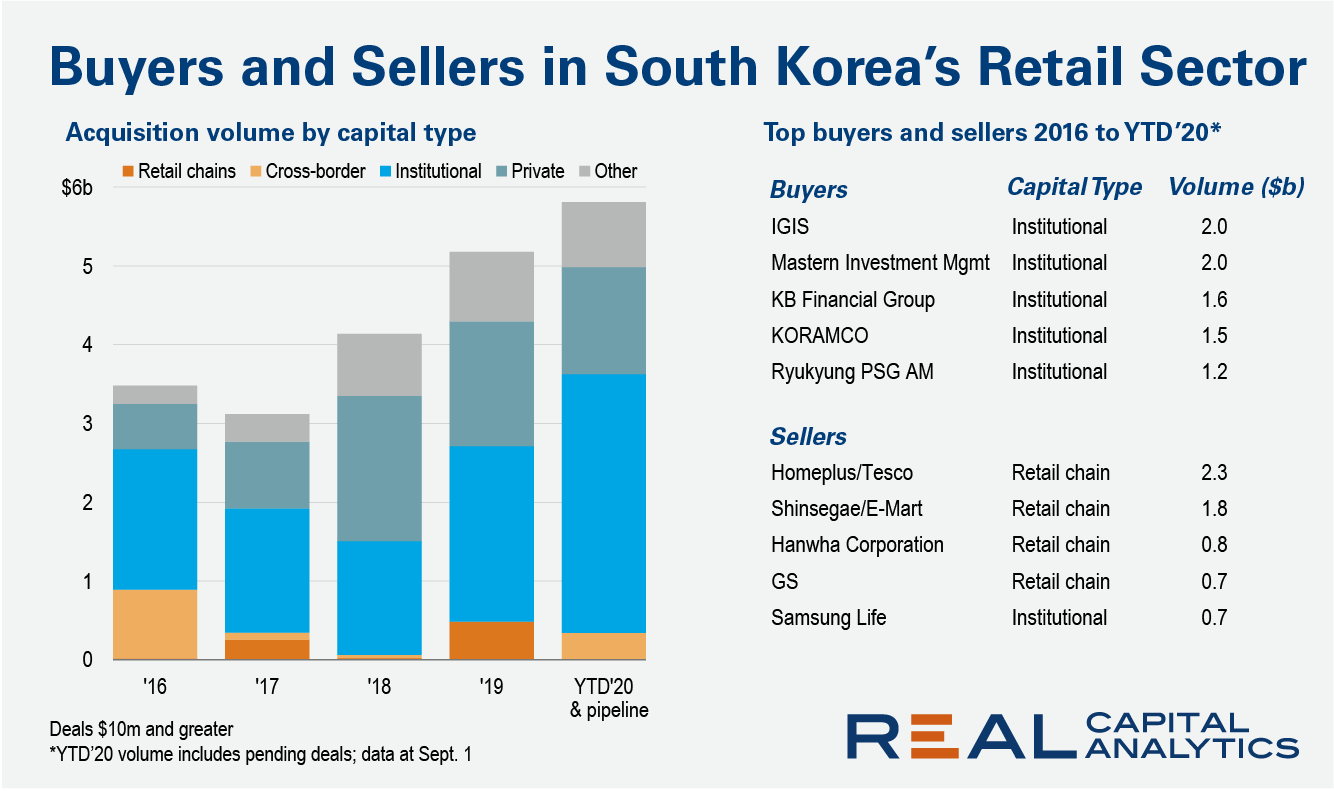

Over the first seven months of 2020, trading of retail assets has crumbled by more than half across all the major Asia Pacific economies bar one – South Korea. Should the current pipeline of deals close by year end, Korea’s 2020 retail investment total will surpass last year’s tally and could potentially become Asia Pacific’s biggest retail investment market, breaking the lock on the top three spots typically held by China, Japan and Australia.

A recent article on Wall Street Journal by Peter Grant took an insightful look at how truck stops in the US have been boosted this year, in part due to the increase in demand for e-commerce and delivery. TravelCenters of America (NASDAQ: TA), the largest publicly listed operator of truck stops in the US, saw its share price increase 50% following its quarterly earning announcement in early August.

Everything in retail has been turned upside down in 2020, so it’s exciting to see something continue as normal. Obviously, we’re talking about the unique power of Starbucks to leverage the calendar to its fullest advantage. And while even this success requires COVID-era context, it still emphasizes a strategic approach that will guide the success, or lack thereof, for many retailers in the coming months.

In this Placer Bytes, we break down the sustained success of Kroger, the recoveries of Casey’s and GameStop, and analyze what Dave & Buster’s struggles mean for experiential. We’ve spoken ad nauseam about the strength traditional grocers have shown amid the pandemic and recovery. And have also dedicated a great deal of time to discussing the changes in customer visitation patterns.

With rising infection rates and concerns about the looming virus season, the COVID crisis is clearly far from over. But with the first wave behind us, it is possible to see the past six months of market volatility in its broader context. The S&P500 is now higher than it was in February 2020, having at one stage lost one third of its value. The VIX spiked from a mid-February level of 14% to a mid-March high of 85%, and currently trades at 33%. The Global BBB spread\[1\] tripled from 1.5% to 4.5% and currently sits at 1.7%.

As expected, during the initial lockdown in March and April, customer spending on online bookings fell dramatically for Airbnb and the hotels studied (Marriott, Hilton, InterContinental). From April 27 to the beginning of June, spending climbed quickly for these companies. Airbnb rose the fastest with an average of 32% week-over-week growth.

Problems for the beleaguered US energy sector have continued to mount this year. Demand for oil plummeted, bringing down prices as competition and supplies grew. Bankruptcies continue in the industry as the broad economy continues to struggle, and it’s not clear how many firms will benefit from any improvement in prices.

The ranks of the Fallen Angels – firms whose credit quality has made the shift from investment-grade to high yield, or “junk” status – continue to grow, but the pace may be slowing down. Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies have now entered the Fallen Angel category.

In this Placer Bytes, we analyze Burlington’s up-and-down recovery, Ulta’s drive to normalcy and how Big Lots trends have differed from others in the space. When Burlington reopened stores, the visits started to flood back in and traffic had returned to just 35.7% down year over year in June. Yet, in July the retailer took a step back with visits down 40.2% year over year.

Cross-border institutional purchases have been one of the most resilient sources of capital in Asia Pacific in the first half of 2020, a surprising trend given that the practical advantages that domestic groups have during the Covid-19 pandemic. The volume of acquisitions by cross-border investors fell by 14% year-over-year, as compared with declines of around a half for listed and private entities.

This week we’re wrapping up our weekly earnings coverage for the 2Q earnings season with an interesting mix of companies ranging from retail to software. Best Buy, Dick’s Sporting Goods, and Ulta Beauty are the companies on the retail side, while Intuit, Autodesk, and Salesforce are the companies we are focusing on in the software domain.

"We originally started with Redshift as our data warehouse. Over time, we realized that there were some features that were missing that we weren’t able to take advantage of, so we looked at Snowflake and realized it was a much more current and modern cloud infrastructure to move to."

Everyone's talking about crypto again and I refuse to be left out (FOMO is a killer). In July, the top 10 crypto wallet apps increased net new installs approximately 81.4% YoY. July is the best performing month on record for this market, and August has the potential to beat it.

In this Placer Bytes we break down the data surrounding three major apparel retailers – Gap, Old Navy and Ross Dress for Less. Gap was in the headlines quite a bit toward the end of the 2019 and beginning of 2020, with news that it called off plans to spin-off its Old Navy brand, and would be closing hundreds of stores globally in the next two years. So, as Gap goes through some changes, we dove into the most recent data to see how the brand is recovering.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that, through the end of July, sales for meal delivery services grew 150 percent year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In July, 33 percent of American consumers had ever ordered from one of the services in our analysis, up from 26 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. Though rideshare is beginning to bounce back, in July, Uber and Lyft sales were down 72 percent and 68 percent, respectively, year-over-year.

In week six of earnings season, retail giants are stepping into the spotlight, and we’ve got earnings insights ahead of their reports. The six companies we’re covering today – Walmart, Target, Alibaba, Nvidia, Home Depot, and Lowe’s – have a total market capitalization of $1.8 trillion, so while the Apples and Microsofts of the world have already reported, now isn’t the time to tune off.

The world of offline retail has been dominated by two key names – Walmart and Target. The strength of these retailers has centered around a unique ability to build a powerful and sustainable brand relationship. And while the entire retail ecosystem took a hit during the pandemic, these giants included, the recovery has presented an opportunity to really compare the environments they operate in.

In this Placer Bytes, we dive into Kohl’s amidst wider concerns over the future of the department store and the impressive performances across the TJX portfolio. Kohl’s has experienced a strong recovery in recent months with June and July down just 26.7% and 26.1% year over year. And while this still marks significant declines, the brand has been hit hard by COVID resurgences in key states like California and Texas where they have a greater number of stores.

Now that most US megacorps have reported their earnings for 2Q, we turn our attention and focus to two of this year’s hottest IPOs and one of the most interesting European companies that are reporting earnings this week. While we often focus on American companies, given their market size, our data goes far beyond the borders of the North American continent, and earnings season is a great time to take a look at our friends across the pond.