Overall, the U.S. trade book market is having a very good year. The U.S. print book market is up 5.5% over the same time period in 2019—a 9% gain over its COVID-19 lowpoint the week after Easter. While 2020 is not a year for dependable predictions, barring another surprise, the U.S. book market is now on track to have one of its best years since NPD BookScan started tracking book data in 2004.

COVID-19 forced B2B companies to change up their marketing strategies for the year. Forced to throw out events, marketers sought out alternative methods for driving brand awareness and conversions. Many event dollars were redirected to online advertising across B2B websites. Using our data, we can see the B2B industries and companies spending the most money on online advertising. Here, we share our findings.

While the past four or five months have been tough times for airlines and airports, the same has been true for suppliers to the industry. An example of this is the fuel suppliers which are on standby, ready to refuel aircraft in their often-short turnaround time. Early on in the pandemic, as OAG frequently reported, airlines struggled to plan schedules around travel restrictions imposed at short notice and plummeting demand.

With many students around the country going back to school remotely, the supply list is proving to be very different this back-to-school season. Sales of school supplies related categories within the office supplies industry, from pencils to spiral notebooks, are down as U.S. consumers delay these purchases. Instead they are investing in other categories such as technology and books to set up school environments at home, according to The NPD Group.

Sports are back—but they are far from normal. While many consumers are eager to sit back and watch a televised game, others aren’t as eager to jump into the distraction yet. How are consumers responding and what does that mean for advertising?

Ghost of Tsushima sold 1.9M digital units in July to become the fastest-selling new PlayStation IP. The game far outpaced the early sales of other new franchises launched on PlayStation 4: Horizon: Zero Dawn sold 1.9M units in its first two months on the market in early 2017, and Days Gone sold 1.3M units in its first two months after launching in late April 2019.

In this Placer Bytes, we dive into the insane momentum driving dollar stores and a similar power being revealed for Best Buy. The wider “dollar” space appeared among the most likely to see a longer-term boost from the pandemic. The sector is dominated by players with a wide range of goods and lower costs, positioning them well in a time where mission-oriented shopping and economic uncertainty reign.

"We originally started with Redshift as our data warehouse. Over time, we realized that there were some features that were missing that we weren’t able to take advantage of, so we looked at Snowflake and realized it was a much more current and modern cloud infrastructure to move to."

The pandemic is wreaking havoc on school reopenings as decisions around in class vs. remote learning vary by county and sometimes by week. It’s no surprise that the Back to School (B2S) spending season is feeling this impact. In this analysis, we analyzed spending at traditional B2S retailers (see our piece from last year) across the East South Central and Mountain states, which tend to have earlier start dates than the rest of the country.

In this Placer Bytes, we dive into BJ’s continued rise, what Dick’s Sporting Goods performance tells us about back-to-school, and the brands that could benefit from Stein Mart’s closures. When we last checked in on BJ’s Wholesale it was becoming clear that COVID helped to re-establish the brand within the wholesale category.

Though the COVID-19 pandemic is occupying all attention at the moment, hurricane season has begun and natural catastrophes do not take a holiday. Forecasts for 2020 project higher than average hurricane activity, implying higher levels of devastating storm surge. Heading into hurricane season, the prospect of confronting a large natural catastrophe like a hurricane or flood during the coronavirus crisis may seem daunting.

Events were central to B2B marketing prior to COVID-19. “The number one thing B2B companies spend money on is events,” explained VP and principal analyst of B2B marketing at Forrester Research Laura Ramos. “Now, some companies say they need to figure how to generate demand in other ways, but if we were good at using other methods, we wouldn’t have relied so much on events.”

In this Placer Bytes we break down the data surrounding three major apparel retailers – Gap, Old Navy and Ross Dress for Less. Gap was in the headlines quite a bit toward the end of the 2019 and beginning of 2020, with news that it called off plans to spin-off its Old Navy brand, and would be closing hundreds of stores globally in the next two years. So, as Gap goes through some changes, we dove into the most recent data to see how the brand is recovering.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that, through the end of July, sales for meal delivery services grew 150 percent year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In July, 33 percent of American consumers had ever ordered from one of the services in our analysis, up from 26 percent a year ago.

COVID-19 has caused major economic damage, especially in sectors connected with travel and leisure. But in manufacturing and technology there will be some strong winners: increased factory automation, major house-building and property conversion programs, increased demand for private cars, new software to facilitate social distancing in a broad range of situations, and major supply chain restructuring.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. Though rideshare is beginning to bounce back, in July, Uber and Lyft sales were down 72 percent and 68 percent, respectively, year-over-year.

There were few stories that captivated the fast food industry like the ‘Chicken Wars’ of 2019. And much of this went far beyond the initial surge and centered around the fundamental shift it caused for Popeyes – leading to a near year-long run of ongoing growth. But, the next round is on its way and the combination of new competitors and a rising giant in the sector could make for an interesting season as the Chicken Wars hit their first anniversary.

Early on in the pandemic, many industries slashed advertising spend due to uncertainty and hurting sales numbers. As the initial shock softened and sales began to return, so did the advertising dollars. While not all consumer industries have recovered, these three sectors are increasing their advertising spending.

Office workers in the US and UK have been among the most reluctant of nations to return to working from their offices, as Huq’s geo-data reveals office attendance across these two countries has yet to surpass 20% of what it was prior to the pandemic. This slow progress in office attendance stands in contrast to other countries in Europe, where both France and Spain for example have seen significantly more office attendance over the last month.

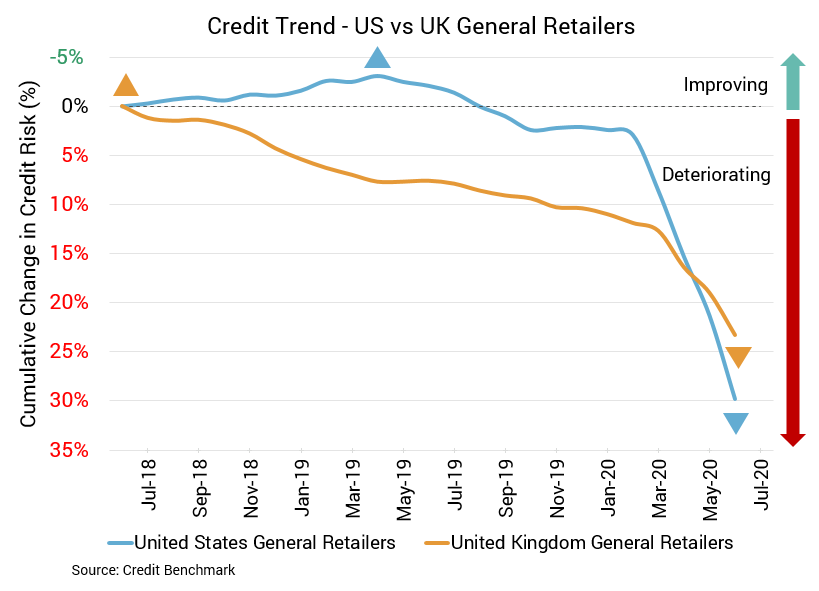

Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by.