The latest data from ForwardKeys reveals that while Southeast Asia has been lagging far behind the rest of the world in its recovery from the COVID-19 pandemic, visitors from the USA are coming back in substantially greater numbers than from other origin markets. In the first five months of the year (1st January – 31st May), travel to Southeast Asia reached just 18% of pre-pandemic levels, whereas travel to Europe reached 55%, to the Americas 66% and to the Middle East & Africa 64%.

Combining the DAUs of the top seven job search apps have been hitting new monthly highs since March of this year. After a period of ebbing and flowing, numbers have been climbing steadily for the past 365 days. Average DAUs for the month of June have grown 57% year-over-year. What's super interesting to note is that no month this year has hit a record for monthly active users.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in May 2022, sales for meal delivery services grew 8 percent year-over-year, collectively. These thriving businesses have been in the spotlight during the COVID-19 era. DoorDash (NYSE: DASH) made its public market debut with one of the biggest IPOs of 2020, while Uber (NYSE: UBER) acquired Postmates at the end of November 2020 in an attempt to consolidate market share and boost profitability.

Choosing the location for a company's headquarters can be critical to a company's success. Amazon spent years deliberating over their coveted new headquarters location. In the end, Amazon landed on the DC and NYC metro areas, where they would be able to “attract world-class talent.” This week, we analyze the geographic distribution of talent in Los Angeles (a highly diverse city) at the zip-code level and use it to showcase why skill concentrations have meaningful implications for businesses.

Foot traffic to some of the Kroger Company’s biggest brands may be lagging slightly, but the success of the company’s prepared foods expansion and recently rolled out ghost kitchen collaboration hints at the supermarket giant’s growth potential. Following its strong pandemic performance, the grocery sector’s offline visit growth slowed in recent months as inflation and high gas prices continued to strain many consumers’ budgets. Still, nationwide year-over-year (YoY) grocery foot traffic was positive every month between January and May 2022 while year-over-three-years (Yo3Y) foot traffic remained close to pre-pandemic visit levels.

The top 10 quick-service restaurant apps in the U.S. were downloaded 10.8 million times in May, 8.9 percent more than those the month prior. Year-over-year in the month of April, downloads of the top 36 quick-serve apps are up 29 percent. A download represents a new user and the first conversion on the mobile app customer’s journey. Normally, there are only one or two apps that break the million mark per month but in May there were three; McDonald’s, Taco Bell, and Starbucks.

As consumers ponder cutting down on spending in the face of high inflation, the QSR sector seems to be maintaining relatively steady visitation patterns. We dove into year to date offline visits to leading brands to see how the various QSR subcategories are faring. While the data doesn’t fully capture delivery orders or drive-thru visits, the foot traffic numbers can still provide a rough sense of the state of the sector going into the second half of 2022.

The pandemic isn’t over, but social distancing is no longer the main driver of consumer behavioral change in our data. Higher prices, especially at the pump, are driving down spending in nearly every vertical, despite COVID-weary consumers’ desire to get out of the home. Visits are healthy and travel and entertainment venues are steady. While COVID cases still continue to rise in many places throughout the US, cases seem less severe than in prior waves.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through March 2022. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

A particularly warm Memorial Day weekend this year provided perfect weather for beaches and grilling, as well as visiting theme parks and outdoor attractions. In today’s Insight Flash, we take advantage of our partnership with WeatherOptics and our unique weather impact tracking capabilities to highlight which companies saw the biggest boost from the beautiful weather, and in which geographies.

When it comes to the food delivery aggregators in the Middle East, ever wonder who is catering to the Emiratis’ hankerings in the United Arab Emirates? Or curious to find out how much does the average UAE consumer spend on each of the major food delivery services? What about the frequency in which they are ordering food delivery services across or from each of the food delivery apps and which dishes are the most popular for the Middle Eastern palate?

Our latest white paper dives into domestic migration trends over the past two years in the United States. While many assumed that there would be a mass exodus from cities, the foot traffic data tells a slightly different story. While some people made big moves, most stayed in place. Others moved, but stayed close to their region of origin. And many of those who did relocate across state lines chose areas whose population had already been trending up pre-pandemic. Below is a taste of our findings. For the full report, click here.

Despite much multifamily analysis lauding 2022 as a continuation of 2021’s generational numbers in rent growth and absorption, 2022 has brought significant change for the industry. Certainly, looking at 12-month numbers paints a rosy picture. Yet, as has previously been covered at ALN, apartment demand has winnowed significantly on a year-to-date basis. Rent growth, now somewhat detached from demand, appears to be relying more on momentum and continued low vacancies after last year’s net absorption explosion. Neither factor is guaranteed to persist.

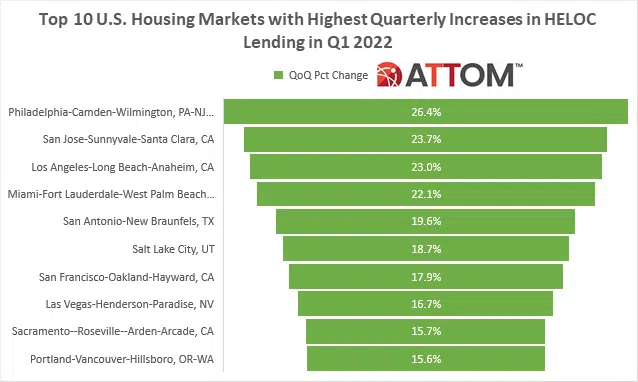

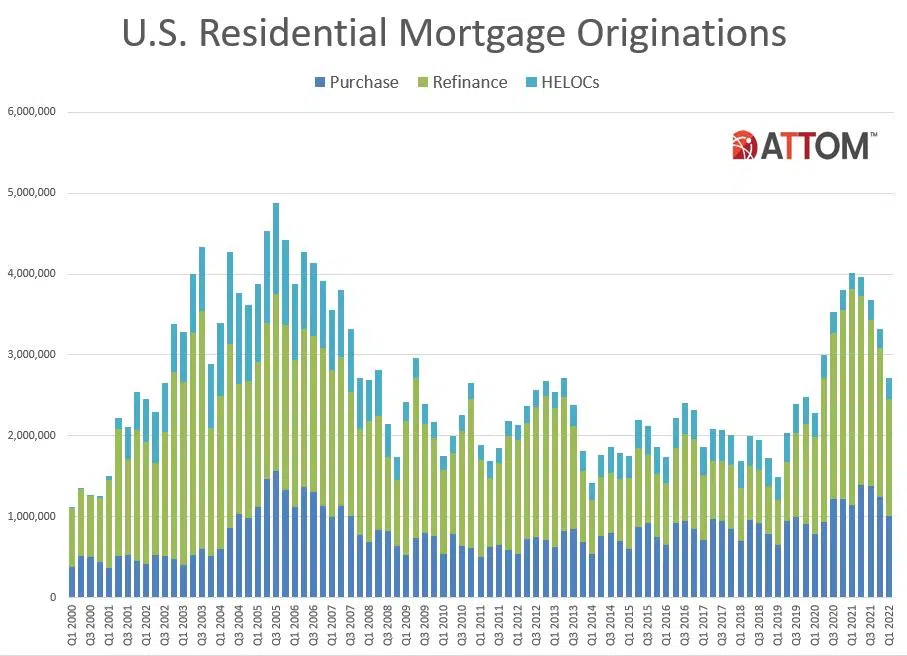

According to ATTOM’s Q1 2022 U.S. Residential Property Mortgage Origination Report, 2.71 million mortgages secured by residential property were originated in Q1 2022 in the U.S. – down 18 percent from Q4 2021, the largest quarterly decrease since 2017, and down 32 percent from Q1 2021, the biggest annual drop since 2014. The report noted that the decline in residential mortgages, which marked the fourth straight quarterly decrease, resulted from double-digit downturns in purchase and refinance activity – even as home-equity lending rose.

National discount retail chain Big Lots (NYSE: BIG) reported an earnings miss in its most recent fiscal quarter, joining other major retailers like Walmart (NYSE: WMT) and Target (NYSE: TGT), whose company performance and earnings have also been hit hard by rising labor costs and supply chain issues. Consumer transaction data shows that both customer counts and sales at Big Lots declined year-over-year from January through April of 2022, but average transaction values were higher than pre-pandemic levels.

From Omicron in January to the impact of rising inflation and the systemwide shock driven by rising gas prices, 2022 kicked off with anything but an easy start. Yet, industry-level analysis provides powerful insights into the segments that have been more resistant to these negative effects and the wider trends that could be driving a more significant retail-wide recovery. At this stage, there are some segments that are seemingly immune to the wider impacts on the retail landscape.

The CoreLogic Homeowner Equity Insights report, is published quarterly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes negative equity share and average equity gains. The report features an interactive view of the data using digital maps to examine CoreLogic homeowner equity analysis through the first quarter of 2022. Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its first-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 2.71 million mortgages secured by residential property (1 to 4 units) were originated in the first quarter of 2022 in the United States. That figure was down 18 percent from the fourth quarter of 2021 – the largest quarterly decrease since 2017 – and down 32 percent from the first quarter of 2021 – the biggest annual drop since 2014.

Fintech companies like Coinbase, Robinhood and Revolut have been snatching talent from Wall Street for years, but recently, this trend has hit a record high. In a collaboration with Bloomberg this week, we look at the talent flows from major banks to fintech companies over the last few years to understand what is driving this trend. Inflows to Fintech from Wall Street accelerated sharply in 2021, after dipping at the onset of the pandemic.

Even as pandemic restrictions eased, the prevailing culture around coming into the office seems to have changed for good. In a recent article, 65% of workers said they would not return to full-time in-office work, and companies are adjusting their expectations accordingly, allowing for a more hybrid work model. A look at our most recent foot traffic data confirms these trends. Visits to office buildings in San Francisco, New York City, and Chicago are still significantly lower than they were three years ago.