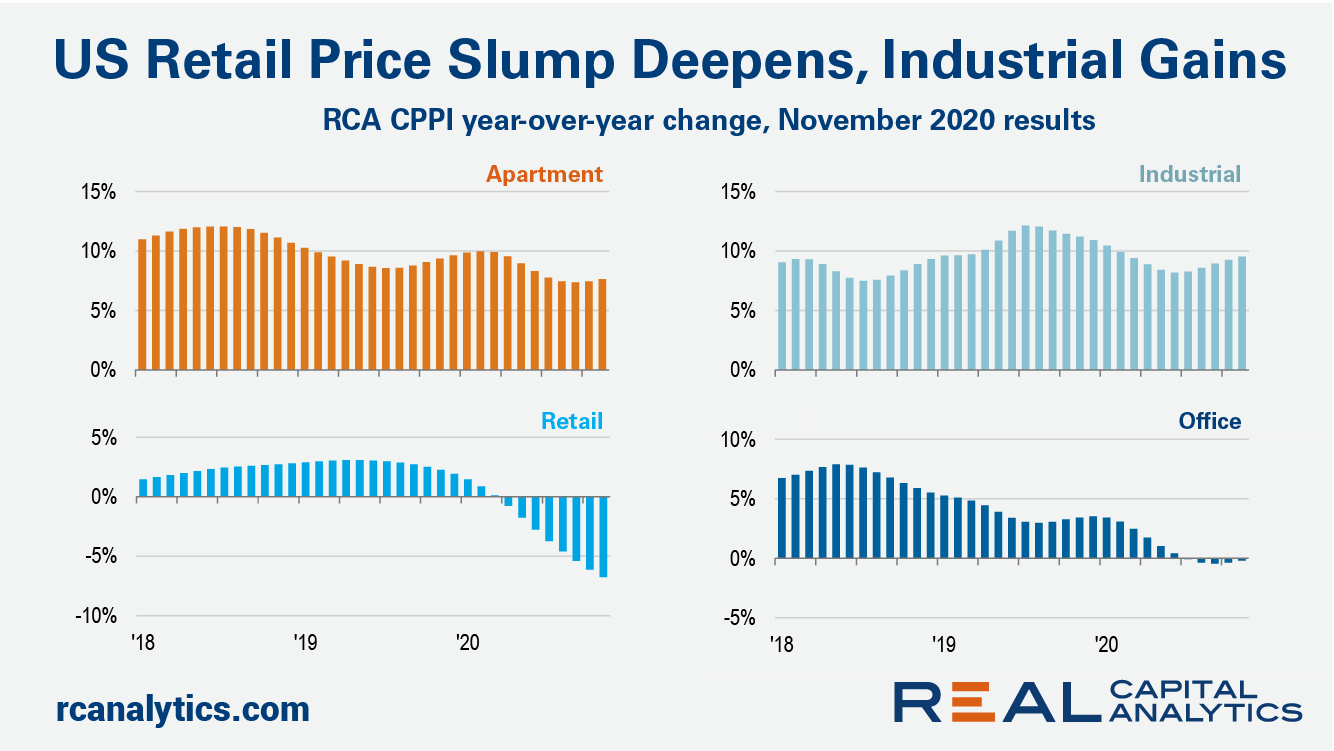

The U.S. national rate of commercial property price growth rose in November at the fastest annual clip since the beginning of the pandemic on the back of continued strong industrial and apartment price gains. The US National All-Property Index increased 5.7% from a year ago, the latest RCA CPPI: US summary report shows. In the retail sector meanwhile, the slump in prices deepened.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. While rideshare sales have been gradually recovering over the past several months, November marked a decline for the first time since April. In November, Uber sales were down 67 percent year-over-year and Lyft sales were down 69 percent year-over-year.

Although the wake-up call for shopping malls to adapt to a changing retail environment was heard long before COVID, the pandemic had enhanced its pressing urgency. Our latest whitepaper discusses some of the ways in which malls can go through a data-driven redevelopment process while adapting to changing industry trends and consumer behavior. Below is a taste of what we found.

After a wildly successful IPO, Airbnb looks to continue to build on its COVID-driven momentum. As traditional travel has slowed, Airbnb has become the preferred method of lodging for many Americans looking for what seems to them a safer way to get away from it all. But is the company’s recent growth sustainable?

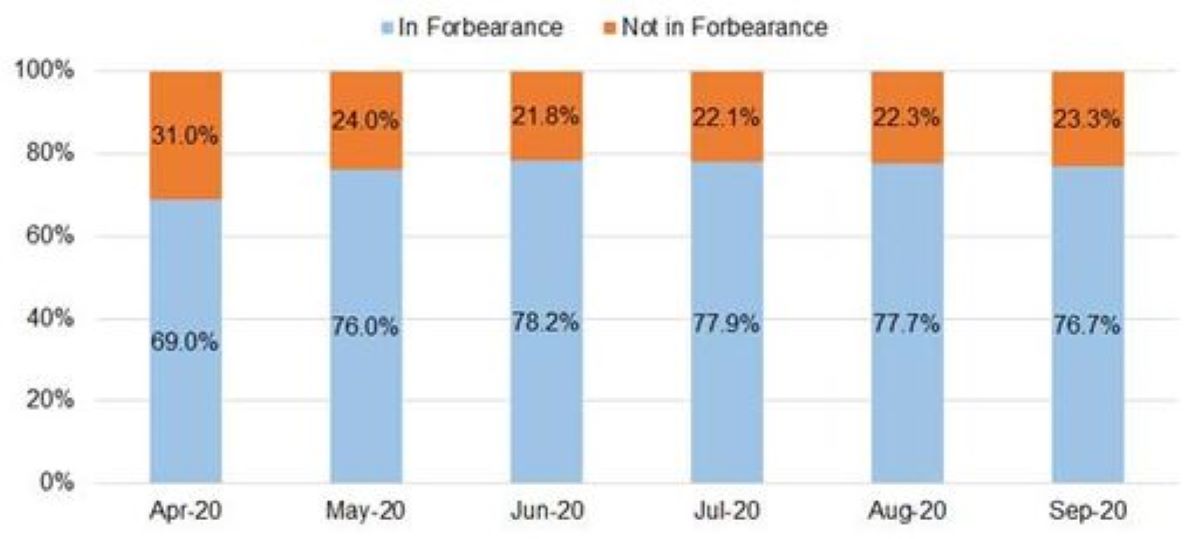

Six months after the CARES Act was signed into law on March 27, 2020, mortgage forbearances remain elevated as millions of Americans sought payment relief after the onset of the COVID-19 pandemic. Beginning in April, forborne loans falling behind payment have become a significant presence in recorded mortgage delinquencies (Figure 1), representing over two-thirds of all delinquent loans

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in November, sales for meal delivery services grew 125 percent, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase.

Total construction starts fell 2% in November to a seasonally adjusted annual rate of $797.5 billion following a strong gain in October. Residential starts fell 7% during the month, while nonbuilding starts dropped 14%. Nonresidential building construction starts, however, rose 19% in November. l.

Nike stock has climbed over 40% in the last six months. The S&P 500 is up 18%. What will happen after Nike reports its earnings this Friday?This earnings season a key part of the equation is Nike’s digital health. Here’s why: At its last earnings report in September, Nike reported that digital sales exploded by 82%.

Workplace attendance in the UK is nearing zero as the second national lockdown and subsequent tired system sends employees back to the home office. The number of people going into work had reached a similar low in April / May before gradually returning to almost 40% of YOY levels by the Autumn

Credit Default Swap (“CDS”) prices are often cited as a proxy for solvency risk. When CDS are not available, consensus credit estimates can be a robust alternative – provided they are adjusted by the market risk premium. GSIBs are the most scrutinised financials in the world. From a solvency perspective, regulators and investors are as well informed about these firms as it is possible to be.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 12, 2020. For this week, total U.S. weekly rail traffic was 546,209 carloads and intermodal units, up 4.9 percent compared with the same week last year.

The recent work-from-home trends have made daytime pajamas the norm and led to declining sales (and in some cases bankruptcy) for many business casual clothing brands. One company that seems to be bucking the trend is Stitch Fix, which recently reported surprisingly strong sales trends.

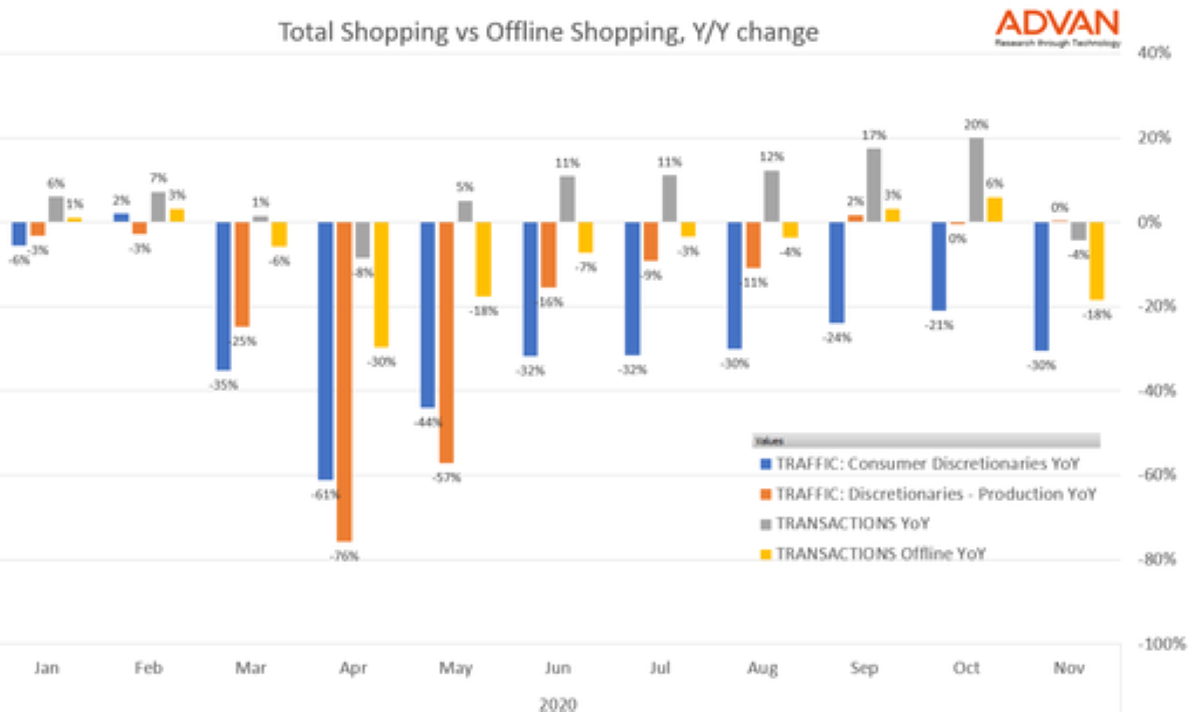

There is no question that a segment of retail has moved online this year. Offline (i.e.in-store) credit and debit card spending is down 15% year-over-year versus total spend according to transaction data from ConsumerEdge. Foot traffic at consumer discretionary store locations is also 20% lower year-over-year than foot traffic to production locations for consumer discretionary retailers.

U.S. single-family rent growth strengthened in October, increasing 3.1% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.9% rate recorded for October 2019, according to the CoreLogic Single-Family Rent Index (SFRI)

There are few sectors that have felt the brunt of the pandemic’s retail impact like the wider apparel sector. After seeing a rapid recovery in the early weeks following springtime lockdowns, the category stagnated with visits down around 25-30% year over year for most weeks since the summer.

The air is electric as innovative automaker, Tesla, prepares for listing on the S&P 500 on December 21st. Adding the $555 billion company, which is prone to huge swings in price, is expected to trigger a massive $100B in trade. So big is the potential impact, S&P is considering the atypical move of adding the stock over multiple days to temper the effects.s.

US General Retailers may not yet feel like the proverbial child in the toy store, but for the first time in a long time they have some cause for hope. Sales continue to rise, even if the pace is less than anticipated. A lack of in-store shopping has, in some instances, transferred to online shopping.

In this Placer Bytes, we dive into Nike’s recovery and holiday performance, analyze the Sephora partnership with Kohl’s, and break down the impact of the COVID resurgence on key Darden restaurant brands. Using location analytics to analyze Nike’s retail strategy puts its offline push in a particularly positive light demonstrating the opportunity that exists there.

Movement through UK ports fell by some measure over the last month, as reports show ‘gridlock’ at container ports such as Felixstowe, Southampton and London Gateway were experiencing reduced access. Happily for the businesses that import / export goods however that trend appears to be recovering.