Credit Benchmark have released the December Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 19, 2020. For this week, total U.S. weekly rail traffic was 520,305 carloads and intermodal units, up 2.5 percent compared with the same week last year.

What a year it’s been! Few people will be sad to see it go and certainly here at Advan we are excited for what 2021 may bring. To cap off the year, we’ve listed below what we think are 5 of the most interesting mobility trends in a year full of unexpected twists and turns. We look forward to more next year!

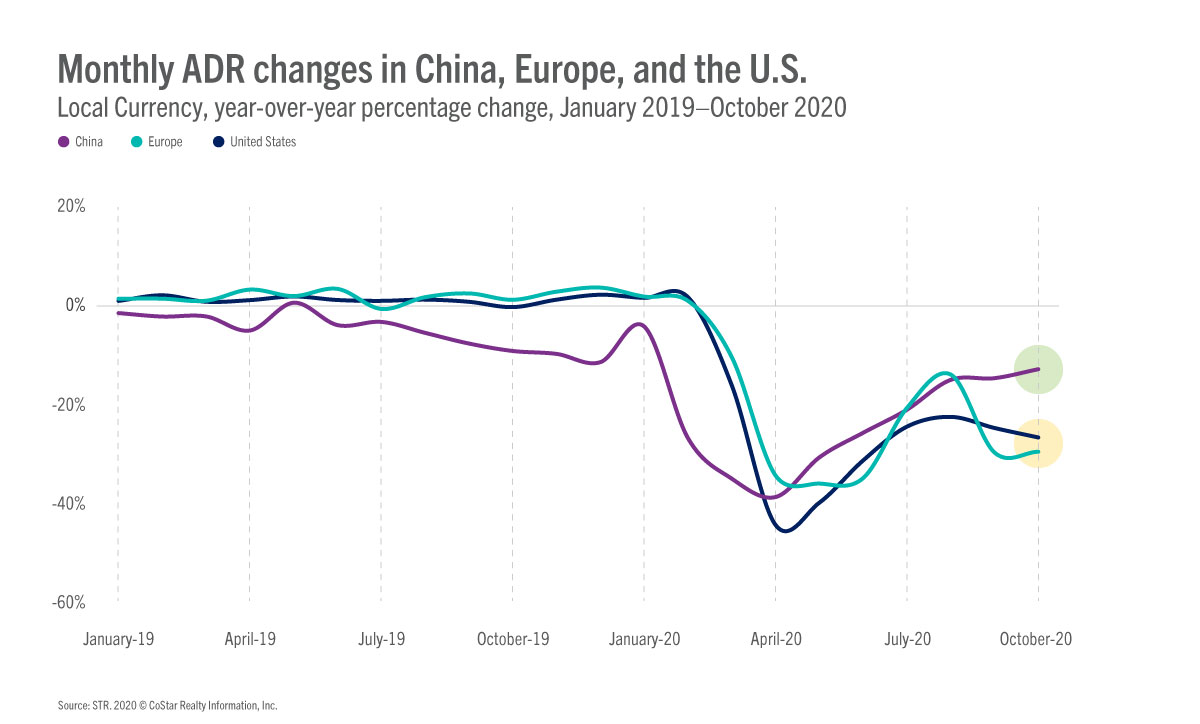

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Asia Pacific region. Demand gradually improving in Mainland China

Traditionally, corporate supply chain information has been patchy. But over the past few years, Bloomberg have collected extensive supplier and purchaser data to shed light on the huge network of linkages between global coporate giants and the myriad of small and/or unquoted and unrated companies that form the fabric of the global economy.

In April 2020, as part of the significant economic damage caused by COVID-19, hotel average daily rate (ADR) in China, Europe, and the United States dropped 40% below pre-pandemic levels. Since that point, rates in all three regions have improved, but hotels in China are much closer to reaching pre-pandemic ADR.

After the pandemic took hold in the U.S. in early 2020, stay-at-home orders and uncertainty in the economy delayed listings from going live on the market. The typical spring home buying season was pushed into summer in 2020 and continued into fall. Meanwhile, low interest rates motivated home buyers.

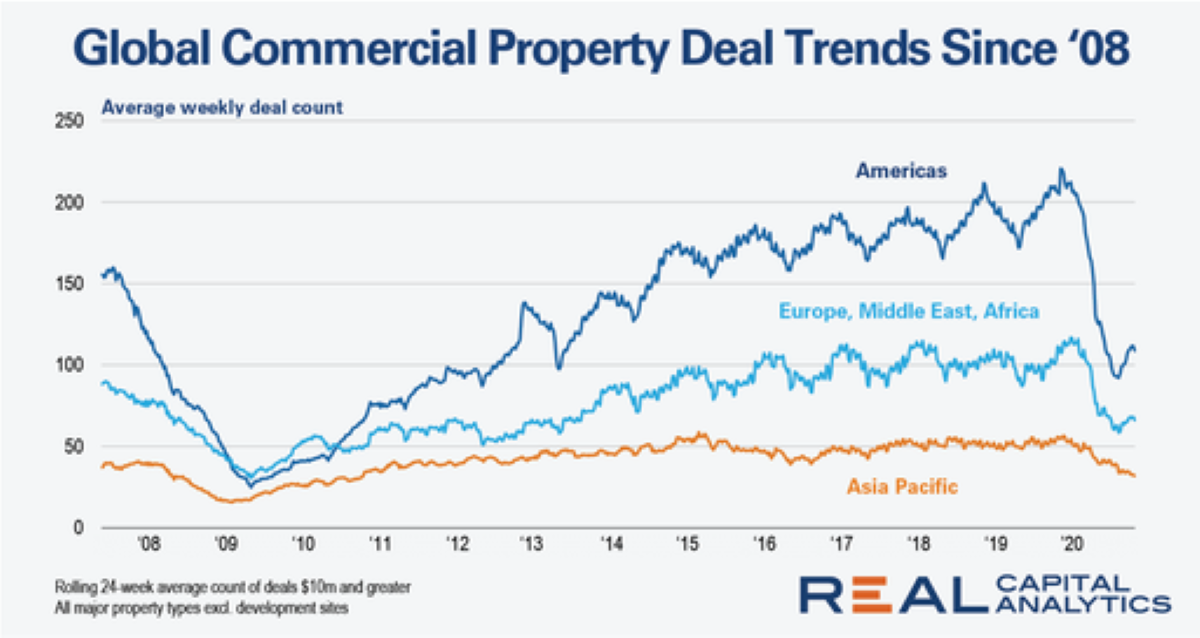

In July, after the first full quarter when we saw the global impact of the Covid-19 maelstrom, we studied the drop in global commercial real estate activity with a historical perspective going back to the Global Financial Crisis (GFC). Today, the chart plotting the average weekly deal count for the three global zones reveals more about the decline caused by an extraordinary crisis

As consumers navigate through a pandemic-defined holiday season, we took the opportunity to dig into the start of this season’s behavior utilizing our spend, foot traffic, and retail pricing data, as well as our newly launched income data. Our analysis is an overview of sales data to date* this season. We will be evaluating the full holiday performance after the New Year.

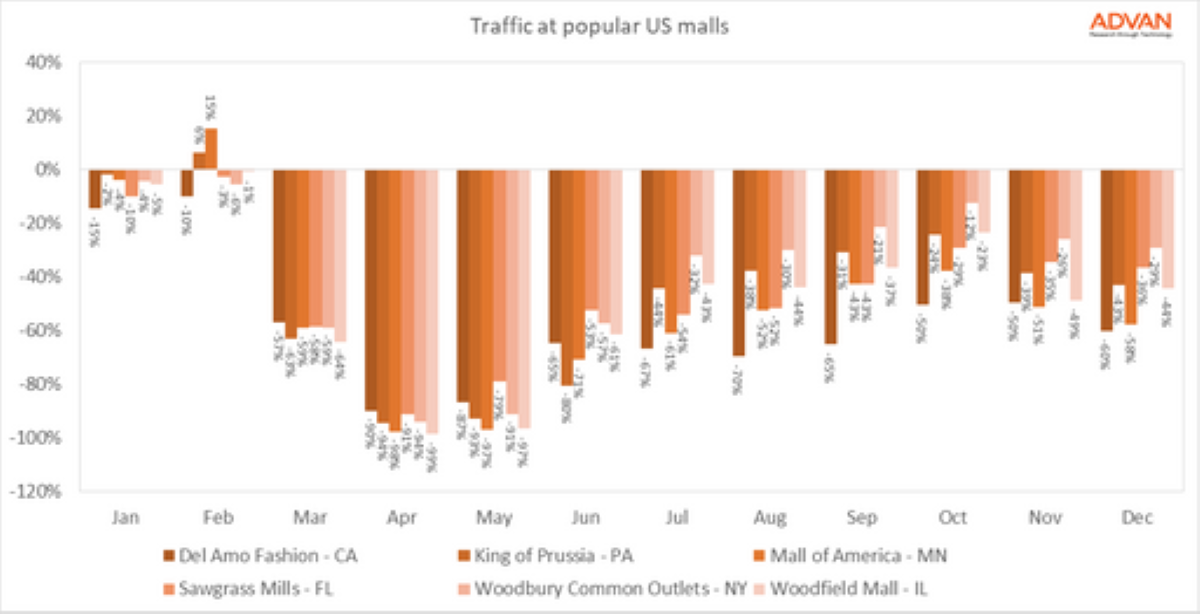

Although the wake-up call for shopping malls to adapt to a changing retail environment was heard long before COVID, the pandemic had enhanced its pressing urgency. Our latest whitepaper discusses some of the ways in which malls can go through a data-driven redevelopment process while adapting to changing industry trends and consumer behavior. Below is a taste of what we found.

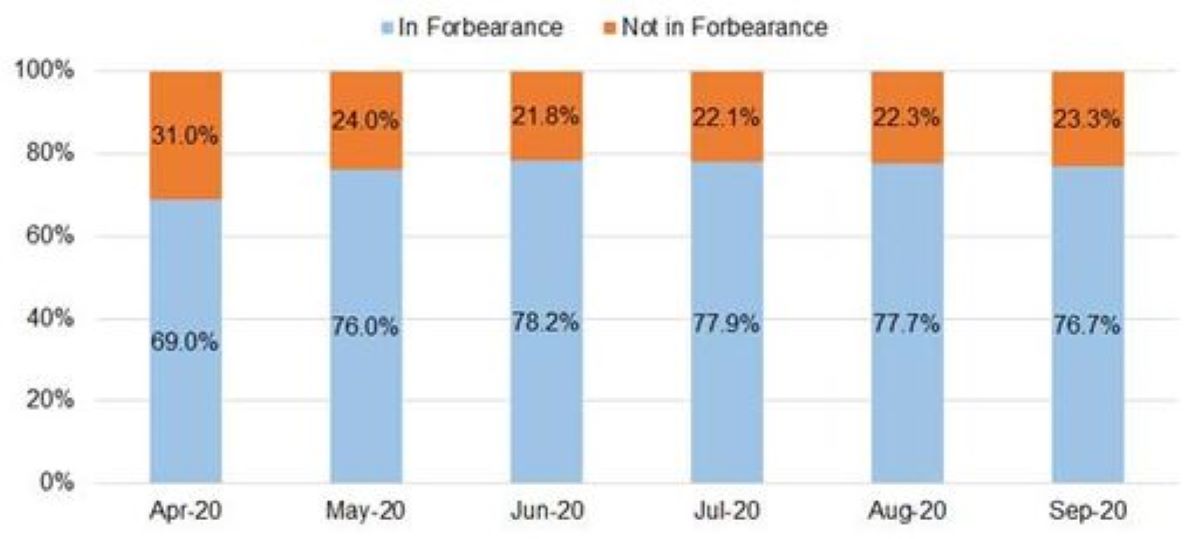

Six months after the CARES Act was signed into law on March 27, 2020, mortgage forbearances remain elevated as millions of Americans sought payment relief after the onset of the COVID-19 pandemic. Beginning in April, forborne loans falling behind payment have become a significant presence in recorded mortgage delinquencies (Figure 1), representing over two-thirds of all delinquent loans

Total construction starts fell 2% in November to a seasonally adjusted annual rate of $797.5 billion following a strong gain in October. Residential starts fell 7% during the month, while nonbuilding starts dropped 14%. Nonresidential building construction starts, however, rose 19% in November. l.

Workplace attendance in the UK is nearing zero as the second national lockdown and subsequent tired system sends employees back to the home office. The number of people going into work had reached a similar low in April / May before gradually returning to almost 40% of YOY levels by the Autumn

Credit Default Swap (“CDS”) prices are often cited as a proxy for solvency risk. When CDS are not available, consensus credit estimates can be a robust alternative – provided they are adjusted by the market risk premium. GSIBs are the most scrutinised financials in the world. From a solvency perspective, regulators and investors are as well informed about these firms as it is possible to be.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 12, 2020. For this week, total U.S. weekly rail traffic was 546,209 carloads and intermodal units, up 4.9 percent compared with the same week last year.

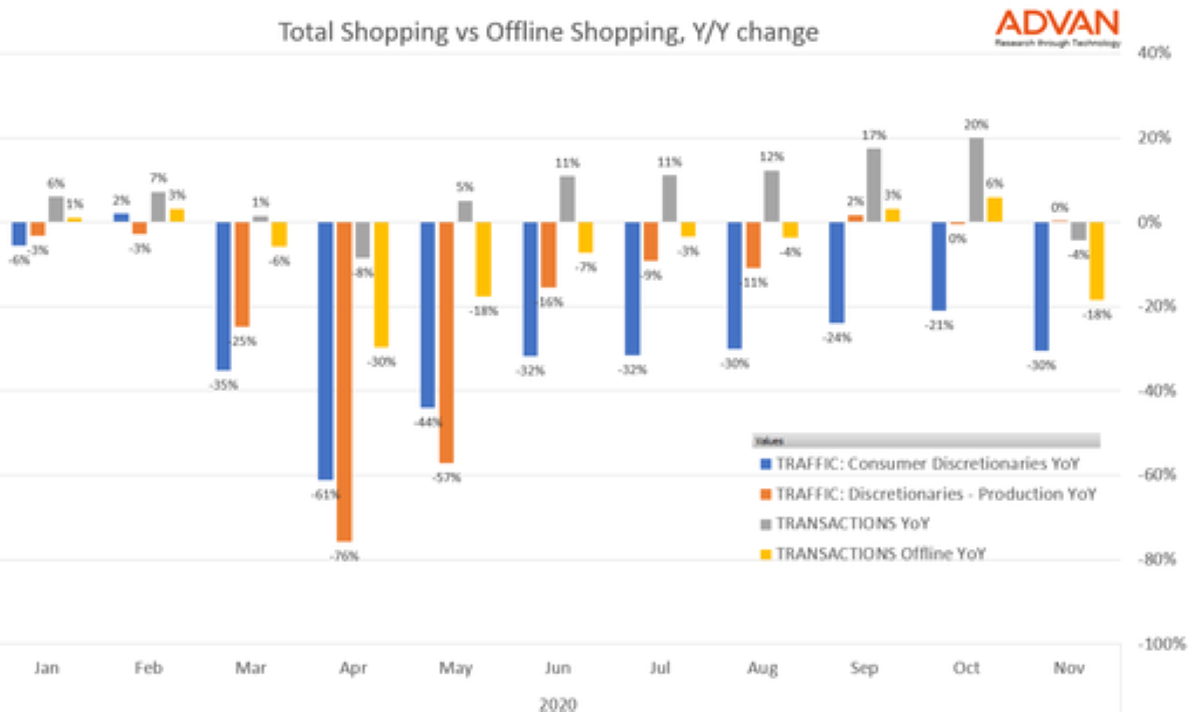

There is no question that a segment of retail has moved online this year. Offline (i.e.in-store) credit and debit card spending is down 15% year-over-year versus total spend according to transaction data from ConsumerEdge. Foot traffic at consumer discretionary store locations is also 20% lower year-over-year than foot traffic to production locations for consumer discretionary retailers.

U.S. single-family rent growth strengthened in October, increasing 3.1% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.9% rate recorded for October 2019, according to the CoreLogic Single-Family Rent Index (SFRI)

US General Retailers may not yet feel like the proverbial child in the toy store, but for the first time in a long time they have some cause for hope. Sales continue to rise, even if the pace is less than anticipated. A lack of in-store shopping has, in some instances, transferred to online shopping.

Movement through UK ports fell by some measure over the last month, as reports show ‘gridlock’ at container ports such as Felixstowe, Southampton and London Gateway were experiencing reduced access. Happily for the businesses that import / export goods however that trend appears to be recovering.

The holiday season is here and, thankfully, 2020 is almost in the rear view mirror. This year has certainly been one of disruption, but one area of relative normalcy was new construction. This was true whether referring to the level of new supply or to the unit mix of product entering the market. The latter will be the focus of this month’s newsletter.